Solana price made waves in the crypto market towards the end of 2023 after breaching the $100 mark. While SOL is now trading at $144, it still has a lot of ground to cover to come close to establishing a new all-time high.

It may seem that the altcoin may not have enough steam to power through after the recent rally. However, one should note that Solana is still undervalued.

Solana Price Might Keep It Up

Solana price increased by 45% in the last two weeks, bringing the cryptocurrency to $144 at the time of writing. Generally, such rallies tend to live for a short while since crypto assets lose their momentum due to saturation of the bullish sentiment or profit-taking. But SOL stands to be a different breed.

Currently, the Relative Strength Index (RSI) is crossing the threshold and entering the overbought zone. Looking at the historical data, it can be observed that SOL tends to rally right after entering this zone. Depending on the broader market conditions, these rallies have ranged from 300% to 400%.

Although a 300% rise may not be on the horizon, investors’ support could increase the SOL price. A successful breach of the $150 resistance would enable a rally to $168. This price coincides with the 50% Fibonacci Retracement of $248 to $89. Flipping this level into a support floor would give Solana the boost necessary to hit $200.

Is SOL Undervalued?

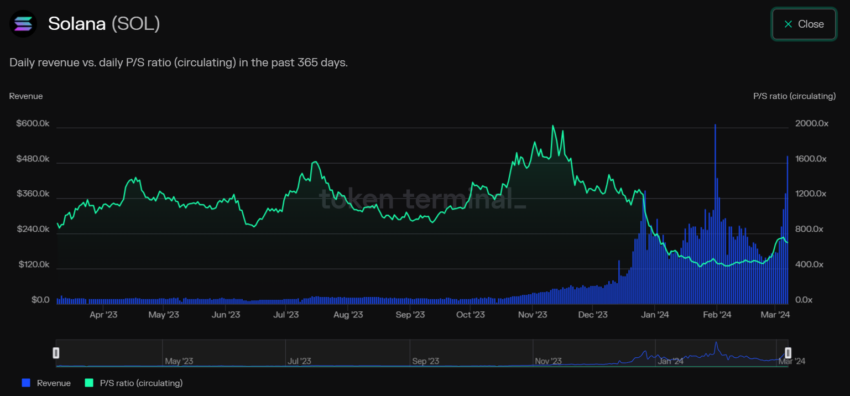

Beyond the technical and historical data, fundamentally, Solana is worth a lot less than what it should be. This is the inference drawn from the Price-to-Sales (PS) ratio of the cryptocurrency.

The PS ratio compares a protocol’s market cap to its revenues. A low ratio could imply that the protocol is undervalued and vice versa. Despite the recent rally, SOL is still highly undervalued according to the metric.

The altcoin did not increase its value even during the bearish 12 months of mid-2022 to mid-2023. However, towards the end of 2023, the revenue generated by the altcoin failed to catch up with the rapidly growing market capitalization. This resulted in Solana being undervalued.

Thus, it implies that the altcoin still has a lot of room to grow and could rally further.

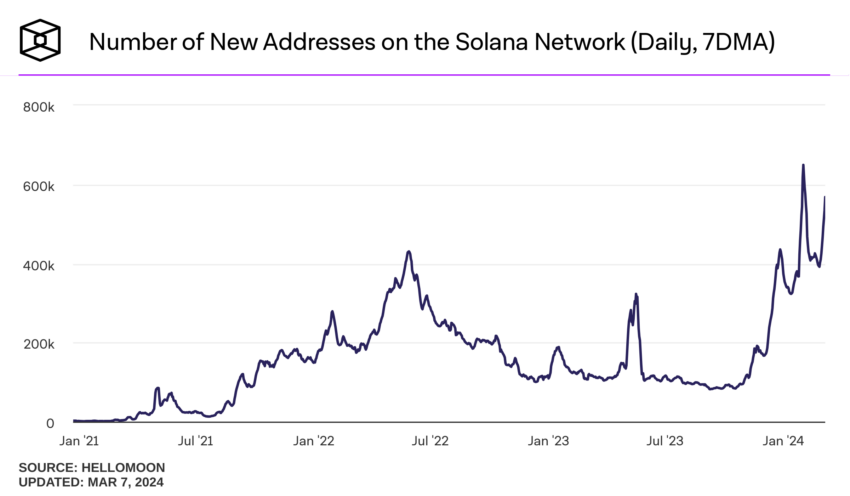

Furthermore, the crypto asset also notes significant support from the investors who are likely to jump on board to capitalize on the ongoing rally. The rate at which the number of addresses has formed on the chain in the last two weeks has increased by 41%.

This is a positive development as growing investors lead to a surge in the transactions conducted on the chain, offsetting the bearishness emanating from profit booking.

Solana Price Prediction: Any Chances of Correction?

Given that the market is slowly growing, it might exhaust the bullish momentum soon if it does not secure a support floor. Currently, this floor lies at $150, which is also a crucial psychological support level.

Should Solana price fail to breach $150, it could trickle to $126, and profit-taking at this time would further intensify the downtrend. Losing $126 would invalidate the bullish thesis completely and potentially even send SOL to $100.