This concern is not unfounded. Under the dual pressures of price declines and tightening macro liquidity, the profitability of the mining industry indeed faces periodic pressure. The market attempts to use the “shutdown price” metric to gauge whether miners will be forced into a large-scale exit, thereby impacting network security and asset prospects. This attention itself reflects market participation. However, if this concept alone is used as the core basis for judging industry risk, it often overlooks the key differences and self-regulating characteristics within Bitcoin’s mining operational mechanisms. In reality, in actual operations, the “shutdown price” is not a simple, uniform price warning line.

The Shutdown Price is Often Misunderstood

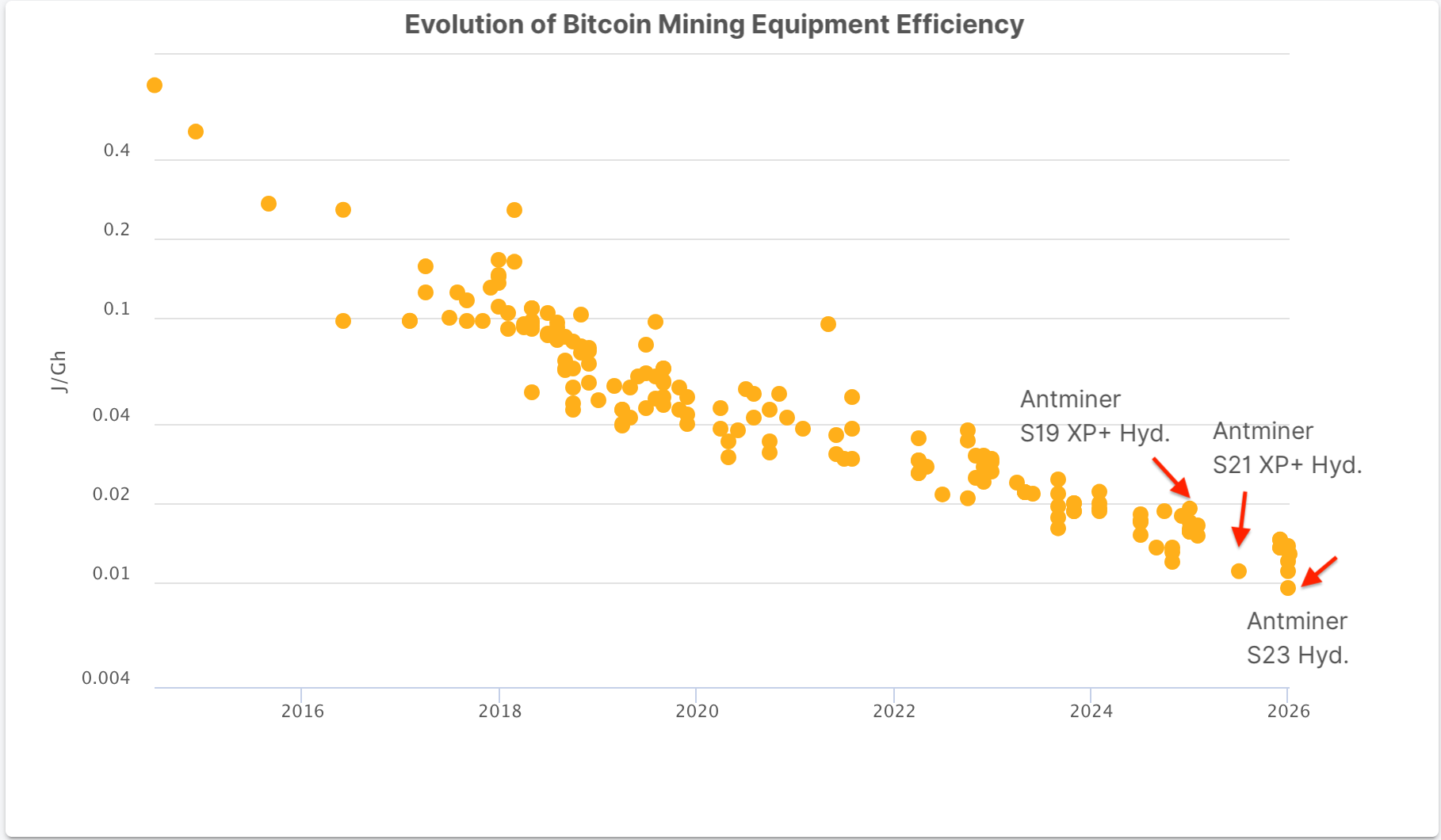

From an industry perspective, there is no single “miner shutdown price” applicable to all miners. The so-called “shutdown price” is more of a theoretical result derived from model calculations under specific assumed conditions, typically assuming uniform electricity costs, equipment efficiency, and operational cost structures. However, in reality, the cost structure of the mining industry is highly fragmented. Different miner models exhibit significant differences in energy efficiency performance; the cost per unit of hashrate between new-generation efficient miners and older equipment is not comparable. For example, among current mainstream models, the Antminer S23 Hyd (approx. 580 TH/s, 5510W) has an efficiency of about 9.5 J/T, the Antminer S21 (approx. 480 TH/s, 5280W) is about 11 J/T, and the Canaan Avalon A16XP-300T is about 12.8 J/T. Every 1–2 J/T improvement in unit efficiency significantly alters the breakeven range under the same electricity price conditions.

Source: Cambridge Bitcoin Electricity Consumption Index (CBECI), Cambridge Centre for Alternative Finance (CCAF), accessed on February 12, 2026

There are also significant differences in the energy environments and contracted electricity prices of different mining farms. From hydropower and wind power to thermal power, different energy mixes directly determine marginal cost levels. Large mining farms in regions abundant with hydropower resources in North America can secure long-term contracted electricity prices as low as $0.03–0.05/kWh, while commercial electricity prices in some regions with higher energy costs can reach $0.08–0.12/kWh. Consequently, the operational pressure on the same miner model varies significantly under different electricity price environments. Furthermore, differences in miners’ operational efficiency, management costs, capital structure, and risk management strategies also affect their ability to withstand price fluctuations.

Precisely because of the significant variations in miner models, electricity price structures, and operational efficiency, there is no uniform “miner shutdown price” in the industry; the actual situation varies depending on mining farm conditions and equipment configuration. Treating a model result based on average assumptions as the industry’s “survival line” inherently tends to amplify market sentiment.

When Bitcoin’s price gradually approaches certain cost ranges amid volatility, the real changes occurring in the industry often resemble a round of structural adjustment rather than a concentrated outbreak of systemic risk. During phases of price pressure and relatively high mining difficulty, the overall profit margin for the industry narrows. Adjustments first appear in marginal hashrate with higher costs and lower efficiency. Some smaller-scale miners, those with higher energy costs, or those using aging equipment may choose to gradually shut down equipment, reduce hashrate, or adjust their asset structure to alleviate operational pressure.

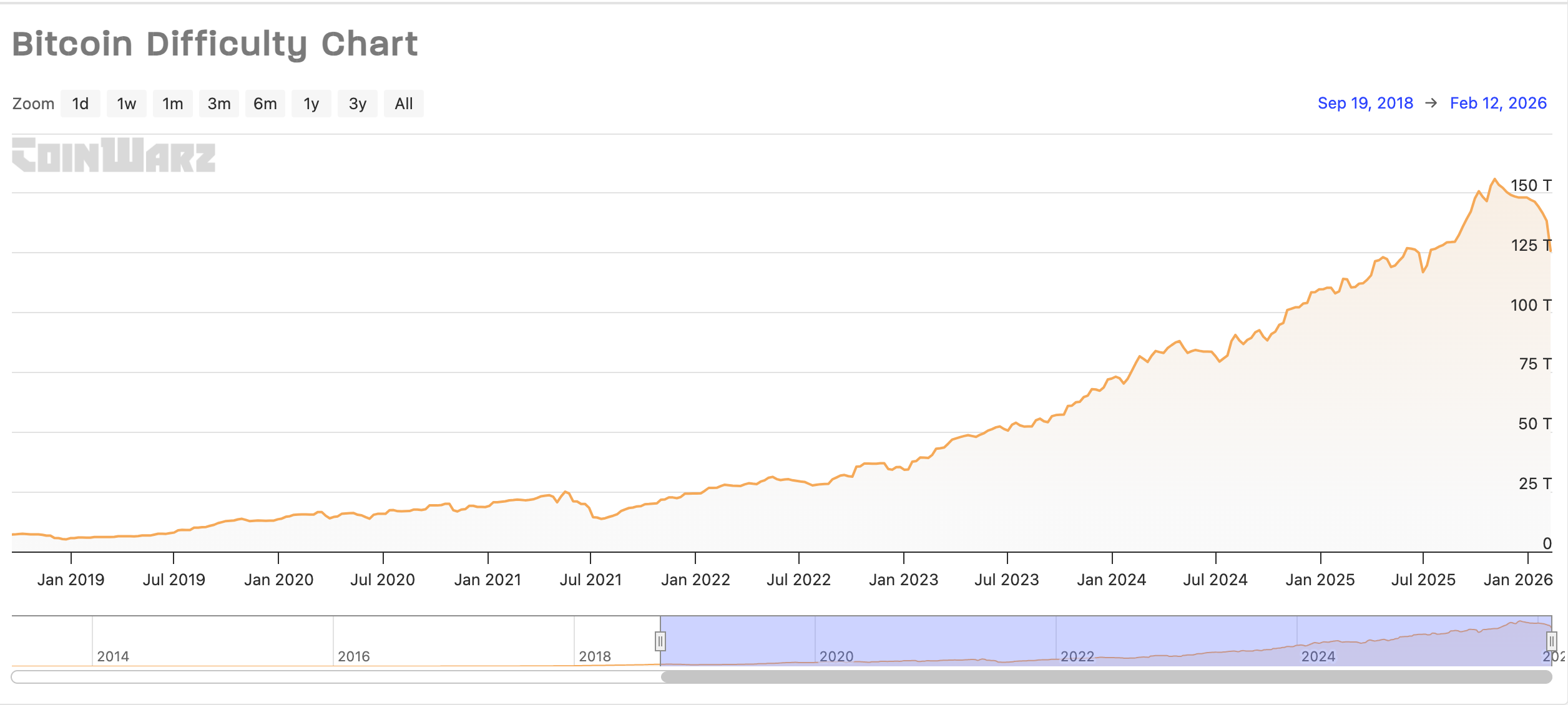

This process is often reflected in macro data as a periodic decline in the network’s total hashrate. A drop in hashrate does not mean network security is compromised; it more reflects the natural clearing and renewal within the industry. In fact, such cyclical changes typically accelerate the concentration of hashrate towards entities with scale operational capabilities and cost advantages, thereby improving the overall operational efficiency of the industry.

市場 Screening and Self-Adaptation

Looking deeper, the “shutdown price” is not an absolute price floor but more like a reference range within a dynamic adjustment process. During market volatility, miners with high costs and low efficiency may choose to temporarily shut down equipment or adjust their operational strategies. Meanwhile, the Bitcoin network itself possesses mature self-adaptive mechanisms. When some hashrate exits, the network’s mining difficulty adjusts downward accordingly. The remaining efficient hashrate still in operation gains a larger share of rewards, gradually pushing the network towards a new equilibrium. It is precisely this self-regulating capability that allows the Bitcoin mining ecosystem to continue operating through multiple cycles, also bringing improved output per unit of hashrate and a better operational environment for the efficient miners that persist.

Extending the timeline makes this pattern clearer. In past cycles, the industry has experienced phases where the price fell below the production cost range for some miners. During periods like 2019 and 2022, Bitcoin’s price also fell below the production cost range for most miners at the time. However, following adjustments in hashrate, changes in difficulty, and market recovery, it gradually converged towards a new equilibrium range. Each cyclical adjustment pushes the industry towards lower energy costs, higher hashrate efficiency, and a more professional, scaled direction. Clearing out outdated capacity is itself a significant marker of industry maturity.

How to Move Forward Amid Volatility

Returning to the enterprise level, the key to navigating industry volatility lies not in short-term price predictions but in long-term preparation and operational resilience. Taking BitFuFu as an example, the company has long focused on mining infrastructure construction and operational efficiency optimization, continuously deploying new-generation high-efficiency miners. Through scaled operations and refined energy cost management, it consistently improves overall hashrate quality. The company has also deployed diversified energy partnerships, building a competitive electricity cost structure. Benefiting from comprehensive advantages in equipment efficiency, energy mix, and operational systems, its current hashrate remains stable, enabling the company to maintain relatively stable output performance and a healthy asset structure during industry adjustment phases.

Short-term market volatility is inevitable. However, what the Bitcoin network and mining industry have demonstrated through successive cycles is a powerful self-adaptive capacity and a continuous forward-evolving force. Behind the discussion of the “shutdown price,” what truly deserves attention is how the industry completes efficiency leaps amid volatility, and those enterprises that remain focused on long-term development, continuously building moats of cost and efficiency.

Winter screens for vitality; cycles temper true value. The industry is experiencing not an exit, but a deeper consolidation and upgrade. We remain here, focused and steady, advancing alongside the network.

この記事はインターネットから得たものです。 Bitcoin’s Shutdown Price in Volatile Markets

Related: 30 Days, $430K Profit: The “Sitting P” Trader’s Memecoin Sniping Strategy

In a livestream on January 13, 2026, he made a single-day profit of $78,400, becoming a hot topic on X and ascending to the top as the new “version darling” among meme trader KOLs. A meme coin was even created and named after him. “Ku Zuo P Xiao Jiang” from the Golden Frog Group has a very strong understanding of meme culture itself. More importantly, he spent nearly a year watching foreign traders’ livestreams to learn how to “hunt dogs” (trade memecoins). For example, his Twitter monitoring technique was “learned from” top Solana chain trader @clukzSOL, and “Ku Zuo P Xiao Jiang” has now transplanted these methodologies to the BNB memecoin market. From simple imitation to developing a personal style, he continuously optimized his hardware setup, tool parameters, and mental…