Multicoin: Why Are We Bullish on Stablecoins Becoming FinTech 4.0?

Original Compilation: TechFlow

Over the past two decades, fintech has transformed how people access financial products, but it hasn’t fundamentally changed how money moves.

Innovation has largely focused on cleaner interfaces, smoother user experiences, and more efficient distribution channels, while the core financial infrastructure has remained largely unchanged.

For most of this period, the fintech tech stack was more resold than rebuilt.

Overall, the evolution of fintech can be divided into four stages:

Fintech 1.0: Digital Distribution (2000-2010)

The earliest wave of fintech made financial services more accessible but not significantly more efficient. Companies like PayPal, E*TRADE, and Mint digitally packaged existing financial products by combining legacy systems (like the decades-old ACH, SWIFT, and card networks) with internet interfaces.

During this stage, money settlement was slow, compliance processes were manual, and payment processing was bound by rigid schedules. While this era brought financial services online, it didn’t fundamentally alter how money moved. What changed was *who* could use these financial products, not *how* they actually worked.

Fintech 2.0: The Neobank Era (2010-2020)

The next breakthrough came from smartphone proliferation and social distribution. Chime offered early wage access for hourly workers; SoFi focused on student loan refinancing for upwardly mobile graduates; Revolut and Nubank served the underbanked globally with user-friendly interfaces.

Although each company told a more compelling story for a specific audience, they were essentially selling the same product: checking accounts and debit cards running on old payment networks. They still relied on sponsor banks, card networks, and the ACH system, no different from their predecessors.

These companies succeeded not because they built new payment networks, but because they reached customers better. Brand, user onboarding, and customer acquisition became their competitive advantages. In this stage, fintech companies became distribution-savvy businesses attached to banks.

Fintech 3.0: Embedded Finance (2020-2024)

Around 2020, embedded finance took off rapidly. The proliferation of APIs (Application Programming Interfaces) enabled almost any software company to offer financial products. Marqeta allowed companies to issue cards via API; Synapse, Unit, and Treasury Prime offered Banking-as-a-Service (BaaS). Soon, nearly every app could offer payments, cards, or loans.

However, behind these layers of abstraction, nothing fundamentally changed. BaaS providers still relied on sponsor banks, compliance frameworks, and payment networks from earlier eras. The abstraction shifted from banks to APIs, but economic benefits and control still flowed back to the traditional system.

The Commoditization of Fintech

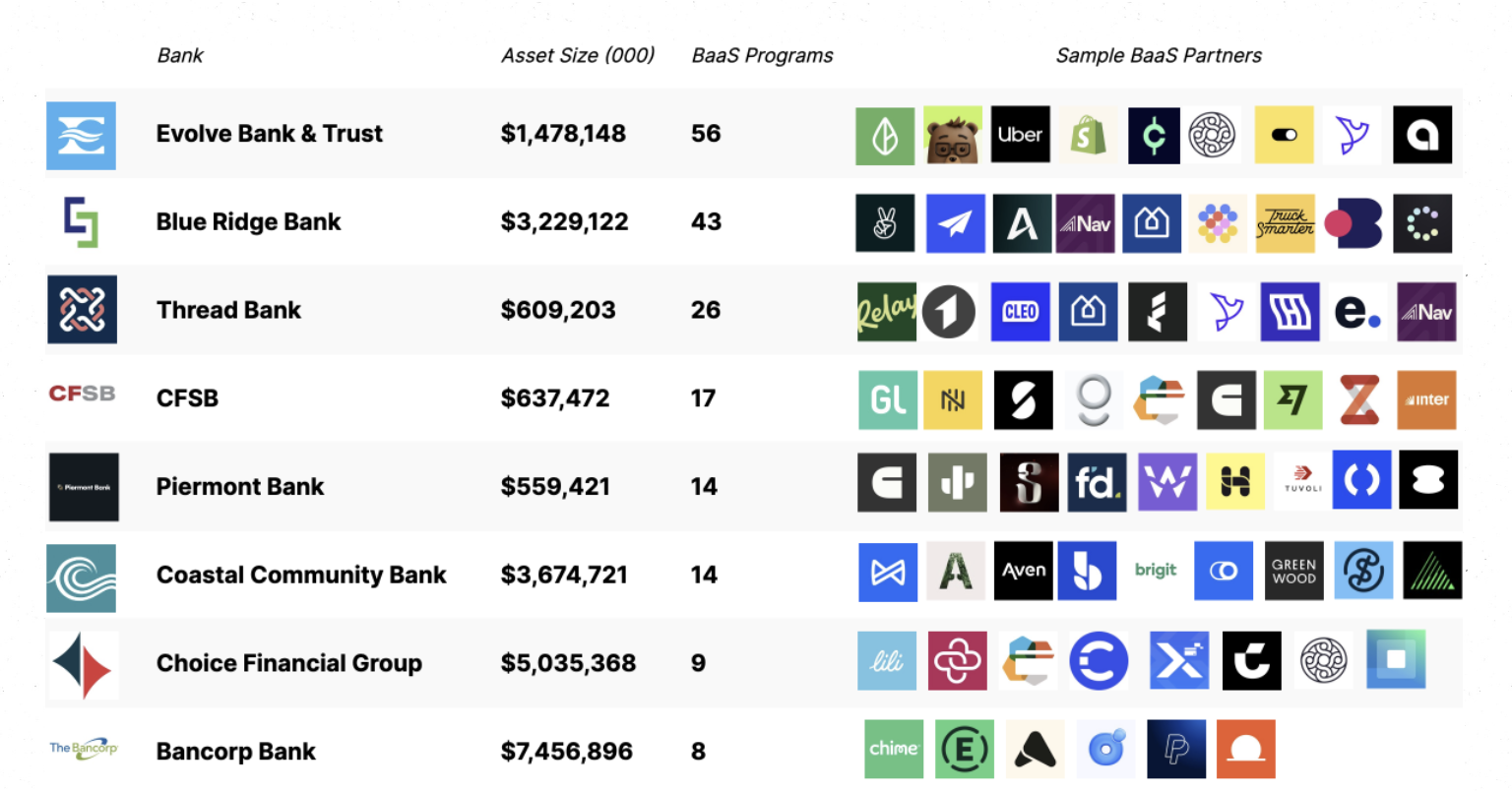

By the early 2020s, the flaws of this model became apparent. Nearly all major neobanks relied on the same small set of sponsor banks and BaaS providers.

Source: Embedded

As companies fiercely competed through performance marketing, customer acquisition costs soared, margins compressed, fraud and compliance costs surged, and infrastructure became nearly indistinguishable. Competition turned into a marketing arms race. Many fintechs tried to differentiate through card colors, sign-up bonuses, and cashback gimmicks.

Meanwhile, control over risk and value concentrated at the bank level. Large institutions like JPMorgan Chase and Bank of America, regulated by the OCC, retained core privileges: accepting deposits, issuing loans, and accessing federal payment networks (like ACH and Fedwire). Fintechs like Chime, Revolut, and Affirm lacked these privileges and had to rely on licensed banks to provide these services. Banks profited from net interest margin and platform fees; fintechs profited from interchange.

As fintech programs proliferated, regulators increasingly scrutinized the sponsor banks behind them. Consent orders and heightened supervisory expectations forced banks to invest heavily in compliance, risk management, and oversight of third-party programs. For example, Cross River Bank entered into a consent order with the FDIC; Green Dot Bank faced enforcement action from the Federal Reserve; and the Federal Reserve issued a cease-and-desist order against Evolve Bank.

Banks responded by tightening onboarding processes, limiting the number of supported programs, and slowing product iteration. The environment that once fostered innovation now required greater scale to justify compliance costs. Growth in fintech became slower, more expensive, and skewed towards launching generic products for broad audiences rather than products focused on specific needs.

From our perspective, the main reasons innovation remained at the top of the tech stack for the past 20 years are threefold:

- Money movement infrastructure was monopolized and closed: Visa, Mastercard, and the Federal Reserve’s ACH network left little room for competition.

- Startups needed significant capital to launch finance-first products: Developing a regulated banking app required millions of dollars for compliance, fraud prevention, treasury management, etc.

- Regulation limited direct participation: Only licensed institutions could custody funds or move money through core payment networks.

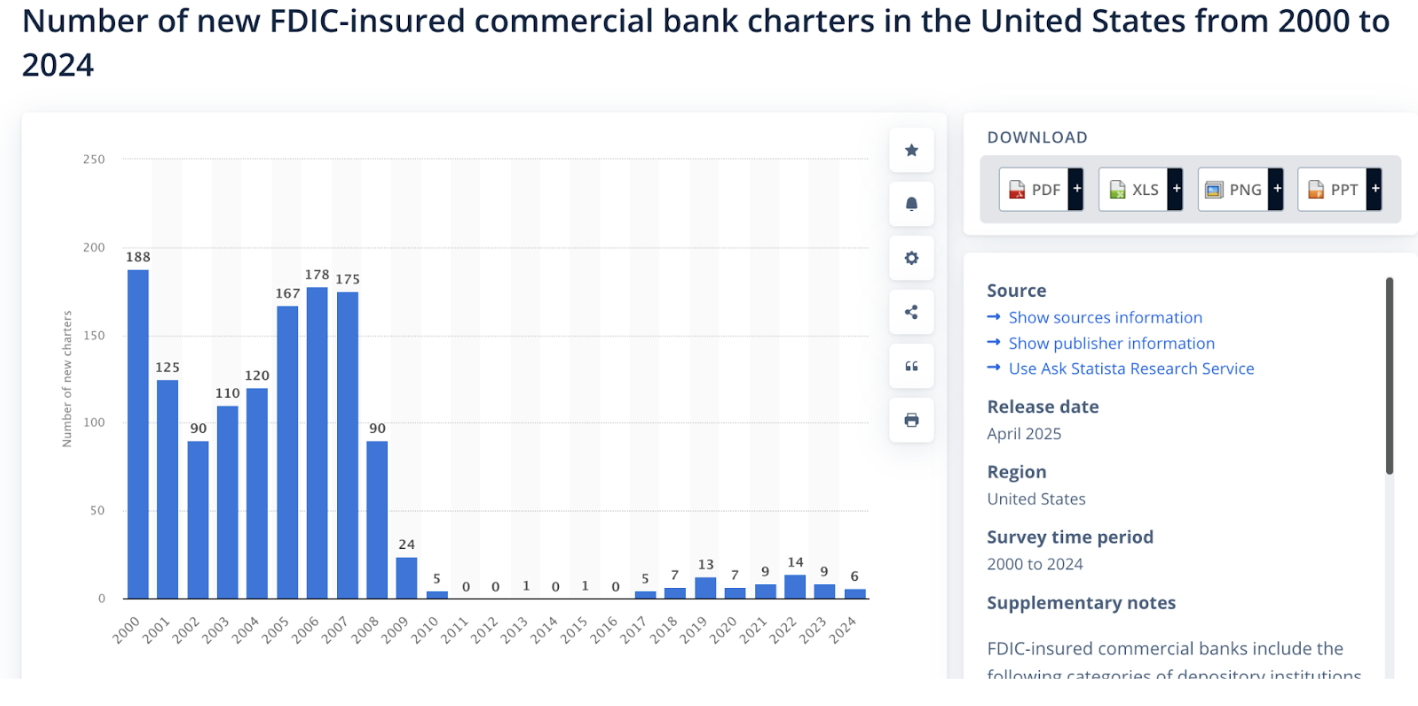

Source: Statista

Given these constraints, it was wiser to focus on building products rather than directly challenging existing payment networks. The result was that most fintech companies ended up as nicely packaged wrappers around bank APIs. Despite two decades of fintech innovation, few truly new financial primitives emerged within the industry. For a long time, there were no viable alternatives.

The crypto industry took the opposite path. Developers first focused on building financial primitives. From Automated Market Makers (AMMs), bonding curves, perpetual contracts, liquidity vaults to on-chain credit, all were built from the ground up. For the first time in history, financial logic itself became programmable.

Fintech 4.0: Stablecoins and Permissionless Finance

Although the first three fintech eras delivered many innovations, the underlying money movement architecture barely changed. Whether financial products were delivered through traditional banks, neobanks, or embedded APIs, money still moved on closed, permissioned networks controlled by intermediaries.

Stablecoins change this model. Instead of building software on top of banks, they replace the bank’s core functions directly. Developers can interact with open, programmable networks. Payments settle on-chain, and custody, lending, and compliance shift from traditional contractual relationships to being handled by software.

Banking-as-a-Service (BaaS) reduced friction but didn’t change the economic model. Fintechs still paid sponsor banks for compliance, card networks for settlement, and intermediaries for access. Infrastructure remained expensive and restrictive.

Stablecoins eliminate the need to rent access entirely. Instead of calling bank APIs, developers interact directly with open networks. Settlement happens on-chain, and fees flow to protocols, not intermediaries. We believe this shift dramatically lowers the cost barrier—from millions of dollars to develop via a bank, or hundreds of thousands via BaaS, to just thousands of dollars via permissionless on-chain smart contracts.

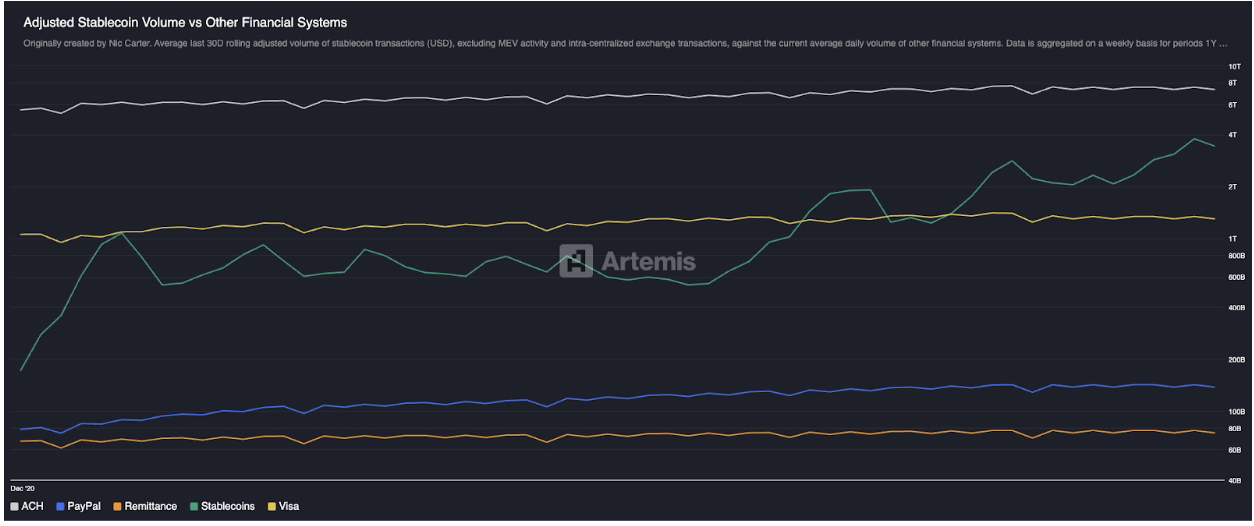

This shift is already visible at scale. The market cap of stablecoins grew from near zero to around $300 billion in less than a decade, and even excluding exchange transfers and MEV, the real economic transaction volume they process has surpassed traditional payment networks like PayPal and Visa. For the first time, a non-bank, non-card payment network is operating at true global scale.

Source: Artemis

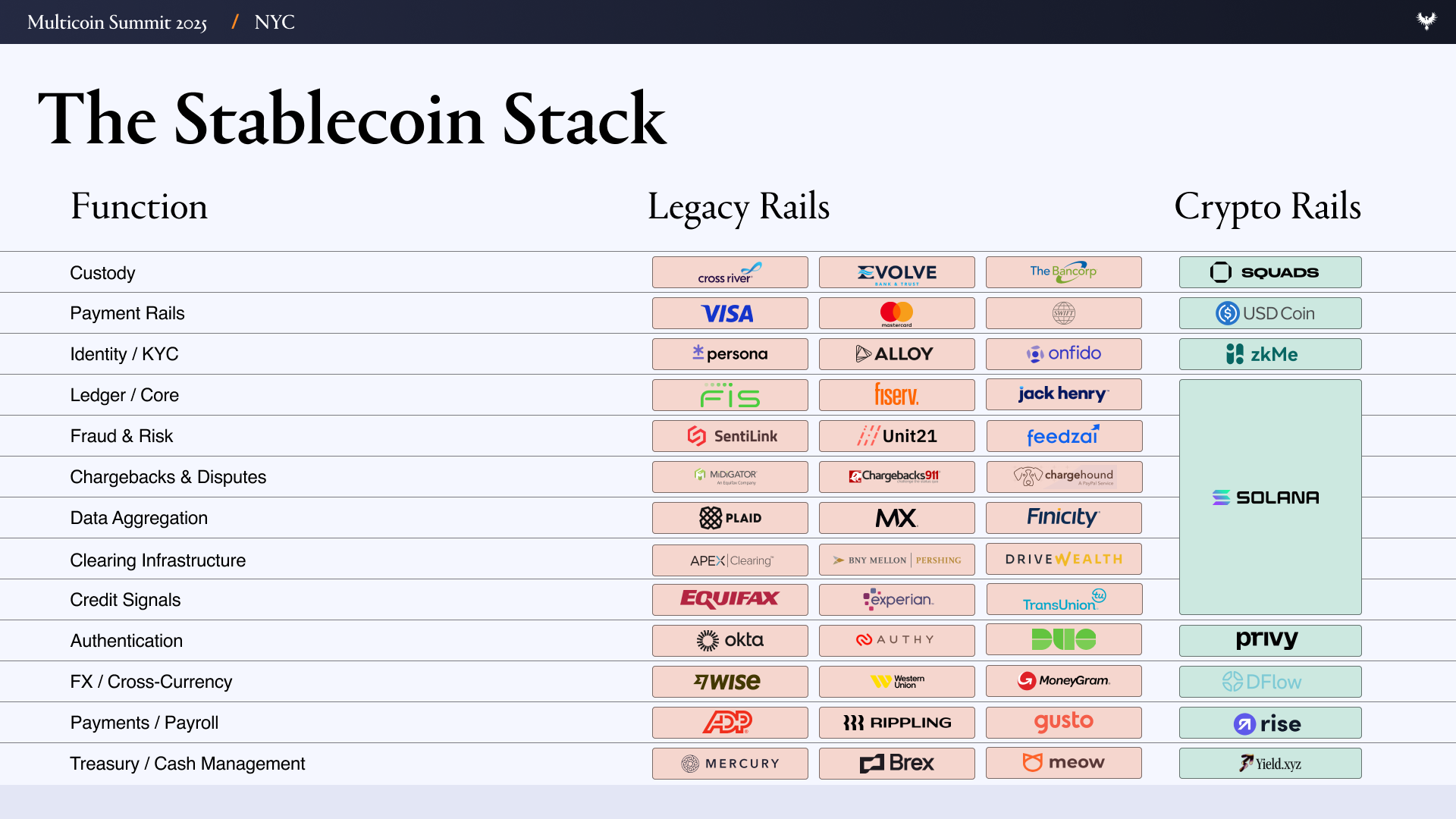

To understand the practical importance of this shift, we need to look at how fintech is built today. A typical fintech company relies on a massive vendor tech stack, including the following layers:

- UI/UX

- Banking & Custody Layer: Evolve, Cross River, Synapse, Treasury Prime

- Payment Networks: ACH, Wire, SWIFT, Visa, Mastercard

- Identity & Compliance: Ally, Persona, Sardine

- Fraud Prevention: SentiLink, Socure, Feedzai

- Underwriting / Credit Infrastructure: Plaid, Argyle, Pinwheel

- Risk & Treasury Management Infrastructure: Alloy, Unit21

- Capital Markets: Prime Trust, DriveWealth

- Data Aggregation: Plaid, MX

- Compliance / Reporting: FinCEN, OFAC checks

Launching a fintech company on this stack means managing contracts, audits, incentive structures, and potential failure modes across dozens of partners. Each layer adds cost and latency, and many teams spend almost as much time coordinating infrastructure as they do building their product.

A stablecoin-based system dramatically simplifies this complexity. Functions that previously required multiple vendors can now be achieved with a handful of on-chain primitives.

In a world centered on stablecoins and permissionless finance, the following changes are happening:

- Banking & Custody: Replaced by decentralized solutions like Altitude.

- Payment Networks: Replaced by stablecoins.

- Identity & Compliance: Still needed, but we believe this can be done on-chain, keeping it confidential and secure with technologies like zkMe.

- Underwriting & Credit Infrastructure: Radically reinvented and moved on-chain.

- Capital Markets Firms: Become irrelevant when all assets are tokenized.

- Data Aggregation: Replaced by on-chain data and selective transparency (e.g., via FHE).

- Compliance & OFAC Checks: Handled at the wallet level (e.g., if Alice’s wallet is on a sanctions list, she can’t interact with the protocol).

What truly differentiates Fintech 4.0 is that the underlying architecture of finance is finally starting to change. Instead of building an app that quietly asks a bank for permission in the background, people are now replacing the bank’s core functions directly with stablecoins and open payment networks. Developers are no longer tenants; they become true owners of the “land.”

Opportunities for Stablecoin-First Fintech

The first-order effect of this shift is obvious: there will be many more fintech companies. When custody, lending, and money movement become nearly free and instant, starting a fintech company will become as simple as launching a SaaS product. In a stablecoin-first world, there’s no need for complex integrations with sponsor banks, no card-issuing middlemen, no multi-day clearing processes, or redundant KYC checks to slow things down.

We believe the fixed cost of creating a finance-first fintech product will drop from millions of dollars to thousands. When infrastructure, CAC, and compliance barriers disappear, startups will be able to profitably serve smaller, more specific communities through what we call “stablecoin-first fintech.”

This trend has clear historical precedent. The last generation of fintechs initially broke through by serving specific customer segments: SoFi focused on student loan refinancing, Chime on early wage access, Greenlight on teen debit cards, and Brex on entrepreneurs who couldn’t get traditional business credit. But this focus didn’t last as an operating model. Limited interchange revenue, rising compliance costs, and dependence on sponsor banks forced these companies to expand beyond their original niches. To survive, teams were pushed to scale horizontally, adding products users didn’t necessarily want, just to make the infrastructure viable at scale.

Now, with crypto payment networks and permissionless finance APIs drastically lowering launch costs, a new wave of stablecoin neobanks will emerge, each targeting a specific user group, much like the early fintech innovators. With significantly lower operating costs, these neobanks can focus on narrower, more specialized markets and stay focused—such as Sharia-compliant finance, lifestyle banking for crypto enthusiasts, or services designed for the unique income and spending patterns of athletes.

More importantly, specialization also dramatically improves unit economics. Customer Acquisition Cost (CAC) falls, cross-selling becomes easier, and Lifetime Value (LTV) per customer grows. Focused fintechs can precisely target products and marketing to niche groups that convert efficiently and gain more word-of-mouth by serving a specific community. These businesses spend less on operations yet extract more value per customer than the previous generation of fintechs.

When anyone can launch a fintech company in weeks, the question shifts from “Who can reach customers?” to “Who truly understands them?”

Exploring the Design Space for Focused Fintech

The most compelling opportunities often appear where traditional payment networks fail.

Take adult content creators and performers, who generate billions in annual revenue but are frequently “de-banked” due to reputational or chargeback risk. Their payouts can be delayed for days, held for “compliance review,” and often incur 10%-20% fees through high-risk payment gateways (like Epoch, CCBill, etc.). We believe stablecoin-based payments could offer instant, irreversible settlement, support programmable compliance, allow performers to self-custody earnings, auto-route income to tax or savings accounts, and receive payments globally without relying on high-risk intermediaries.

Consider professional athletes, especially in individual sports like golf and tennis, who face unique cash flow and risk dynamics. Their income is concentrated in a short career span and often needs to be split among agents, coaches, and team members. They have tax obligations across multiple states and countries, and injuries can completely halt income. A stablecoin-based fintech could help them tokenize future earnings, pay their team via multi-signature wallets, and auto-withhold taxes according to different jurisdictional requirements.

Luxury and watch dealers are another market poorly served by traditional financial infrastructure. These businesses frequently move high-value inventory across borders, often via wire transfers or high-risk payment processors for six-figure transactions, while waiting days for settlement. Their working capital is often locked in inventory sitting in safes or display cases, not bank accounts, making short-term financing expensive and hard to obtain. We believe a stablecoin-based fintech could directly address these issues: instant settlement for large transactions, credit lines collateralized by tokenized inventory, and programmable escrow with built-in smart contracts.

When you look at enough of these cases, the same constraints appear repeatedly: traditional banks don’t serve users with global, irregular, or non-traditional cash flows. But these groups can become profitable markets through stablecoin payment networks. Here are some theoretical examples of focused stablecoin fintechs we find compelling:

- Professional Athletes: Income concentrated in a short career; frequent travel and relocation; may need to file taxes in multiple jurisdictions; need to pay coaches, agents, trainers, etc.; may want to hedge injury risk.

- Adult Performers & Creators: Excluded by banks and card processors; global audience.

-

stable currencyfinance

This article is sourced from the internet: Multicoin: Why Are We Bullish on Stablecoins Becoming FinTech 4.0?

Related: From Sahara to Tradoor, let’s review the recent “creative price drops” in altcoins.

Author | Asher ( @Asher_0210 ) Despite a recent market recovery, the crypto world remains shrouded in a persistent gloom since the “1011 crash.” Particularly noteworthy is the apparent unanimous triggering of a series of crashes on newly listed altcoins, with various price swings: halving in a single day, drops exceeding 80%, initial surges followed by a continuous decline, and concentrated sell-offs of airdrops. It’s worth noting that these anomalies are largely concentrated on new projects launched on Binance Alpha. In just a few weeks, a series of bizarre price drops have occurred. On-chain fund flows, market maker operations, and the team’s responses and silences piece together fragmented truths about this turmoil. Below, Odaily Planet Daily will summarize some of the most discussed and representative cases of these “creative price…