SignalPlus Volatility Column (20240425): IBTC has zero inflow on the first day, and IV hits a recent low

Affected by a new round of geopolitical news in the Middle East, Bitcoin fell more than 4% during the day, reaching a low of 63,606 and forming a support level around 64,000.

Source: TradingView

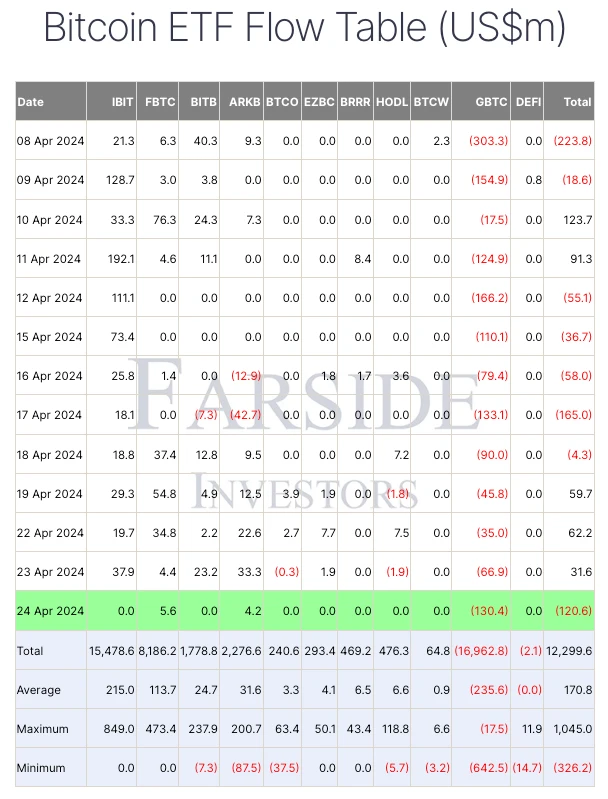

Affected by the decline in currency prices, the worlds largest Bitcoin spot ETF, BlackRocks IBIT, ended its 71-day streak of continuous positive inflows, while Graysacles GBTC once again saw a sell-off of up to $130M, significantly exceeding the total inflows of other ETFs.

Since the ETF was approved, its daily net inflow has been regarded by many investors as a sentiment indicator of the market towards BTC. The fact that IBIT has lost its appeal to the market in the past day may be considered a short-term bearish signal. But it is also at this point that it should be noted that the net flow obtained by the ETF since its launch has far exceeded market expectations, and the total amount of assets under management has exceeded 20 $B in such a short period of time. It is understandable that the Flow has been suspended.

In other news, according to U.Today, a recent report from AdvisorHub cited two anonymous executives as saying that banking giant Morgan Stanley may allow 15,000 brokers to sell Bitcoin ETFs to their clients. So far, the bank has only proactively offered these products, which means that they have not actively recommended investing in Bitcoin ETFs to their clients. But as hinted in the report, this policy change (if not just a rumor) could significantly increase the demand for BTC ETFs.

Source: Farside Investors

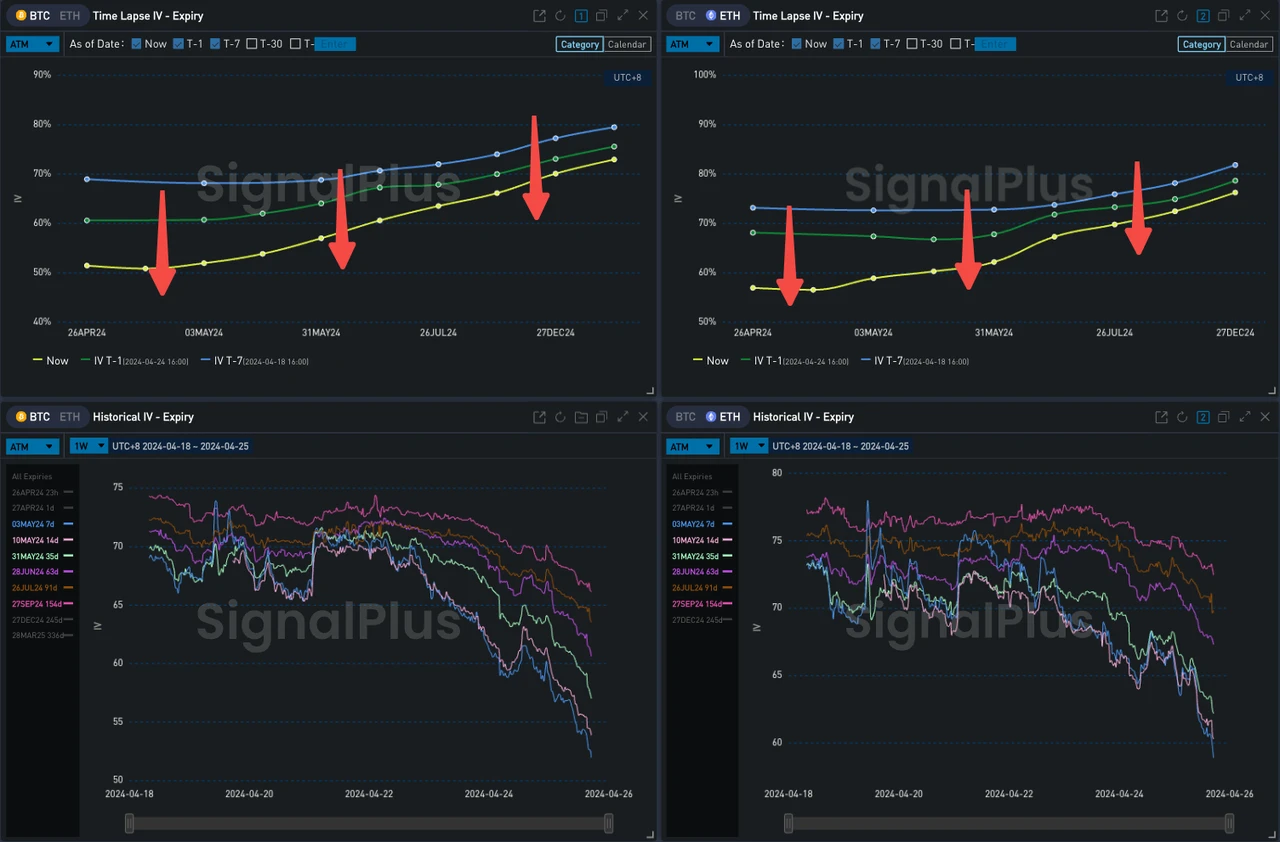

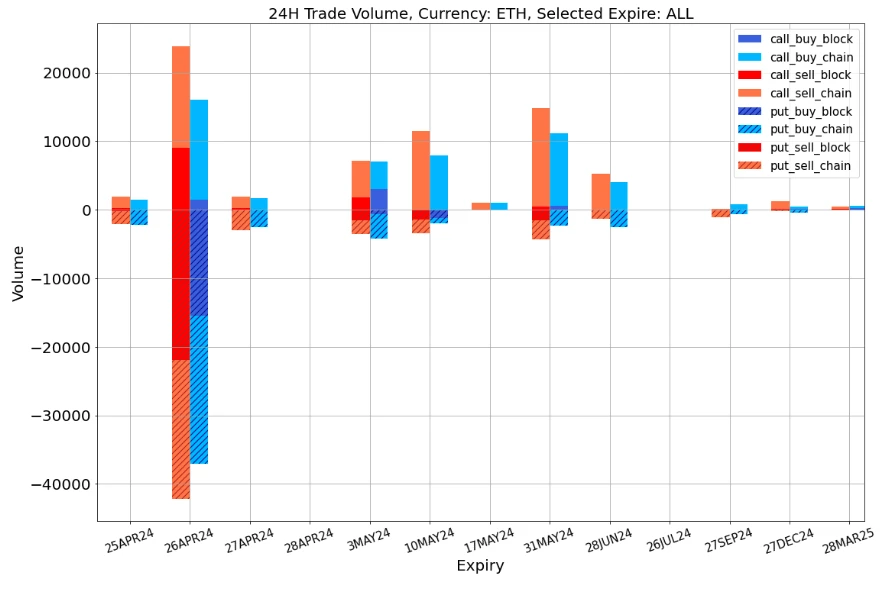

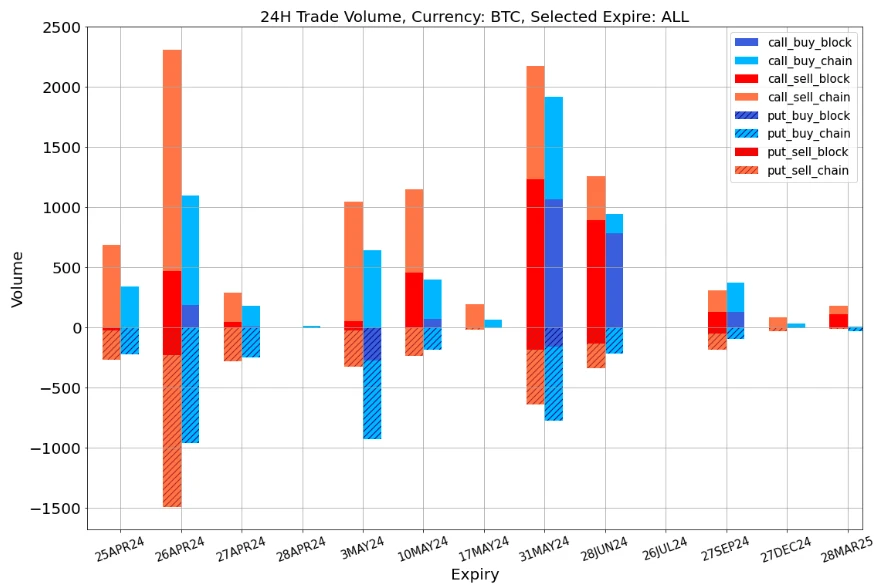

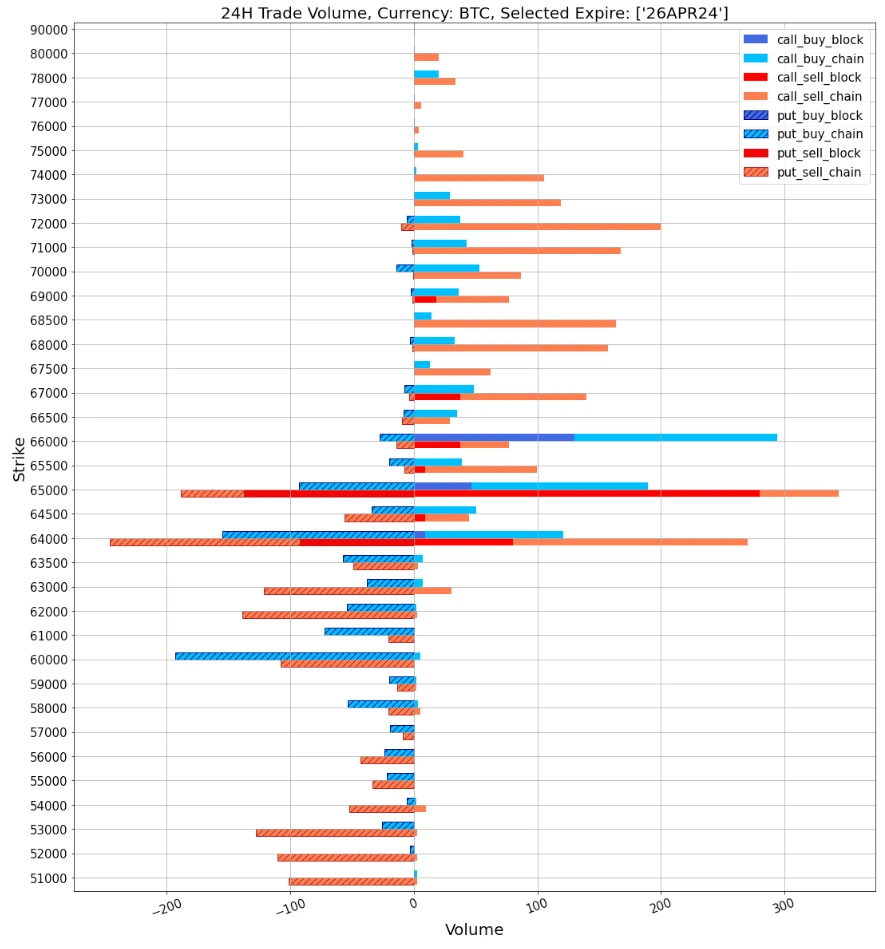

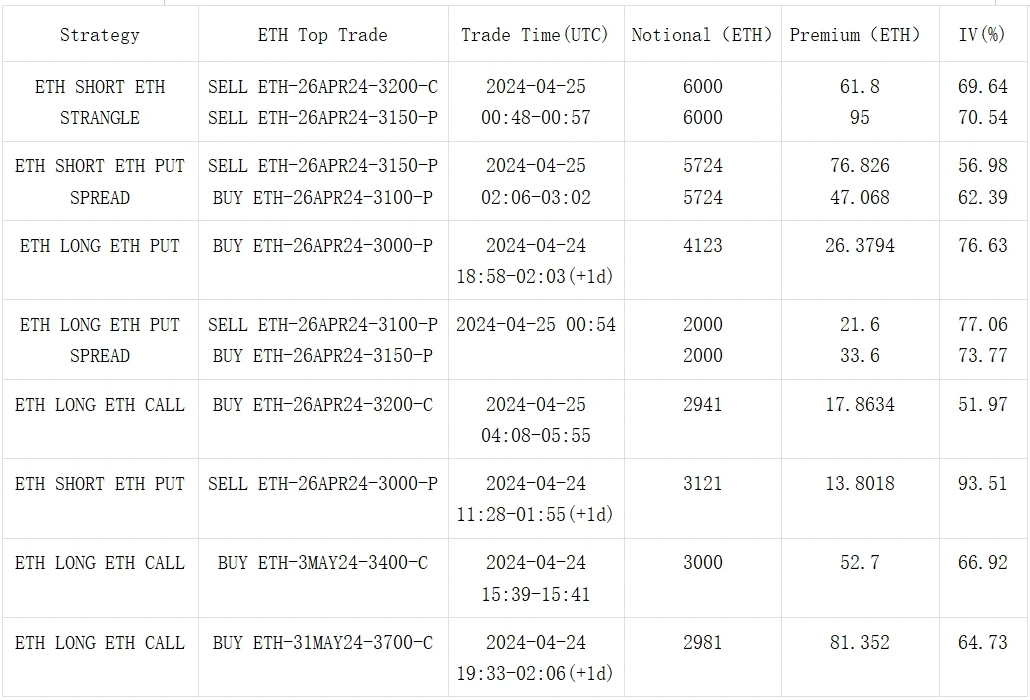

In terms of options, the overall IV level plummeted again. The cyclical options of BTC and ETH continued the selling pressure of yesterday, and the IV fell by about 8%. Among them, ETHs transactions concentrated in the 26 APR 24 3000-3200 strike price almost accounted for all ETHs trading volume in the past day, while BTC was sold on both ATM and Wing.

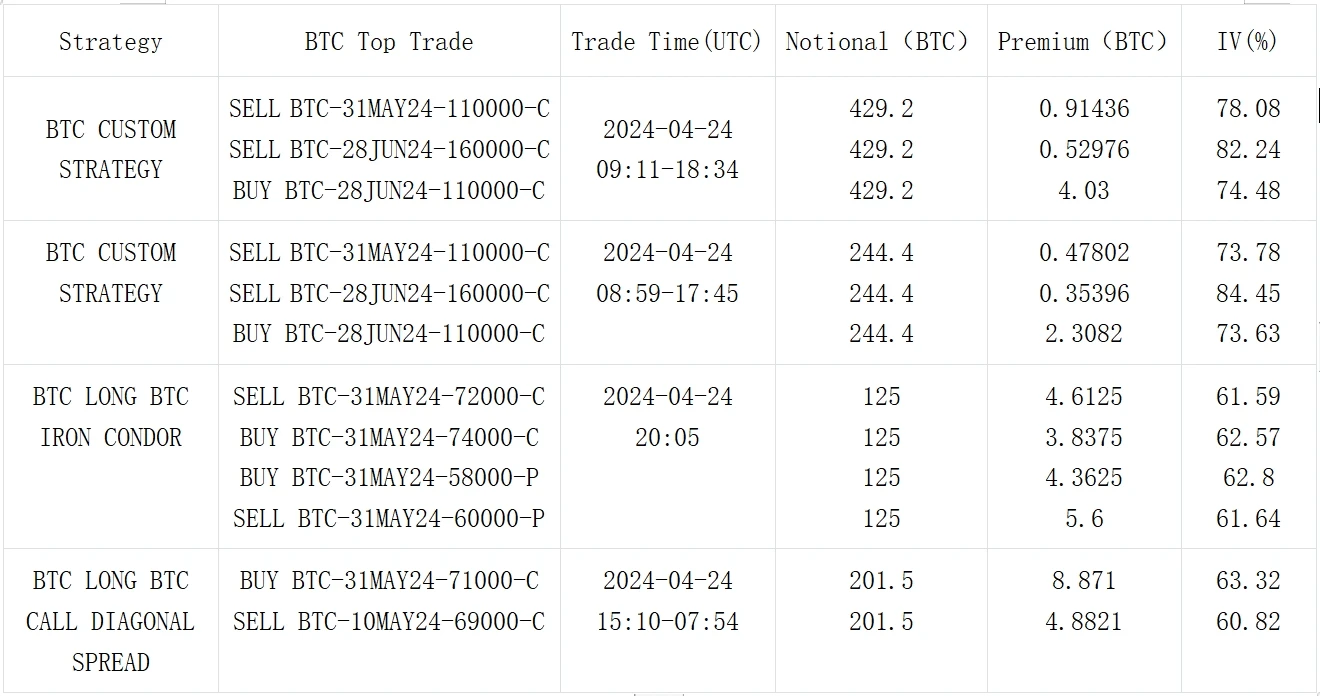

In addition, there were some call options buying positions at low prices near the strike price of USD 70,000-80,000 for BTC at the end of May. The selling of Deep OTM call options mainly came from the customized strategies of the block platforms, which sold the May 110,000 Call and bought an equal amount of June 110,000 vs 160,000 Call Spread at the same time.

Source: Deribit (as of 25 APR 16:00 UTC+8)

Source: SignalPlus

Data Source: Deribit, ETH overall trading distribution and 26 APR 24 transactions

Data Source: Deribit, BTC trading overall distribution and 26 APR 24 turnover

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240425): IBTC has zero inflow on the first day, and IV hits a recent low

Related: Bitcoin Surges 10% Despite $742 Million in ETF Outflows

In Brief Bitcoin value rises nearly 10% despite $742 million ETF outflows, defying bearish expectations. Grayscale Bitcoin Trust, Invesco Galaxy ETF see major withdrawals; yet market remains resilient. Despite ETF outflows, Bitcoin’s strong demand and optimistic metrics indicate a continuing bull cycle. Bitcoin’s (BTC) value surged by nearly 10% on Wednesday. This rise defied the prevailing trend of net outflows from US-listed spot Bitcoin Exchange-Traded Funds (ETFs). These funds have seen a significant withdrawal of approximately $742 million this week. Notably, a substantial outflow of $261.5 million occurred on March 20 alone. Why is The Bitcoin Bull Cycle Far From Over? Farside Investors provided data showing a stark contrast between inflows and outflows within the sector. The Grayscale Bitcoin Trust (GBTC) and Invesco Galaxy Bitcoin ETF (BTCO) experienced the most…