Accused of false tax payment, the former Bitcoin Jesus cant escape the iron fist of supervision

Recently, the biggest regulatory event in the crypto space was the four-month prison sentence for Binance founder CZ. On the day of CZs trial, another person who once had a huge influence on the crypto industry appeared in the topic of crypto regulation. Compared with his former influence, the news of his arrest was rarely discussed.

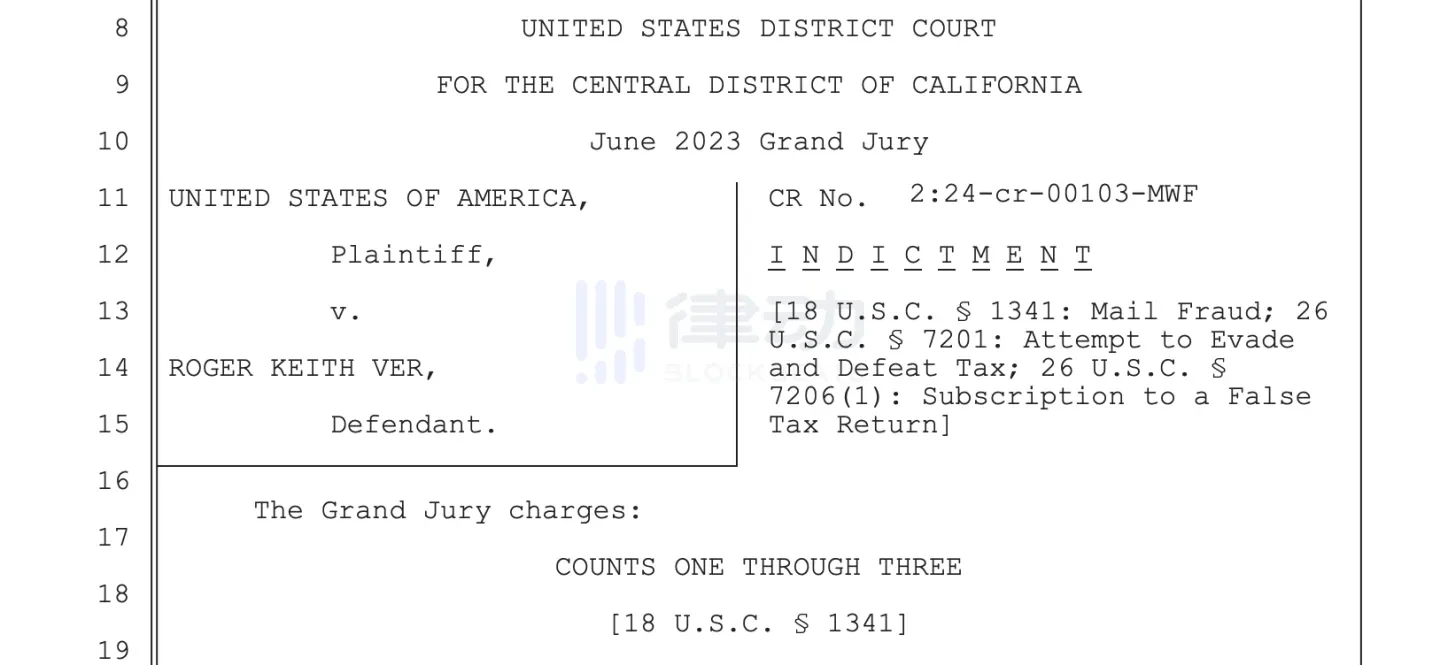

A week ago, the U.S. Department of Justice released a document charging 45-year-old St. Kitts and Nevis-born American Roger Keith Ver with tax evasion of nearly $50 million, mail fraud, tax evasion and filing false tax returns. Since Roger Ver was arrested in Spain in late April, the United States is seeking his extradition to the United States for trial.

The name Roger Ver may be unfamiliar to the current crypto community. In fact, in the short twenty years of Bitcoin development history, the role played by Roger Ver is of great significance. He was once called Bitcoin Jesus.

The suspicion of tax evasion by the U.S. Department of Justice stems from the fact that Roger Ver concealed the amount of Bitcoin he held when he renounced his U.S. citizenship in 2014. At that time, the price of Bitcoin was only over $800, and later fell to around $300. Roger held 131,000 Bitcoins at the time, which is undoubtedly a huge asset today. Three years after leaving the United States, Roger sold 70,000 Bitcoins. The notice issued by the U.S. Department of Justice stated that Roger Ver caused a total loss of at least $48 million to the IRS.

Bitcoin Jesus Owns Hundreds of Thousands of BTC

Roger Ver, born in Silicon Valley in 1979, is a well-known libertarian and anarchist. He dropped out of community college in the United States after one year to start a business and founded his own company, Memorydealers, an online sales company for electronic parts and equipment. Later, at the age of 21, he participated in the election of the California State Assembly as a candidate of the Libertarian Party. As a result, he was reported for selling an explosive product on eBay without a license and was sentenced to 10 months in prison by the California Federal Court for illegal sale of explosives.

In 2011, Roger discovered Bitcoin and became a true believer in it. He first integrated Bitcoin payments into his companys website, allowing customers to pay with Bitcoin on the website. At the time, each Bitcoin was worth less than $1. It is estimated that Roger collected more than 400,000 Bitcoins through such attempts.

In the past decade, the price of Bitcoin has experienced many roller coaster fluctuations. Roger Ver, who was able to find and hold tens of thousands of Bitcoins from the price of $1, now seems to be full of wealth, but this is not the reason why Roger is called Bitcoin Jesus. As a loyal believer in Bitcoin, Roger spent more than $100,000 to broadcast Bitcoin advertisements on radio stations across the United States in the early days of Bitcoin.

In 2012, Roger Ver and other founders founded the Bitcoin Foundation (bitcoinfoundation.org), dedicated to promoting Bitcoin worldwide. In addition to collecting Bitcoin, Roger Ver also actively seeks out and funds startups dedicated to promoting Bitcoin. He can be regarded as the angel investor of the first batch of Bitcoin startups (he calls himself the second participant of these projects). In the early days of Blockchain.com, Roger Ver found the founder of Blockchain.com who had just graduated from high school and provided him with funds so that he could buy a dedicated server to operate the project instead of relying on the Mac mini at home.

In addition to Blockchain.com, Roger Ver has also invested in many crypto projects including Kraken, purse.io, Bitpay and Ripple. Just after Roger Ver was arrested, Ripple CTO David Schwartz made a comment, recalling that Ver is one of the best and most sincere people I have ever met, and his actions are based on a firm belief in the moral principles he holds.

In 2014, Roger Ver bought the control of the Bitcoin.com domain name and leased it to Blockchain.info, and later to OKCoin. In 2015, Rogers Bitcoin rose from $1 to more than $200, and he still persuaded others to buy Bitcoin, Its not too late to buy Bitcoin now, just like some people later thought it was too late to enter the Internet…

The halo is gone, and it owes $47 million

In the history of crypto development, Roger Ver is not a completely positive figure. After gaining the aura of Bitcoin Jesus for his early support for Bitcoin, Roger Vers activities in recent years have mostly caused controversy rather than admiration.

In 2017, at the crossroads of Bitcoin hard fork, Roger Ver chose BCH, which was advocated by Bitmain founder Wu Jihan. His mining pool Bitcoin.com also played a pivotal role in helping Wu Jihan win the computing power war after the BCH fork. Since then, Roger Ver has become a staunch evangelist for BCH, repeatedly stating that BCH is the real Bitcoin. Because BCH did not have the same wealth effect as Bitcoin, Roger was called a scammer by a large number of investors who bought BCH.

Roger is also well-known in the community for his debt disputes and the resulting verbal battles. In 2022, the news that Roger Ver sued Smart Vega, a subsidiary of Wu Jihan, became the focus of community discussion at the time. Roger Ver claimed that he was frozen $8 million by the latter, but Wu Jihan asked Roger to repay CoinFLEXs debt first.

The debt dispute stems from the huge losses Roger incurred on CoinFLEX, a trading platform in which he participated in investing, due to the collapse of Luna. Wu Jihan is a creditor of CoinFLEX. According to CoinFLEX CEO Mark Lamb, Roger Ver owes CoinFLEX $47 million worth of USDC. However, Roger Ver himself denied the allegations on Twitter, calling the debts rumors and accusing CoinFLEX of owing him a large sum of money.

Charged with false tax payment, awaiting extradition trial

Unlike other important figures in the crypto industry who have been charged with crimes, Roger Ver was accused of criminal activities by the U.S. Department of Justice, which originated from the tens of thousands of bitcoins he sold when he renounced his U.S. citizenship 10 years ago. The official announcement reads, Ver provided false or misleading information to the law firm and appraiser, concealing the true number of bitcoins he and his company owned. As a result, the law firm submitted a false tax return that severely underestimated the value of the two companies and their 73,000 bitcoins, and did not report any bitcoins owned by Ver personally.

After leaving the United States, Voger Ver sold 70,000 bitcoins in November 2017 for $240 million in cash. This transaction was problematic in the eyes of the U.S. Department of Justice: Although Ver was not a U.S. citizen at the time, the law still required him to report to the IRS and pay taxes on certain distributions.

Since Roger Ver discovered Bitcoin, Bitcoin has grown more than 60,000 times in 13 years. Looking back, we will find that Roger Vers mythical aura has nothing to do with his investment ability. His support for Bitcoin stems from his belief in the freedom of economic circulation. Later, he chose BCH from the perspective of monetary economy. He believes that only by expanding the block size can Bitcoin have all the economic characteristics that a currency should have and become accepted by the mainstream. In a youtube interview in 2022, Roger Ver said, Many people think I am a BCH maximalist, but I am not. What I want to promote is peer-to-peer electronic cash, or more precisely, a tool that can maximize the free flow of economy worldwide.

From dropping out of school to start a company to becoming a Bitcoin Jesus with billions of assets, to becoming a BCH scammer, being involved in debt lawsuits, and now being arrested, in the huge wealth myth brought by the rise of cryptocurrencies over the past decade, Roger Vers stage only belongs to the very early period. But even if the main crypto activities were in the very early period, Roger Ver could not escape the iron fist of US supervision.

After the US ETF was approved, many institutions believed that Bitcoin will exceed $100,000 in this bull market. The amount of funds in the crypto world is increasing, and Rogers vision of cryptocurrency challenging the traditional economic system and supporting anarchism is still a long way off. Today, the total market value of cryptocurrency has exceeded $2.5 trillion, and its influence on traditional finance has gradually increased. The US regulatory policy has also been tightened. The heavy-handed regulation not only affects the present and the future, but also the past events of the crypto industry are being examined and liquidated one by one.

Since last year, the US regulatory authorities have launched intensive lawsuits against institutions/personnel in the crypto industry. In addition to SBF, the former CEO of FTX, and DoKwon, the head of Terra, the crypto institutions sued also include ConsenSys, Kraken, Gemini, Celsius Network, Ripple Labs, Uniswap, and Coinbase. After CZ was sentenced to 4 months in prison and Roger Ver was caught, the regulatory pain that the crypto industry will experience will continue.

This article is sourced from the internet: Accused of false tax payment, the former Bitcoin Jesus cant escape the iron fist of supervision

Related: Arkham’s ARKM Token Tumbles 20% Amid Market Skepticism and Controversy

In Brief ARKM token falls 20% after controversial transfers, sparking debate in crypto community. Arkham moved 25.2 million ARKM tokens, raising transparency concerns and skepticism. ARKM price declines, tests new support at $1.93; further drop of 26% to $1.43 possible. Arkham’s ARKM token witnessed a drastic 20% decline following controversial token transfers. This event sparked widespread debate in the cryptocurrency community. Arkham is trying to address the market concerns while the ARKM token tests critical support. Why Arkham’s Transactions Gained Crypto Community’s Attention Nansen, a competitor, reported that Arkham moved substantial ARKM amounts, over 25.2 million tokens valued at more than $56 million, to unidentified wallets and Binance. This revelation raised concerns about transparency and intent. In response, Arkham addressed the situation on April 9. They clarified that these transfers…