Bitcoin has once again captured the spotlight, registering a staggering 72% price increase year-to-date. Opening the year at $42,560 and breaking all-time highs to now trade at $73,000, BTC finds itself in price discovery mode. With no historical price resistance or support, the market is tasked with establishing new benchmarks before the halving.

Despite this impressive rally, there are indicators suggesting that Bitcoin may be on the verge of a price correction.

Bitcoin Whales Are Booking Profits

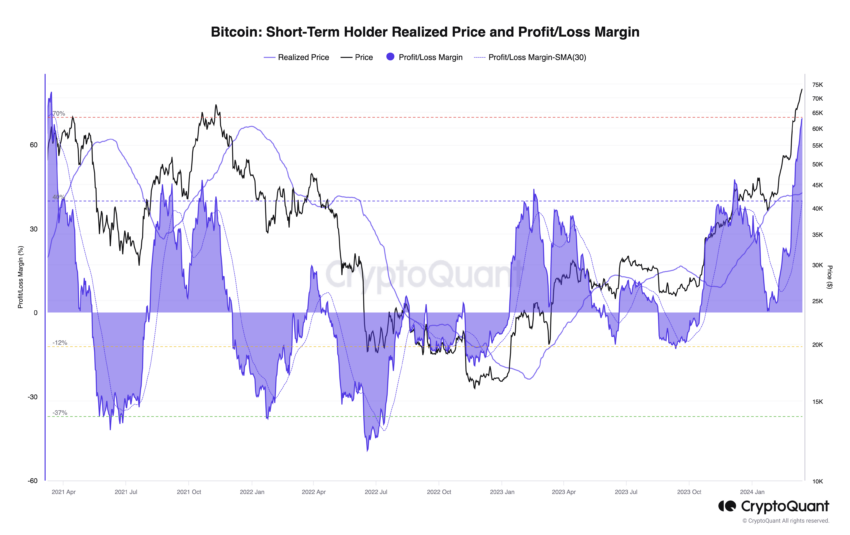

A notable metric, the Short-Term Holder Realized Price and Profit/Loss Margin indicator, reveals that short-term holders are currently sitting on 70% profits in their Bitcoin holdings. This level of unrealized profit, unprecedented in the last three years, hints at a potential sell-off.

This indicator, which tracks the average price at which coins held by short-term holders, less than 155 days, were last moved, suggests a significant portion of these holdings are in profit.

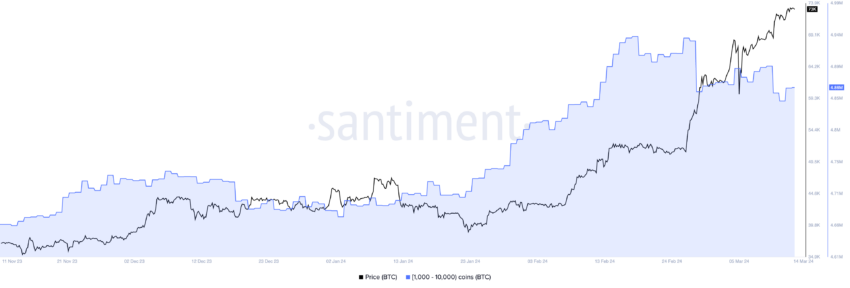

While short-term holders seem reluctant to realize profits, several whales have begun to reduce their Bitcoin holdings ahead of the halving.

On-chain data shows that Bitcoin whales, or large-scale investors holding between 1,000 and 10,000 BTC, have offloaded over 80,000 BTC in the past month, equating to approximately $4.96 billion. If it persists, this selling pressure could prompt a price correction by encouraging short-term holders to book profits, potentially accelerating a downward trend.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

BTC Price Prediction: A Dip Ahead

Based on the MVRV Pricing Bands indicator, a price correction could push Bitcoin to test the 2.4 MVRV level, currently near $61,700.

The MVRV Pricing Bands are graphical representations that plot the MVRV ratio over time, delineating different market sentiment levels. They can gauge how the current price compares to historical realization prices and signal potential market reversals or continuations.

Read more: Bitcoin Price Prediction 2024/2025/2030

However, amid these bearish signals, a bullish factor emerges with the recent influx to Bitcoin ETFs. These financial instruments have been accumulating at an unprecedented rate, purchasing 433,843.58 BTC since their inception, which translates to about $31.67 billion at current prices.

This significant buying power, excluding Grayscale’s GBTC, could potentially counteract the bearish outlook.

Should these ETFs continue their aggressive accumulation and Bitcoin sustain a daily close above $74,000, it may invalidate the bearish perspective. Such a scenario could trigger a bullish price breakout before the halving, propelling Bitcoin to test the 3.2 MVRV level at $85,000.