Ethereum (ETH) network activity increased has been sharply increasing. But will this also have a positive effect on the ETH price?

The Ethereum price is on the verge of a bullish breakout, with chances of a bullish trend reversal. To do this, ETH must pass the important Fibonacci resistance between $2,400 and $2,600.

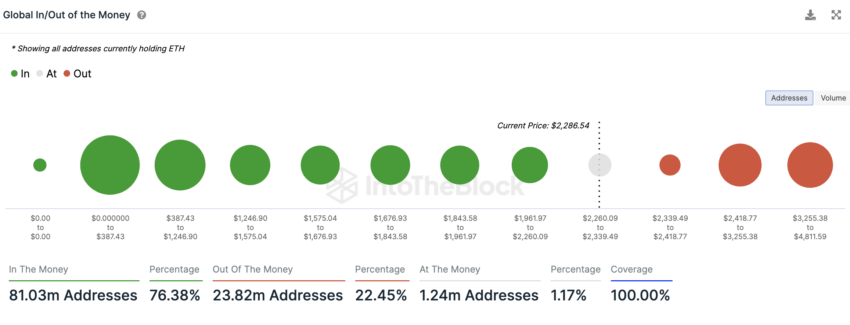

The Overwhelming Majority of Ethereum Addresses Are in Profit

Over 76% of Ethereum addresses are in the money at the current price of around $2,200. Only 22.5% of ETH addresses are out of the money, whereas around 1.17% of addresses are at the break-even point.

In the money means the addresses are at a profit. Whereas, out of the money means they have an unrealized loss.

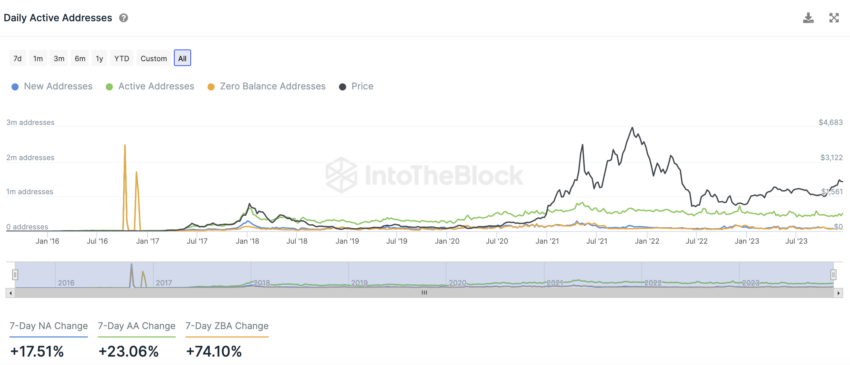

Ethereum Network Activity is Surging

Ethereum network activity has increased significantly in the last seven days. The number of new addresses in the ETH network has increased by around 17.5%.

The number of active addresses has even increased by around 23%, while Ethereum addresses without ETH balances have even increased in number by around 74%.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

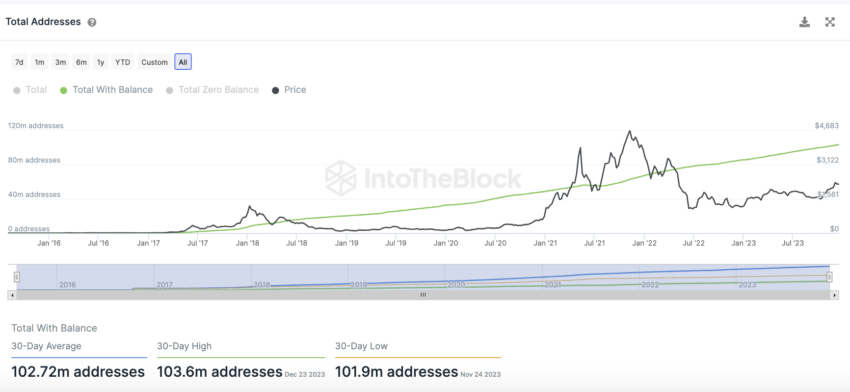

The Ethereum network is growing – the number of addresses with ETH balances is increasing

The total number of Ethereum addresses is in a stable upward trend. There were an average of 102.72 million ETH addresses in the last 30 days. That is more than twice as many as for Bitcoin (BTC).

Read more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

There Has Been a Surplus of Withdrawals on Exchanges in the Last Seven Days

In the last seven days, around 166,320 more ETH were withdrawn from crypto exchanges than were deposited. Moreover, in the last 24 hours, the centralized exchanges’ ETH balance declined by 139,150.

This suggests that these ETH will be held and not released for trading purposes.

Read more: How To Evaluate Cryptocurrencies with On-chain & Fundamental Analysis

More Than Half of ETH Tokens are in the Hands of Retail Investors

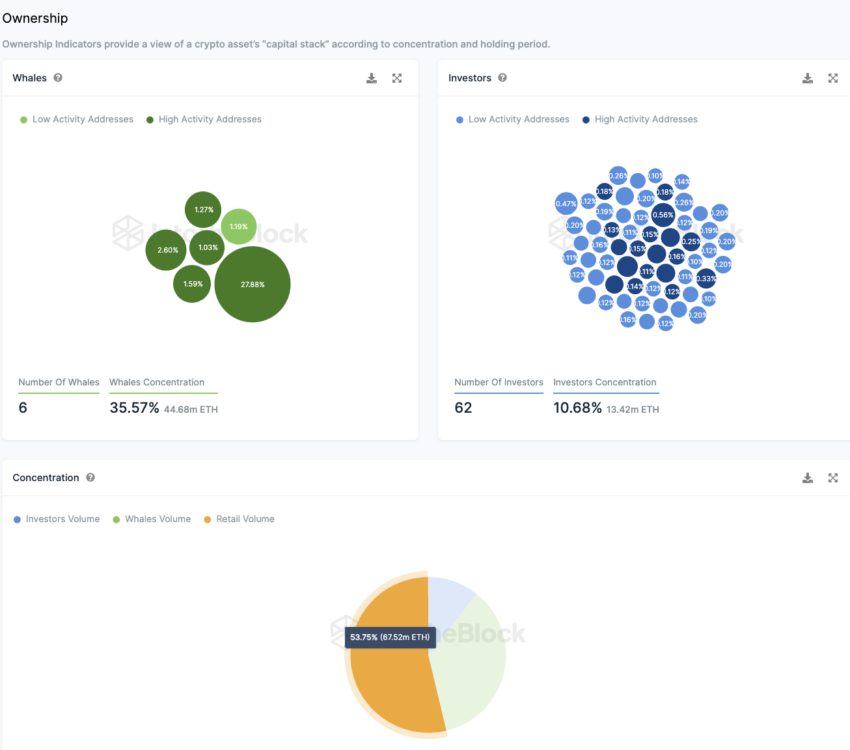

Most ETHs (around 54%) are in the hands of retail investors. These are addresses that each hold less than 0.1% of the supply. There are only six whale addresses, each holding more than 1% of the supply.

Together, whales’ wallets make up around 35.6% of the token supply, i.e. a significant share. These players have great market power.

A relatively large number of 62 addresses each hold between 0.1% and 1% of ETH Supply. Together, these major investor addresses hold around 10.7% of all available Ethereum.

Do you have anything to say about Ethereum network activity or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.