Solana token growth continues to hit a record high, explaining the growth engine Pump.fun

Original | Odaily Planet Daily

Author | Nanzhi

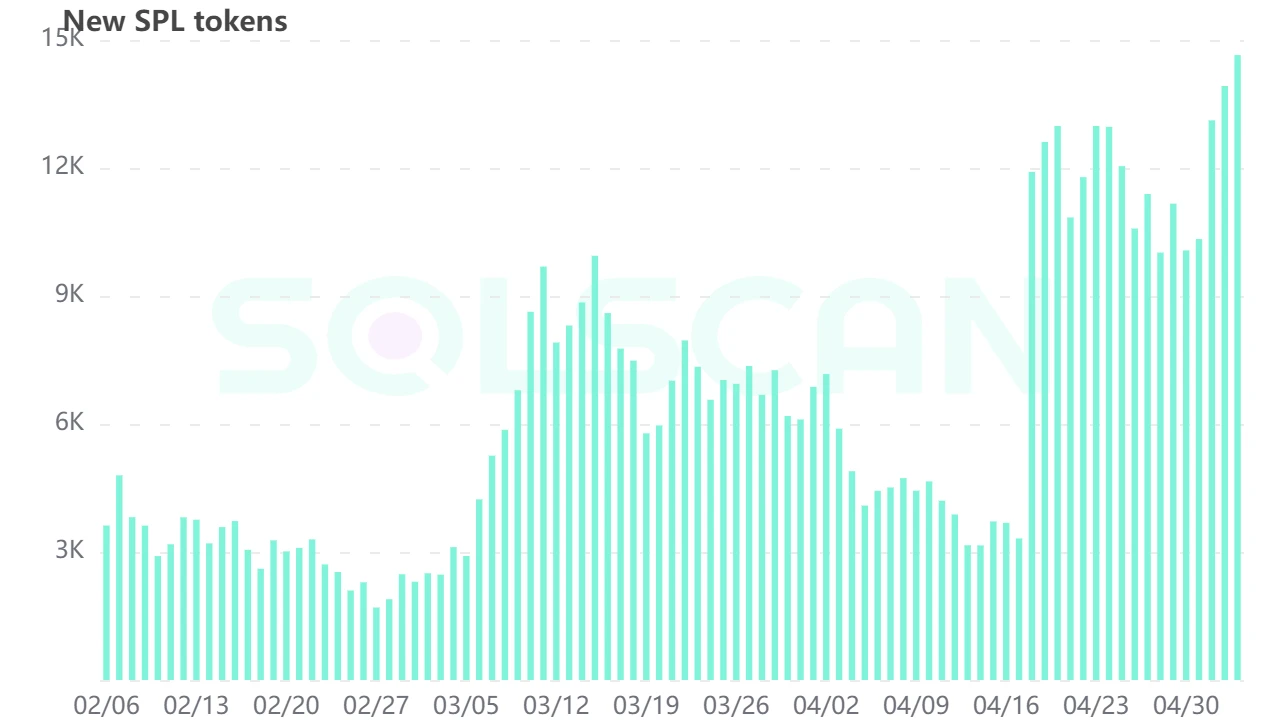

In April, the market experienced a sharp correction, but the Solana market became increasingly hot. On May 4, the newly issued SPL tokens continued to set a record high of 14,648. More than half of the newly issued tokens came from pump.fun. Odaily Planet Daily will interpret the platforms functions, data and this phenomenon.

About Pump.fun

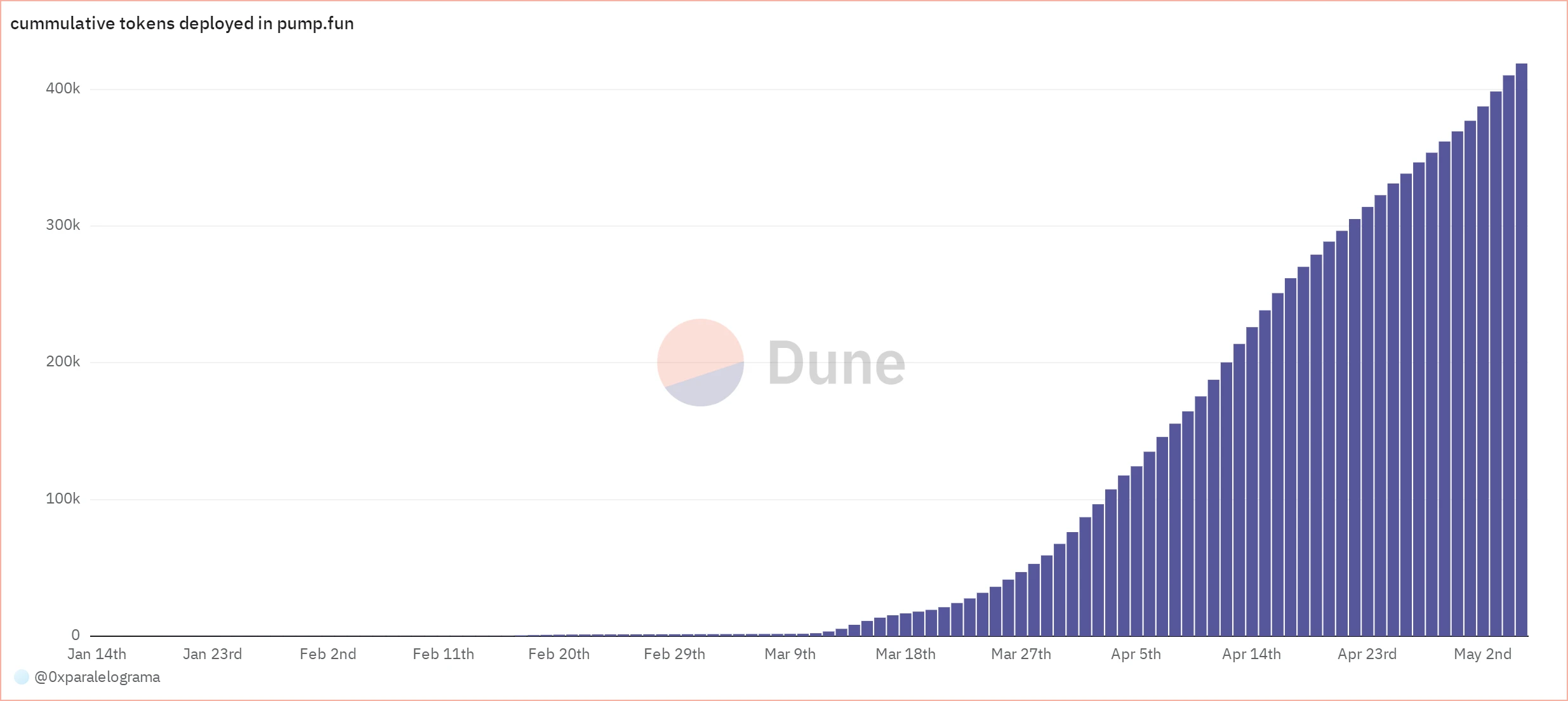

Pump.fun was launched in February 2024. It is a one-click issuance platform for Meme tokens. When it was launched in February, there were not many users paying attention to and using it. By mid-March, the number of users and usage began to soar.

Running the process

-

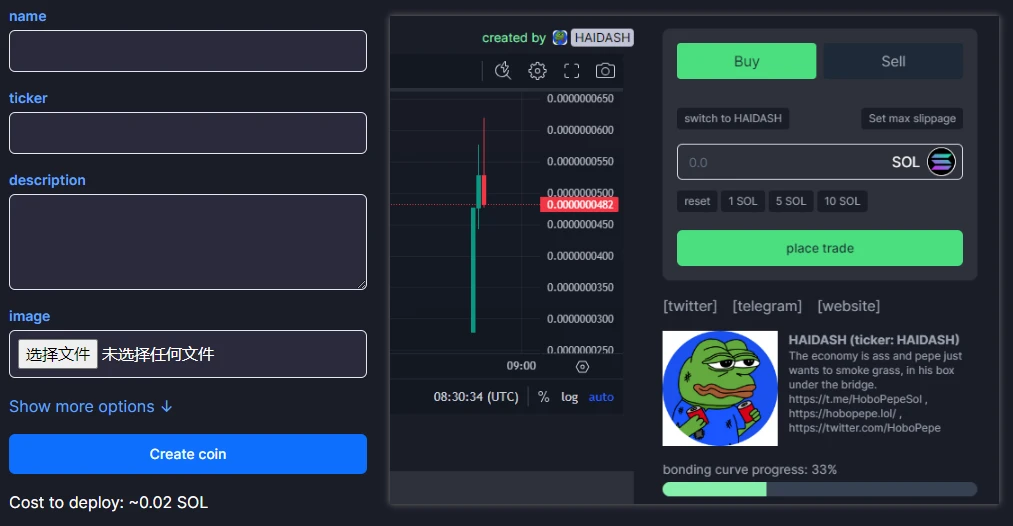

Create a token: The issuer only needs to enter the name, description and image of the token and pay about 0.02 SOL to start the fund-raising issuance process of a token.

-

Intra-market fundraising: For users, selecting the token they want to participate in and then entering the number of tokens they want to purchase is equivalent to participating in the token issuance fundraising, and being able to sell the corresponding shares before the issuance. Pump.fun will charge a 1% fee.

-

Price curve: However, it should be noted that the price of Pump.funs tokens before the official launch is not evenly distributed, but is calculated according to the Bonding curve. In simple terms, the token price will rise as the fundraising progresses and fall as the tokens are sold on the market.

-

Token issuance: When users purchase enough tokens and the market value reaches $69,000, Pump.fun will add $12,000 of liquidity to Raydium (Solana’s top DEX) and destroy LP.

What makes Pump.fun stand out

As of May 5, Pump.fun has issued 418,936 tokens, with a cumulative revenue of $6.9 million. From April 1 to May 1, Pump.funs revenue reached $4.99 million , equivalent to an annualized revenue of about $60 million, and the growth trend has not shown any signs of decline. So how did Pump.fun achieve this achievement?

Continuation of the Fairness Narrative

The answer still lies in the narrative of fairness. Since its rise in 21 years, Meme tokens have flourished on Ethereum and BSC successively. However, with the emergence of problems such as insider trading, RUG, and scientists rush to get ahead of others, users enthusiasm for Meme has been severely hit. Therefore, a series of launch platforms such as Pinksale have also come into being.

On Solana, in fact, the period 23 years and earlier was full of Rug tokens. In order to avoid excessive losses due to Rug, many users became 10 U God of War and only participated in transactions with very small amounts, hindering the development of various ecosystems.

The automatic LP addition and destruction functions of Pump just meet the fundamental needs of users. The tokens from Pump have no nominal project party and manager, so there will be no problems caused by super-authority Rug.

Meme and social attributes

In addition to the name of the token itself, Pump.funs token also needs to be accompanied by a picture and introduction, and have a comment function, which gives it the ability to quickly and intuitively spread the story and style behind it.

Previously, Meme tokens, project websites, and official media mostly needed to reference each other to achieve information links, but Pump.fun is equivalent to completing one-click aggregation. On the one hand, users can quickly obtain most of the information, and on the other hand, the tokens themselves are given the ability to socialize and effectively spread.

A new way to “harvest”?

Although it was created to pursue “fairness”, some of Pump.fun’s mechanisms have become a tool for some users to exploit. As mentioned above, Pump.fun issues tokens very quickly, so the number of new tokens added every day is very large, and most users can only judge the quality of the project based on its “social” attributes.

On the other hand, the price of Pump.fun is not evenly distributed. The cost of the last user to enter is usually more than five times that of the earliest user. Therefore, some malicious users purchase accounts with a high number of followers X, create the illusion of high attention, purchase a large number of chips at the bottom, and quickly exit before the token is issued after users are deceived by the illusion of high attention. Similarly, some big Vs create new tokens through their own influence, and then use extreme price curves to quickly realize their influence (harvest).

in conclusion

Since the beginning of BRC-20, the voices of pursuing fairness and opposing high FDV VC tokens have intensified. The momentum of PEPE and WIF to sprint to the top ten is also the primary representative of this trend. Pump.fun was also born with this story. It is not difficult to foresee that the word fairness will run through this round of bull market and become the detonation point for many disruptive projects.

On the other hand, Pump.fun is also of great significance to the Solana ecosystem, not only in terms of the annual revenue of 60 million US dollars, but also in the billions or even tens of billions of US dollars in trading volume behind the 60 million US dollars. This is a considerable growth for DEX and nodes, and it is also the ultimate tool for Solana to attract users.

This article is sourced from the internet: Solana token growth continues to hit a record high, explaining the growth engine Pump.fun

Related: Ethereum (ETH) Is Set to Fall Below $3,000 for This Reason

In Brief Ethereum price is currently losing the support of $3,336 after noting a 5.5% decline in the last 24 hours. With over 96% of the supply in profit, ETH is facing market-top conditions that suggest correction is imminent. As is the ongoing selling has resulted in over 2.31 million ETH entering exchanges in the last month. Ethereum (ETH) price trades under two crucial support levels after noting consistent declines for the past week. The bearishness, however, is expected to intensify in the coming days as ETH is witnessing a market top at the moment. Ethereum Is Set to Lose $3,000 for This Reason Despite the recent drawdown, Ethereum’s price nearly recovered $3,500 as a support floor before failing. This has resulted in cryptocurrency investors witnessing profits. At present, over…