The anticipated Bitcoin halving is just two weeks away. While historically, it has signaled the start of a price acceleration phase, analysts at CryptoQuant argue that its impact is waning.

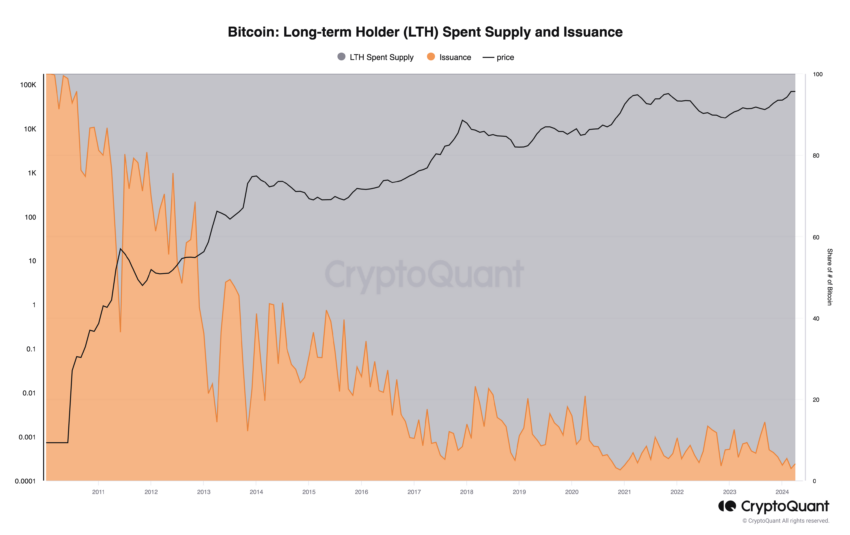

The forthcoming halving will reduce the new issuance by 14,000 BTC on a monthly basis, traditionally decreasing sell pressure from miners. However, the once-significant influence of halvings on Bitcoin prices seems to diminish as the new issuance becomes smaller relative to the total supply available for sale.

Bitcoin Halving Influence Wanes

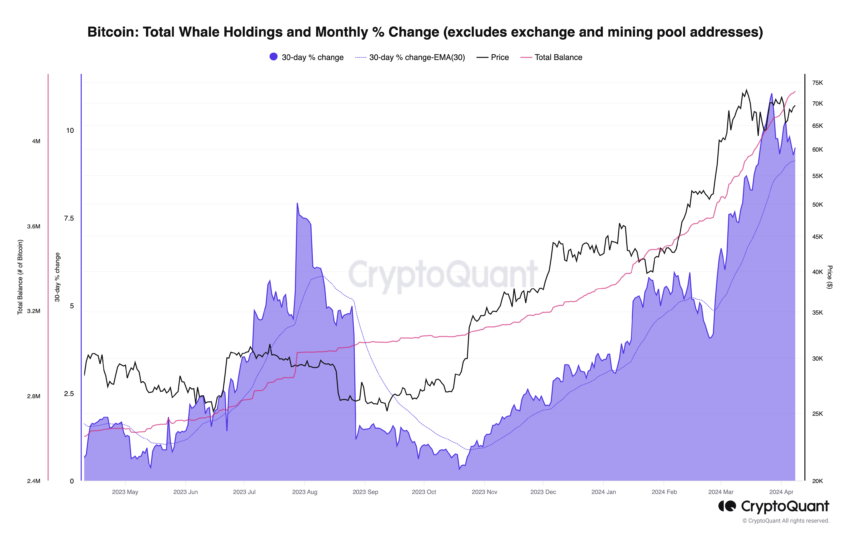

Long-term holders (LTH) selling, for instance, has averaged 417,000 BTC per month in the last year, overshadowing the monthly issuance of 28,000. In contrast, CryptoQuant highlights that Bitcoin demand growth, particularly from large holders or whales, is emerging as the primary driver for higher prices post-halving.

This cohort of investors is currently showing the highest-ever demand growth, which has historically fueled price rallies.

“In previous cycles, Bitcoin demand growth from large holders or whales has spiked, fueling the price rally. Currently, demand growth is around the highest ever, around 11% month over month,” analyst at CryptoQuant told BeInCrypto.

Read more: Bitcoin Halving Countdown

Moreover, the demand for Bitcoin from permanent holders has outpaced issuance for the first time in history. This adds further fuel for a potential Bitcoin price rally after the halving.

Permanent holders now add as much as 200,000 BTC monthly to their balances. This is significantly more than the approximately 28,000 BTC monthly issuance, which will further decrease to about 14,000 post-halving.

CryptoQuant also points out that the monthly issuance of Bitcoin has dwindled to just 4% of the total Bitcoin available supply. This starkly contrasts the periods before the first, second, and third halvings, where issuance represented 69%, 27%, and 10% of the total supply, respectively.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

In summary, while the upcoming Bitcoin halving will reduce the new issuance of BTC, leading to less selling pressure from miners, the unprecedented demand growth from large holders and permanent holders is poised to be the key driver for higher prices post-halving.