Bitget Research Institute: GAS on ETH chain drops to 2 Gwei, EIGEN airdrop application has been opened

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money.

-

Sectors that need to be focused on in the future: AI sector, TON ecosystem

-

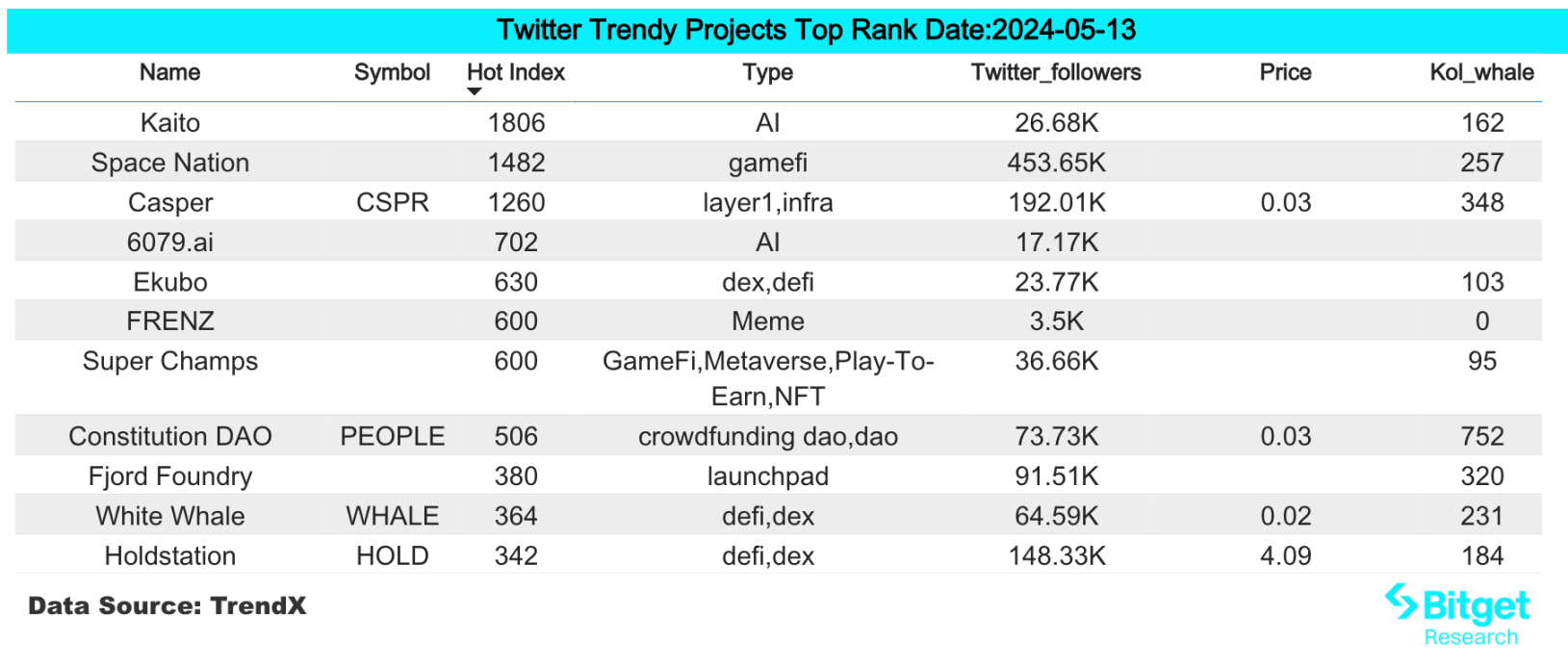

The most popular tokens and topics searched by users are: Kaito, NOT, TON

-

Potential airdrop opportunities include: UXLINK, Li.Finance

Data statistics time: May 13, 2024 4: 00 (UTC + 0)

1. Market environment

The cryptocurrency market fluctuated over the weekend as the market waited for the US CPI data on May 15. Traders were clearly risk-averse and the market lacked hot spots. ETH/BTC fell to 0.047, and the ETH network gas fee dropped to a freezing point of 2 gwei. In the past two years, the previous three ETH gas bottoms were also the bottoming ranges of the ETH price.

The airdrops and TGEs of well-known projects are still the focus of market attention: since EigenLayer opened the EIGEN token airdrop application, the number of addresses participating in the token application has exceeded 130,000 and is still increasing rapidly. The airdrop announcements of BounceBit, io.net, Notcoin, LayerZero, etc. have attracted market attention.

2. Wealth-making sector

1) Sectors that need to be focused on in the future: AI sector

main reason:

-

The AI sector and the distributed computing sector have a strong consensus in this round of market, with strong gains and a smaller maximum retracement than other sectors, which provides certain support. Today, the AI sector has experienced a certain correction, and you can wait for a good entry opportunity.

-

Market rumors say Apple is close to reaching an agreement with OpenAI to apply ChatGPT to the iPhone. At the same time, Apples Worldwide Developers Conference will begin on June 10, when Apple may announce its plan to upgrade Siri with AI technology.

-

ChatGPT-5 may be officially released as early as June.

Specific project list: TAO, RNDR, AR, ARKM, WLD, FET, AGIX

2) The sector that needs to be focused on in the future: TON ecosystem

main reason:

-

Panteras investment in TON may be at least over US$250 million, which is Panteras largest investment in cryptocurrency in history.

-

Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

-

The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

-

The increase in the issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million within two weeks, making it the eighth blockchain in terms of USDT issuance.

Specific project list: TON, FISH, UP

3. User Hot Searches

1) Popular Dapps

EigenLayer:

Eigenlayer is an innovative protocol described as recursively composable that enhances blockchain networks by reusing the security of base layers such as Ethereum. This approach enables improved computation and greater scalability by leveraging the established security of the underlying blockchain, ensuring that enhanced functionality does not compromise security, thereby maintaining trust and reliability.

Recently, EigenLayer has opened airdrops. All users on the chain who have participated in re-staking before can receive EIGEN tokens, but EIGEN tokens cannot be transferred at present. Users who currently receive EIGEN tokens can participate in the token staking of AVS services and participate in the project ecosystem development.

2) Twitter

Kaito:

Kaito AI aims to build an AI search engine for the crypto industry to bring together fragmented information in the crypto space. Kaito has built one of the most extensive information databases in the crypto space. By combining this database and our in-house AI technology with ChatGPT/GPT-3s advanced language models, Kaito aims to provide a better search experience than existing alternatives on the market.

Kaito AI, an AI-based encryption search engine, announced that it has completed US$5.3 million in financing. This round of financing was led by Dragonfly Capital, with participation from Sequoia China, Jane Street, AlphaLab Capital and others.

Kaito AI is quite agile in capturing hot information in the crypto industry and has recently attracted the attention of the crypto community, which is very helpful for following the dynamics of the crypto community. At the same time, the project has not yet issued coins, so users can actively participate in the interaction.

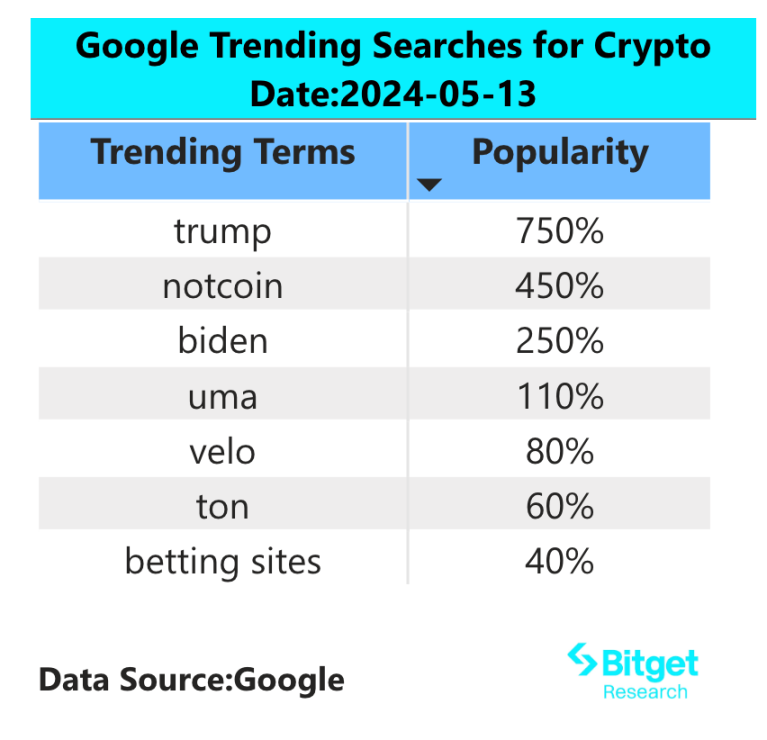

3) Google Search Region

From a global perspective:

Notcoin (NOT): Notcoin is a game based on Telegram, where users can earn in-game tokens by clicking on coin images. Similar to the concept of Tap to Earn. Before the Notcoin TGE, vouchers were used to represent the Notcoin currency in the game, which could be exchanged for $NOT after the TGE. The project has its own pre-market trading market: https://getgems.io/notcoin, and data shows that 640,000 users hold NOT pre-market tokens. It has been confirmed to be listed on Binance Launchpool and OKX.

From the hot searches in each region:

(1) Yesterday鈥檚 hot searches in various regions of Asia were mainly focused on recent hot topics: AI, SocialFi, and MEME

The recent hot AI-related tokens on the chain include: OLAS, FET, etc.; the SocialFi ones that have attracted attention include Farcaster, Degen, Pump.fun, etc.; the MEME ones that have attracted attention include Shiba Inu, Floki, etc.

(2) There are no significant hotspots in Africa, CIS and English-speaking regions

The regional popularity in this region shows a relatively dispersed performance, among which BTC, ETH, and Solana frequently appear on hot searches. Some users will pay attention to narratives on themes such as AI and Meme, and the overall market shows theme differentiation.

4. Potential Airdrop Opportunities

UXLINK

UXLINK is a groundbreaking web3 social system designed for mass adoption, allowing users to build social assets and trade cryptocurrencies. It includes a series of highly modular Dapps, from onboarding to graph formation, group tools to social trading, all seamlessly integrated in Telegram.

UXLINK recently announced financing, led by SevenX Ventures, Ince Capital, and HashKey Capital, with a total financing of US$15 million.

Specific participation method: Web3 social infrastructure project UXLINK issues IN UXLINK WE TRUST series NFT as airdrop vouchers. According to the users community contribution, on-chain interaction and asset status, it is divided into four levels: MOON, TRUST, FRENS, and LINK, corresponding to different rights and interests and the number of UXLINK token airdrops.

Li.Finance

Jumper Exchange is a multi-chain liquidity aggregator that supports cross-chain exchange and gas fee exchange functions of most mainstream blockchains, and is technically supported by LI.FI.

Its developer LI.FI completed a $17.5 million Series A financing round, led by CoinFund and Superscrypt.

Specific participation method: Complete multiple cross-chain transactions on Jumper Exchange. The specific transaction amount, number of transactions, active time, etc. can refer to the airdrop standards of other DEXs in the past.

Original link: https://www.bitget.com/zh-CN/research/articles/12560603809478

銆怐isclaimer銆慣he market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk.

This article is sourced from the internet: Bitget Research Institute: GAS on ETH chain drops to 2 Gwei, EIGEN airdrop application has been opened

Related: The new wave of interest-paying stablecoins: mechanisms, features, and applications

Original author: 0x Edwardyw The new interest-paying stablecoin generates yield from three different sources: real-world assets, Layer 1 token staking, and perpetual contract funding rates. Ethena offers the highest yield but also the greatest volatility, while Ondo and Mountain protocols restrict access to U.S. users to reduce regulatory risk in order to distribute interest income. Lybras model redistributes $ETH staking income to stablecoin holders and is the most decentralized model, but faces incentive problems. Based on the number of holders and DeFi usage scenarios, Ethenas USDe and Mountains USDM are leading in stablecoin adoption. Part I: Diverse Sources of Income Unlike the last crypto bull cycle, when algorithmic stablecoins relied on subsidies or native token inflation to provide very high but unsustainable returns, ultimately leading to the collapse of projects…