Before we begin, let’s first experience just how lively the American Super Bowl is from a first-person perspective:

(Video source: https://www.tiktok.com/t/ZP89Vvjyr/)

Amidst such a high density of attention, three viral events perfectly illustrate our expectations for prediction markets: an insider with a perfect win rate betting on the halftime show performers on the prediction market Polymarket, a “fanatic fan” arrested on the field, and a secretly filmed video of a mega-influencer using a prediction market that went viral, later revealed to be a marketing stunt.

The “Perfect Win Rate” in Prediction 市场s: A New Account’s Extremely High Accuracy in Betting on the Halftime Show Lineup

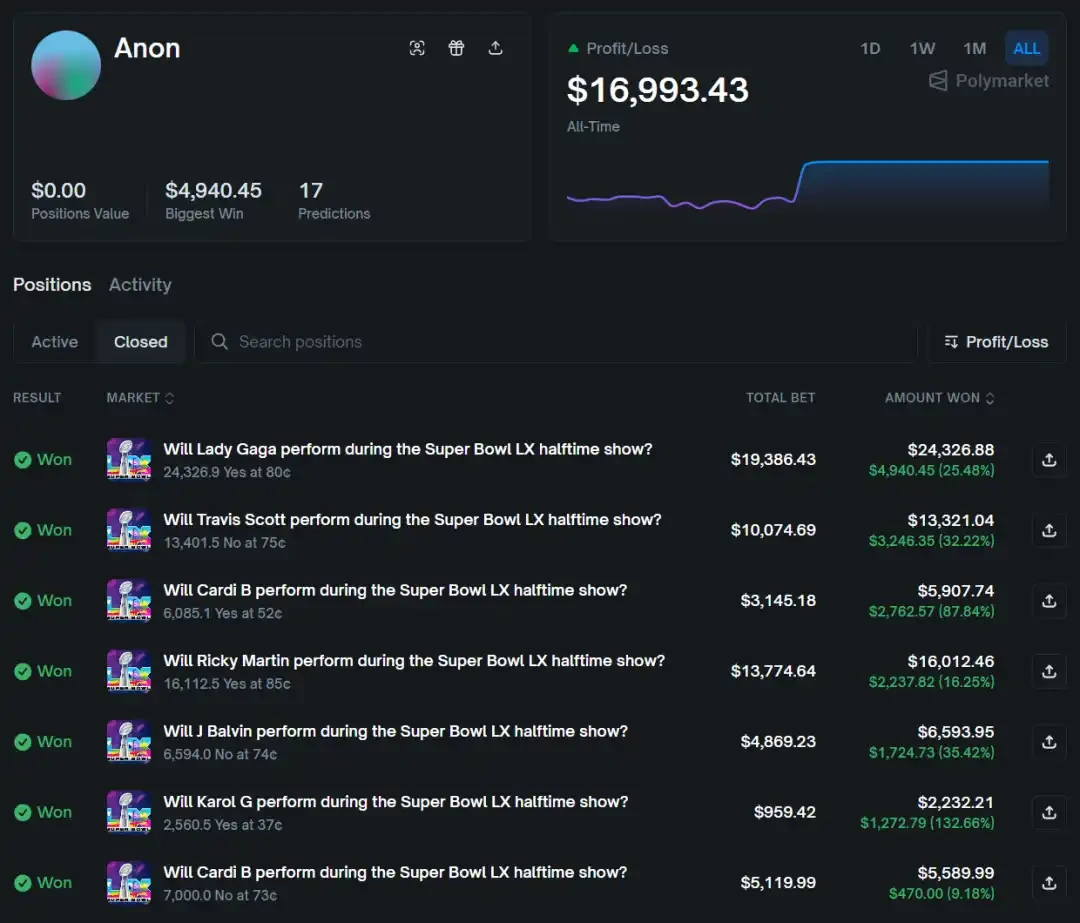

Approximately 48 hours before the Super Bowl kickoff, nearly $80,000 was deposited into a newly registered account on the prediction market Polymarket. Subsequently, this account concentrated all its funds on bets related to the halftime show performers and setlist, covering various specific predictions such as Lady Gaga performing and Travis Scott not performing, totaling 19 prediction bets.

After the halftime show concluded, 17 of these 19 bets were correct, yielding a profit of $17,600. A new account, heavily concentrated on a single event, with a near-perfect hit rate. This far exceeds the realm of good luck.

Since the Super Bowl halftime show has long been overseen by Roc Nation for overall planning and production, the community quickly began speculating that the account owner likely possessed insider information, possibly even connections to the production team. In this event with over $10 million in trading volume, while ordinary traders were placing blind bets, this insider might have been holding the setlist in one hand and locking in profits with a phone in the other.

However, the anonymous nature of blockchain also means this remains merely speculation. This trade has become yet another classic case 定义ning prediction markets as a venue for insiders to monetize information asymmetry.

A Trader Bets “Someone Will Rush the Field,” Then Rushes the Field Himself

If the insider trader profited from information asymmetry in the shadows, then the actions of a “fan” during the game were an open, calculated maneuver. He is also the protagonist from the video at the beginning of our article.

During the fourth quarter of the game, a shirtless fan climbed over the barrier and rushed onto the Super Bowl field. All cameras and the television broadcast instantly focused on this unexpected guest. His bare chest was painted with slogans: “Trade in the blind spot” on the front, and his account ID “@fxalexg” along with the advertisement “Trade with Athena” on his back.

From the moment he stepped onto the field until he was tackled by security, he ran for a total of 30 seconds. The price tag for an official 30-second Super Bowl commercial spot is $7 million.

When viewers pulled out their phones to search for his account, they discovered this “fan” was not an ordinary spectator but a trader—Alex Gonzalez. The slogans on his body were essentially a moving advertisement.

Even more intriguing, according to Sportscasting, Gonzalez had engaged in similar actions as early as 2024. He reportedly bet $5,000 that “someone would rush the field during the Super Bowl,” then proceeded to rush the field himself during the game, ultimately profiting approximately $110,000; after deducting bail and legal fees, his net gain was still around $70,000.

In other words, he not only created the event on the field but may have also bet on himself creating that event within the prediction market.

When the odds are sufficiently high, some stop predicting the future and instead create it themselves. This represents one of the most extreme, and ironically, one of our expectations for prediction markets.

The “Secretly Filmed” Video of an Influencer Betting a Million Dollars Was Actually a Marketing Stunt

Another video that went viral across the internet during this Super Bowl came from top influencer Logan Paul—in the clip, his phone screen shows the Polymarket betting interface as he places a $1 million bet on which team would win. The footage is blurry, the angle is tilted, perfectly mimicking a casual, surreptitious recording from a fellow spectator.

Shortly after this 12-second “secretly filmed” video spread, it was reposted by the official Polymarket account, generating the expected heat and traffic. However, this transaction never appeared in the PolyBeats information stream, which we use to monitor prediction market trades.

Further investigation revealed that the so-called “million-dollar bet” never actually occurred. This seemingly explosive “behind-the-scenes moment,” which catered to public voyeurism, was nothing more than a meticulously packaged marketing performance: as early as December 2025, Logan Paul joined the venture capital firm Anti Fund as a partner, and this firm was one of the investors in Polymarket’s Series B funding round in 2025.

When a globally watched sporting event simultaneously overlaps with probability markets, advertising markets, and attention markets, the boundaries of the game extend far beyond the two competing teams. Beyond the odds, there’s the pricing of exposure; beyond the betting lines, there’s narrative design.

Driven by money and attention, the “viral moments” we scroll past on social media may not be spontaneous but the result of months of planning.

本文来源于互联网: Commercials during the American Spring Festival Gala all look like scams

Related: Tiger Research: Why Do Financial Institutions Prefer Selective Privacy?

Key Takeaways The core advantage of blockchain—transparency—can expose corporate trade secrets and investment strategies, posing substantial risks to businesses. Fully anonymous privacy models like Monero do not support KYC or AML, making them unsuitable for regulated institutions. Financial institutions require selective privacy that protects transaction data while remaining compatible with regulatory compliance. Financial institutions must determine how to connect with open Web3 markets for expansion. 1. Why is Blockchain Privacy Necessary? One of the core features of blockchain is transparency. Anyone can inspect on-chain transactions in real-time, including who sent funds, to whom, the amount, and when it was sent. However, from an institutional perspective, this transparency presents obvious problems. Imagine a scenario where the market could observe exactly how much Nvidia transferred to Samsung Electronics, or the precise timing…