Fantom (FTM) price hit the ceiling today as the cryptocurrency has declined by more than 6% in the last 24 hours.

This drawdown is set to leave FTM holders even more distraught since the likely outcome will mean losses for more investors.

Fantom Price Poised for a Correction

Fantom price had a good run this past week, rising by more than 40%, breaching the $1.00 mark and closing at $1.11 on Wednesday. However, by the looks of it, this will be the highest point of the rally as the cryptocurrency has already begun to decline.

At the moment, the altcoin is changing hands at $1.04, testing the local support level of $1.03. This decline will continue down the line as the bullish sentiment is waning.

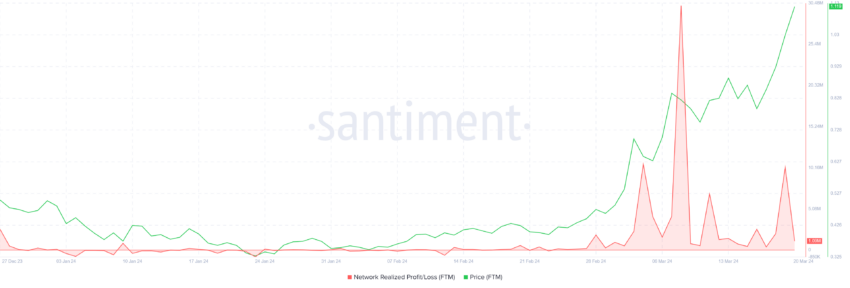

The recent rise gave rise to profits as well, which can be observed by looking at the network’s realized profits and losses. This indicator measures the last moved price of the asset to the current price to provide an estimate of the market condition.

Spikes on the metric show that over the past week, profits have been running high. This suggests that over the coming days, profit-taking will probably take precedence as investors jump to secure their gains.

Additionally, the conviction to act bullish among investors is rather low right now. The reason behind this is that despite the huge recent profits, the larger picture is still bearish. Nearly 50% of all FTM holders are still sitting in losses, and in order to prevent joining this lot, the investors in profit would sell their holdings.

All in all, the impact on Fantom’s price will knock it further down.

FTM Price Prediction: Correction Could Tap This Key Support

Fantom price trading at $1.04 is getting closer to the crucial support of $0.93. The reason that this is important is because it is also the point at which the 50-day Exponential Moving Average (EMA) stands.

Falling through this level would ascertain short-term losses, which could result in FTM observing a low of $0.84. This would invalidate the bullish thesis, potentially sending the altcoin to $0.80.