BTC falls below $57,000, hitting a two-month low. Who is to blame?

Original | Odaily Planet Daily

Author | How to

Recently, the overall crypto market has been on a downward trend. OKX market data shows that at 16:00 this afternoon, BTC briefly fell below 57,000 USDT, temporarily reporting 57,131.1 USDT, a 24- hour drop of 8.87%; ETH fell below 2,900 USDT, temporarily reporting 2,859 USDT, a 24-hour drop of 9.07%.

Under the influence of BTC and ETH, altcoins also experienced a sharp correction. As of the time of writing, SOL is temporarily reported at 120.88 USDT, a 24-hour drop of 10.57%; ORDI is temporarily reported at 32.21 USDT, a 24-hour drop of 22.91%; BNB is temporarily reported at 547.5 USDT, a 24 -hour drop of 8.54%; OP has a smaller drop, currently reported at 2.43 USDT, a 24-hour drop of 1.58%.

Affected by the overall downward trend, the total market value of cryptocurrencies has also shrunk significantly. According to CoinGecko data, the total market value of cryptocurrencies has shrunk to 2.2 trillion US dollars, a 24.. drop of 8.56%. Cryptocurrency users trading enthusiasm has also declined significantly. Todays panic and greed index has reached 54, and the weekly level change has also dropped from greed to neutral.

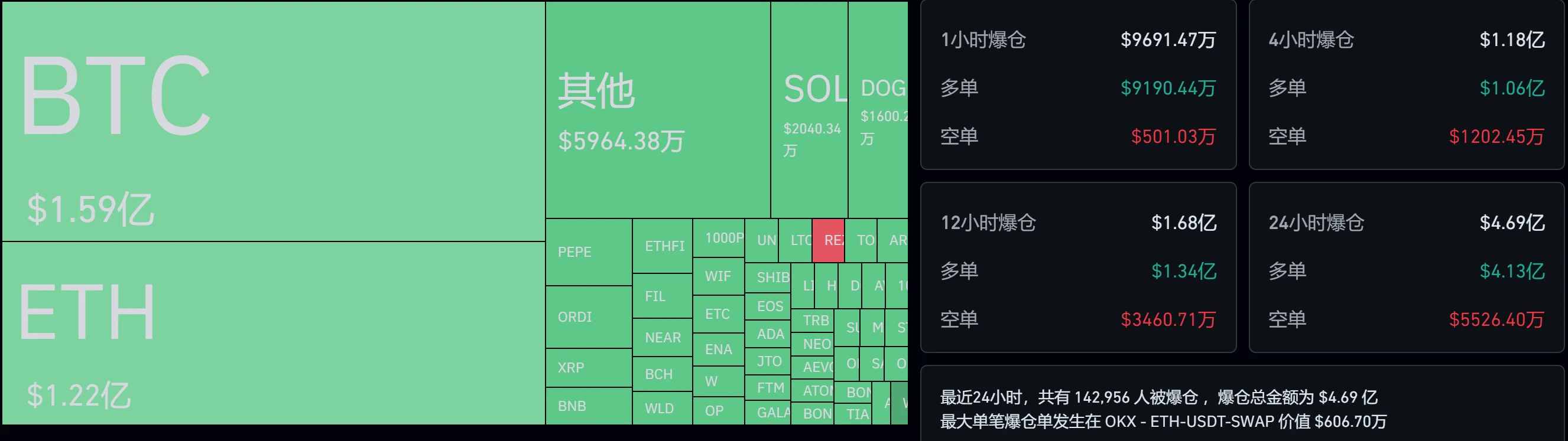

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network has liquidated $469 million, most of which are long orders, amounting to $413 million. In terms of currencies, BTC liquidated $159 million and ETH liquidated $122 million.

Reasons: The prospect of a Fed rate cut is slim? Hong Kong ETFs failed to meet expectations? CZ was sentenced to 4 months in prison?

The overall downward trend of the market began to show signs in early April. Although it rebounded briefly for a few days around April 20 due to the Bitcoin halving, the overall situation is still not optimistic.

From the perspective of the global situation, the geopolitical situation in many regions is chaotic, and the confrontation between Iran and Israel continues to escalate, leading to an overall decline in the global market. In addition, the prospect of the Feds interest rate cut is slim. Many Fed officials have revealed that there will be no interest rate cut before the end of the year, and according to the Feds semi-annual financial stability report, continued inflation is still regarded as the number one financial risk.

Therefore, changes in the global geopolitical landscape and slim expectations for interest rate cuts have become the fundamental reasons for the decline in the crypto market.

From the perspective of ETFs, the US Bitcoin spot ETF had a net outflow of $162 million, and had a net outflow for 5 consecutive trading days. The main reason why Bitcoin prices have broken through new highs this year is the inflow of funds into Bitcoin spot ETFs and the future prospects brought by ETFs, but success or failure is also due to Xiao He, when the funds of the US Bitcoin spot ETF flow out, the market decline is also expected.

However, according to 10x Research , this round of pullback is because institutional investors have different risk management methods from most retail traders. After this pullback, the price of Bitcoin is close to the average entry price of US Bitcoin ETF holders, which is about $57,300.

In addition, the first day of trading of Hong Kong Bitcoin Spot ETF and Ethereum Spot ETF was not ideal. Compared with the first day trading volume of the US Bitcoin Spot ETF, it was only 0.02%. The amount of capital inflow has not yet been announced, which may be a foreshadowing.

And in the early hours of this morning, the much-anticipated CZ trial was also one of the triggers, but compared to the three-year prison sentence previously recommended by the U.S. Department of Justice and prosecutors, a four-month suspended sentence may be the best solution. The market also rebounded briefly, but it still could not affect the overall downward trend.

Finally, from the perspective of the crypto market itself, it is a consensus that there will be a brief correction after the historical halving.

The future is still bright, with only two expected events yet to be achieved

Since last year, the crypto market has had many expected events that have affected market trends, including the US Bitcoin spot ETF, the Feds interest rate cut, the FTX incident, the SEC and Binance dispute, the US Ethereum spot ETF, and the halving cycle. As of now, there are still two major uncertain events: the US Ethereum spot ETF and the Feds interest rate cut.

The US Ethereum spot ETF will face its first fund approval deadline on May 23, which may determine the current market trend. However, the market is not optimistic about this. It is reported that many institutions and SEC insiders will not approve the Ethereum spot ETF on May 23, so there may be a new round of market changes around May 23.

In addition, the expectation of the Feds interest rate cut was also mentioned in the previous article. At present, the US inflation rate is still facing signs of rebound. Although many Wall Street institutions have indicated that the interest rate cut will come in July, judging from the current situation, the possibility of a rate cut this year will continue to decrease.

In addition to the above two expectations, Hong Kong Bitcoin Spot ETF and Ethereum Spot ETF may become potential factors affecting the market trend. Although the trading volume on the first day is not outstanding, the ETF radiation range in Hong Kong will include countries and regions in the Asian time zone such as Southeast Asia and the Middle East, and may become a new source of capital inflow in the crypto world. Although it has not yet been opened to mainland China, the expectation still exists.

In general, the future market trend is still in an overall upward trend, but there are uncertainties in the expected results. Odaily Planet Daily reminds everyone that the recent market fluctuations are large, so pay attention to investment risks.

This article is sourced from the internet: BTC falls below $57,000, hitting a two-month low. Who is to blame?

Related: Shiba Inu (SHIB) Price Forecast: Is an 18% Drop Imminent Due to Slowed Buying?

In Brief Shiba Inu’s price is in a descending channel and will continue the drawdown following a failed breach. Whales have slowed down their accumulation, adding only $328 million worth of SHIB in the last two months. Active addresses by profitability show that over 20% of the investors are in profit and likely looking to sell. Shiba Inu (SHIB) price faces bearish woes at the time of writing, which could result in the meme coin witnessing further decline. Investors could counter this, but now, their intentions are leaning more toward selling than accumulating. Shiba Inu Investors See No Profit Shiba Inu’s price could likely be observed as red candlesticks forming on the daily chart as the current investors are not acting very bullishly. The meme coin, which is dominated by whale holders, is observing a…