SignalPlus Macro Analysis (20240429): Core PCE data continues to be high

Last Friday, the US Treasury yields took a breather. The core PCE data basically met the high expectations of analysts (overall and core increased by 0.3% month-on-month, and increased by 2.7%/2.8% year-on-year). At the same time, core services increased by 0.39% month-on-month, higher than 0.19% in February. Actual personal consumption expenditures also rose unexpectedly. Economic and price pressures were more stubborn than expected, bringing further hawkish pressure to the FOMC meeting later this week. The University of Michigan Consumer Confidence Index basically remained at 77.2, but the 1-year inflation expectation rose again from 2.9% in March to 3.2%, and the 5-10 year inflation expectation also rose from 2.8% to 3.0%.

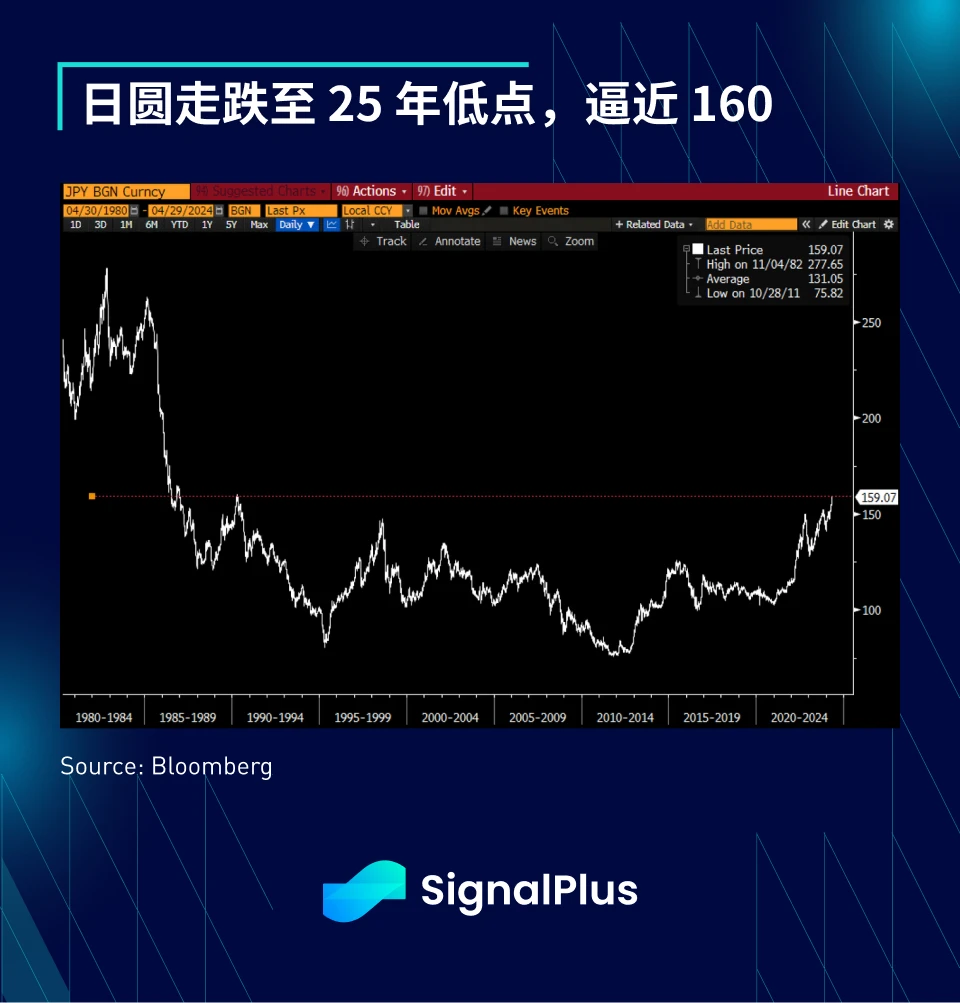

However, as the US Treasury position is close to being extremely bearish and the PCE results are not worse than market expectations, interest rates fell by about 3 basis points across the board, and the Nasdaq index rose by 2% due to yield trends and strong technology stock earnings. On the other hand, the Japanese yen has attracted more attention. Compared with the hawkish Federal Reserve, the Bank of Japan still chooses to maintain a dovish stance. The yen exchange rate is currently above 159, approaching a 25-year high of around 160.

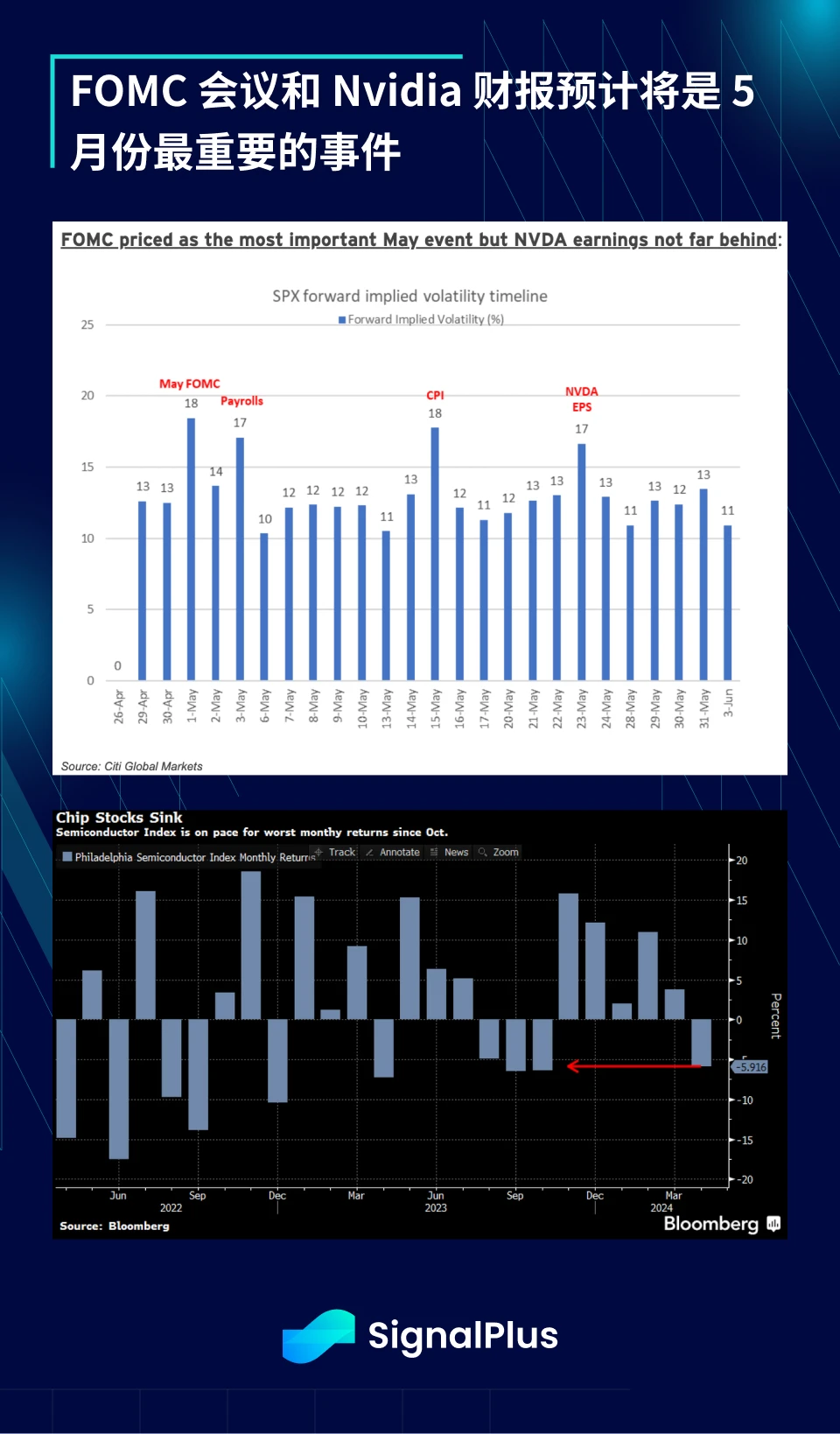

The FOMC meeting will be the focus of attention this week, but the market will also be affected by the US JOLTS and non-farm payrolls before and after the meeting, while CPI and Nvidia earnings are expected to be the biggest market influencers later this month, when the chip giant will seek to reverse its worst monthly performance since October last year. In addition, WSJ reported that allies of former President Trump are busy developing a secret plan to eliminate the independence of the Federal Reserve after his re-election. Of course, this situation is difficult to happen, but it is also an interesting idea in some atypical scenarios (BTC to 200,000?).

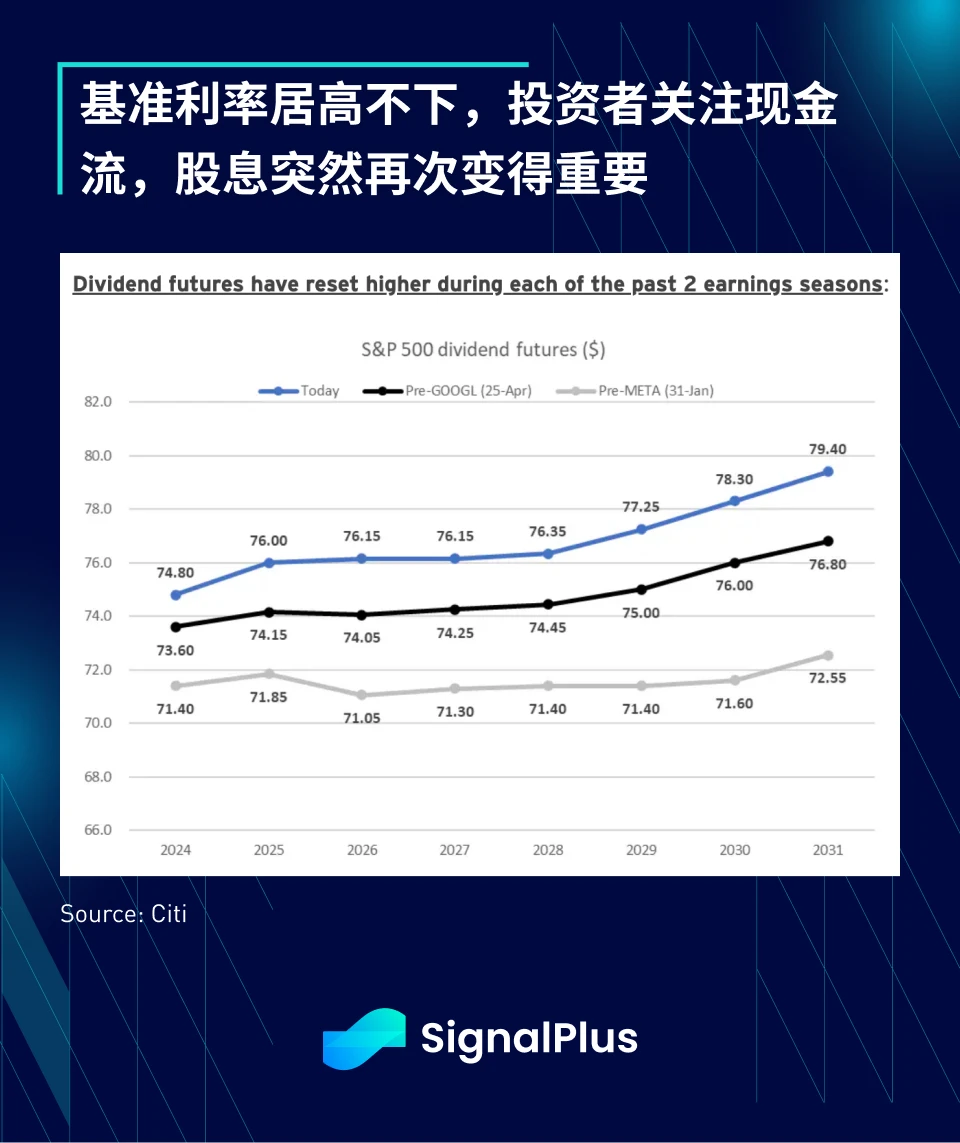

Despite the uncooperative US economic data last week, US corporate profits have once again become a bright spot, and the strong performance so far has led to a 3.3% upward revision of profits for the first quarter of 2024. In addition, the resumption of dividends by some companies (Meta, Google) has also brought new growth momentum to SPX and others. Currently, other technology companies are also under pressure to start dividend plans or convert some stock repurchases into cash payments, especially considering that many SPX companies have strong balance sheets and are fully capable of distributing dividends regularly.

On the crypto side, none of the major ETF products saw significant buying interest, with $84 million of outflows on Friday following $218 million of outflows last Thursday. Additionally, while still well above 2023 levels, CMEs BTC futures open interest has fallen sharply from recent all-time highs, and mainstream FOMO sentiment has slowed significantly, especially as the likelihood of rate cuts becomes increasingly unlikely. Native user interest remains concentrated in BTC runes/memecoins and ETHs L2 restaking and other yield-growth areas that are relatively unfamiliar to the general investor. We remain cautious on near-term price action and prefer a wait-and-see approach until the dust settles on the FOMC meeting and CPI data later in May.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240429): Core PCE data continues to be high

Related: Litecoin (LTC) Correction: How Deep Will the Price Drop?

In Brief LTC number of active addresses has been declining heavily since last week. LTC number of transactions is also declining, showing its momentum is cooling off. EMA Cross lines are currently forming a bearish signal, entering a downtrend. Litecoin (LTC) price saw a dramatic 40% increase, quickly followed by an equal correction over a week, raising questions about future trends. A decline in active addresses and transactions suggests cooling interest, while bearish signals from the Exponential Moving Average (EMA) crosslines indicate a potential downtrend. These developments point to a critical phase for LTC, as it might enter a price adjustment period before stabilizing. Investors are watching closely to see if LTC can overcome these bearish trends or if it will face further corrections. Litecoin Active Addresses Is Heavily Decreasing…