저자|아즈마 (@아즈마_에스)、Mandy (@mandywangETH)

For a long time, Binance has been crowned the “largest exchange in the 암호화폐 universe.” However, recently, I have begun to harbor increasingly strong doubts about this label, which has long been solidified in the minds of retail investors.

Of course, with its vast matrix comprising a public chain, ecosystem, wallet, and VC portfolio, Binance remains the super-platform with the widest influence coverage in the current Crypto industry—this point is undisputed.

What truly deserves re-examination is another, more core question: In the most essential and critical battleground for an exchange—trading itself, especially in the high-volume, high-fee futures market that determines price discovery, does Binance still firmly hold the industry’s top spot? Does it still possess an unshakable absolute advantage over other competitors? And in terms of innovation leadership in other emerging areas, are there entities surpassing Binance?

The reason for raising this question is not due to any short-term data fluctuations, but because of several minor incidents that have occurred in succession recently. Individually, they might seem insignificant, but together, they are continuously eroding my established perception of Binance’s market position.

Futures Trading Volume Faces Challenges

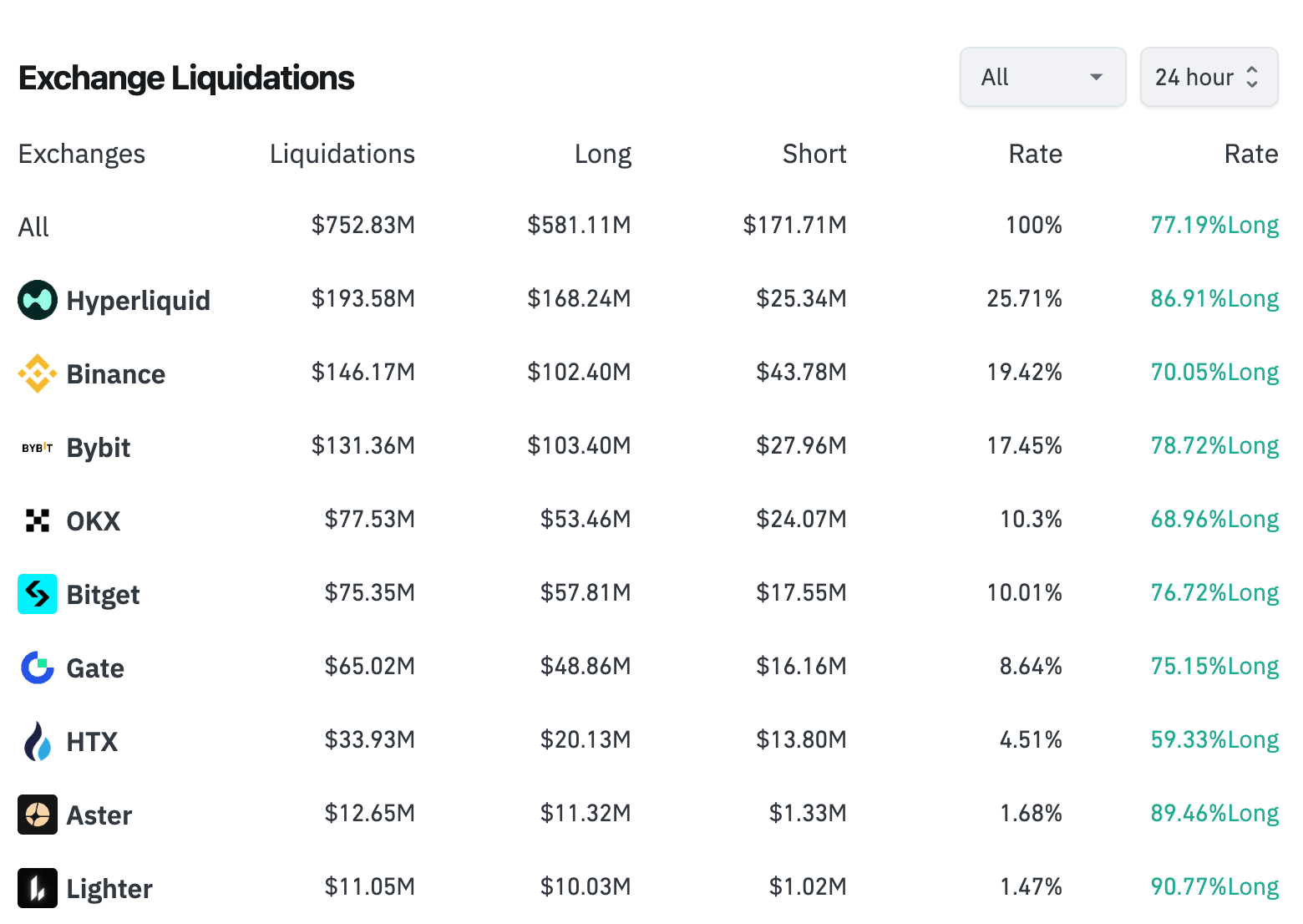

The first is that during the recent volatile market conditions, Hyperliquid’s liquidation data has surpassed that of Binance. As shown in the chart below, Hyperliquid’s liquidation amount in the last 24 hours was approximately $193 million, while Binance’s was $146 million.

Odaily Note: Data sourced from Coinglass, as of 14:00, February 2.

A point of doubt here is that Binance’s liquidation data push frequency is limited to a maximum of once per second, so data platforms like Coinglass might experience some delay when scraping.

However, based on our observations, it is indeed true that an increasing number of large traders are choosing to place orders on Hyperliquid. Typical representatives include “Machi Big Brother,” the “1011 Insider Whale,” James Wynn, AguilaTrades, “CZ’s Counterparty,” the “14-Win Streak Whale,” Gambler@qwatio, Low-Stack Degen, among others—the so-called “Eight Vajras”… You can criticize them all as gamblers, but where the gamblers go, the volume follows, and volume is the lifeblood of an exchange.

The reason for this situation is that compared to the inevitable “black box” suspicion surrounding CEXs, all orders, trades, liquidations, and settlements on Hyperliquid are executed on-chain, inherently possessing advantages in transparency and fairness. In the first half of last year, a prominent figure who had founded several well-known projects over the years (name omitted) experienced a targeted liquidation on a certain CEX (clarification: not Binance), resulting in losses exceeding $100 million. The platform never publicly disclosed the internal order matching and liquidation details.

Mainstream Coin Liquidity Partially Surpassed

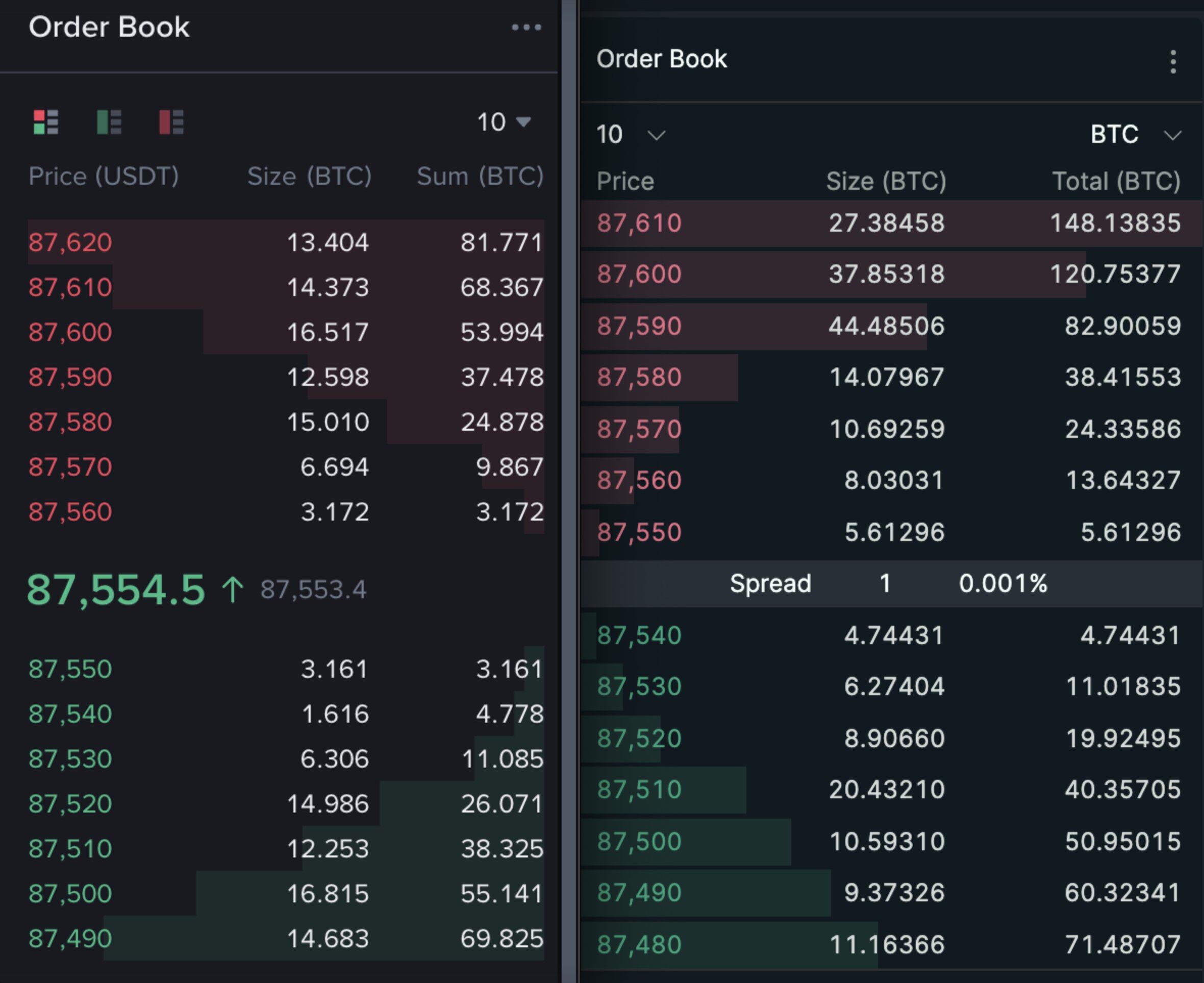

The second incident occurred last week when Hyperliquid’s founder, Jeff, posted on X a comparison of the BTC futures order books on his platform (right side of the image below) and Binance (left side). The chart shows that Hyperliquid has narrower bid-ask spreads and thicker order book depth for BTC.

Jeff boldly proclaimed: “Hyperliquid has become the world’s best cryptocurrency price discovery platform in terms of liquidity.”

This is not an isolated case. Real-time checks of order books for other mainstream tokens like ETH and SOL on both Hyperliquid and Binance reveal that the former’s liquidity performance is no longer inferior to the latter’s.

Slow Progress in New Asset Expansion

Over the past year, compared to many second-tier exchanges, Binance has noticeably tightened its pace regarding “official listings,” shifting the high-frequency testing window more towards Binance Alpha. However, the post-listing performance of many assets has been unsatisfactory. Furthermore, with the hype around Chinese Memes, Alpha’s focus has further tilted towards the BSC ecosystem. After the 10.11 incident, controversies surrounding Binance’s listings have continued to ferment, leading the industry to question Binance’s listing path.

A few days ago, Solana co-founder Anatoly Yakovenko (toly) criticized Binance on X, leading CZ to unfollow him. Even before this, a sentiment had emerged in the market that Solana ecosystem projects were shifting their exit strategies towards Bybit. Following this trend, Binance may no longer hold a monopoly on future project listing premieres and pricing power as it once did.

More importantly, in the current climate of persistently sluggish crypto-native assets, the industry has begun viewing asset classes originating from traditional finance—such as tokenized stocks and precious metals—as new breakthroughs. However, on this path, Binance’s progress appears somewhat slow compared to both Hyperliquid and several other highly proactive CEXs (Bitget, Gate, Bybit, etc.).

Last Monday, Binance officially launched its first stock futures contract, TSLA (Tesla), and today followed up with INTC (Intel) and HOOD (Robinhood). Meanwhile, Binance’s competitors like Gate and Bitget are more aggressively expanding into traditional asset categories—from tokenized stocks to precious metals, from indices to commodities. The competition for potential users has already begun.

On the decentralized front, Hyperliquid, leveraging its open HIP-3 architecture, has long ago listed dozens of traditional asset types, including Pre-IPO stocks like OpenAI and Anthropic, through more flexible custom market mechanisms. It has already accumulated considerable trading volume around these assets—traditional assets recently accounted for nearly half of Hyperliquid’s trading volume rankings.

What Has Changed?

Looking at the current evidence together, it’s difficult to conclude that “Binance has lost its throne.” Binance remains the most important liquidity hub. However, what I believe is truly worth vigilance is not Binance’s market share being temporarily surpassed by a specific second-tier exchange, but rather that Binance is continuously facing structural challenges on its most core trading battleground.

What Binance is losing is not market share, but the discursive power to “디파이ne what an exchange is.”

For a long time, the reason Binance was the “largest exchange in the crypto universe” was not just because it had the largest liquidity, but also because—the default industry answers to where price discovery happens, where mainstream capital trades, and which exchange new assets should first test the waters, were all Binance.

But as more high-net-worth accounts prioritize “verifiable, fair, traceable” over fees and brand, as price discovery begins to be reorganized on-chain, and as the testing ground for new assets gradually shifts from exchange backends to front-end, verifiable market mechanisms, Binance is encountering on its most proficient and core track not the challenges of past, similar competitors, but competitors that might bring about a paradigm shift for the industry.

Although the article discusses specific categories, the underlying question is about the most core value of the exchange species itself: where does price originate, and who backs the trust?

Perhaps Binance should contemplate how deep its moat still is.

이 글은 인터넷에서 퍼왔습니다: Is Binance Still the World’s Largest Exchange?

Related: Xianyu, China’s Version of the Folk Dark Web

撰文:伞牢大|深潮 TechFlow 在闲鱼搜索“USDT”,页面一片空白。但把关键词换成“出 USD 币”,一个隐秘的数字黑市瞬间展开。 卖家们用各种谐音、暗语、图片规避平台监管,“懂的都懂”是这里的通行口令,有人把联系方式藏在图片角落,有人直接把交易所 LOGO 截图摆上来证明自己是“圈内人”。 在公开语境中高度敏感、被严格限制的加密资产,并没有真正消失,而是被伪装折叠进了一个更下沉的平台。 “买卖 USDT”、“手把手指导下载交易所 APP”、“海外身份证过交易所 KYC”、“币安 alpha 教程”……在这里几乎可以买到一站式加密交易指导服务。 数字黑市远不止加密相关内容:折扣机票、酒店代订、热门餐厅位置、演唱会内场、大兵 AI 认证…… 在社交平台上,流传着一句评价: “你几乎可以在闲鱼买到一切。” 这并非夸张。 隐秘的加密生意 2025 年 10 月,帕劳共和国数字身份官方 X 账号罕见用中文发布公告。 “近期发现有人员在社交媒体上公开展示伪造的帕劳身份证件,并用于绕过各平台的 KYC 验证流程。此行为已构成严重身份欺诈。”RNS.ID 官方宣布,将对所有使用中文拼音的帕劳 ID 用户实施二次审核,未通过验证的用户将被标注为欺诈对象,同步全球欺诈数据库。 这个太平洋岛国政府为何专门发布中文公告?答案藏在闲鱼的搜索结果里。 输入“海外身份”、“帕劳 ID”等关键词,会发现一个地下的虚假证件交易网络。价格从几十到几百元不等,承诺“100% 通过各大交易所认证”。 除了帕劳,多米尼克、尼日利亚、菲律宾等国证件也是热门商品,这些虚假证件制作水平不断提升,卖家会提供定制服务,用买家真实照片制作假证,确保通过人脸识别。 除了卖用于 KYC 的假证件,在闲鱼加密黑市中,更多的是 0 成本的虚拟服务。 在闲鱼,一个名为“深圳小侠”的账号,曾经以 10 元的价格,出售“币安欧易下载、安装”的 30 分钟指导服务。(注:目前已下架) “小侠”并非无名之辈,在加密世界中,这是一个如雷贯耳的名字,一位顶流 KOL。 就在不久前,他负债 6000 万人民币购入深圳顶级豪宅中信·信悦湾的新闻,还在业内广为流传。 一位身家上亿的币圈富豪,为何要在闲鱼上,亲自做着 10 元一单的“客服”生意? 10 元教学费只是诱饵,真正收入来自推荐返佣。每个通过他链接注册的用户,未来都能为他带来交易手续费分成。一个活跃用户每月可能产生几百甚至几千元收益。 这 10 元的生意,是一根成本极低的钓竿。钓竿的另一头,连接着一个庞大的、可持续变现的流量池。 如果说“小侠”的生意是阳谋,那么更多的卖家则在信息差的墙壁上,做着更纯粹的“凿壁偷光”买卖。 一个标价 88 元的“币某安阿尔法入门教学”商品,提供一对一线上授课,承诺“手把手带练,省心省力”。所谓的“阿尔法(Alpha)”,通常指代币安等平台推出的、允许用户通过完成任务来赚取潜在空投奖励的活动。 这些活动的参与方式,在 X、YouTube 等平台上早已是公开的秘密,无数博主免费分享着详尽的攻略。但对于大多数国内用户而言,这堵由语言、网络环境和信息渠道共同构筑的墙,是真实存在的。 有买家评论道,“卖家很热心,比自己摸索方便多了。” AI“军火库” 加密货币的数字交易,顶多算是闲鱼这个折叠空间里开辟的一间小“暗房”,那么关于 AI 的交易,才是一个真正庞大、全民参与的“数字军火库”。 当 ChatGPT、Claude 这些名字引爆全球时,一堵无形的墙也随之升起。复杂的注册流程和网络环境、信用卡支付的壁垒,将绝大多数充满好奇的中国用户挡在门外。他们能看到新世界的绚烂烟火,却找不到入口的门径。 闲鱼,意外地成为了那条绕过高墙的民间小路。 这里的“军火商”们,提供着从入门到精通的全套服务。 最基础的商品是“账号”,一个注册好的 GPT 或 Claude 成品号,售价从几十元到上百元不等,并且提供后续的每月充值服务。 市场中最热门的海外 AI 应用和大模型都有哪些?看看闲鱼就知道了。 2025 那年,当如今被 Meta 以 20 亿美元收购的 AI 应用 Manus 横空出世时, 内测资格一码难求,闲鱼上内测码价格从最初的几百元,一夜之间飙升至数千、数万,最高时,甚至有人挂出了“十万元”的天价,这也促成了 Manus 影响力大规模出圈。 如今,最热门的闲鱼 AI 产品当属 Gemini 和 ChatGPT。 高级版本每月 20 美元的订阅费,足以浇灭不少普通人的体验热情。 然而,Google 为在校学生提供了一项一年全免的福利,OpenAI 也面向美国退役军人及现役军人推出福利活动,可免费领取一年 ChatGPT Plus。这个小小的政策善意,在闲鱼上,被一群嗅觉敏锐的卖家,开发成了一门规模化的生意。 在闲鱼搜索“大兵”,一个奇特的赛博景观便会展开。商品封面是各种卡通士兵或硬汉形象,商品名则充满了黑话般的默契:“大兵帮过!”、“大兵一年 plus 成品号”、价格从几块到几十块不等。 一位闲鱼用户在社交媒体上提到:“闲鱼是目前中文世界最大的 AI 培训基地。少了闲鱼,大部分中国人,根本用不上国际一线 AI 模型。” 这句话充满了矛盾,却又无比写实。 闲鱼,这个本用于交易二手用品的平台,就这样阴差阳错地担任起国际一线 AI 模型在中国的“启蒙者”与“普及者”角色。 买到一切 无论是加密交易,还是 AI 服务,这依然只是闲鱼数字黑市的冰山一角。 “人类对闲鱼的开发不足百分之一”,有人评论道,闲鱼是中国版暗网。 闲鱼的“暗”是并非一味指黑色,更多是荒诞,大量捞偏门、生活中难以见到的“地下产业”在平台上生根发芽。 部分产品过于抽象,甚至匪夷所思,成为社交媒体上的欢笑来源。 打工人遭遇恶意欠薪咋办? 有人上闲鱼找到一个低成本的法律援助,没想到商家直接派出八十多老奶挺身出战,一哭二闹三上吊,工资三天到账。 有人想退机票,在闲鱼上寻求帮助,直接喜提一张“死亡证”。…