Compliance Stablecoin Competition Heats Up, Tether Launches USAT to Enter the US Market

Author|Azuma (@ازوما_ايث)

On January 27, stablecoin giant Tether officially announced that its new USD stablecoin, USAT, designed specifically for the U.S. market and the GENIUS regulatory framework, has officially launched.

The promotion of USAT has been building for a long time. As early as last year when the GENIUS Act was being pushed through, Tether had already decided to launch a separate USD stablecoin alongside USDT to compete head-on with other stablecoins in the U.S. market under a compliant system. Since then, Tether has disclosed the development progress and design details of USAT several times. It was previously rumored to launch before the end of 2025, but it finally went live this January.

USAT: A More Compliant USDT

With the official launch of USAT, the veil has been completely lifted on this new stablecoin.

According to Tether’s official statement, USAT is tailor-made for the U.S. market, and its design will fully comply with the new federal stablecoin regulatory framework established by the GENIUS Act (you can simply think of it as a compliant version of USDT). Specifically, Tether will issue USAT through the U.S. federally chartered bank Anchorage Digital Bank, with Cantor Fitzgerald designated as the custodian of USAT’s reserve funds and the preferred primary dealer. Bo Hines, former Executive Director of the White House Cryptocurrency Council, will serve as CEO to directly oversee USAT’s operations.

At launch, USAT will initially be issued only on the Ethereum mainnet, with an initial issuance size of $20 million. The official contract address is 0x07041776f5007aca2a54844f50503a18a72a8b68.

In terms of distribution, Bybit, Crypto.com, Kraken, OKX, and Moonpay will be the first platforms to support USAT, with each platform now gradually announcing the listing of USAT. It is noteworthy that Binance and Coinbase are not among the first batch of platforms. Currently, the former is cozying up to World Liberty Financial (USD1), while the latter has long-standing ties with Circle (USDC). Their choice to not support USAT for now may involve certain strategic considerations.

Tether’s Future: A Dual-Track Approach

The launch of USAT does not mean USDT’s position will be replaced.

In fact, Tether has stated multiple times regarding USDT and USAT, emphasizing a future development model where the two stablecoins operate in parallel — USAT will focus on the U.S. market, competing head-on with rivals like USDC within the compliant system to capture institutional clients from traditional finance; USDT will focus on offshore markets, continuing to serve as the liquidity cornerstone of the تشفيرcurrency market.

In yesterday’s issuance announcement about USAT, Tether also reiterated USDT’s gradual compliance strategy: “USDT will continue to operate globally, leading the market as the most widely adopted stablecoin, while gradually moving towards compliance with the GENIUS Act.”

In the short term, USDT will remain Tether’s main business focus. It is difficult for USAT to replace USDT in terms of scale, but it is expected that Tether will allocate some resources to USAT to boost its early growth.

From First-Mover to Follower, How Will Tether Break Through This Time?

With USAT’s entry, the competitive landscape for stablecoins in the U.S. market is destined to heat up again.

Considering the current development trends, Circle’s (USDC) temporary lead is not secure. The global stablecoin king Tether (USAT), World Liberty Financial (USD1) backed by the Trump family, internet giant representative Paypal (PYUSD), BlackRock-backed USDtb… various competitors are launching fierce attacks.

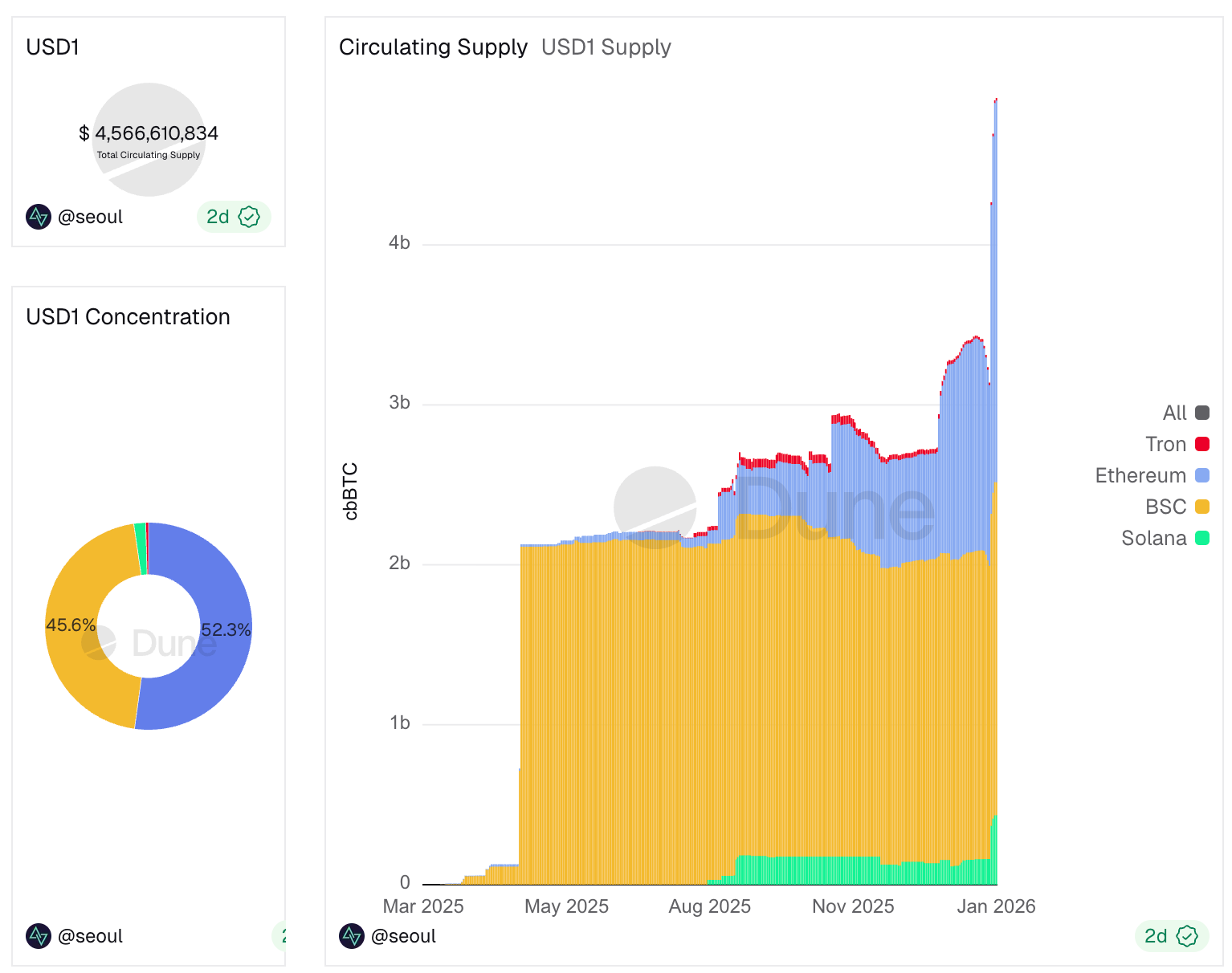

A typical example is that since Binance and USD1 launched a joint subsidy campaign (including the concluded flexible savings and the ongoing airdrop subsidies) on December 24 last year, USD1’s supply has grown by over $2 billion, while USDC’s supply has shrunk by over $5 billion during the same period — there is likely some correlation in this shift.

A similar scenario could also happen with USAT. As a latecomer stablecoin, if Tether wants to stimulate the growth of its supply, subsidies would obviously be the most efficient measure. As ordinary users, we naturally hope to see major stablecoins engage in an incentive war.

Tether’s financial strength is undeniable. In 2025, Tether achieved over ten billion dollars in profit in just three quarters. However, the issue here is that Tether has long been opposed to profit-based subsidies. Tether CEO Paolo Ardoino explicitly expressed disdain last year for the industry’s pursuit of interest-bearing stablecoins, bluntly calling it a “bad idea.” Therefore, whether Tether will adopt a growth strategy similar to USD1’s for USAT in the future remains unknown.

This is the unresolved question for Tether — in the development history of stablecoins, Tether once fully exploited the first-mover advantage with USDT. This time, as a latecomer playing catch-up, Tether’s strategy to break through is worth anticipating.

هذا المقال مصدره من الانترنت: Compliance Stablecoin Competition Heats Up, Tether Launches USAT to Enter the US Market

Related: The New York Times: Trump is pushing cryptocurrency into a capital frenzy.

Original authors: David Yaffe-Bellany and Eric Lipton, The New York Times Original translation by Chopper, Foresight News This summer, a group of corporate executives pitched a business plan to Wall Street financier Anthony Scaramucci, a former advisor to President Trump. They wanted Scaramucci to join a publicly traded company with a unique strategy: to enhance the company’s appeal to investors by accumulating massive amounts of cryptocurrency assets. “They didn’t really need to say much,” Scaramucci recalled. Soon after, he joined three unknown companies that were using this strategy as a consultant, and “the entire negotiation process went very smoothly.” However, this craze didn’t last long. The cryptocurrency market crashed this fall, and the stock prices of the three companies Scaramucci was involved with plummeted, with the worst-performing one falling by…