Avalanche (AVAX) price could face a drawdown in the coming days, given that the altcoin is not receiving much support from its investors.

The potential outcome could result in AVAX failing to breach $45, leading to consolidation for the altcoin.

Are Holders Looking to Sell Their Avalanche?

Avalanche’s price for nearly a month has been hovering under the $40 mark. Breaching it is crucial for the altcoin to shoot up to $45. However, the chances of this happening in the coming days are bleak.

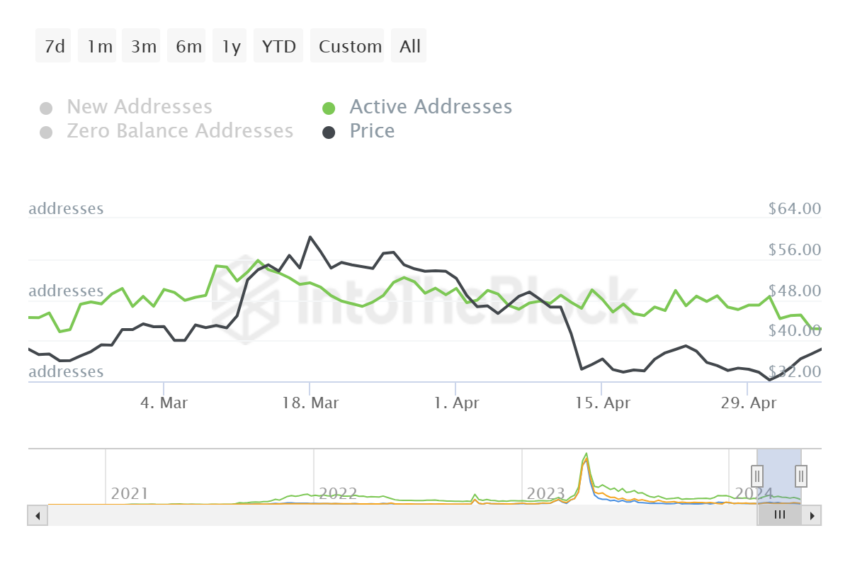

This is because the price daily active addresses (DAA) divergence is flashing a sell signal at the moment. Deviation of price from participation indicates potential discrepancies between market valuation and network activity.

Since the investors’ confidence is low, this could lead to potential selling as AVAX holders opt to book profits.

Consequently, the altcoin’s price could take a bearish hit.

This uncertainty of AVAX price’s outcome is also being reflected amongst the new investors that are joining the network. At the moment, the adoption rate of Avalanche is at 16%. This means that out of 100 new AVAX holders, only 16 are conducting transactions on the network.

Read More: How To Buy Avalanche (AVAX) and Everything You Need To Know

Put, this shows that the project is potentially losing traction in the market, which could slow down capital inflows.

AVAX Price Prediction: Is $45 in Sight?

Avalanche’s price, trading at $37 at the time of writing, is struggling to close above $40. This has occurred multiple times in the past, and flipping it into support usually leads to AVAX reaching the crucial psychological support of $45.

Thus, based on the aforementioned bearish cues, Avalanche’s price could be noted to have a drawdown toward $32. This would result in a potential 12% correction on the daily chart. As a result, AVAX could continue its consolidation.

Read More: Avalanche (AVAX) Price Prediction 2024/2025/2030

However, if the $40 resistance is breached, Avalanche’s price could attempt to chart a 14.8% rally toward $45. This would invalidate the bearish thesis, initiating recovery for the asset.