原文作者:Mary Liu,BitpushNews

Financial markets were trading higher on Wednesday afternoon as weak U.S. Consumer Price Index (CPI) data boosted investor expectations for rate cuts.

Data provided by the U.S. Bureau of Labor Statistics showed that after excluding food and energy prices, the core CPI rose 3.6% year-on-year. This data was consistent with market forecasts, slightly cooling from the 3.8% increase in March. The CPI in April was 0.3% month-on-month, 0.1% lower than expected.

It was the first time in more than four months that the reading met or fell short of market expectations, which traders viewed as a positive sign for interest rates and the likelihood of a rate cut before the end of the year.

Following the CPI release, markets are now pricing in about a 70% chance that the Fed will start cutting rates at its September meeting, up from 45% last month, according to the CME FedWatch tool.

Benefiting from the favorable impact of low CPI, the SP, Dow Jones and Nasdaq all hit or approached historical highs on Wednesday, closing up 1.17%, 0.88% and 1.40% respectively.

According to BitPush data, Bitcoin was in an upward trend on Wednesday, surging from a low of $61,315 to a high of $66,420 in the afternoon. As of the time of writing, BTC was trading at $66,035, up 7.21% in 24 hours.

Altcoins rose on the back of Bitcoin’s momentum, with nearly all of the top 200 tokens by market cap rising on Wednesday. Livepeer (LPT) was the best performer, up 20.8%, followed by Axelar (AXL) and GMX (GMX), up 18%. Ribbon Finance (RBN) was the biggest loser, down 21.5%, while Pepe (PEPE) fell 2.6% and Starknet (STRK) fell 1.9%.

The current overall cryptocurrency market capitalization is $2.38 trillion, and Bitcoin’s dominance rate is 54.7%.

CPI cooling does not mean the Feds inflation progress has won

While the market may have reacted positively to the CPI data, Youwei Yang, chief economist and vice president of BIT Mining, warned that it is too early to declare victory on inflation progress.

“Despite policy easing and consumer price index (CPI) inflation reaching 3.4% as expected, the current global economic landscape rem人工智能ns dangerously close to a mild stagflation scenario,” she said in a note. “Today’s policymakers appear to be underestimating stagflation risks, echoing the scenario of the 1970s, albeit without the extreme inflation rates of that era.”

She added: “Despite these risks, many investors and policymakers remain overly optimistic, as evidenced by historically high price-to-earnings ratios in many major market sectors. Cryptocurrencies are always the first to react when markets face potential risks, and have therefore been falling over the past few months, even as AI-driven stock growth appears to have given financial markets a worrying false boom.”

Bitfinex analysts also expressed concerns, warning that the decline in CPI does not guarantee that the Federal Reserve will lower interest rates.

They said: “Investors viewed this as a bullish shift as it marked the first decline in CPI inflation in the past three months and came after the Fed announced its intention to taper quantitative tightening. CPI had formed a local top in the past two months so this was seen as positive for risk assets but it had the opposite effect. However, we still have inflation above 3% and yesterday’s PPI inflation data showed a third consecutive month of increases and while the decline in inflation data is good news, investors will have to wait and see if the Fed sees this as positive enough news to cut rates.”

Leena ElDeeb, research assistant at 21 Shares, said, CPI alone is not enough to convince the Fed to cut interest rates, especially considering that the data is still well above the 2% target, as expressed at the FOMC meeting two weeks ago, and hopes of a rate cut in the short term have become slim.

ElDeeb warned that “with rate cuts still in doubt, the recovery is likely to be slow. Typically, higher interest rates reduce the appeal of risky assets such as tech stocks and Bitcoin, as investors can earn significant returns from safer options such as U.S. Treasuries. This drives short-term investors to traditional markets.”

ElDeeb added: “However, despite its short-term impact on the market, many investors take a long-term view on Bitcoin as a global asset that can protect against currency debasement and economic instability. While the Fed’s policies may cause short-term volatility, they will not fundamentally change Bitcoin’s long-term trajectory.”

“Bitcoin is therefore currently uniquely positioned as both a risk-on and risk-off asset, leading unique market dynamics,” she concluded.

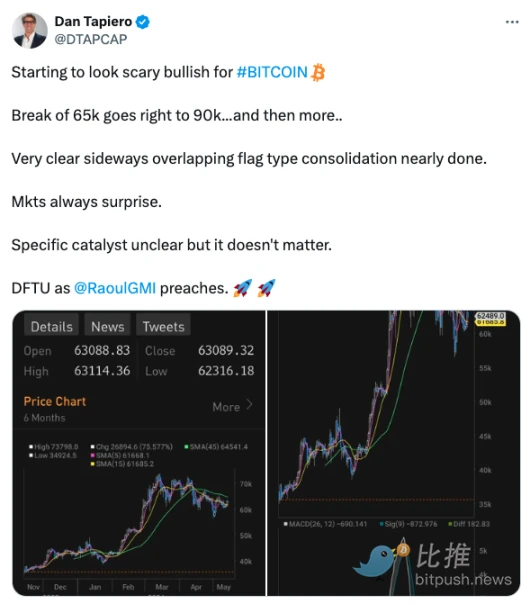

Dan Tapiero, CEO of investment firm 10 T Holdings, believes that if Bitcoin can regain support at $65,000, its price could continue to surge by more than 45%. He said on the X platform: Breaking through $65,000 will go straight to $90,000… and then more, a very clear horizontal overlapping flag consolidation is about to be completed.

Market analyst Mustache agreed with Tapiero’s speculation, noting on Wednesday that “Bitcoin’s weekly Stoch RSI just crossed bullish,” suggesting that “the biggest move is coming.”

This article is sourced from the internet: Is there a chance of a rate cut in September? Bitcoin reaches $66,000

Related: Santiment CEO Maksim Balashevich Explains Why Bitcoin Holders Must Be Cautious

In Brief Maksim Balashevich stresses caution for Bitcoin investors post-halving. Crypto whales often start selling early, while smaller holders buy or hold. Santiment CEO discusses complex Bitcoin market dynamics, post the halving. promo var rnd = window.rnd || Math.floor(Math.random()*10e6); var pid588602 = window.pid588602 || rnd; var plc588602 = window.plc588602 || 0; var abkw = window.abkw || ”; var absrc = ‘https://servedbyadbutler.com/adserve/;ID=177750;size=0x0;setID=588602;type=js;sw=’+screen.width+’;sh=’+screen.height+’;spr=’+window.devicePixelRatio+’;kw=’+abkw+’;pid=’+pid588602+’;place=’+(plc588602++)+’;rnd=’+rnd+’;click=CLICK_MACRO_PLACEHOLDER’; document.write(”+’ipt>’); Understanding Bitcoin’s market dynamics is crucial for investors in the volatile crypto industry. Maksim Balashevich, CEO of Santiment, offers a compelling analysis. He highlights why caution is necessary after the recent Bitcoin (BTC) halving on April 20. Why Bitcoin Holders Should be Cautious Bitcoin halvings often trigger bullish sentiments and price rises, leading to speculative trading and optimistic forecasts. However, Balashevich suggests a more nuanced approach. “Instead of…