Tracking 5 MEME coin smart money addresses on the chain: How to create a hundredfold return?

Автор оригинала: Фрэнк, PANews

MEME coin is a dark forest, and the competition is extremely cruel. Countless speculators compete in it, but it seems difficult for anyone to become a victorious general. In this case, those examples that became famous in one battle are more instructive. For these smart money addresses, in addition to being able to learn and imitate by copying orders, perhaps we should explore the scientific method of MEME coin trading through their trading logic and behavior analysis. This article lists 5 typical smart money addresses in recent times, trying to penetrate their transactions and see what secrets have made them successful.

Case 1: Single-handedly turning a garbage tray into a golden dog

Smart MoneyAcLHpBGUgsRApF2eF3tPPxMsgsnyBAr53mdBvLM8ST8z

On May 16 at 10:42:30, 1 DOL token was created on pump.fun. In the early stage, only the founder bought 5 SOL. This token had only 10 comments on PUMP, and almost no one traded it within 3 days after its creation. The Twitter account showed that the account was banned. Originally, this was another case of failed issuance. Starting at 4:28:18 on May 19, the founder sold 1.5 SOL in succession.

On May 19th at 5:39:58 am, the address 4gQYeDooUUHXG6wXDaUR3sL68ZHr2niim2aiZiQNgvGv began to buy 1 DOL for 13 SOL. After the address 4gQYe bought it, it quickly triggered a buying craze in the market. Within 1 hour, the amount of funds for this project met the price curve progress on Pump and was launched on Raydium.

Subsequently, the market value of 1 DOL once rose to 20 million US dollars, and the holdings of 4 gQYe addresses were nearly 2.26 million US dollars, with a return of 993 times. According to PANews analysis, this address is a Twitter user named Sunday Funday. Sunday Funday is a senior MEME coin player. He once spent 421 to participate in the fundraising of BOME, and thus obtained about 18 million US dollars in profits.

According to analysis, Sunday Fundays main way of finding is to pay attention to those crypto artists. He once said on Twitter that the success of BOME is because of his understanding of artists, so he made a big bet and made a lot of money. Of course, after the success of BOME, Sunday Funday became the target of many players. Therefore, every time he buys, many people will follow. Although it is not known whether 1 DOL is intentionally promoted to the altar or unintentionally, judging from the results, this has forged a new wealth code. However, judging from the current fund pool size of only 230,000 US dollars, Sunday Fundays millions of earnings are only paper wealth and difficult to cash out.

On social media, many players questioned whether Sunday Funday was an insider trader who attracted other addresses to buy in order to obtain high returns. In response to these questions, Sunday Funday said: “Do I buy because I believe in the artist? 100%

Did someone else buy it because I bought it? Maybe.” As of May 21, Sunday Funday had not sold any tokens.

Case 2: Short-term hunters and long-term lurkers on GME

3zdzNQPcJ4NdEsK2EEHbRMvupVqJPmk94YQyJpMSjPf1 is a short-term hunter who made $200k on GME.

Initial purchase: 2024-05-13 00:05:41 to 2024-05-13 03:13:54 spent about $16,000 to buy 18,640,537 GME

After holding the position for about 9 hours, the seller started to sell it. At this time, the price of GME had basically increased by more than 1 times based on its cost price. The initial sale was about $61,000, recovering the cost and realizing a 4-fold profit.

During the purchase process, the GME hotspot had just fermented, and during the initial purchase period, GME rose by more than 30%. However, this player still bought firmly and completed most of the positions within 5 minutes (accounting for about 87% of the initial total position).

2nU4GehM5FLtdZcx8BiAHgMFW6ziDJbtFmXsKiwkzUdP is a long-term player who built a GME position 2 months in advance. The player started to build a GME position on March 5 and continued until May 1, accumulating a total of 69,400,000 GME and a total investment of 19,000 US dollars. Until May 13, when Roaring Kitty returned and began to be shipped, he made a profit of 468,000 US dollars.

Both players have obtained high returns through the GME token, but their operation styles are obviously different. From the results, it seems that the long-term player is better. However, the 3 zdzN short-term hunter also has a similar long-term layout token, but its price trend is falling all the way. Obviously, short-term operations may be more suitable for the player of the 3 zdzN address.

Case 3: Lottery Player Wins $100,000 Jackpot

7BBgSsxsjtS8NSZqKZp7qmsoDenupqBaCNZPj8Tvh7g8 (alienbot.sol)

The user of this address is like a lottery player, who likes to invest 0.2 ~ 0.3 SOL in the newly launched currencies. Of course, most of the tokens ended up being zero. The player completed 450 such transactions from May 6 to May 8, spending a total of 57.3 (about $8,700) SOL, and 99% of the projects did not get a return. Only one PumpnDump successfully got out of the pattern and made a profit of $106,000. Although the media will mention that the user won $100,000 with 0.3 SOL, the cost behind this $100,000 is not low (alienbot.sol and other related addresses also have the same investment strategy, and the total cost is far more than 57.3 SOL)

Many players questioned on social media whether the address was an internal transaction address, but after analysis, the players success may be purely the result of winning the lottery. However, this strategy is not suitable as an investment plan. After all, the number of tokens issued on the Solana chain every day is as high as 16,000, and the final result of such a trading method may still be more loss than gain.

Case 4: Suspected insider trading with potential profit of nearly 10 million

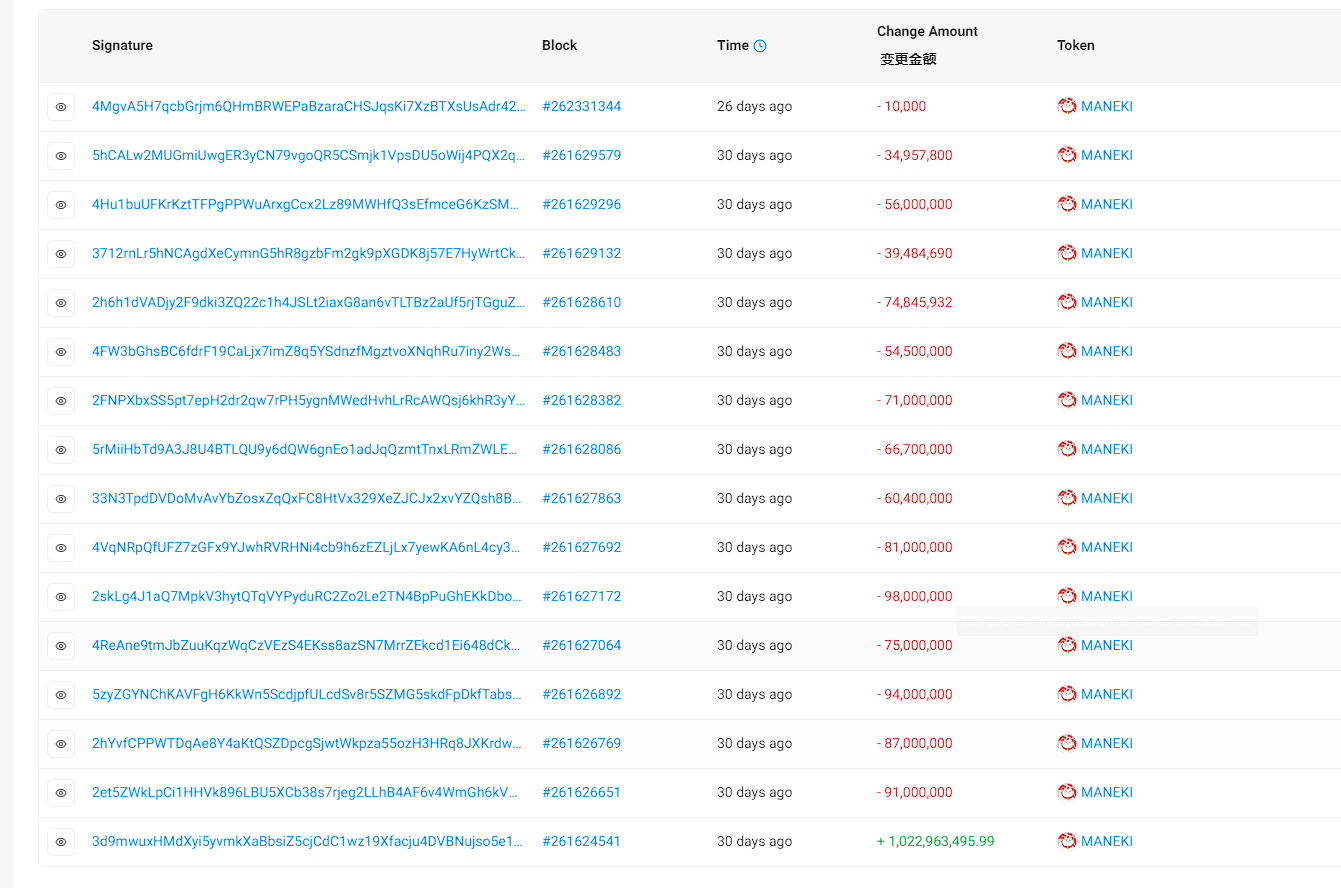

5YYaPTFHuW3cgFvgd6oHZy1HgPWGKa59NJKhHVKoMCAX was suspected to be a insider trading of MANEKI. This address invested more than 100,000 US dollars one minute after MANEKI opened.

MANEKI Opening time: 04-22-2024 14:55, Buying time: 04-22-2024 14:56:48 Buying quantity 718 SOL accounts for 11% of the total supply of the token, and then the address distributes these tokens to 15 addresses. The current value of the token is about 9.55 million US dollars. The total funds in the liquidity pool are only 15.5 million US dollars. The tokens held by this user have not been shipped since they were exposed by @ai_9684 xtpa. Rat trading is indeed an important way for many smart money, but with the current situation where on-chain tracking tools are very developed, it seems that the behavior of rat traders has been difficult to hide in the dark.

Summarize:

1. Rushing to open the market is not the choice of smart money

In the analysis of several smart money addresses, only one lottery player and a rat warehouse address adopted the method of grabbing the opening. Instead, their choices paid more attention to the project initiator or the narrative behind the project.

2. There is no such thing as an invincible general. It is not wise to follow orders.

After analyzing the addresses of smart money, we found that almost every smart money completely changed the size of funds after seizing 1 to 2 opportunities, and in terms of success rate, most of the tokens they bought also ended up returning to zero. Therefore, blindly following orders by blindly believing in smart money is not reliable.

3. Not only a lucky person, but also a booster

Judging from the transaction scale and time of these smart money addresses, there are almost no real small retail investors in these addresses. Instead, they all have certain investment strength, and the purchase scale is not small, generally in the tens of thousands of US dollars. In fact, these smart money is the main booster of the price increase of these MEME coins. For example, Sunday Fundays purchase directly attracted many followers for 1 DOL. It may not be their luck, but the power contributed by the fans behind them.

4. Does the 10 U Ares still have a chance?

In the process of analyzing the addresses, it is found that there are many addresses with similar or even lower costs before and after these smart money buys. However, these addresses often clear their positions in a short period of time, and ultimately miss out on big gains. Therefore, it is not to say that smart money is always lucky, but that they do have some of their own holding methods in terms of strategy. For example, they will first recover part of the cost after the price rises. Even if they are optimistic about the trend of the project, they will continue to increase their positions. These are different from the habits of ordinary players who enter and exit quickly. For most 10 U war gods, opportunities seem to always exist, but whether they can really hold on is the main reason that prevents them from becoming smart money.

This article is sourced from the internet: Tracking 5 MEME coin smart money addresses on the chain: How to create a hundredfold return?

24 апреля, согласно официальным новостям, компания China Asset Management (Гонконг) объявила сегодня, что China Asset Managements Bitcoin ETF и China Asset Managements Ethereum ETF были одобрены Комиссией по ценным бумагам и фьючерсам (SFC) Гонконга и планируется к запуску. выпущен 29 апреля 2024 г. и зарегистрирован на торговой платформе Гонконга 30 апреля 2024 г. Это первый раз, когда такие продукты выводятся на азиатский рынок. Эти два типа продуктов предназначены для обеспечения инвестиционной доходности, привязанной к спотовым ценам Биткойна и Эфириума. Этот важный шаг еще раз привлек внимание к концепции Гонконга. В начале этого года CFX, лидер гонконгской концепции, за два месяца вырос с US$0,19 до US$0,52…