Discussion approfondie sur le nouveau mécanisme de friend.tech V2, le modèle est-il durable ?

Auteur original : Francesco

Traduction originale : TechFlow

About friend.tech

friend.tech (FT), one of the most successful Web3 dApps in SocialFi, achieved its highest revenue to net deposit ratio ever, with over $2 million in revenue and over $33 million in net deposits in its first month.

This was supposed to be a big week for FT as they launched V2 of their product and the platform鈥檚 token $FRIEND, introduced major changes to enhance the sustainability and appeal of the protocol, and more, but it turned out to be (probably) the end of it.

Previously, some were optimistic about these développements while others were pessimistic, but after today鈥檚 developments, everyone is in disbelief.

In this article, we鈥檒l take a deep dive into FT V2鈥檚 new mechanism, $FRIEND, explore any vulnerabilities it has experienced or is still experiencing, and discuss whether this business model is sustainable.

Lets first look at the challenges faced by the early version of friend.tech.

On friend.tech V1

FT is the first decentralized social application to generate sustained revenue by aligning the interests of prominent cryptocurrency figures with those of retail investors .

This consistency has resulted in FT being one of the new projects with the largest user base growth, increased activity, and increased revenue during the bear market.

However, this model is not sustainable due to the fees charged by the platforms.

While KOLs and FTs earn a handsome income, retail investors lose money every day . Since there is a 0% tax on buy and sell transactions, they can only make a profit by selling keys at a price at least 20% higher than the purchase price.

This is only possible during periods of high platform activity and inflows, and is the main reason for the volatile behavior observed in the chart below.

Ultimately, fees became a barrier to entry for many people , causing FT V1 to be miserable for many people.

Even so, FT V1 achieved several milestones in 6 months, which few protocols achieve in their entire lifecycle:

-

Incurred approximately $13 million in expenses:

-

Transaction volume reached $130M (probably the highest volume ever achieved by the SocialFi dapp):

-

Approximately $6 million in revenue was distributed to its users:

On friend.tech V2

FT V2 was released on Friday, March 3, 2024 .

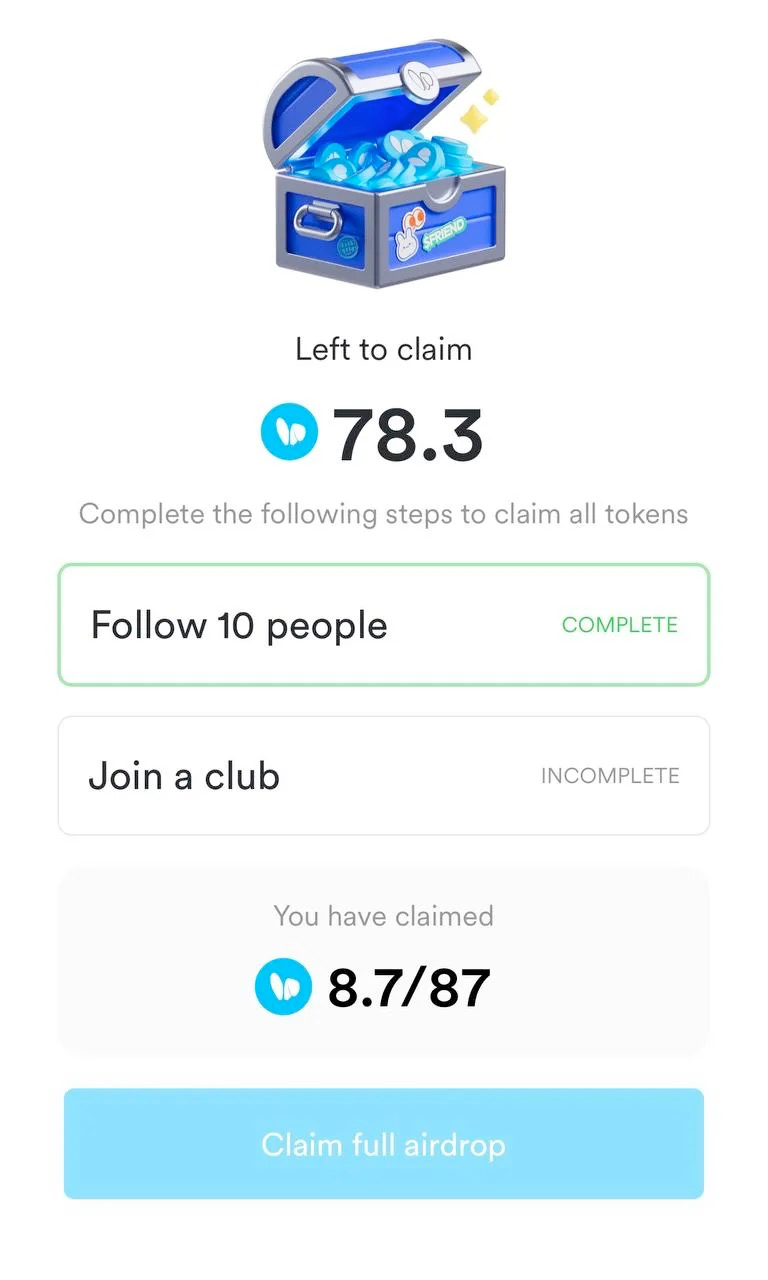

As part of this long-awaited update, users can finally claim their $FRIEND tokens.

However, the launch seemed to fall short of expectations, including a lack of relevant information.

This is the only official announcement from the FT on Twitter since its launch.

Understandably, this has left many confused about the airdrop claiming process.

Users can only claim 10% of their airdrop (provided they follow at least 10 people), and need to join a club to claim the remaining 90% .

However, the requirements were unclear as there were no pop-ups or guidance in the app, and in many cases, even after joining a club, users were unable to claim it .

What are clubs?

Clubs is one of the major new features introduced in FT V2.

Anyone can create a new club. Clubs are defined as group spaces owned and managed by key holders ; however, it is unclear how they will be used in the future.

Here鈥檚 how clubs work:

– Key holders vote to elect the club president

– The chairman manages the club and selects moderators

– All club keys are traded using $FRIEND

– Each club transaction is subject to a 1.5% transaction fee, which is distributed between the farmer and the FT

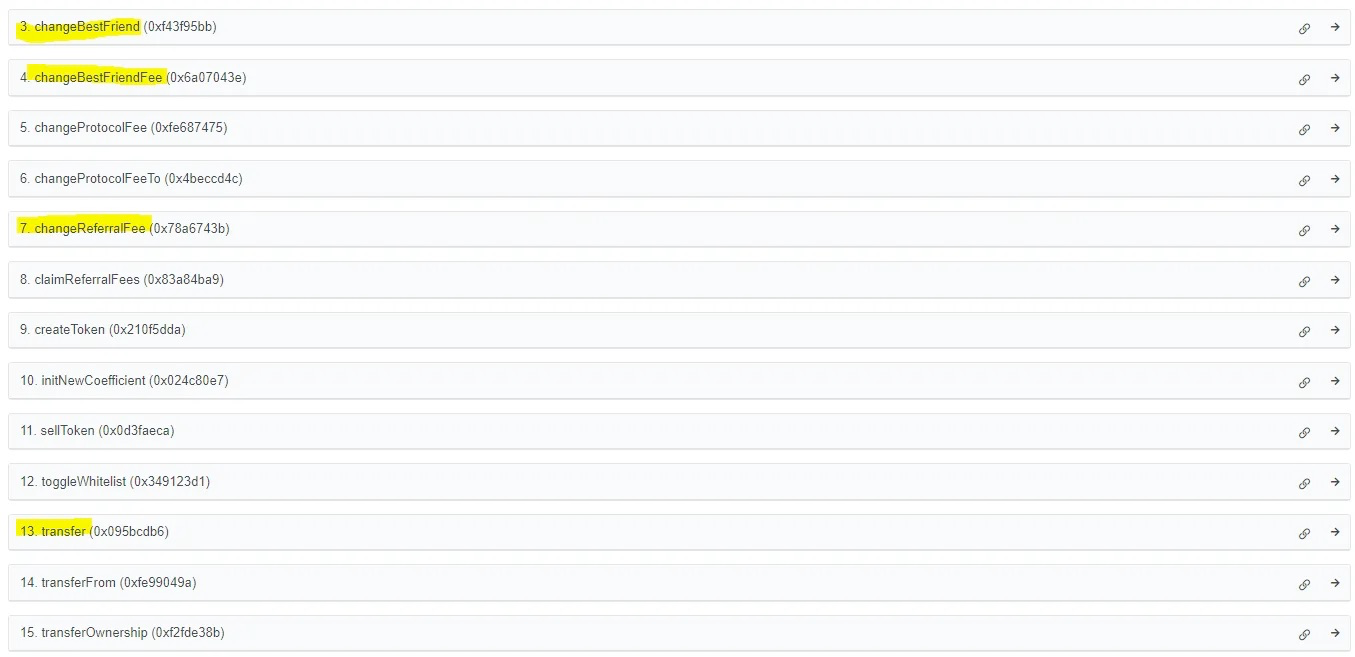

The interesting things we observed through the Base Scan contract interface are the changes to changeBestFriend and changeBestFriendfee, which we can speculate will be used to allow anyone to add a best friend , which would allow us to reduce or eliminate fees when trading keys.

We can also speculate that FT will soon introduce referral fees (point 7 in the figure below), and we also know that club keys are transferable (and maybe even user keys too?).

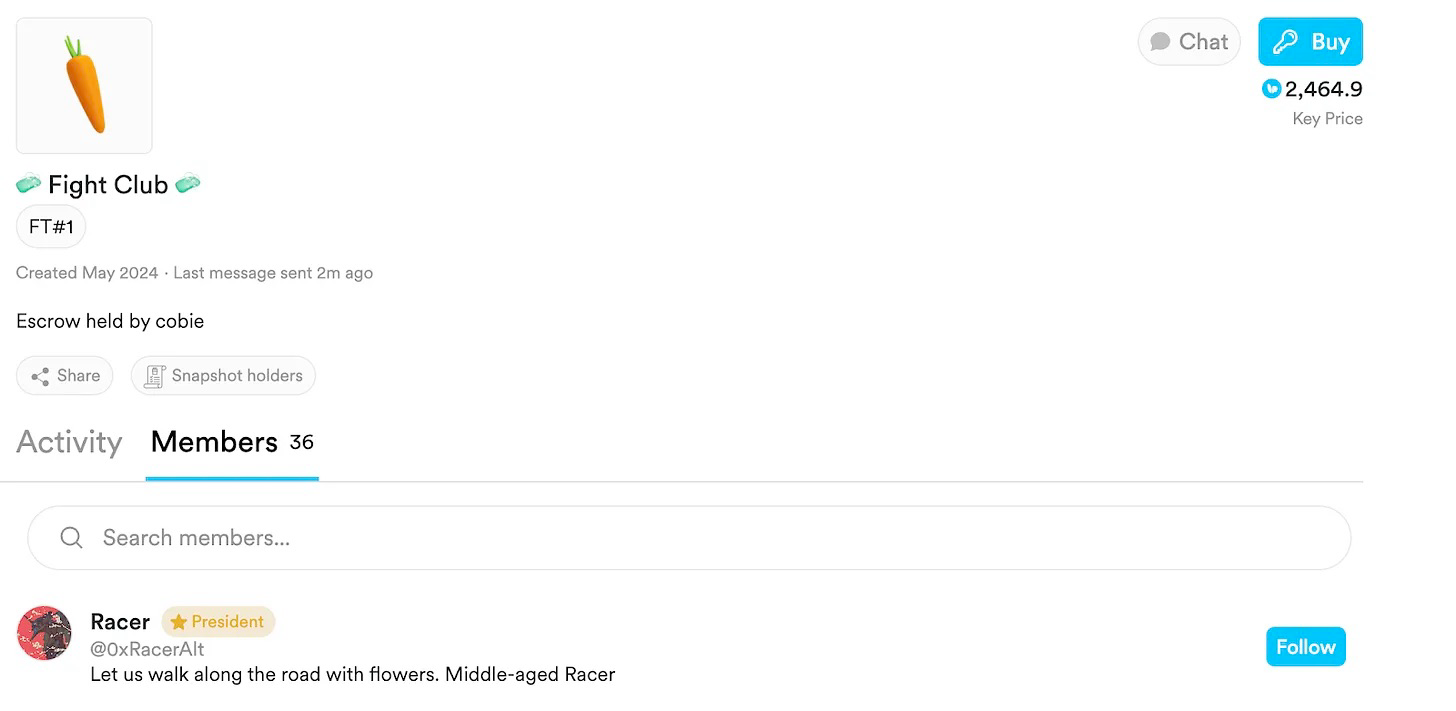

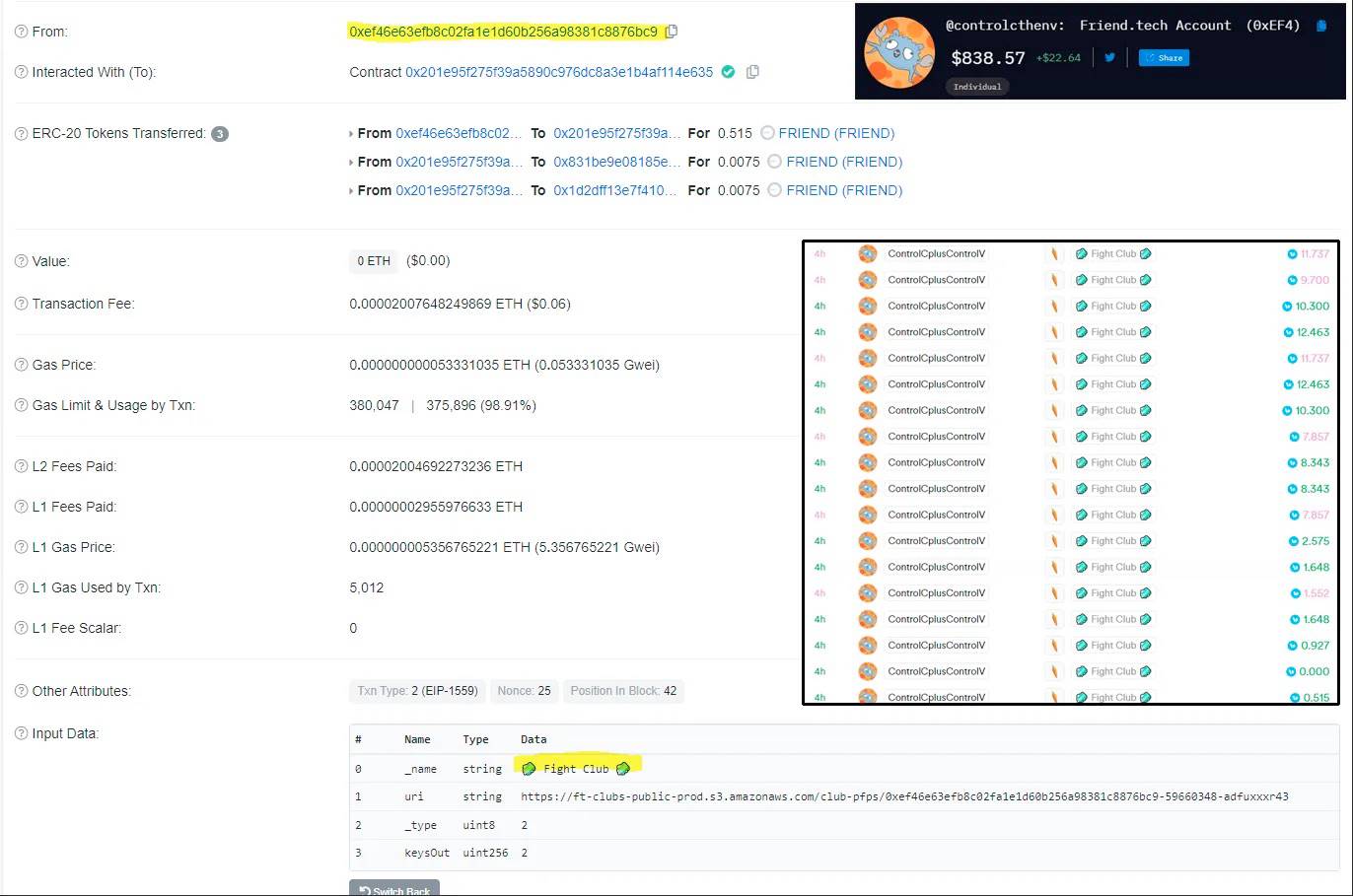

The club below (Fight Club) is the first club represented by FT#1 , and Racer is actually its president, which is reflected in the price of the key.

However, as you can see from the picture below, he did not create the club himself.

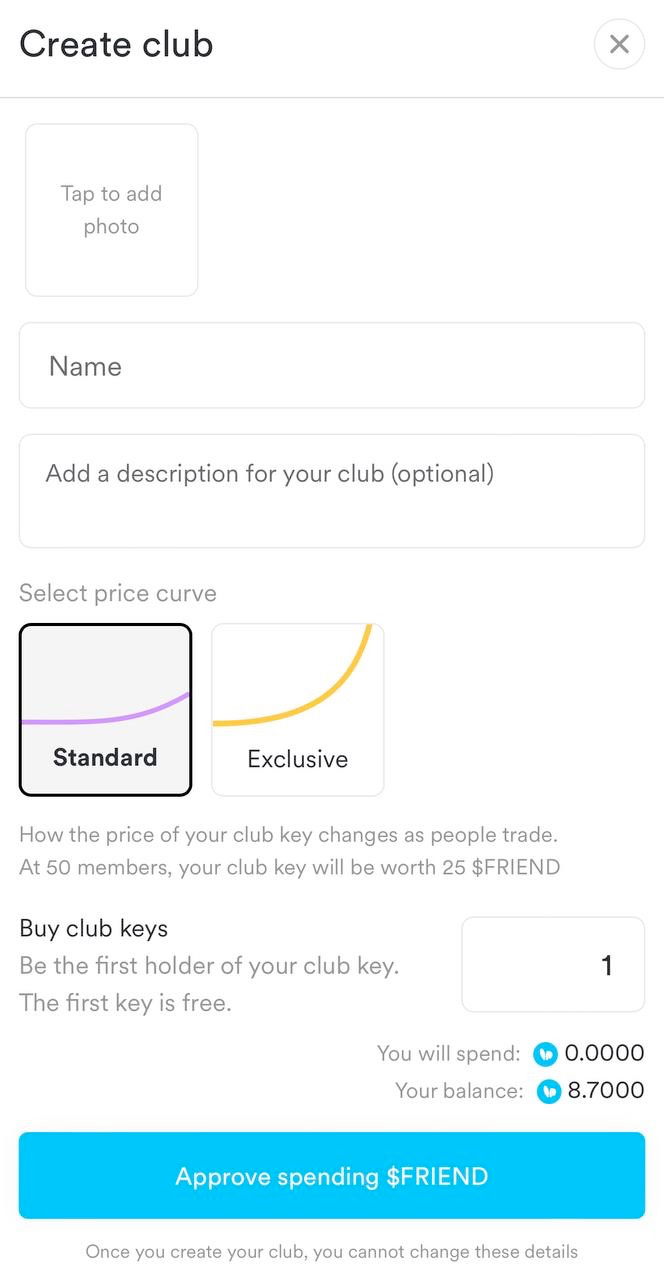

When creating a club, users can select the following:

-

name

-

describe

-

Price curve (standard or exclusive)

-

How many keys to buy

Still, it鈥檚 worth noting that much of this is hypothetical , as the FT promises to provide more information about Clubs and their mechanics.

There are also some elements that users need to be aware of when interacting with clubs: Anyone can transfer clubs sharing to someone else and appoint them as chairperson.

So you have to be very careful about well-known people who are nominated for the chair: they may not even know they have been nominated.

For example, this morning we created a random club and invited Racer to join!

Please note that Clubs can have the same name, so always check the clubs FT# to ensure you are purchasing the correct club.

In addition to these changes, the homepage of the Web App has also changed. It now displays new elements including Farm (LP), airdrop claims, and rewards.

Currently, users can only claim their airdrops, create clubs, buy and sell tokens, and farm them for rewards.

Furthermore, many stressed that the role of keys hadn鈥檛 really changed, nor had their usefulness expanded. The social media element that was supposed to change the direction of the platform also seemed missing or unimpressive.

Still, we don鈥檛 know if this is the final version or a new update will be released soon.

Last but not least, many people have higher expectations for the price of $FRIEND token.

This, combined with the lack of new use cases for keys, may be the difference between whether the airdrop is worth it and whether many people will fumble to sell their $FRIEND tokens.

All of these factors make it difficult to envision the long-term sustainability and success of such a model, which may or may not be the final version given the current design.

It is also worth mentioning that there is a delay between completing on-chain operations and being reflected on the FT interface.

We observed a delay of approximately 3-4 hours.

Is the friend.tech model sustainable?

Many have questioned the sustainability of the FT model, and while these doubts were initially ignored due to the incredible appeal of dApps, these critics have become increasingly vocal as the hype around FT has faded.

As FT V2 moves away from the influencer-centric model launched with V1, the protocol aims to reduce its dependencies and become more sustainable .

Indeed, reliance on influencers is a single point of failure: a social network is only as valuable as its users. The absence of many key figures would make FT much less attractive.

What is the value of Hsaka or Ansem if they rarely connect to the app, let alone share alpha there?

This is probably one of the key reasons why the team has recently moved towards a more community-centric (ie: degen) approach .

This is one of the key questions for FT : How can they ensure that users are incentivized and prefer their app over other apps like Twitter, Farcaster, Lens, etc.?

Despite the hype following the token鈥檚 launch, FT has not attracted the same level of attention as the previous two waves.

Many speculated that with the launch of $FRIEND, the protocol would gradually gain more and more attention. However, current indicators are far from meeting expectations.

Will this be another case of Sell the news?

Or will the long-awaited V2 release transform friend.tech into a leading social app and attract new user groups?

The current FT V2 version seems to be missing some key features which have been removed from the application.

For these reasons, it can be assumed that this will not be a complete release of FT 2, and there may be an upcoming update that follows.

We want to end this post with a reflection : is this all that FT could develop after 8 months with crazy funding, resources, and hype? Or is this another masterful strategy of the team to collect all the negative feedback, iterate, and release the final version of the application?

Judging from the current situation, it seems to be the latter, and the current situation of FriendTech V2 is worth pondering.

This article is sourced from the internet: In-depth discussion of the new mechanism of friend.tech V2, is the model sustainable?

Connexes : Litecoin (LTC) cible $100 : possible avant avril ?

In Brief Litecoin price has reclaimed the support of 61.8% Fibonacci Retracement, also known as bull run support. Reserve Risk suggests that LTC is a lucrative asset to accumulate right now, with the potential of rewards running high. However, Liveliness noting an incline shows that long-term holders are liquidating their positions. Litecoin (LTC) price noted recovery in the last few days following the bearish week in mid-March, which has investors certain of losses. However, not only has LTC nearly made back the losses, but it is also close to reclaiming $100, which might happen soon. Litecoin Looks Rewarding Litecoin’s price, trading at $95 at the time of writing, is currently among one of the best-performing cryptocurrencies. The recent rally reignited the bullishness surrounding the asset, which is evident in the…