Ethereum (ETH) price bounced back this week from the lows of $3,100, reigniting hopes of new highs for the altcoin.

However, the inclination of ETH investors toward realizing profits might impede this process.

Ethereum Price Rise Warrants Restraint From Investors

Ethereum’s price increased to $3,642 at the time of writing, and in doing so, it brought investors back on the network. However, their actions are not in line with the expectations.

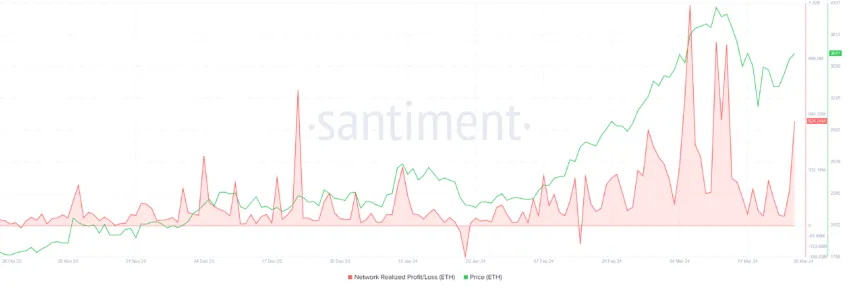

The transfer of ETH from one address to the other shows that the current price is higher than the last price. This signals the fact that the supply held by such addresses is bearing profits, which will push other investors to engage in the same.

This is an indication of the potential profit booking that might take place, which will accelerate selling among ETH holders.

Read More: How to Invest in Ethereum ETFs?

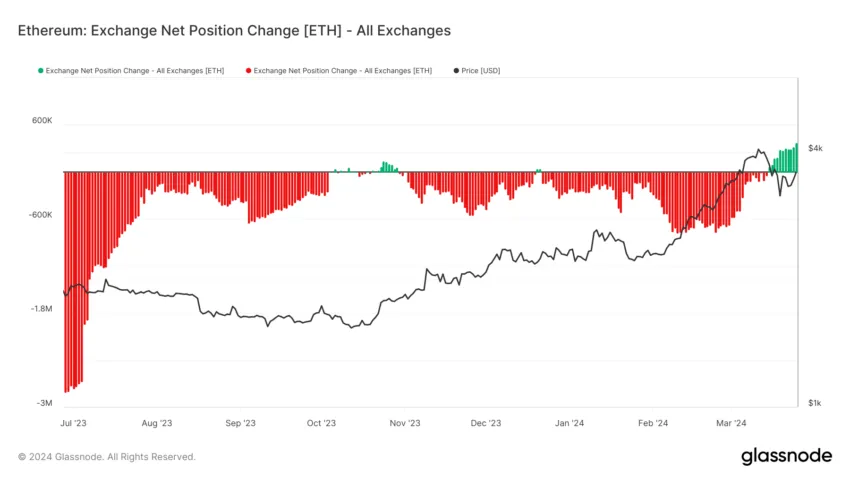

ETH price declining is already at a high risk since investors have been offloading their holdings into exchange wallets. The net position change shows that about 374,130 ETH worth over $1.36 billion have been sold in the last ten days. In the past 24 hours alone, over 52,030 ETH worth $190 million was sold by the investors.

Thus, as profits run up, so will selling, which might result in the rally halting soon.

ETH Price Prediction: Count Down to $3,000

Ethereum’s price managed to reclaim the 50- and 100-day Exponential Moving Average (EMA). However, considering the sentiment of profit-taking, ETH may trickle down to find support at $3,336, which coincides with the 100-day EMA.

If this support is lost too, $3,031 is the next likely support floor, which is in confluence with the 23.6% Fibonacci Retracement of $4,626 to $2,539.

On the other hand, ETH has already flipped the 50% Fibonacci Retracement. It could invalidate the bearish thesis if it sees further growth and flips the 61.8% Fib line into support.

Read More: Ethereum ETF Explained: What It Is and How It Works

The reason is that the latter is considered to be the bull run support floor and tends to reignite the rally. Marked at $3,830, ETH could climb further from here on.