Litecoin (LTC) price noted recovery in the last few days following the bearish week in mid-March, which has investors certain of losses.

However, not only has LTC nearly made back the losses, but it is also close to reclaiming $100, which might happen soon.

Litecoin Looks Rewarding

Litecoin’s price, trading at $95 at the time of writing, is currently among one of the best-performing cryptocurrencies. The recent rally reignited the bullishness surrounding the asset, which is evident in the Reserve Risk metric.

Reserve Risk is an indicator used to analyze and assess the risk associated with holding a particular cryptocurrency over time. When the indicator is in the green zone, the asset is considered to be rewarding, given investors’ confidence is running high.

Such is the case with Litecoin as well at the moment, as Reserve Risk is right under the green zone. This would drive investors towards LTC, effectively pushing up the price of the altcoin.

Read More: Litecoin (LTC) Price Prediction 2024/2025/2030

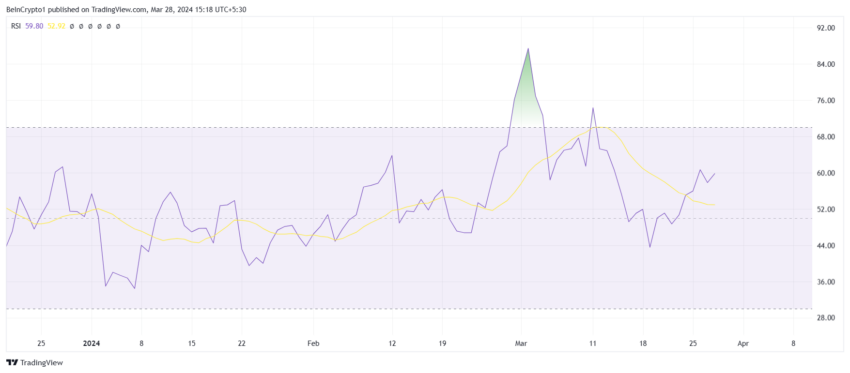

Furthermore, the altcoin is already expected to note further increase as observed on the Relative Strength Index (RSI). RSI is a momentum oscillator measuring the speed and change of price movements and suggests whether an asset is overbought or oversold.

Since LTC is still under the 70.0 mark, it is not overbought but in the bullish zone, poised for the rise.

LTC Price Prediction: Any Obstruction?

Litecoin price, after rallying by 22% in the last week, managed to flip and test the 61.8% Fibonacci Retracement level into support. At $93, traders mark this level as the bull run support floor, which tends to serve as a bounce point for uptrends once established as support.

This places Litecoin price in a bullish spot, too, with the next major resistance lying at$102. Given the aforementioned conditions, it would not be surprising if LTC attempted a jump and managed to breach the barrier. This would, in turn, help the altcoin cross $100.

Read More: 7 Best Litecoin (LTC) Wallets for 2024

However, the potential for profits will keep investors on their toes and ready to sell, which seems to be the long-term holders’ (LTH) intention as well. Liveliness, a metric used to assess the LTH’s position, is noting an uptick. An increase in liveliness is a signal that long-term holders are liquidating positions.

Thus, these LTHs could become the resistance in Litecoin price’s attempt to cross $100. If failed, the altcoin would invalidate the bullish thesis, bringing LTC to $86.