The crypto market is presently elated as Bitcoin has marked a new multi-year high, and its bullish impact can also be noted on MATIC’s price, which has risen by over 57% over the past month.

The altcoin is absorbing the optimism and pushing upwards despite the Polygon token observing potential drawbacks from its investors. Will they be looking to sell soon?

Polygon Traders Switch to Selling

Over the past month, Polygon’s price has seen considerable gains, reaching $1.12 at the time of writing. Unlike Bitcoin, MATIC faced considerable resistance throughout February, but support from its investors kept the rally going, bringing the cryptocurrency to an 11-month high.

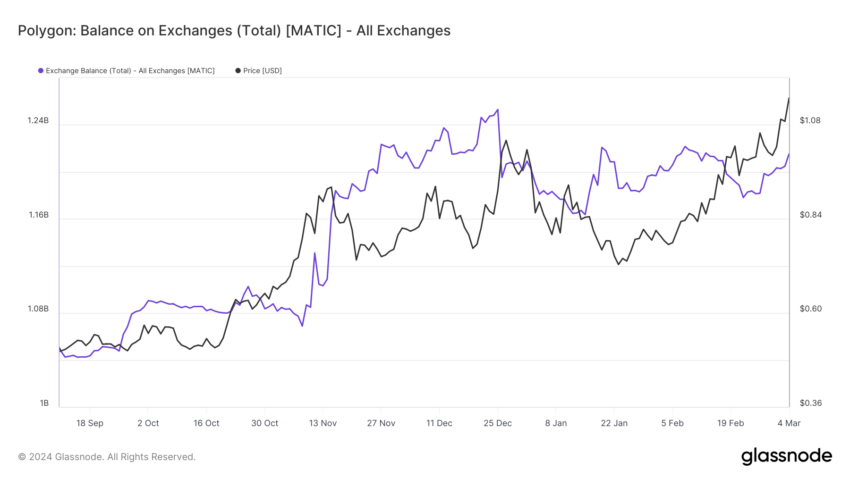

The same investors could trigger a decline in the MATIC price as they have seemingly decided to start selling. The total supply of MATIC available on the exchanges noted an increase of 100 million MATIC in the last 12 days, bringing the total holdings to 1.2 billion MATIC.

Usually, an increase in the exchange supply hints towards the intention of selling. Furthermore, during the period of rallies, this is indicative of profit booking. Given that the bullish sentiment is rather ephemeral, MATIC holders would likely opt to secure their profits before corrections arrive.

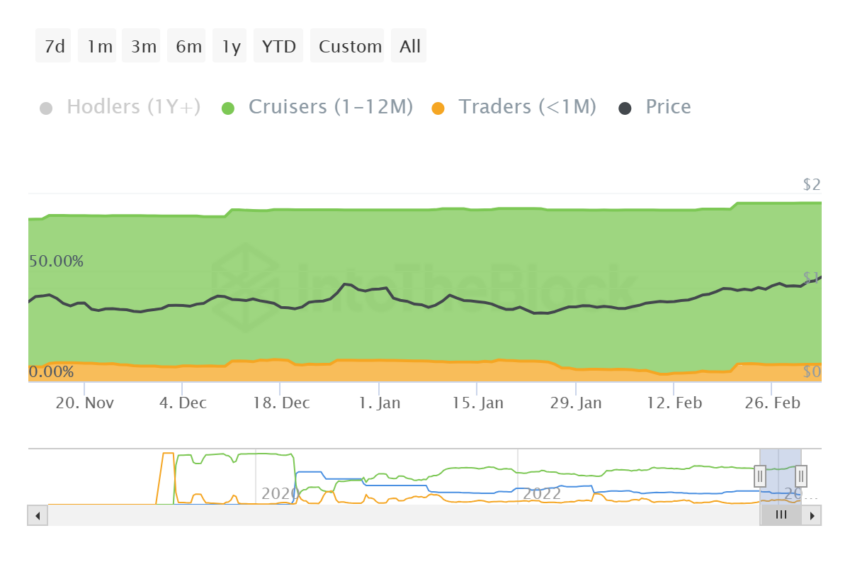

However, this particular cohort is the biggest threat to Polygon’s price rise as these investors are known for quick buying and selling. These are the short-term traders. Essentially, addresses that have held the asset for less than a month.

In the case of MATIC, their concentration doubled from 3.9% to 7.8% in merely two weeks, and they currently hold about $782 million worth of tokens. Should these investors opt to sell their holdings for profits, the altcoin could face considerable resistance from rising further and potentially even decline on the daily chart.

MATIC Price Prediction: Performance Hinges on Bitcoin’s Performance

MATIC price is presently close to testing a critical resistance level of $1.18. Which has historically proven to be a solid support level, generally the first step towards a rise beyond $1.20. But since the cryptocurrency is noting pushback from its investors, its next best shot is to ride the highs of Bitcoin.

BTC’s price on Monday established a new yearly high of $68,359, imbuing optimism of additional profit. If BTC continues this rally, MATIC could see further gains, too, as the altcoin shares a positive correlation of 0.9 with Bitcoin. This high correlation suggests that MATIC could follow the momentum generated by BTC in the event that it fails to follow the path created by the demand and supply of the asset.

Should MATIC price continue rising, it could flip the $1.18 resistance level into support. However, it could fall back to $1.05 if it fails to breach this barrier. A daily candlestick close below this line would leave the altcoin vulnerable to a fall to $0.95, invalidating the bullish thesis.