The Crypto Market Cap (TOTALCAP), Bitcoin (BTC), and Arweave (AR) closed above important long-term resistance levels.

In the news today:

- Forbes announced its venture into The Sandbox metaverse by acquiring virtual land.

- BlackRock has released a new advertisement for its Bitcoin iShares Bitcoin ETF product.

TOTALCAP Closes Above Critical Resistance

The cryptocurrency market cap has increased considerably in the past two weeks, creating large, bullish weekly candlesticks.

After moving above the 0.382 Fib retracement resistance level at $1.61 trillion, TOTALCAP increased and closed above the 0.5 Fib retracement resistance level of $1.88 trillion.

If the upward movement continues, the next resistance will be at $2.10 trillion, 10% above the current price.

Despite the bullish TOTALCAP price prediction, closing below the 0.5 Fib retracement resistance level can trigger a 16% drop to the closest support at $1.61 trillion.

Bitcoin Closes Above $50,000

Similarly to TOTALCAP, BTC increased considerably in the past two weeks, reaching a close above the 0.618 Fib retracement resistance level. Bitcoin reached its first weekly close above $50,000 since December 2021.

However, it is worth mentioning that the weekly Relative Strength Index (RSI) shows weakness. While TOTALCAP’s RSI invalidated its bearish divergence, Bitcoin’s did not, confirming it with this week’s close.

Nevertheless, the price action does not show any bearish signs.

If BTC continues to increase, the next resistance will be at $65,000, 25% above the current price.

Despite the bullish BTC price prediction, a close below $48,600 can trigger a 22% drop to the closest support at $40,600.

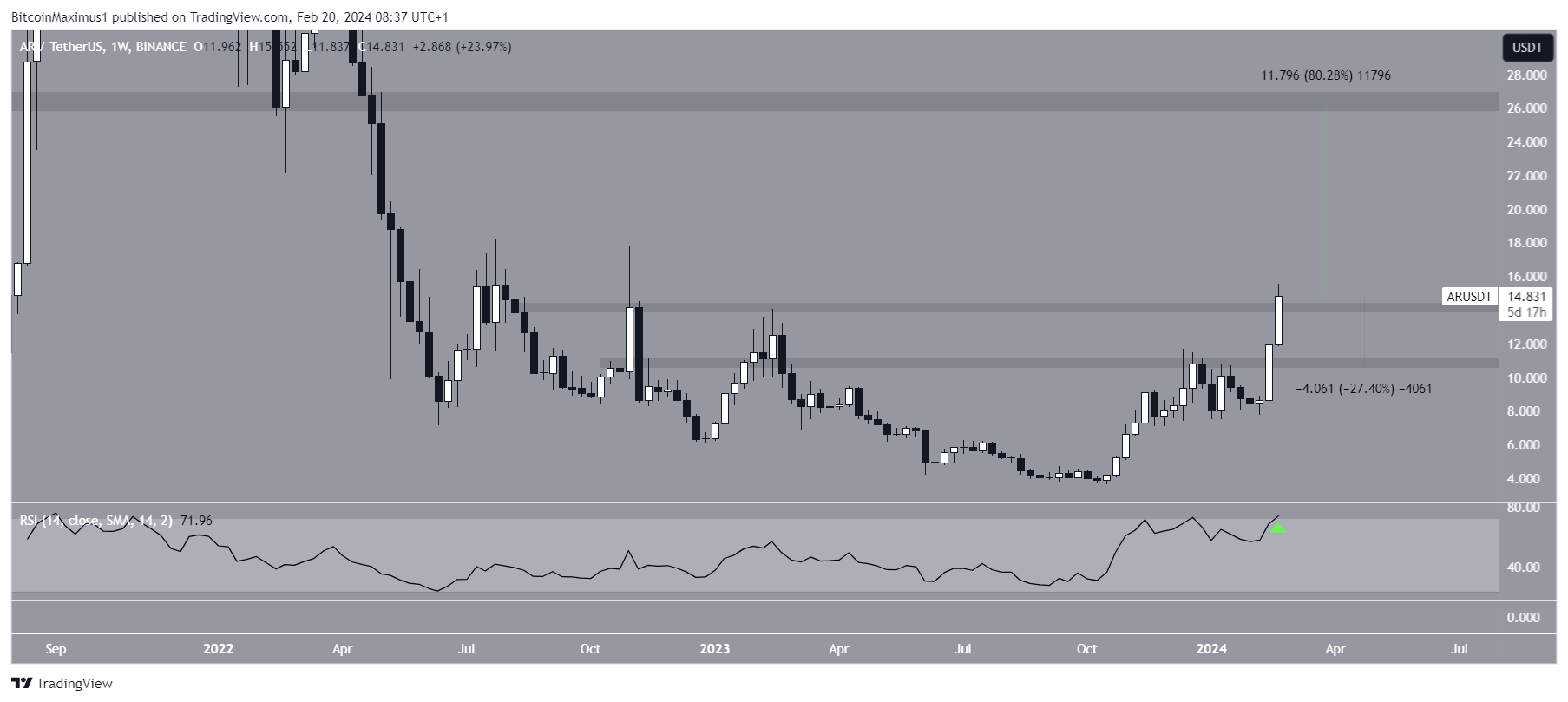

Arweave (AR) Reaches Yearly High

The AR price has increased swiftly during the past two weeks, creating successive bullish weekly candlesticks. Today, the price reached a high of $15.55, the highest since November 2022.

More importantly, the high exceeded the $14.20 long-term resistance area. However, AR has not closed above this resistance yet.

The weekly RSI supports this increase since it moved above 70 (green icon). If AR continues to increase, it can reach the next resistance at $26.50, 80% above the current price.

Despite the bullish AR price prediction, a close below $14.60 can trigger a nearly 30% drop to the next closest support at $10.75.

For BeInCrypto‘s latest crypto market analysis, click here.