PEPE price is making every meme coin enthusiast’s dreams come true as the altcoin has noted a 506% increase in the last ten days. The world’s third-largest meme token is now at a new all-time high of $0.00000820.

But as quickly as the meme coin has risen, it may be on track to note a decline, too, since investors are actively moving their holdings around.

PEPE Price Rise Is All Thanks to the Whales

In addition to the broader market bullish cues, the PEPE price rose due to the sudden accumulation observed by the whales. These large wallet investors and retail investors collectively bought nearly 48 trillion PEPE worth $385 million over the past ten days.

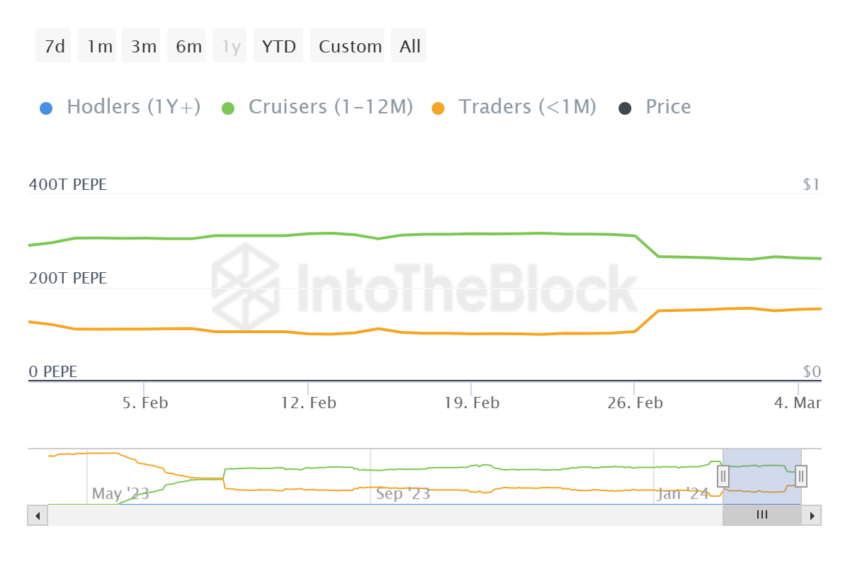

This has resulted in the meme coin shooting up by 506% to trade at $0.00000820 at the time of writing. However, meme coin investors are known to leverage the volatility for their profit. Thus, it is to be noted that 37% of the circulating supply is in the hands of short-term holders.

These traders have been holding their PEPE for less than a month and are susceptible to sudden selling. Unless this supply moves into the hands of mid-term holders (addresses holding supply for six to 12 months), the recently added 48 trillion PEPE could see increased selling pressure once the price stalls.

Why a Sell-Off Could be Next

Another major reason selling is likely is that the HODLing sentiment among PEPE holders is dissipating. Making a quick buck is all that meme coins are worth today, and once that goal is fulfilled, they will likely serve no other purpose. This, in return, leads to selling.

This is verified by the Mean Coin Age indicator, which has been dropping off since February’s end. Historically, such drops precede corrections in PEPE price, indicating a likely decline.

PEPE Price Prediction: The Price Could Leap Ahead

Considering the aforementioned development, the PEPE price will likely register a drop on the daily chart before it can flip the $0.00000807 resistance into a support floor. This could initiate momentum for further price decline, potentially pulling the meme coin down to $0.00000474.

However, the Average Directional Index (ADX) and the Moving Average Convergence Divergence (MACD) indicators signal steady bullishness. The former is well above the 25.0 threshold, and the latter is exhibiting rising green bars. This suggests the uptrend still has strength.

Accordingly, if the PEPE price flips the $0.00000800 level into support, it could rise toward $0.00000959, marking another 21% rally. Breaching this resistance level would push the meme coin towards the $0.00001000 price and invalidate the bearish thesis.