I. Introduction

In 2023, Bitcoin inscriptions brought new vitality and possibilities to the Bitcoin ecosystem. Then in early 2024, Bitcoin hit a record high of $73,000 and the Bitcoin halving event once again attracted market attention.

Bitcoins proven security and network effects have attracted many developers who see Bitcoin as the base layer of the blockchain. These developers are working on building many different Layer 2 projects on top of Bitcoins base layer. In this article, we will introduce the early and recent Layer 2 projects of Bitcoin.

Why does Bitcoin need Layer 2?

According to the scalability trilemma, it is difficult for a distributed network to balance decentralization, security, and scalability. The Bitcoin network has more than 75,000 core nodes, making it extremely decentralized and recognized as the most secure blockchain, but the Bitcoin network can only process 3-5 transactions per second, making it unscalable. A potential solution to the scalability problem is Bitcoin Layer 2 technology, which aims to improve Bitcoins scalability, enabling it to handle a large number of transactions without reducing transaction speed or increasing transaction prices.

2. Bitcoin Layer 2 Early Construction Project

Currently, the total locked value (TVL) of Bitcoins Layer 2 (L2) projects is only a small fraction of Bitcoins market cap. The total TVL of the four most well-known L2 projects is about $700 million, accounting for only about 0.15% of the entire L2 market. This shows that Bitcoins Layer 2 ecosystem is still in its infancy, especially compared to the Layer 2 market on other blockchains.

However, things are changing. The Lightning Network continues to grow steadily, Stacks is working on major upgrades to boost the Bitcoin smart contract market, and Rootstock is also constantly upgrading. Currently, the existing L2 solutions on Bitcoin have different goals, some aiming to improve the scalability of the Bitcoin network, while others aim to enhance its more expressive programmability.

1. Lightning Network

As a second-layer solution for Bitcoin, the Lightning Network aims to solve Bitcoins scalability problem, increase transaction throughput, and reduce transaction fees. Through payment channels, users can conduct transactions off-chain, thereby avoiding the time of competing for block space on the Bitcoin blockchain or waiting for L1 consensus, thereby improving efficiency. When users decide to complete a transaction through a payment channel, they can choose to close the channel and aggregate off-chain activities to the Bitcoin network for settlement. The current total locked value of the Lightning Network is:

The Lightning Network is designed to facilitate more than 40 million transactions per second, far more than other blockchains and traditional payment channels. In addition, the Lightning Network greatly reduces transaction fees, with very low base fees and rates. As the use of the Lightning Network increases, these fees continue to decline.

More and more users and businesses are adopting the Lightning Network to reduce transaction costs and increase the utility of Bitcoin. Integration at the government and corporate level has also promoted the application of the Lightning Network, such as the government of El Salvador setting Bitcoin as the national legal currency and compatibility with the government-commissioned ChivoWallet. Companies such as Twitter and CashApp have also added support for the Lightning Network on their platforms.

The market is optimistic about the future prospects of the Lightning Network, and many projects and investors are committed to building the L2 network. For example, Jack Dorseys Bitcoin startup Block launched a new venture capital institution called c=, which focuses on providing new financing tools and services on the Lightning Network. At the same time, companies such as Spiral are developing the Lightning Network Development Kit (LDK) to improve the user experience of the Lightning Network and increase its appeal to mainstream users. In addition, the Lightning Network core team Lightning Labs launched the Taro upgrade to bring new assets to the Bitcoin network using Bitcoins Taproot upgrade, enabling users to issue and transfer synthetic assets, tokens, and NFTs on Bitcoin.

Finally, some companies such as Zeebeedee and Strike are negotiating with different countries on fiat currency deposits, aiming to attract more users to join the Lightning Network and provide international remittance services to expand its application scenarios.

2. Stacks

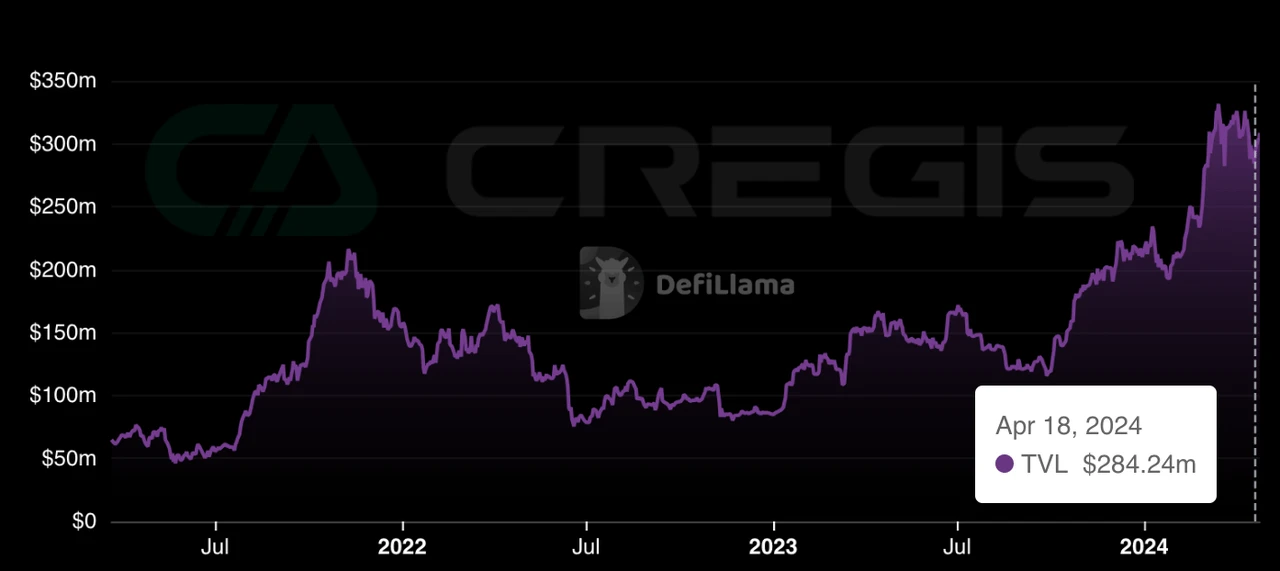

Stacks calls itself a Bitcoin layer, which means it is a second-layer solution that runs on the Bitcoin blockchain. Although it is not a sidechain, it leverages the security of Bitcoin and incentivizes miners and processes transactions by introducing STX tokens and a consensus mechanism called PoX. Stacks allows developers to build a variety of DApps, especially in the fields of DeFi and NFT. Stacks current total locked value:

Now, Stacks introduces sBTC, an asset pegged to Bitcoin, allowing users to trade on the Stacks layer with sBTC equivalent to Bitcoin. This will help further promote the development of DeFi and NFT use cases on Stacks and is expected to unlock capital within the Bitcoin ecosystem. In addition, Stacks is upgrading to Nakamoto to fully utilize Bitcoins security to determine transaction confirmations on the Stacks layer.

Interest in Stacks has increased significantly recently due to discussions about Ordinals and Runes and the role of Stacks in increasing Bitcoin use cases. Founder Muneeb Ali has also been active on top crypto-related podcasts. Investors may be preparing for the upcoming Stacks upgrade, and everyone is keeping a close eye on sBTC and the impact it may have on Bitcoin.

Rootstock

Rootstock (RSK) is an EVM-compatible sidechain for general-purpose Bitcoin smart contracts. It uses a unique variant of Bitcoins Nakamoto consensus called DECOR+, which enables RSK to be merged-mined with Bitcoin. SmartBitcoin (RBTC) is the native currency within RSK, pegged 1:1 to Bitcoin, and is used to pay transaction fees. Rootstocks current total locked value:

RSK connects to Bitcoin L1 through Powpeg, allowing BTC to be transferred between the two chains. Powpeg was initially managed by a consortium responsible for managing multi-signature wallets, and RSK later further increased the decentralization of Powpeg. Nevertheless, Powpeg still requires a certain degree of trust, as BTC transfer applications require at least 51% of the consortium members to sign and pass. Currently, there are nine members providing support for Powpeg.

One of the key advantages of RSK is that its virtual machine (RVM) is compatible with the Ethereum Virtual Machine (EVM), which means that RSK smart contracts can be written in Solidity. Sovryn is a relatively well-known RSK project, which is a non-custodial smart contract platform that supports Bitcoin lending and leveraged trading. RSK recently announced the removal of the supply cap of RBTC, which will expand the supply of RBTC to 21 million, which is comparable to BTC. This move is significant for Bitcoin DeFi because the supply of RBTC previously limited the activities that could be conducted on RSK. The removal of the supply cap may attract more developers attention and prompt them to build more DApps on RSK.

Any new DApps launched on RSK should be closely followed as they develop, as RSK provides a strong foundation for the goal of enabling DeFi on Bitcoin.

4. Liquid Network

LiquidNetwork is an L2 sidechain that can settle and issue digital assets such as stablecoins, security tokens, and other financial instruments on top of the Bitcoin blockchain. Unlike other L2 solutions, LiquidNetwork is relatively centralized and secures itself through a federation consensus mechanism managed by 60 workers. The workers are tasked with validating blocks and adding transactions to the LiquidNetwork sidechain.

Similar to RSK, LiquidNetwork also has a token called L-BTC that is pegged 1:1 to BTC. At the time of writing, the circulating supply of L-BTC tokens is about 3,534. The token is mainly used for the Lightning Network, which has relatively higher transaction speeds and throughput than the Bitcoin main chain. In addition, LiquidNetwork users can also use their L-BTC for other LiquidNetwork-enabled applications, such as lending or purchasing security tokens.

3. New Bitcoin Layer 2 Projects

1. BEVM

Founded in 2023, BEVM is a decentralized Bitcoin L2 compatible with EVM. Based on technologies such as the Schnorr signature algorithm brought by the Taproot upgrade, BEVM allows BTC to cross-chain from the Bitcoin mainnet to Layer 2 in a decentralized manner. Since BEVM is compatible with EVM, all DApps running in the Ethereum ecosystem can run on BTCLayer 2 and use BTC as Gas.

On November 29, 2023, BEVM released a white paper. Currently, BEVM has launched the pioneer network ChainX. According to the 2023 BEVM pioneer network annual data, its total transaction volume is 2.77 million, the total number of active addresses is 55,000; TVL reached 119.56 BTC (about 5.09 million US dollars); the total bridge capacity to and from Ethereum L2 is 11.53 million US dollars. Recently, the BEVM pioneer network launched the first inscription protocol Bevscriptions, which processed 3 million transactions in 6 hours, with a tps of about 150.

In December 2023, BEVM launched the first Odyssey event, which has now ended. BEVM founder Gavin (@gguoss) said that the second phase is expected to start on January 15, and 10-20 ecological projects will be invited to participate. The name of the second phase of the event will not use Odyssey, but will be named after the place name Helsinki where the first BTC block mined by Satoshi Nakamoto was found.

Currently, the BEVM ecosystem has more than 20 ecological projects including BTC full-chain DEXOmniSwap, decentralized signature protocol BoolNetwork, etc.

2. B虏 Network

Founded in 2022, B虏Network is a Bitcoin second-layer network developed based on ZK-Rollup. It is also compatible with EVM, which enables EVM ecosystem developers to seamlessly deploy DApps. The network participated in ABCDEs Bitcoin ecosystem project roadshow in November 2023 and eventually received investment. According to ABCDE, the core members of the B虏Network technical team come from mainstream Web3 open source communities such as Ethereum, Bitcoin, Cosmos, and Sui, and have received multiple Grant support. The team is good at Web3 Infra products such as blockchain Layer 1, Layer 2, cross-chain, and account abstraction, and has mature engineering capabilities.

On December 18, 2023, B虏Network announced the launch of the Alpha testnet MYTICA for partners and publicly recruited ecosystem developers. Partners and developers can deploy DApps on the B虏Network testnet. The networks ecological project cross-chain protocol Meson has deployed the stablecoin USDC on the B虏Network Alpha testnet. Meson is a cross-chain protocol that focuses on speed, stability, security and low fees. It supports the free circulation of mainstream digital assets such as ETH, BNB, USDC, USDT between B虏Network and more than 30 mainstream public chains.

3. Dovi

Dovi was founded in 2023 and is a Bitcoin Layer 2 compatible with EVM smart contracts. In November 2023, Dovi officially released a white paper, which introduced the technology that integrates Schnorr signatures and MAST structures to improve transaction privacy, optimize data size and verification processes. In addition, Dovi has also implemented a flexible framework for issuing various asset types other than Bitcoin, enabling cross-chain asset transfers.

KuCoinLabs announced a strategic investment in Dovi in December 2023, and its native token DOVI was launched on the KuCoin trading platform on December 12 of that year. The distribution of DOVI tokens adopts a fair release model. Within 4 hours of going online, all 15 million tokens have been claimed. As of January 15, the fully diluted market value of DOVI is approximately US$9.4 million. Currently, users can stake DOVI on the official website to receive rewards.

Dovis official website announced that the next step will be to release a test network, build developer community and ecosystem support, and launch Dovi V1. This move will help further develop Dovis ecosystem and attract more developers and users to participate.

4. Map Protocol

MAPProtocol is a very promising project, especially in solving cross-chain interoperability. By leveraging the security of Bitcoin, MAPProtocol provides other public chain assets and users with a way to seamlessly interact with the Bitcoin network, which will help strengthen the security and interoperability of the entire blockchain ecosystem.

Its latest strategic investment from DWFLabs and WaterdripCapital will undoubtedly provide strong support for the development of the project, which demonstrates the markets recognition and expectations for the project.

Regarding the destruction of MAP and MAPO tokens, this will not only help reduce the circulation of tokens and increase the scarcity of tokens, but also help increase the value of tokens. The current fully diluted market capitalization is approximately $260 million, which shows the markets recognition of the potential value of MAPProtocol, and this number is expected to grow further as the project develops and adoption increases.

In general, MAPProtocols innovation in cross-chain interoperability and the investment support it has received have laid a solid foundation for its future development.

5. MerlinChain

MerlinChain is a ZKRollup Bitcoin Layer 2 network that supports multiple types of native Bitcoin assets and is compatible with EVM, launched by the well-known BRC-420 Blue Box and Bitmap development team. According to the official website and some research reports, Merlin is a Bitcoin Layer 2 solution that integrates the ZK-Rollup network, decentralized oracle, and on-chain BTC fraud prevention module.

From MerlinChain鈥檚 official website, we can see the properties of its Bridge. It can transfer assets on BTC to the second-layer network, thereby reducing transaction fees. It is a typical representative of solving pain points first.

This solution, which integrates ZK-Rollup, oracle and anti-fraud modules, is expected to bring more innovation and development to the Bitcoin ecosystem, provide a more efficient and secure transaction experience, and attract more users and developers to participate.

(VI) Bison

Founded in 2023, Bison is a Bitcoin-native zk-rollup designed to increase transaction speeds while enabling advanced functionality on native Bitcoin. Developers can leverage zk-rollup to build innovative DeFi solutions such as trading platforms, lending services, and automated market makers.

Bison also participated in the roadshow of the ABCDE Bitcoin Ecosystem Project. According to the introduction, the Bison solution uses zero-knowledge proofs and ordinals for fast and secure transactions. All data is anchored back to Bitcoin to enhance security. Bison is able to achieve 2,200 transactions per second, and its fees are only 1/36 of Bitcoin.

The Bison team includes Starknets own code contributors, which means that the team has rich experience and expertise in blockchain technology and is capable of developing efficient and secure solutions. As Bison continues to develop in the Bitcoin ecosystem, it is expected to bring more innovation and convenience to Bitcoin users and developers.

4. The next step of Bitcoin ecology: smart contract market

Over the years, Bitcoin has been dealing with a variety of issues, including a lack of developer tools, slow and clunky infrastructure, and seemingly limited innovation relative to smart contract platforms like Ethereum, BNBChain, and Solana. However, things seem to be changing recently. Developers are finally able to showcase their skills within the Bitcoin ecosystem, and they are working around the clock to push updates and advance Bitcoin at an unprecedented pace. And all of this is driven by natural demand. This is exactly the point, when an ecosystem faces real, natural user demand, these demands essentially drive innovation and product development, forming a virtuous cycle, and things will improve rapidly.

1. BitVM

Robin Linus, the head of the ZeroSync project, published a paper on BitVM on October 9. In simple terms, BitVM is the virtual machine of the Bitcoin network, which achieves Turing completeness without changing the consensus rules of the Bitcoin network through off-chain execution and on-chain verification.

There is still a big difference between BitVM and Ethereum smart contracts. Ethereum smart contracts can support multi-party transactions, but BitVM is designed to support only two-party transactions. Most of BitVMs transaction processing is done off-chain, minimizing the impact on the underlying Bitcoin blockchain. Unlike BitVM, EVM is an on-chain engine, and all operations are performed in the native environment of Ethereum. BitVM is an optional additional engine for the Bitcoin blockchain, and its own operations do not require BitVM. In contrast, EVM is an integral part of the Ethereum blockchain; without EVM, there is no Ethereum.

The function of BitVM is realized through the Bitcoin Taproot upgrade. BitVM mainly relies on the taproot address matrix (taptree), which is similar to the program instructions of a binary circuit. In this framework, the UTXO spending conditional instructions in each Script script are regarded as a minimum unit of the program, and 0 or 1 is generated through the specific code in the taproot address to form a taptree. The execution result of the entire taptree is a binary circuit text effect, which is equivalent to an executable binary program. The complexity of the program depends on the number of combined taproot addresses. The more addresses there are, the richer the instructions preset in the Script, and the more complex the program that the taptree can execute.

Most of BitVMs processing is done off-chain, and transactions processed off-chain are bundled into batches and published to the underlying Bitcoin blockchain, using a validity confirmation model similar to that used in optimistic rollups. At the same time, BitVM uses a model that combines fraud proofs with a challenge-response protocol to process and verify transactions between two parties (provers and verifiers). The prover initiates a computational task and sends it through a channel established between himself and the verifier, who then confirms the validity of the computation. Once verified, the transaction is added to the entire batch that has been collated so that it can be published to the underlying Bitcoin blockchain.

2. RGB

RGB is maintained and updated by the LNP/BP Association and is a smart contract system that supports the Bitcoin network and the Lightning Network. The RGB protocol proposes a more scalable, more private, and more future-oriented solution, based on the concepts of client-side validation and single-use-seals proposed by Peter Todd in 2017.

The core idea of RGB is to use the Bitcoin blockchain only when necessary, that is, to use proof of work and the decentralization of the network to achieve double-spending protection and censorship resistance. All verification of token transfers is removed from the global consensus layer and placed off-chain, and is only verified by the client of the party receiving the payment.

So how does it work? In RGB, basically tokens belong to a Bitcoin UTXO (either an existing UTXO or a temporary one), and in order to transfer tokens, you need to spend this UTXO. When spending this UTXO, the Bitcoin transaction must contain a commitment to a message, the content of which is the payment information of RGB, which defines the input, which UTXO these tokens will be sent to, the assets id, the amount, the transaction to spend it, and other data that needs to be attached.

The specific payment information of RGB tokens is transmitted off-chain through a dedicated communication channel, from the payer to the recipients client, who verifies that it does not violate the rules of the RGB protocol. In this way, blockchain observers will not be able to obtain any information about RGB user activities.

However, verifying the payment information sent is not enough to ensure that the sender really owns the assets to be sent to you. Therefore, in order to ensure the finality of the transaction sent, you must also receive the history of all transactions of these tokens from the payer, from the current one all the way back to the one that was originally issued. By verifying all transaction histories, you can ensure that these assets have not been inflated and all spending conditions attached to the assets have been met.

Conclusion

Bitcoin Layer 2 is an important part of the development of modern Web3. If Bitcoin wants to maintain its position as one of the main blockchain networks, it needs a way to process transactions quickly and affordably. Fortunately, many developers have decided to take on Bitcoins scaling challenges, so there are many different Bitcoin Layer 2s to choose from when people are looking to reduce transaction fees and expand Bitcoins functionality.

Cregis is a solution platform for the Web3 era. Since 2017, it has focused on providing enterprises with crypto asset management tools and solutions. We have currently served more than 3,200 Web3 companies and teams, including exchanges, project parties, CryptoFunds, and cross-border e-commerce, with an average daily turnover of more than 30 million US dollars on the chain. Cregis currently provides MPC wallet services, transaction interface APIs, etc., and will fully implement VCC services and Web3 underlying asset solutions Web3 Bridge in 2024 to help more Web3 teams achieve diversified crypto asset transactions and management.

contact us

Official website: https://www.cregis.com/

Twitter: https://twitter.com/0xCregis

This article is sourced from the internet: Cregis Research: Bitcoin Layer2 Track Analysis

Related: Kaspa (KAS) Price Correction: Is $0.10 at Risk of Being Breached?

In Brief Kaspa price is down by 32% in the duration, where all other crypto assets rallied. The Open Interest and Funding Rate are both declining rapidly, suggesting investors are likely going to refrain from betting on a price rise. However, KAS shares a negative correlation with Bitcoin, which might help in recovery, given BTC is sinking right now. The Kaspa (KAS) price has been trending against the broader market cues since mid-February. While the entire crypto market flourished, KAS ended up wiping out a chunk of its gains. However, despite the massive corrections, this may not be the bottom line for the altcoin, as more losses seem to be on the way. Kaspa Investors to Likely Back Down Kaspa’s price has been consistently declining since mid-February. This barrage of…