As the Injective (INJ) token exhibits a consolidation pattern, market enthusiasts and traders closely monitor on-chain metrics to discern whether the price could be setting up for a leap toward the $40 mark.

Recent data reveals a substantial consolidation phase for INJ, marked by steady network growth and an uptick in daily active addresses.

Injective On-Chain Metrics Show Consolidation

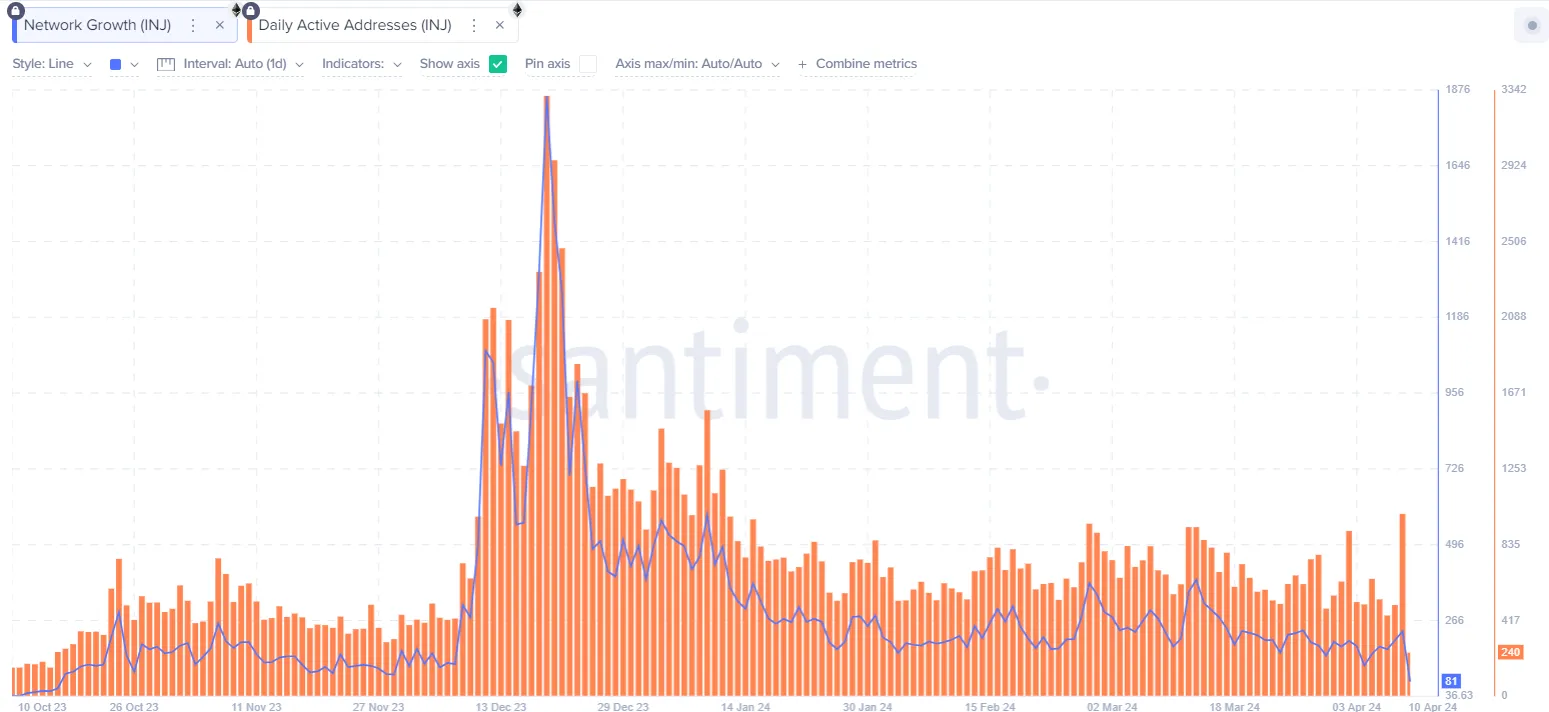

INJ has seen a steady phase of consolidating with its daily active addresses. on April 9, daily active addresses surpassed 1,000 for the first time since January 12. Additionally, network growth, which shows the number of new addresses created daily, sits at 234 as of April 9. An increase from its 2024 low of 130 set on April 4.

This increased activity may indicate heightened user engagement and an accumulation phase as more traders join the network, potentially laying the groundwork for a bullish surge.

Adding to this narrative, INJ’s network growth has steadily increased. This metric, which often precedes price movements, indicates new wallets are continuously being created, signaling fresh capital inflow and a broadening user base.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

Furthermore, the Daily Active Addresses metric for INJ has shown fluctuations but maintains a general upward trend, underscoring sustained and growing user interaction with the token. This metric and stable network growth typically precede upward price action.

Injective Holders at a Crossroads

A closer examination of INJ’s In/Out of the Money (GIOM) data suggests that many addresses bought in between $23 and $31.50, with a notable congregation of ‘In the Money’ addresses within this range.

Essentially, the Global In/Out of the Money (GIOM) classifies addresses based on whether they are profiting (in the money), breaking even (at the money), or losing money (out of the money) on their positions at the current price.

Moreover, 44.27% of INJ holders in this range are in the green. While currently, 42.88% remain in the red. 12.85% remain break-even. The current price remains a pivotal point for holders as any upward movement could push more ‘Out of the Money’ holders into profit.

INJ Price Prediction: $40 Possible if Bearish Indicators Cool

Lastly, the four-hour price chart for INJ portrays a tight trading range. While the token trades below key moving averages, the consolidation within this band may point to an accumulation by savvy investors who anticipate future price appreciation.

Injective Protocol (INJ) is undergoing a consolidation phase below significant Exponential Moving Average (EMA) levels. Analysts have highlighted the price’s struggle to break above the 20, 50, 100, and 200 EMAs, a scenario typically associated with a bearish sentiment.

However, there’s a glimmer of optimism as the Relative Strength Index (RSI) sits at approximately 21.23. This indicates a potential oversold market condition.

Despite this, the Moving Average Convergence Divergence (MACD) reinforces the prevailing bearish sentiment, with the MACD line trailing below the signal line and a widening negative histogram suggesting mounting downward pressure.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

Finally, as INJ teeters at crucial levels, the possibility of reaching the coveted $40 milestone hinges on a decisive change in market momentum. Technical indicators hint at the possibility of an underlying reversal. Still, only time will reveal if INJ can muster the momentum necessary to overcome bearish barriers and embark on a new upward trajectory. Should the bearish momentum accelerate, INJ will likely retest key support at the $30 price range.