Unveiling the on-chain income gameplay: How to earn relatively stable and efficient passive income?

Original author: @DodoResearch

Tired of the fighting in the secondary market of centralized exchanges? Why not take a look at the rarely visited on-chain strategy? Compared with the huge number of users and trading volume of centralized exchanges, the on-chain with fewer players may be a relatively optimal solution in the current market situation. There are many sources of on-chain income, but most users are still in the primary stage of interactive airdrops, staking to accumulate points and buying new local dogs according to project activities.

This issue of #HottestCoin will reveal the on-chain income gameplay from several aspects, teach you how to earn relatively stable and efficient passive income on the chain, outperform the income levels of most asset management, and explain several popular projects in detail in the next few issues.

There are many sources of on-chain income. In the current market environment, chains, DAPPs, and narratives are all important, but they are not directly related to the strategy itself. For example, in the EVM system, there are only mainnets, Arbitrum, and BNB Chain that have long-term stable yields. Some EVM L2s have high initial staking yield expectations, but after the ecosystem stabilizes, very few can form a stable source of income. In terms of DAPP, it is mainly DEX, lending, stablecoins, the yield market Pendle, and various individual projects.

Taking the well-known LRT and LSD related projects as an example, staking to get points according to the project rules is a good strategy when the narrative trend is high. When the airdrop is finally realized, the returns are relatively good. However, in the current situation where the airdrop rules of the project are unclear, liquidity is poor, and the secondary market is weak, simply staking to get points is obviously not a particularly good strategy.

If the project itself supports @pendle_fi , then earning 20-40% annual passive income is obviously much more attractive. At the same time, there may be better strategies, such as providing liquidity in DEX, which can sometimes earn more than 40% annual income in the concentrated liquidity pool. Due to the staking lock-up, it is a long way to go to redeem ETH from the project party. Many users actually exit by directly swapping, and the liquidity pool of some projects is actually very small, which provides relatively high income opportunities.

So how do you choose a pool for DEX? Do you just look at the APR, the higher the better? No, DEX provides liquidity, and the income is generally affected by three factors: handling fees, token incentives, and the cost of impermanent loss. Some DEX handling fee yields include token incentives themselves, but it does not affect our separate analysis.

Pools suitable for retail investors include various stablecoin pools and LRT/LST pools. Note that you should choose pools with concentrated liquidity. Concentrated liquidity will improve market-making efficiency and increase the rate of return. These pools also have a great advantage. There is no need to worry about the risks brought by impermanent loss, nor is there any need to frequently change positions. There is no operational threshold. As long as the pool is selected appropriately, it is easy to exceed the rate of return of asset management.

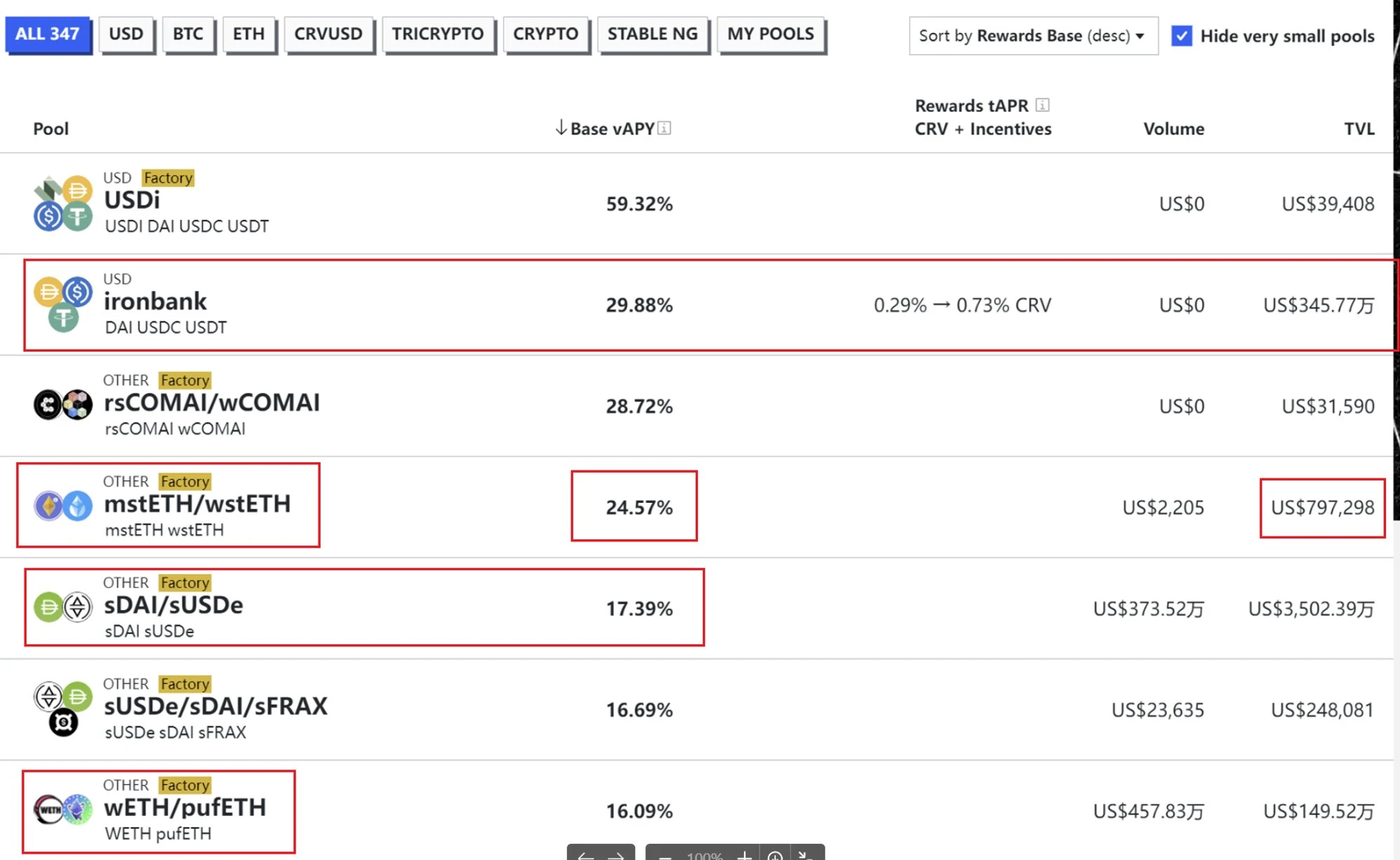

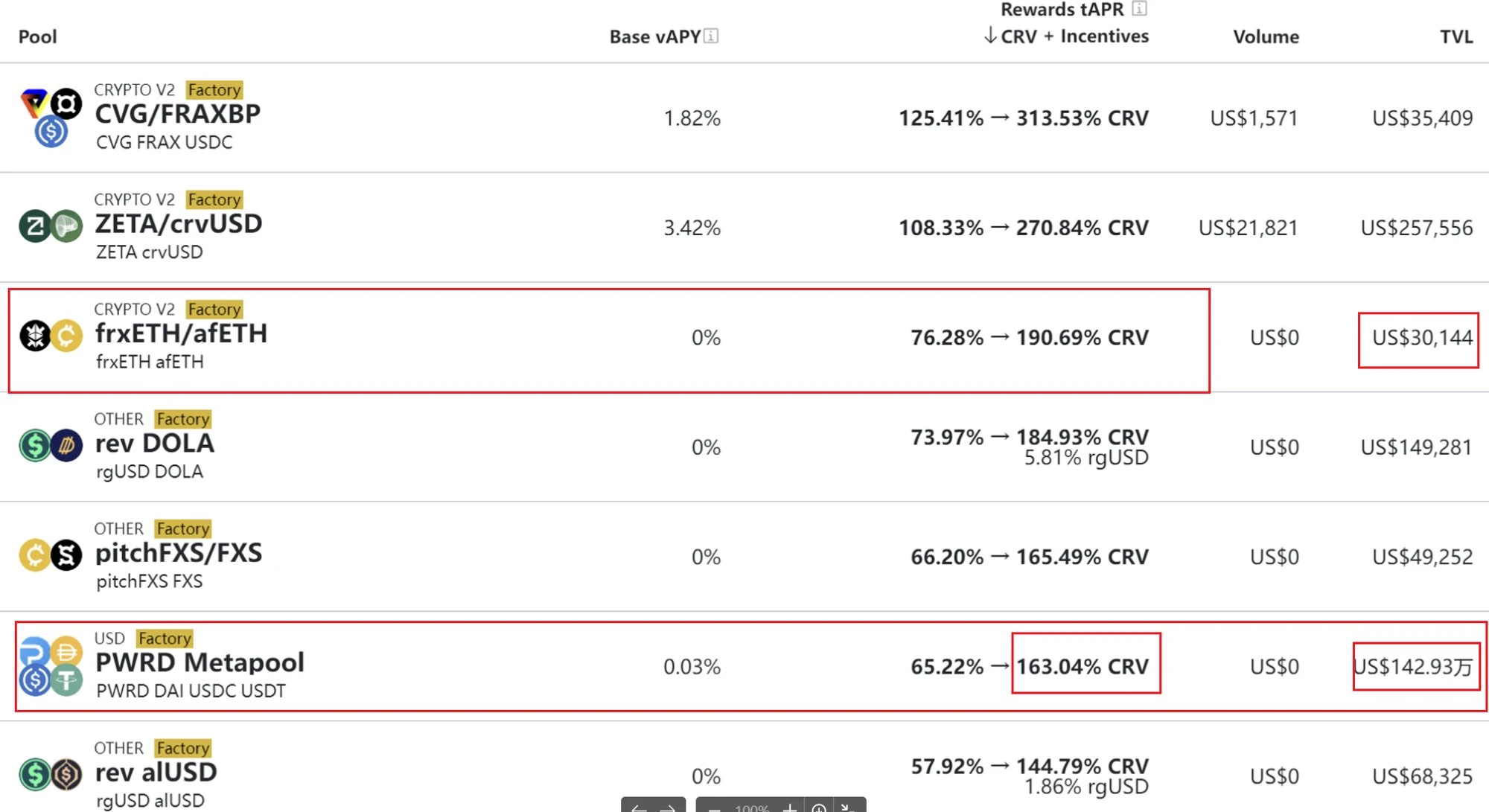

For example, the three pools on Curve have relatively high returns.

Pools like WETH/pufETH and mstETH/wstETH can also yield more than 15%, and the mining income related to crvUSD is more than 20%, and you can exit at any time. Isn鈥檛 it better than simply locking up positions?

Another example is the PWRD Metapool 4 pool on Curve, which has high token incentives and a deep pool, and is one of the optional pools.

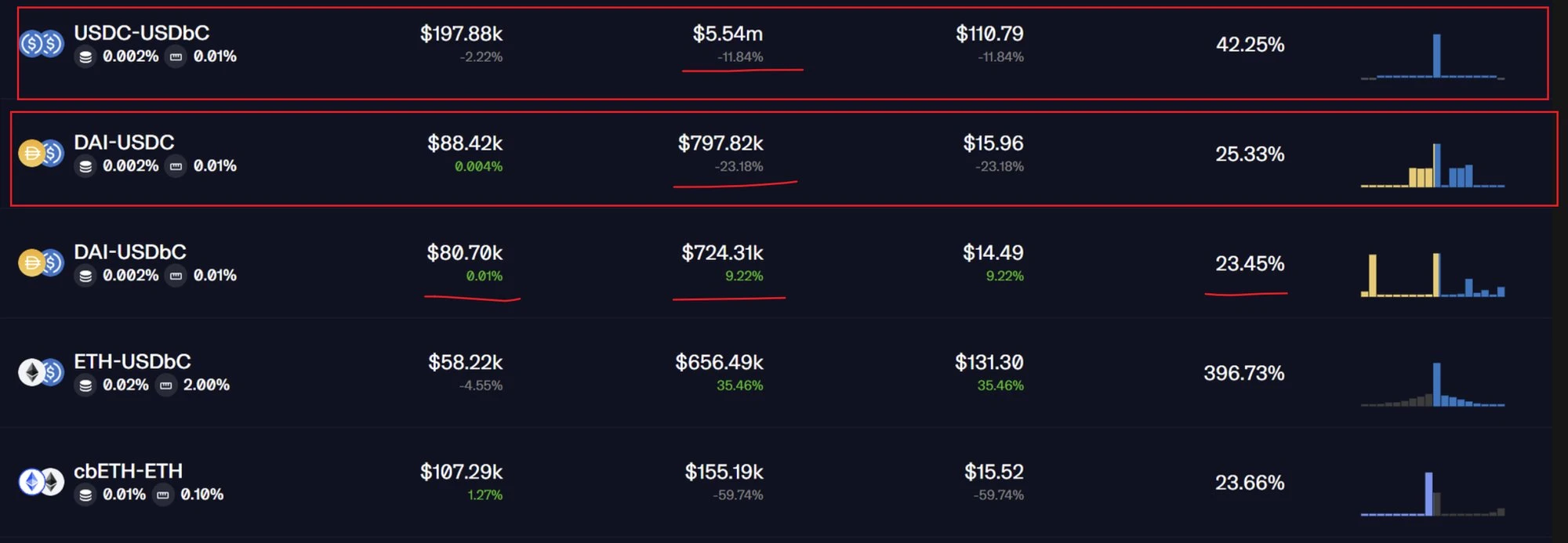

@mavprotocol is also one of the typical DEXs with centralized liquidity. The GHO stablecoin-related pool has a high depth and strong incentives, and is also a pool that is very suitable for retail investors to participate in.

This article is sourced from the internet: Unveiling the on-chain income gameplay: How to earn relatively stable and efficient passive income?

Related: Ethereum (ETH) Eyes $3,500 Target as Prices Rally Towards Trigger Zone

In Brief Ethereum’s price is holding on above $3,000, and it is doing its best to prevent a fall below it. Signs of recovery are visible in the demand for profits for $27 billion worth of ETH. The altcoin is in the Optimism zone on the NUPL, which historically has been the initiation point of a bull run. Ethereum (ETH) price is one of the strongest altcoins in terms of resilience, holding well above $3,000 for several days. This would give ETH the necessary boost to initiate a recovery and push back to new local highs. Ethereum Investors Pine for the Rise Ethereum’s price witnessed considerable losses following broader market cues in the last couple of days. The altcoin has since been holding above the $3,000 mark, and investors seeing…