BTC is unable to consolidate, Trumps words trigger MAGA coin explosion

Original author: BitpushNews Mary Liu

The cryptocurrency market continued to fluctuate on Thursday, with Bitcoin regaining support at $62,000 after midday and most altcoins rising, led by the meme sector related to the US election.

According to Bitpush data, Bitcoin rebounded from a daily low of $60,623 in the early morning, rising 3.4% to hit a daily high of $62,663 before falling back to the $62,500 support level. As of the time of writing, BTC is trading at $62,395, up 1.15% in 24 hours.

Altcoin markets were mixed on the day, with a slim majority of the top 200 tokens by market cap posting gains. Akash Network (AKT), Livepeer (LPT), and Arweave (AR) posted gains of 17.4%, 15.3%, and 11.9%, respectively. Render (RNDR) and Toncoin (TON) both rose 11%. FTX Token (FTT) had the biggest drop, down 7%, while Tellor (TRB) fell 5.4%, and GuildFi (GF) fell 4.2%.

Analysts at Secure Digital Markets said: “Bitcoin has rebounded from recent lows this morning and is poised to challenge the previous peak of $65,000. Overall trading volume, including spot and derivatives markets, fell for the first time in seven months, down 44% to $6.58 trillion. The decline was attributed to increased geopolitical tensions and reduced investment in U.S.-listed spot ETFs, which cast a shadow over the cryptocurrency market.”

The U.S. labor market continues to cool, with the latest number of unemployment claims at 231,000, up 22,000 from the previous week, the highest level since August, driving U.S. stocks higher. This suggests that many see this as a positive sign, and one or more rate cuts are still possible in 2024, although several Fed officials have recently reiterated the possibility that interest rates need to remain higher for a longer period of time, citing the fight against inflation.

However, Bert Dohmen of Dohmen Capital Research said the recent sharp rise in the M2 money supply means the Federal Reserve will not be able to achieve its expected interest rate cuts this year, and investors should start preparing for this possibility.

Dohmen said the Fed is “stuck in a dilemma” because they are forced to finance record deficits in the national debt while continuing to fight stubbornly high inflation. “The Fed is forced to put its foot on the gas and finance record deficits in the U.S. Treasury,” he said. “They know this will cause inflation, but they have no choice.”

As of the close, the SP, Dow Jones and Nasdaq all rose, up 0.51%, 0.85% and 0.27% respectively. As the market improved, the US dollar index fell 0.5% from its daily high to 105.218 at press time, while the US 10-year Treasury yield fell 142 basis points from its daily high to 4.457%.

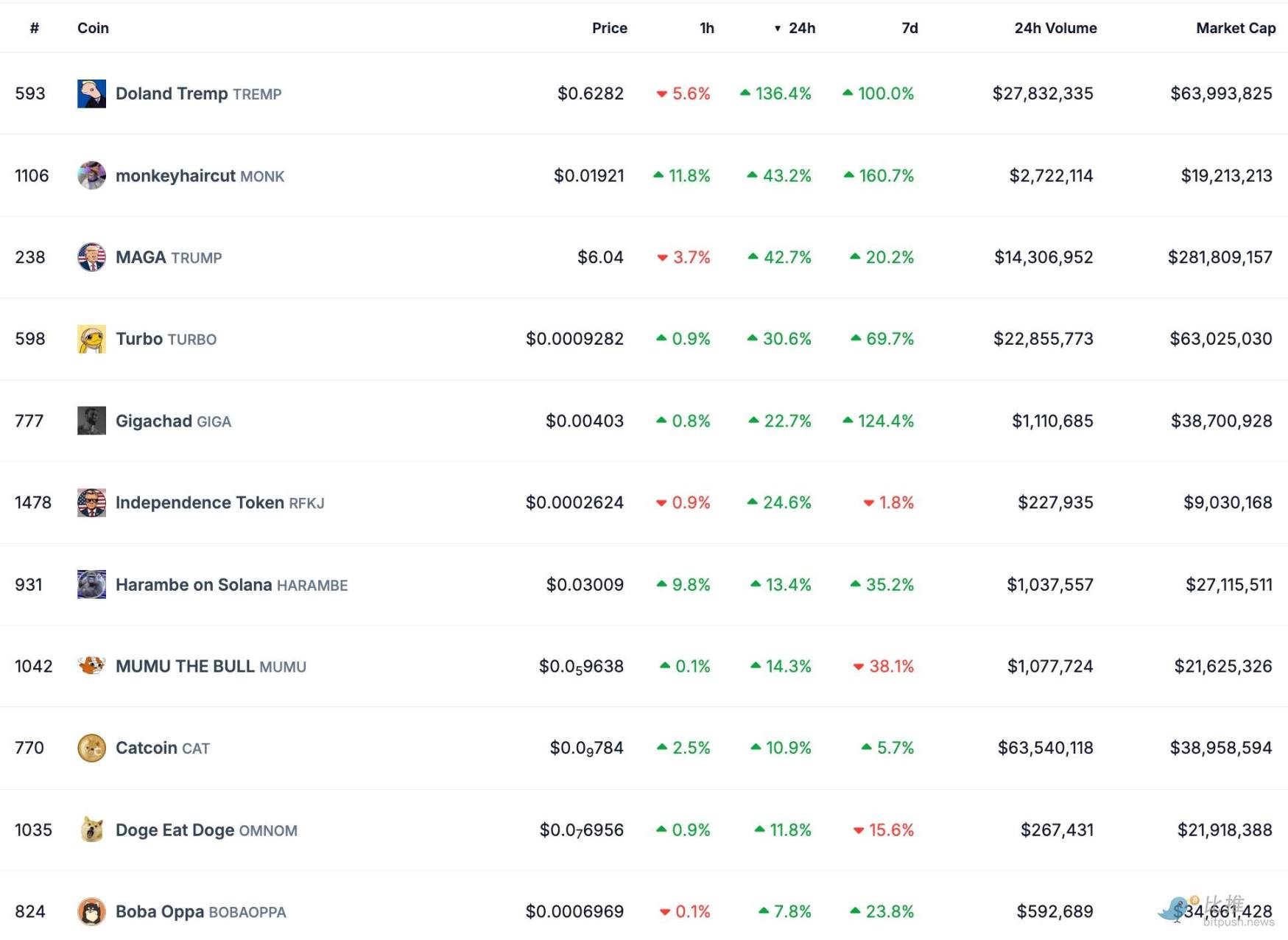

memecoin MAGA rebounds strongly

Following yesterday’s comments on cryptocurrencies by Republican presidential candidate Donald Trump, Trump-themed meme coin MAGA (TRUMP) surged 78% on May 9, with its 24-hour trading volume jumping 620% to $281.8 million. TRUMP has a market cap of $281.8 million and is ranked 248th on CoinGecko. At press time, the token is the 13th largest meme coin by market cap.

Trumps presidential campaign team currently does not accept crypto donations, but he expressed an open attitude to this in an impromptu audience QA at a dinner yesterday. When asked, Can we donate in cryptocurrency? He replied, If you cant do it (donate in crypto), I will make sure you can do it.

TradingView data shows that MAGA is trading at $6, up 46% in the past 24 hours.

Other U.S. politics-related tokens also rallied on May 9, led by Donal Tremp (TREMP), which tripled and is up 136% in the past 24 hours. Independence Token (RFKJ) — a token dedicated to supporting the presidential election of Robert F. Kennedy Jr. — rose 24.4% over the same period.

Meme coins have seen massive growth in 2024, becoming the highest-returning crypto narrative in Q1.

According to anonymous X user Crypto Koryo, CoinMarketCap listed a record 138 ERC-20 meme coins in April 2024, a 666% increase from 18 in April 2023.

“The number of memecoin ERC-20 tokens will grow parabolically in 2024. Last month, 138 new memecoins were registered on CoinMarketCap, compared to 18 in April 2023,” the analyst said.

As of press time, there are over 2,230 memecoins listed on CoinMarketCap with a total market cap of over $52,325, accounting for 2.15% of the global cryptocurrency market cap.

The current overall cryptocurrency market capitalization is $2.31 trillion, and Bitcoin’s dominance rate is 53.3%.

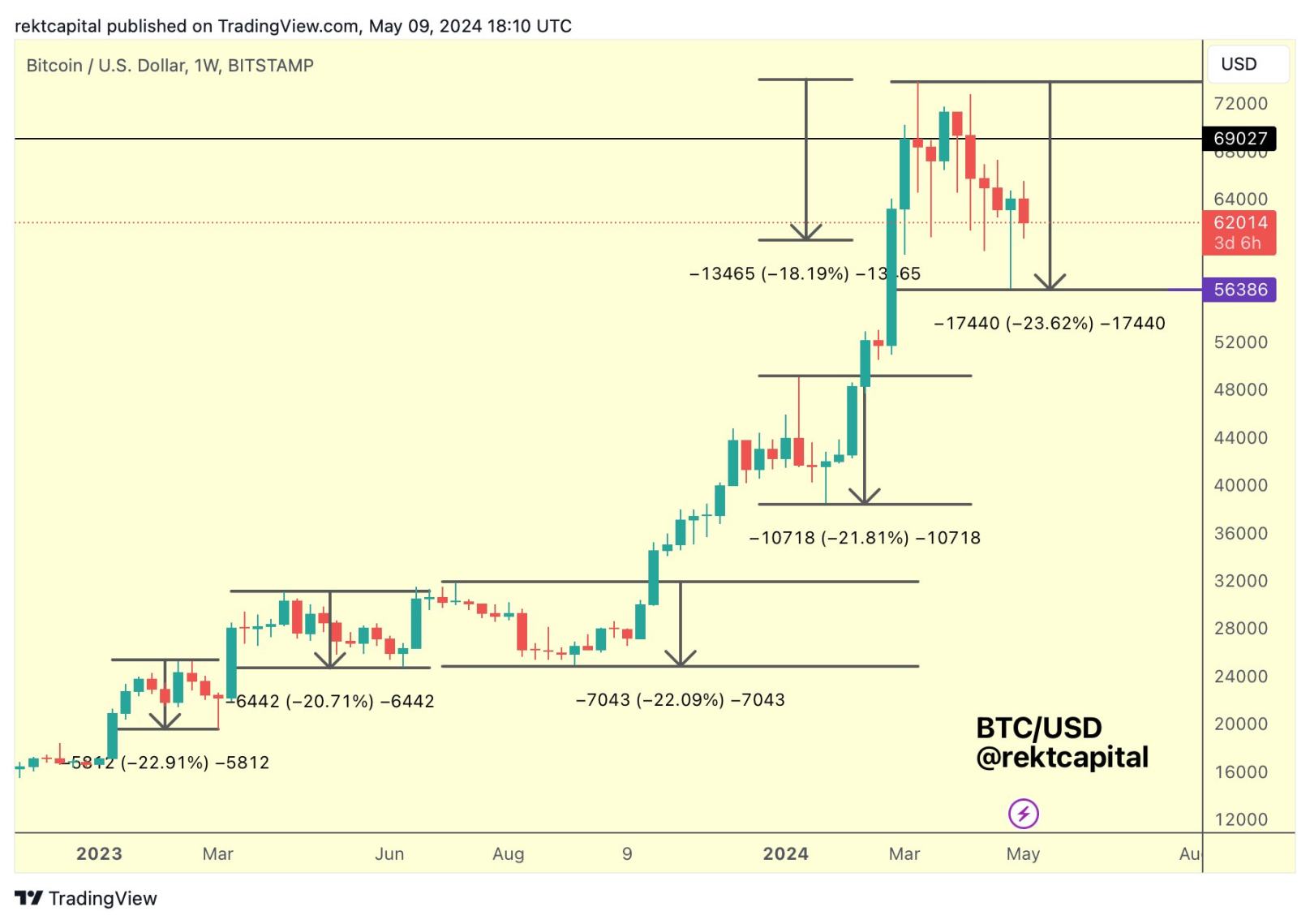

The next uptrend may have begun

Market analyst Rekt Capital said the next uptrend may have already begun, as ending a long downtrend of more than -20% correction over the past year and a half has tended to be key to future price reversals.

He added that the fact that “following last week’s downside candle, Bitcoin is still only holding range lows as support” suggests a bottom may be in.

Twitter celebrity Vil Capo Of Crypto also believes that Bitcoin may form a solid support base at the current level and may start to move higher soon. He wrote on Twitter: After deviating from the range low, the price rebounded, hit the resistance level, and is now retreating to an interesting support area, which may form the first higher low.

The analyst said: “There is strong demand between $59,000 and $61,000, and indicators look mostly bullish, so a rally could be in the cards. If BTC breaks above the $65,000 resistance, I would be looking for $68,000 to $69,000 as the first target and $74,000 to $75,000 as the second target.”

This article is sourced from the internet: BTC is unable to consolidate, Trumps words trigger MAGA coin explosion

Related: Can Ethereum spot ETF become a new narrative in May?

Original | Odaily Planet Daily Author | How to With the approval of the Bitcoin spot ETF at the beginning of the year, funds from traditional finance have been pouring into the crypto world in the past few months. Especially after Bitcoin completed its halving, the new round of market narrative focus has once again returned to ETFs – Ethereum spot ETFs. Now that the deadline for the key decision on the Ethereum spot ETF (May 23) is getting closer, judging from the remarks of celebrities and the unusual market movements, the outlook does not seem optimistic. Odaily Planet Daily organizes the markets opinions on whether the US Ethereum spot ETF can be approved, and analyzes it based on the current development status of global crypto asset ETFs. Ethereum Spot…