Understanding market makers: gray area predators, why are they so important to the crypto world?

Original author: Min Jung

Original translation: TechFlow

Summary

-

Market makers contribute significantly to reducing volatility and transaction costs by providing significant liquidity, ensuring efficient trade execution, enhancing investor confidence, and making markets function more smoothly.

-

Market makers use a variety of structures to provide liquidity, the most common being token lending protocols and retention models. In token lending protocols, market makers borrow tokens from projects to ensure market liquidity for a specific period (usually 1-2 years) and receive call options as compensation. On the other hand, the retention model involves market makers being compensated for maintaining liquidity over the long term, usually through monthly fees.

-

As in traditional markets, clear rules and regulations for market maker activities play a vital role in the smooth functioning of the cryptocurrency market. The cryptocurrency market is still in its early stages and there is an urgent need for reasonable regulations to prevent illegal activities and ensure fair competition. These regulations will greatly help promote market liquidity and protect investors.

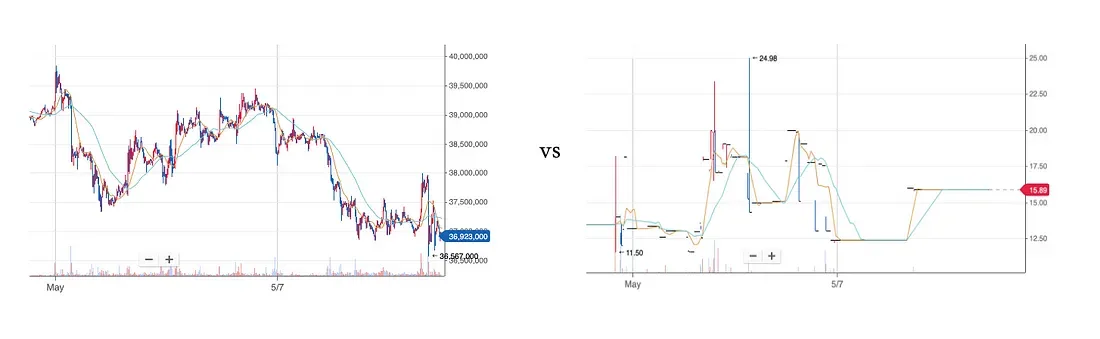

Which market do you want to trade?

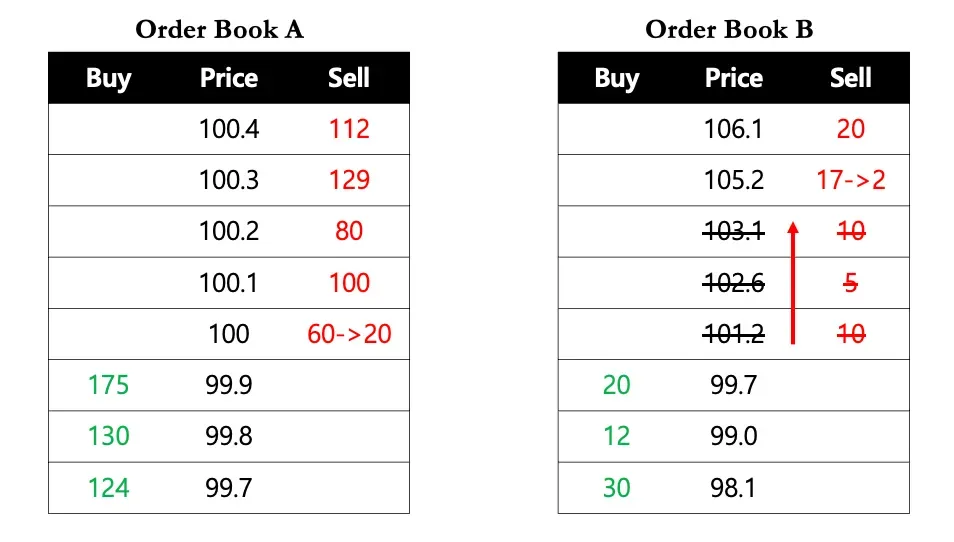

Source: Presto Research Presto Research

Recent events in the cryptocurrency market have sparked a surge of interest in market makers and the concept of market making. However, market makers are often misunderstood and viewed as an opportunity to manipulate prices, including the infamous pump and dump schemes, and accurate information about the true role of market makers in financial markets is scarce. It is common for emerging projects to remain blind to the significance of market makers and often question the need for them as their tokens are about to be listed. Against this backdrop, this article aims to explain what market makers are, the importance of their role, and their function in the cryptocurrency market.

What is a market maker?

Market makers play a vital role in maintaining continuous liquidity in the market. They usually do this by providing both buy and sell quotes. By buying from sellers and selling to buyers, they create an environment where market participants can trade at any time.

This can be likened to the role of used car dealers that we often see in our daily lives. Just as these dealers allow us to sell our current vehicles and buy used cars at any time, market makers perform a similar function within the financial markets. Global market maker Citadel provides the following definition of market makers:

Figure 2: Traditional financial markets define the role of market makers

Source: Presto Research

Market makers are also crucial in traditional financial markets. On Nasdaq, there are an average of about 14 market makers per stock, for a total of about 260 market makers. In addition, in markets that are less liquid than stocks, such as bonds, commodities, and foreign exchange, most transactions are conducted through market makers.

Profits and risks of market makers

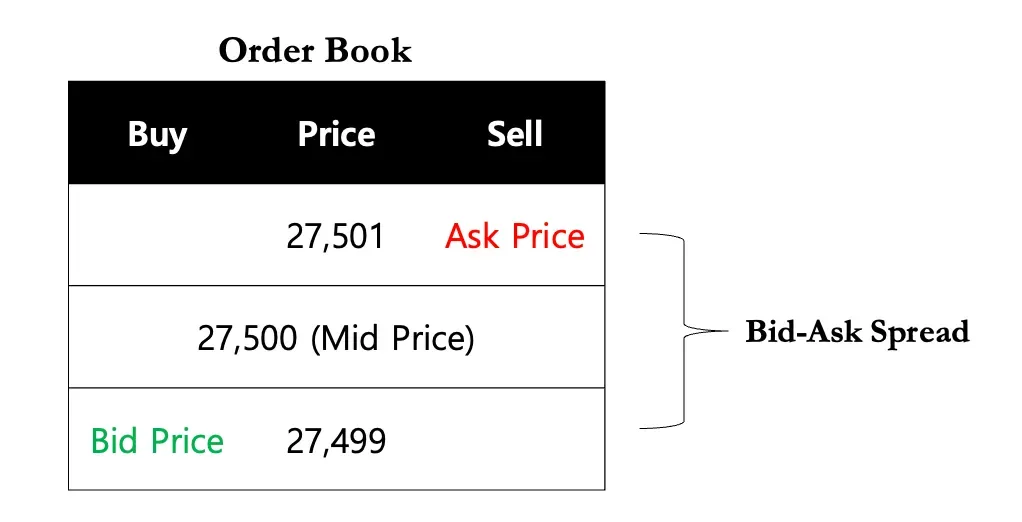

Market makers make a profit through the difference between the bid and ask prices of financial instruments. Since the ask price is higher than the bid price, market makers make a profit by buying the financial instrument at a lower price and selling the same financial instrument at a higher price (i.e. the bid-ask spread).

Figure 3: Bid-ask spread

-

Consider a situation where a market maker simultaneously offers a bid of $27,499 and an ask of $27,501 for an asset. If these orders are executed, the market maker buys the asset at $27,499 and sells it at $27,501, thereby making a profit of $2 ($27,501 – $27,499), which represents the bid-ask spread.

-

This concept is consistent with the example of the used car dealer mentioned earlier, where the dealer buys a used car and then sells it at a slightly higher price, profiting from the difference between the buying and selling prices.

However, it is important to note that not all market making activities generate profits, and market makers can indeed incur losses. In rapidly volatile markets, the price of a particular asset may move sharply in one direction, resulting in only one bid or one ask being executed, but not both. Market makers also face inventory risk, which is the risk associated with not being able to sell an asset. This risk exists because market makers always hold a portion of their market making assets to provide liquidity.

For example, in one scenario, a used car dealer buys a car but cannot find a buyer, and the recession causes used car prices to fall, so the dealer will suffer financial losses.

Why do we need market making?

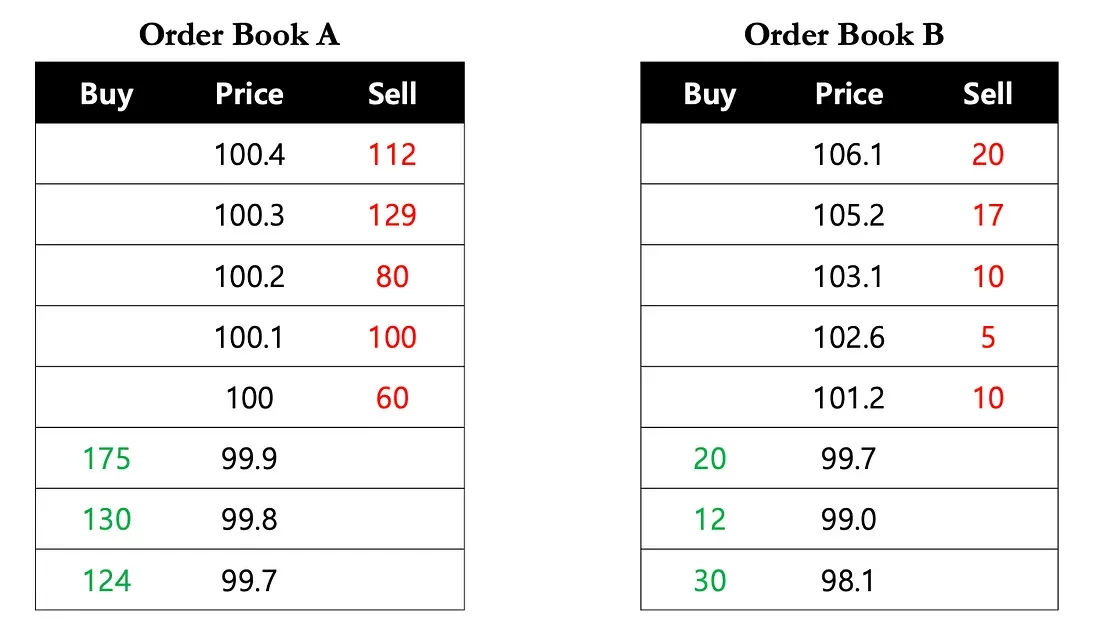

Provides a large amount of liquidity

The primary goal of market making is to ensure that there is ample liquidity in the market. Liquidity refers to the degree to which an asset can be quickly and easily converted into cash without incurring financial loss. High market liquidity reduces the impact of transaction costs on any particular trade, minimizes losses, and allows large orders to be executed efficiently without causing significant price fluctuations. In essence, market makers facilitate investors to buy and sell tokens faster, in greater volumes, and more easily at any given time without causing major disruptions.

Figure 4: Why liquidity matters

Source: Presto Research

For example, an investor needs to buy 40 tokens immediately, in a highly liquid market (Order Book A), they can immediately buy 40 tokens at $100 per token. However, in a less liquid market (Order Book B), they have two options: 1) buy 10 tokens at $101.2, 5 tokens at $102.6, 10 tokens at $103.1, 15 tokens at $105.2, an average price of $103.35, or 2) wait a longer period of time for the tokens to reach the desired price.

Reduce volatility

As shown in the previous example, the large amount of liquidity provided by market makers helps mitigate price volatility. In the above scenario, the next available price in order book B is $105.2 just after the investor purchased 40 tokens. This indicates that a single trade caused a price movement of approximately 5%. In real-world cryptocurrency markets, even small trades can cause significant price changes for assets with low liquidity. This is especially true during periods of market volatility, when fewer participants can cause significant price swings. Therefore, market makers play a key role in reducing price volatility by bridging this supply-demand gap.

Figure 5: How market makers help reduce volatility

Source: Presto Research

The role of market makers described above ultimately helps to strengthen investor confidence in a project. Every investor wants to be able to buy and sell their holdings as needed with minimal transaction costs. However, if investors believe that the bid-ask spread is wide, or that it takes a considerable amount of time to execute the desired number of trades, they may become discouraged despite their positive views of the project. Therefore, if market makers are continuously active in the market and provide liquidity, it not only lowers the entry barrier for investors, but also incentivizes them to invest. This action, in turn, brings more liquidity, forming a virtuous circle and promoting an environment where investors can trade with confidence.

Crypto Projects ↔ Market Makers

Although there are many forms of contract structures between market makers and projects in the crypto market, including token loan + prepaid contract structure, the most widely used contract structure (token loan + call option) works as follows:

Figure 6: ProjectMarket Maker Structure

Source: Presto Research

Project → Market Maker

-

Market makers borrow tokens from projects for the market making process. In the early stages of a token listing, tokens are often in short supply due to the small number of tokens available on the market. To offset this imbalance, market makers borrow tokens from projects, usually for an average period of 1-2 years (equivalent to the term of the market making contract) to ensure market liquidity.

-

In return for their market making services, market makers receive the right to exercise a call option when the loan matures. This call option gives them the right to purchase the token at a predetermined price. Since the project has limited cash resources, it does not rely on fiat currency, but instead offers call options as compensation. In addition, the value of the call option is directly related to the price of the token, providing market makers with protection against early high-sell scams.

Market Maker → Project

-

Market makers provide services by negotiating with the project party during the contract period of borrowing tokens to ensure maximum spread and sufficient liquidity. This arrangement is conducive to trading in a good liquidity environment.

In short, market makers borrow tokens from projects, obtain call options, and provide services with the goal of ensuring liquidity within a specific spread during the borrowing period. But it should be noted that legitimate market makers will not make any commitments on prices.

Insufficient regulation of market makers in the cryptocurrency market

The negative perception of market makers in the cryptocurrency market is mainly due to its lack of regulation compared to traditional financial markets. In US stock markets such as NASDAQ and NYSE, market makers must maintain bid and ask prices for at least 100 shares and are obliged to fulfill orders if corresponding orders appear (see Figure 7). There are also very specific requirements for market makers, such as only placing orders within a certain range (e.g., within an 8% or 30% range for large-cap stocks). These measures prevent market makers from placing the above two orders at ridiculous prices (far away from the highest bid price/lowest ask price) and only place corresponding orders when there is a profit opportunity.

Figure 7: New York Stock Exchange rules on market making

Source: Presto Research

However, as mentioned earlier, market making in the cryptocurrency market remains relatively underregulated. Unlike in traditional financial markets, there is no separate license or regulator overseeing these operations.

As a result, it is common to see news reports about companies illegally profiting under the guise of “market making.” The biggest problem is that while traditional exchanges like Nasdaq enforce strict penalties and regulations for illegal market making activities, the decentralized cryptocurrency market lacks substantive penalties for deceptive market making practices. This clearly exposes a glaring lack of regulatory oversight, highlighting the need for the same level of regulation in the cryptocurrency market as in traditional financial markets.

in conclusion

Despite regulatory deficiencies that allow for grey areas in crypto market making, market makers will continue to play a key role in the market. Their function of purchasing financial instruments from sellers and selling them to buyers to provide liquidity remains fundamental. Especially in illiquid crypto markets, market makers help reduce transaction costs and volatility, thereby fostering an environment where investors can trade with greater confidence. Therefore, by incorporating market makers into the system and promoting fair competition and sound market making practices, we can expect an environment where investors can trade with greater assurance.

This article is sourced from the internet: Understanding market makers: gray area predators, why are they so important to the crypto world?

Related: Bitcoin (BTC) Defies Bearishness, Price Aims for $70,000 Post-Halving

In Brief Bitcoin price is attempting to rally toward new highs close to observing a Golden Cross. Accumulation has been high this month, continuing to date with over 9,000 BTC pulled by investors. An increase in profit and decrease in participation is flashing a sell signal that could cause a halt in the rise. Bitcoin’s (BTC) price is taking its time to return to the recent highs. The cryptocurrency is presently at $66,000. However, it is still vulnerable to selling from investors, which could reduce prices. Adding Bitcoin to Wallets Bitcoin’s price is taking hints from both bulls and bears at the moment, as visible in their actions. The exchanges’ balance is a chart that tracks the movement of BTC in and out of exchanges’ wallets. Over the past few…