Goldman Sachs Casts a Vote of Confidence in ETH: The Biggest Detail in Its $2.3 Billion Holdings Isn’t BTC

Today, it is no longer news for Wall Street giants to enter the 암호화폐 space. The presence of mainstream institutions is becoming increasingly clear in crypto sectors such as ETFs, RWA, and derivatives. What the market truly cares about has long shifted from whether they will enter to how they will position themselves.

Recently, Goldman Sachs disclosed its crypto allocation worth up to $2.3 billion. Although this still represents a “small position” within its overall asset portfolio and has seen a significant reduction compared to before, its holding structure is quite telling. Despite the vast disparity in market capitalization, Goldman Sachs maintains nearly equal-sized exposures to BTC and ETH.

This detail might carry more signaling significance than the size of the holdings itself.

Putting ETH on Par with BTC: Goldman Sachs Casts a Vote of Confidence in ETH

At a time when Ethereum’s price remains under pressure and market sentiment has noticeably cooled, Goldman Sachs’ latest disclosed holding structure sends a signal different from the prevailing market mood.

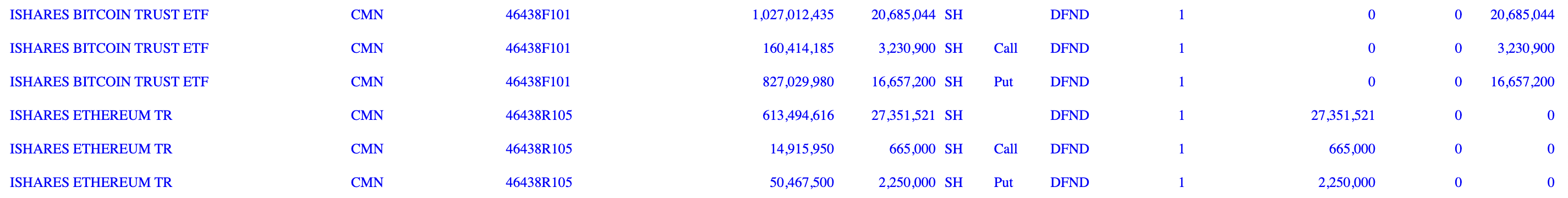

According to 13F filings, as of Q4 2025, Goldman Sachs indirectly holds approximately $2.361 billion in crypto assets through ETFs.

Within its overall portfolio, this allocation is not prominent. Goldman Sachs’ total investment portfolio for the same period was a massive $811.1 billion, with crypto asset exposure accounting for only about 0.3%. For traditional financial giants managing trillions or even tens of trillions of dollars, such a proportion can only be described as testing the waters. In the eyes of mainstream players, crypto remains an alternative asset, not a core allocation. Participating with a small proportion can meet client demands, maintain market participation, and strictly control risks in a volatile environment.

What is truly noteworthy is not the scale, but the structure and direction of the holdings.

In the fourth quarter of last year, the crypto market experienced an overall correction, and spot ETF products also saw significant net outflows. Goldman Sachs accordingly reduced its positions, with holdings in Bitcoin spot ETFs and Ethereum spot ETFs decreasing by 39.4% and 27.2% quarter-over-quarter, respectively. Meanwhile, the firm initiated new positions in XRP ETF and Solana ETF during the quarter, beginning to cautiously test second-tier assets.

As of the quarter’s end, Goldman Sachs held approximately 21.2 million shares of spot Bitcoin ETFs, valued at about $1.06 billion; held about 40.7 million shares of spot Ethereum ETFs, valued at about $1 billion; and allocated approximately $152 million to XRP ETF and $109 million to Solana ETF.

In other words, nearly 90% of its crypto exposure remains concentrated in the two core assets, BTC and ETH. Compared to some aggressive asset managers or crypto-native funds, Goldman Sachs’ strategy is clearly more conservative, with liquidity, compliance, and institutional acceptance remaining its primary considerations for allocation logic.

But what holds more signaling significance is the almost equal weighting between BTC and ETH.

Currently, Bitcoin’s market capitalization is about 5.7 times that of Ethereum, yet Goldman Sachs did not allocate based on market cap weighting, instead placing ETH essentially “on par” with BTC. This means that within its asset framework, Ethereum has been elevated to a second strategic-level crypto asset. Furthermore, during the Q4 2025 reduction, the ETH position was cut by 12% less than the BTC position. To some extent, this is an over-allocation-style vote of confidence.

This preference is not a momentary decision.

Over the past few years, Goldman Sachs has been continuously building out multiple business lines around asset tokenization, derivative structure design, infrastructure, and OTC trading, most of which are highly relevant to the Ethereum ecosystem.

In fact, several years ago, Goldman Sachs’ research department publicly predicted that Ethereum’s market cap could surpass Bitcoin’s in the coming years, citing its network effects and ecosystem application advantages as a native smart contract platform.

This judgment persists to this day. In its “Global Macro Research” report released last year, Goldman Sachs again emphasized that, from dimensions such as real-world utility, user base, and technological iteration speed, Ethereum has the potential to become a core carrier for mainstream crypto assets.

Despite the recent divergence between Ethereum’s price and fundamentals, Goldman Sachs maintains a relatively positive outlook. It pointed out that Ethereum’s on-chain activity paints a different picture, with daily new addresses reaching 427,000 in January, a record high, far exceeding the average of 162,000 addresses per day during the DeFi Summer of 2020. Simultaneously, daily active addresses reached 1.2 million, also setting a new historical record.

Perhaps, in the asset logic of Wall Street institutions, Bitcoin has become a macro hedge tool, while Ethereum carries the structural narrative of on-chain finance and application ecosystems. The two represent different dimensions of allocation logic: the former leans towards value storage, while the latter bets on infrastructure and network effects.

Goldman Sachs’ Pivot: Wall Street’s Hesitation and Entry

Goldman Sachs is also a “latecomer” crypto player.

If we extend the timeline, this typical traditional financial institution’s entry path has not been aggressive, adopting a “compliance-first, gradual testing” approach.

As early as 2015, Goldman Sachs filed a patent application for a securities settlement system based on SETLcoin, attempting to explore using blockchain-like technology to optimize clearing processes. At that time, Bitcoin had not yet entered the mainstream view, and this was more of a technical interest rather than asset-level recognition.

In 2017, as Bitcoin’s price soared to historical highs, Goldman Sachs once planned to set up a crypto trading desk to provide Bitcoin-related services; in 2018, it hired a former crypto trader to prepare a Bitcoin trading platform. By then, Goldman Sachs had begun to directly engage with this emerging market.

But the real shift in attitude occurred in 2020. That year, in a client-facing conference call, Goldman Sachs explicitly stated that Bitcoin could not even be considered an asset class, as it neither generates cash flow nor effectively hedges against inflation. This public bearish stance sparked considerable market controversy.

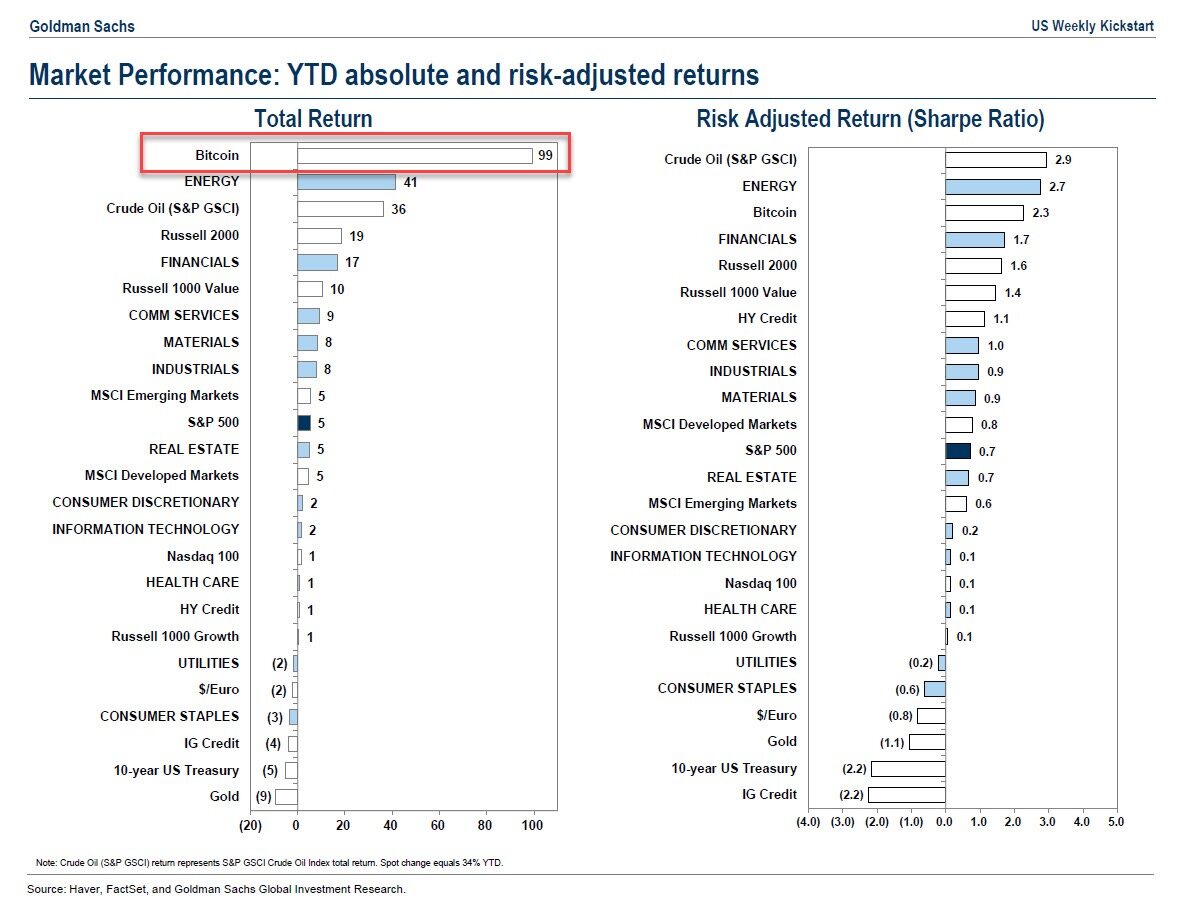

Goldman Sachs began including Bitcoin in its weekly asset class reports in 2021

Goldman Sachs began including Bitcoin in its weekly asset class reports in 2021

A year later, Goldman Sachs’ position quickly softened. In 2021, against the backdrop of rising institutional client demand, Goldman Sachs restarted its cryptocurrency trading division, began trading Bitcoin-related derivatives, and partnered with Galaxy Digital to launch Bitcoin futures trading products. In 2022, Goldman Sachs completed its first crypto OTC transaction and expanded its digital asset team. By 2024, it not only invested in several crypto companies but also formally entered the crypto spot ETF market.

Truly comprehensive acceptance has emerged in the last two years.

In March 2025, Goldman Sachs first mentioned cryptocurrency in its annual shareholder letter, acknowledging intensified industry competition and judging that clearer regulations would drive a new wave of institutional adoption, with areas like tokenization, DeFi, and stablecoins poised for growth under new regulations. More recently, its CEO David Solomon publicly confirmed that the firm is increasing research and investment in tokenization, stablecoins, and prediction markets.

This script of transformation is not uncommon among traditional “old money.”

For example, in 2025, SkyBridge Capital founder Anthony Scaramucci admitted that although he was exposed to Bitcoin as early as 2012, it took him a full eight years to make his first Bitcoin investment because he initially did not understand it and was full of skepticism. It was only after truly studying blockchain and Bitcoin’s mechanisms that he realized it was a “great technological breakthrough.” He even stated that 90% of people would lean towards Bitcoin if they “did their homework.”

Today, SkyBridge Capital holds a significant amount of Bitcoin and invests about 40% of client funds in digital assets. Amid the recent bearish market sentiment, Scaramucci revealed that the institution has been accumulating Bitcoin in batches at $84,000, $63,000, and the current range, describing buying Bitcoin in a downtrend as “like catching a falling knife,” but remains firmly long-term bullish.

For these elite Wall Street investors, risk management remains the core of decision-making, typically choosing to allocate at scale only under controllable risk conditions.

Moreover, institutional decision-making cycles dictate that true capital entry is a marathon.

According to Bitwise Chief Investment Officer Matt Hougan in a recent 회견, the next wave of potential buyers remains financial advisors, large brokerages like Morgan Stanley, family offices, insurance companies, and sovereign nations. Bitwise’s average client requires 8 meetings before allocating assets. We typically meet quarterly, so “8 meetings” means a decision cycle of up to 2 years. Morgan Stanley only approved Bitcoin ETFs in Q4 2025; their “8-meeting clock” has just started, and real capital inflows might not surge until 2027. This is similar to the situation when gold ETFs launched in 2004—capital inflows increased year by year, taking a full 8 years to reach the first peak. Most professionally managed money currently does not hold Bitcoin.

The journey of crypto assets from the fringe to the mainstream is itself a slow and winding process. When former skeptics begin holding in compliant ways, and when doubters turn into long-term allocators, the real change in the crypto market may not lie in price action, but in the upgrade of participant structure.

이 글은 인터넷에서 퍼왔습니다: Goldman Sachs Casts a Vote of Confidence in ETH: The Biggest Detail in Its $2.3 Billion Holdings Isn’t BTC

Author | Ethan (@ethanzhang_웹3) RWA Sector 시장 Performance According to the rwa.xyz data dashboard, as of February 3, 2026, the total on-chain value of RWA (Distributed Asset Value) reached $239.6 billion, an increase of $7.3 billion from $232.3 billion on January 27, representing a weekly gain of 3.14%. In terms of the broad RWA market size, i.e., the total value of representative assets (Represented Asset Value), there was a significant correction, dropping from $3551.7 billion on January 27 to $1994.2 billion, a decrease of $1557.5 billion, or 43.86%. This may be due to adjustments in statistical methodology, a situation that has frequently occurred before and is not an anomaly. Regarding the number of asset holders, the total number of asset holders increased from 656,444 to 830,533, a net increase of…