Christmas rally in mind? Analyzing three key catalysts for the crypto market in December.

Bitcoin has finally rebounded from a low of $80,000 to above $90,000, slightly easing market panic. Two consecutive months of sharp declines since October have disheartened many investors. Will the upcoming December act as a catalyst for a rebound?

December was not only packed with events, but almost every positive event pointed in the same direction: loose liquidity, technological advancements, and favorable policies. These three drivers were working together.

Ethereum will activate the Fusaka upgrade on December 4th.

In early November, the Ethereum Foundation released an announcement about the Fusaka upgrade. The Fusaka network upgrade is scheduled to be activated on Ethereum mainnet slot 13,164,544, around 5:00 AM on December 4, 2025.

The Fusaka upgrade aims to expand data capacity, enhance resistance to DoS attacks, and introduce new tools for developers and users.

This upgrade could have far-reaching consequences. Fusaka is not a minor patch; it redesigns Ethereum’s data availability management, blob pricing, and transaction protection mechanisms. Its success will depend on Ethereum’s ability to scale to meet the growing demands of Layer 2 networks without causing network splits or excessively burdening node operators.

This upgrade includes 11 EIPs, with three of the most significant changes:

The core feature of the Fusaka upgrade is PeerDAS, a new way of handling blobs. Each node only needs to store a portion of the blob (approximately one-eighth) and relies on 암호화폐graphic reconstruction techniques to fill in the missing data fragments. This design verifies data availability through random sampling with an extremely low error probability of only one in 10²⁰ to 10²⁴.

The number of blobs has increased from 9 to 15 (BPO Fork1 officially took effect on December 17), which directly means that Layer 2 transaction fees will drop significantly again. Gas fees for mainstream L2 services such as Arbitrum, Optimism, and Base are expected to be reduced by another 30%-50%.

Furthermore, for the first time, regular EOA accounts possess “account abstraction” capabilities, allowing users to fully emulate Web2 with features such as email + social media recovery, private key delegation of transactions, and batch operations. This will benefit user growth in high-frequency applications such as social networking, finance, and gaming.

Verkle Trees has laid the initial groundwork, paving the way for future “stateless clients.” Node synchronization time has been reduced from weeks to hours, lowering the cost for institutions and large funds to run full nodes.

This Fusaka upgrade comes at a time of respite after market despair, and the price performance of ETH may be worth looking forward to.

The Federal Reserve may cut interest rates by another 25 basis points in December.

The latest data from the CME FedWatch 도구 shows that the probability of a 25 basis point rate cut at the December 10 meeting has surged to 85%, up from only 35% a week ago.

The direct reason for the rapid increase in the probability of triggering inflation is that the November PPI data was significantly lower than expected, and inflationary pressures continued to decline. The combination of “tariffs + tax cuts + energy deregulation” implemented after Trump took office will indeed push up inflation in the short term, but Federal Reserve officials have repeatedly stated that a “soft landing” will remain the primary goal before 2026, and they will not easily turn to tightening.

A rate cut means a weaker dollar, lower US Treasury yields, and higher valuations for risk assets. More importantly, if a rate cut does occur in December, it opens the door for one or two more cuts in the first quarter of 2026.

The market will trade in advance the “rate cut trade” for 2026, which will help the price of risky assets rise.

Currently, Polymarket is betting on an 84% probability of the Federal Reserve cutting interest rates by 25 basis points in December, and a 15% probability of no rate cut.

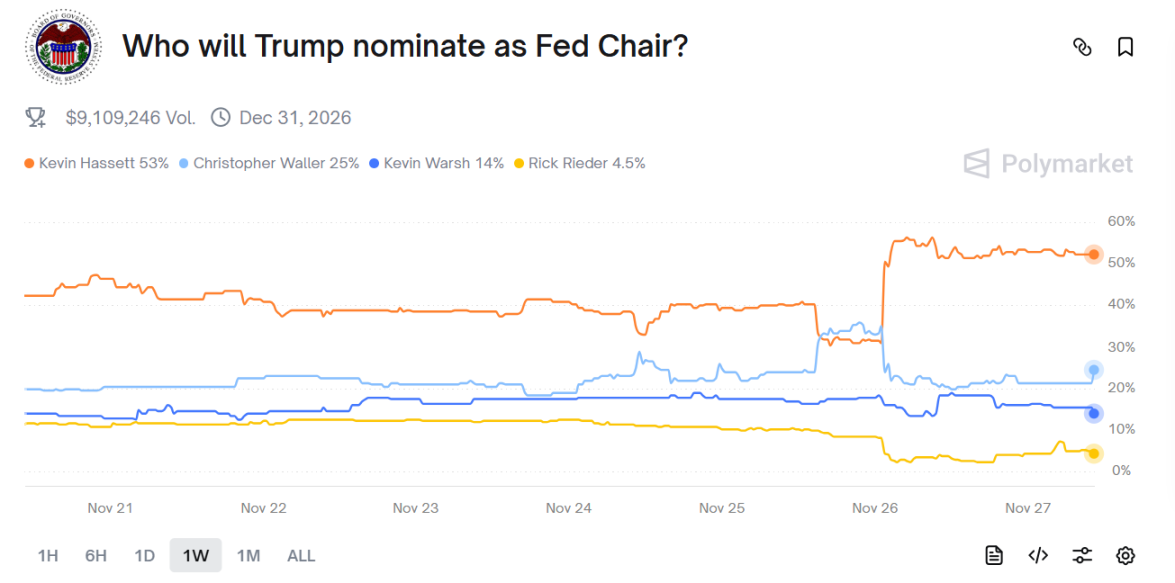

The nominee for Federal Reserve Chair could be announced as early as before Christmas, with Hassett leading by a wide margin.

This could be the biggest “dark horse” positive development in December.

According to the latest reports from multiple media outlets, Trump’s team has narrowed down the list of candidates for Federal Reserve Chair to five, with Kevin Hassett, director of the National Economic Council, currently leading by a wide margin. There are even reports that Trump may announce the nomination before Christmas.

Data from Polymarket shows that the market has a 53% probability of betting on Hassett.

Who is Hassett? He served as Chairman of the Council of Economic Advisers during Trump’s first term and is a typical advocate for both interest rate cuts and tax reductions. He has repeatedly criticized Powell for raising interest rates too aggressively, arguing that interest rates should be significantly lower than the inflation rate. More importantly, Hassett is extremely friendly towards cryptocurrencies, stating in multiple interviews in 2024 that “Bitcoin is digital gold and should be included in strategic reserves.”

If Hassett comes to power, the Federal Reserve will most likely enter a “super-loose” mode.

Even if Hassett doesn’t ultimately emerge, the remaining candidates (such as Kevin Warsh and Chris Waller) have all been personally interviewed by Trump, making it impossible for another Powell-style “hawk” to appear. A shift towards a more favorable Federal Reserve policy is almost a certainty.

Mike Novogratz, founder of the well-known crypto investment firm Galaxy Digital, stated on a podcast that he remains confident Bitcoin can return to $100,000 by the end of the year, but significant selling pressure is expected at that time. He explained that the psychological impact of the “10/11” crash on the market is medium-term. Novogratz also stated that with clearer crypto policies and the entry of traditional financial giants, the market will become more differentiated, and tokens that provide value will be favored.

이 글은 인터넷에서 퍼왔습니다: Christmas rally in mind? Analyzing three key catalysts for the crypto market in December.Recommended Articles

Related: Bitmain’s “Revenge”: How Expelled Miners Stifled America’s Energy Supply for AI

Original author: Lin Wanwan, Beating In late 2025, Bitmain, a Chinese encryption equipment company, was added to the U.S. national security review list. On November 21, the U.S. Department of Homeland Security launched Operation Red Sunset, citing national security concerns, to put Bitmain under scrutiny. The charges were pointedly aimed at investigating whether its equipment contained remote backdoors and whether it could deliver a fatal blow to the U.S. power grid in an extreme situation. Why is a Chinese mining company being accused of potentially jeopardizing the U.S. power grid? This reflects America’s extreme anxiety about core resources. Because right now, Silicon Valley is witnessing the most expensive “silence” in technological history. In AI data centers, tens of thousands of NVIDIA H100 GPUs lie quietly on the floor, gathering dust.…