These two cryptos have increased significantly recently and reached new all-time highs today.

Worldcoin (WLD) has increased for eight successive days, while BEAM has increased for three. How long will these increases continue?

Parabolic WLD Increase Leads to New All-Time High

The WLD price has increased parabolically since breaking from a descending resistance trend line on February 7. The upward movement became parabolic on February 12, and the price has increased by more than 200%.

Today, WLD reached a new all-time high of $7.67. If today’s movement holds, WLD will close its eighth successive bullish daily candlestick. The high took WLD above the 1.61 external Fib retracement resistance of $6.45.

The wave count suggests the WLD price will continue increasing. Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology. The most likely count suggests the price is in wave three of a five-wave upward movement.

If the upward movement continues, WLD can increase by another 22% and reach the next resistance at $9.15.

Despite the bullish WLD price prediction, a daily close below $6.45 will mean the local high is in and can lead to a 35% drop to the closest support at $4.90.

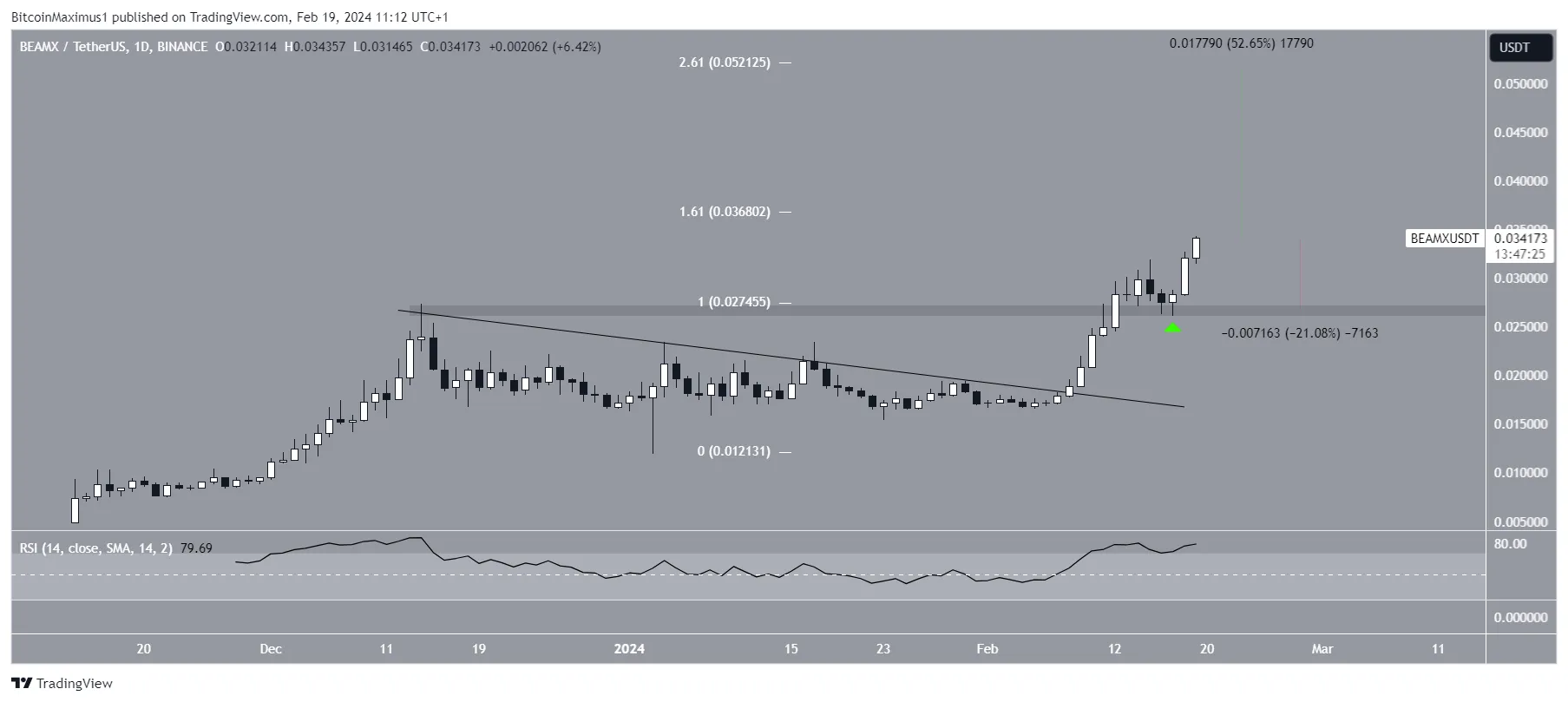

BEAM Price Breaks Out From Range

Similarly to WLD, BEAM broke out from a descending resistance trend line on February 8. It has increased parabolically since. After breaking out from the $0.26 area and validating it as support (green icon), the crypto reached a new all-time high of $0.035 today.

Well-known cryptocurrency analyst InmortalCrypto noted that he is over 80% in profit from his BEAM position due to the breakout.

The daily Relative Strength Index (RSI) supports the increase. When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The RSI is above 50 and increasing, both signs of a bullish trend.

BEAM has nearly reached the closest resistance at $0.037, created by the 1.61 external Fib retracement of the previous decrease. Breaking out above it can trigger a 50% increase to the next resistance at $0.052.

Despite the bullish BEAM price prediction, a rejection from the $0.036 resistance can trigger a 20% drop to the closest support at $0.26.

For BeInCrypto‘s latest crypto market analysis, click here.