2026 is shaping up to be a big year for IPOs. This prediction was validated as early as January.

Before January even ended, تشفير custodian BitGo rang the bell on the NYSE, while Chinese AI companies Zhipu and MiniMax successively listed on the Hong Kong Stock تبادل. Three companies, different sectors, all chose January.

Zhipu’s public offering was oversubscribed by 1,164 times, and MiniMax surged 109% on its debut. Money is genuinely pouring in.

But these January listings are just the beginning. The queue of companies expected to IPO this year is much longer. Super unicorns abroad are getting bigger, and a batch of Chinese tech companies are still going through the process in Hong Kong and A-shares…

Which ones might land this year, what are their valuations, and when might there be opportunities to participate?

We’ve compiled a list of noteworthy IPOs for 2026, broken down by sector.

The Trillion-Dollar Club on the US Stock سوق

Data Source: Bloomberg, AI compilation

If 2025 was the year crypto companies went public en masse, 2026 might be the year tech giants reopen the IPO floodgates.

The focus of this round isn’t on startups, but on those super unicorns nurtured in the private market for many years.

Their commonality is that their valuations have reached the limit of the private market, with only a handful of institutions able to take on such stakes, making further private fundraising less meaningful.

Among them, some missed their window due to unfavorable market conditions, while others were kept private by their founders’ deliberate choice.

In 2026, these conditions are simultaneously maturing.

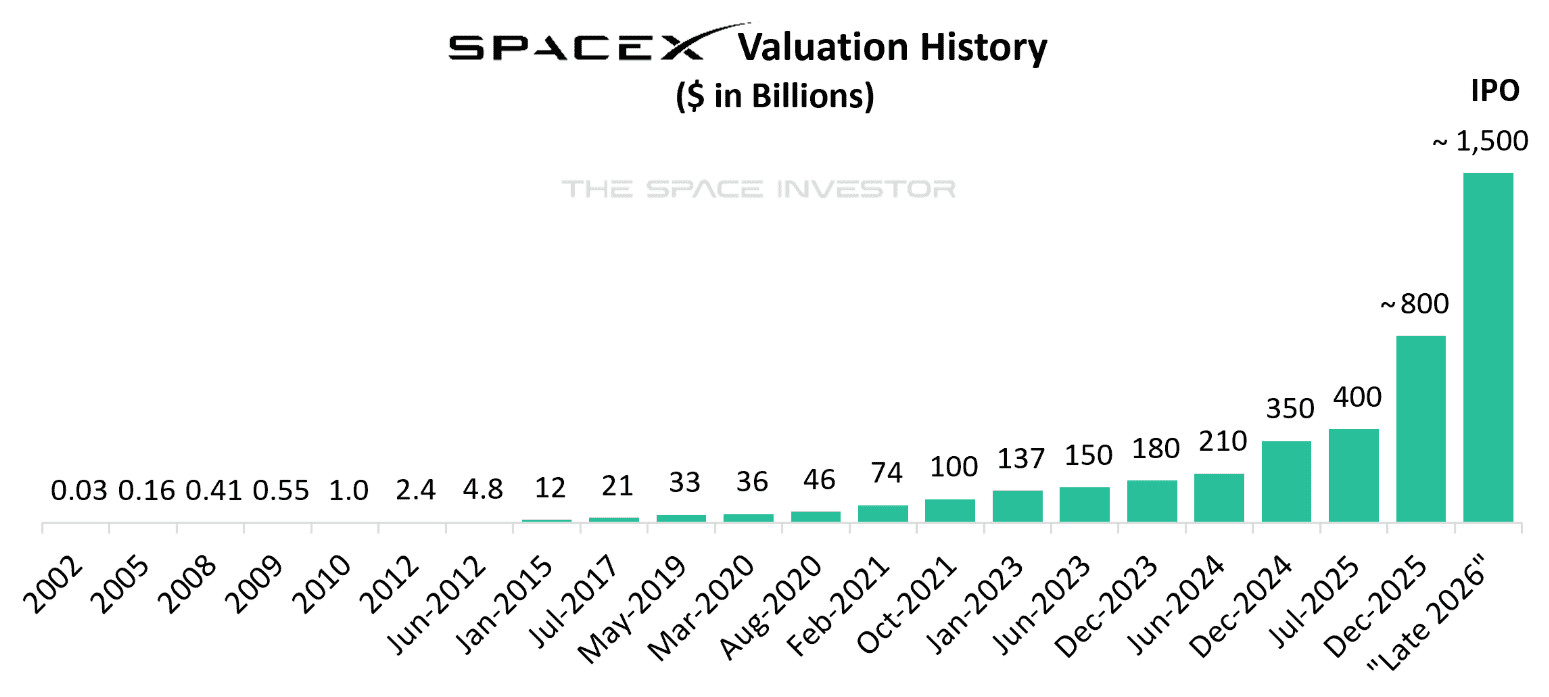

1. SpaceX, Valuing the Stars and Beyond

Estimated Market Cap: $1.5 trillion

Estimated Timing: Q3/Q4 2026

On December 10th, Musk confirmed on Twitter:

SpaceX plans to IPO in 2026.

According to Bloomberg, the target is to raise over $30 billion with a valuation of approximately $1.5 trillion. If realized, this would surpass Saudi Aramco’s $29 billion record in 2019, becoming the largest IPO in human history.

SpaceX currently has two core businesses. The first is rocket launches; in 2025, Falcon 9 launched over 160 times, accounting for more than half of global launches. The second is Starlink satellite internet, with over 10,000 satellites in orbit and more than 8 million users in 2025, projected annual revenue of $15.5 billion.

Based on internal SpaceX documents, when Starlink reaches scale, the company’s annual revenue could reach $36 billion with an operating margin of 60%.

If achieved, a $1.5 trillion valuation implies a price-to-sales ratio of about 70x. This is already high, but the market might be willing to pay for a company growing over 50%.

Additionally, a small data point you might overlook is that while SpaceX looks like a space company, 70% of its revenue actually comes from Starlink.

Investors aren’t buying the dream of “Mars colonization,” but rather the world’s largest satellite internet service provider—a network service provider cloaked in a space suit.

Why is Musk willing to go public now?

According to Ars Technica, it’s mainly to fund the construction of space data centers, such as using modified Starlink satellites as orbital AI computing nodes.

It sounds like science fiction, but what has SpaceX done in the past 20 years that didn’t?

Valuing the stars and beyond is sexy enough.

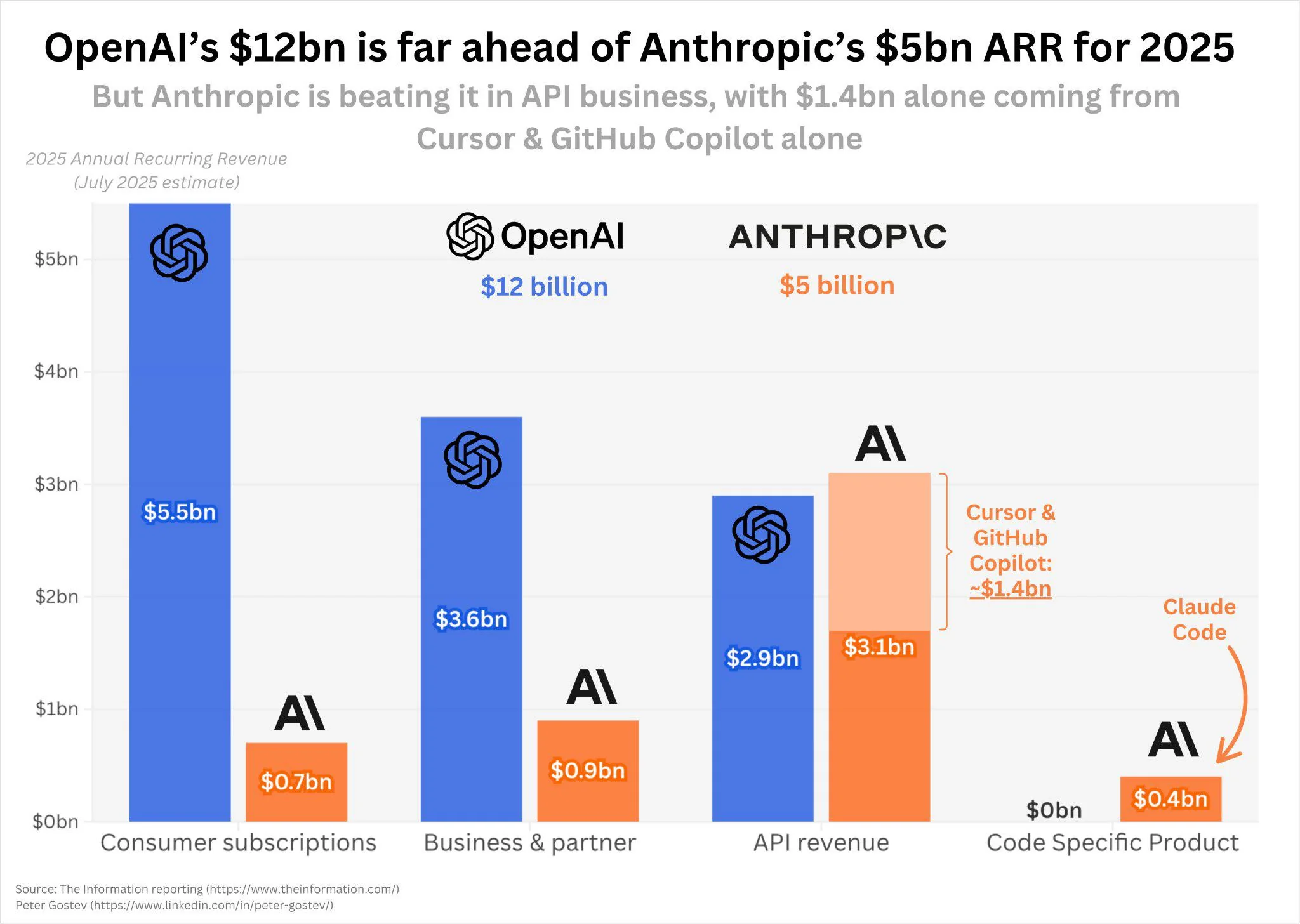

2. OpenAI vs Anthropic, The AI Duo’s IPO Race

Estimated Market Cap: $830 billion – $1 trillion (OpenAI), $230 billion – $300 billion (Anthropic)

Estimated Timing: Late 2026 – Early 2027 (OpenAI), Second Half 2026 (Anthropic)

These two are written together, as ChatGPT and Claude are often used side-by-side.

OpenAI is currently valued at around $500 billion, with annualized revenue exceeding $13 billion (Sam Altman has even said revenue is far higher), targeting a $1 trillion valuation for its IPO.

CFO Sarah Friar stated the IPO is targeting 2027, but some advisors believe it could be brought forward to the second half of 2026.

Sam Altman was blunt on a podcast: “My excitement level about being a public company CEO is 0%.”

But he also admitted, “We need a lot of capital, and sooner or later we’ll hit the shareholder limit.” OpenAI just completed its restructuring from non-profit to for-profit, with Microsoft’s stake reduced to 27%, clearing a path for an IPO.

Anthropic is moving faster.

According to the Financial Times, the company has hired Wilson Sonsini (the law firm that helped Google and LinkedIn with their IPOs) to prepare for a listing, possibly as early as 2026.

Currently valued at $183 billion, it’s undergoing a new funding round targeting a valuation over $300 billion; meanwhile, Microsoft and Nvidia may jointly invest $15 billion.

In terms of revenue data, Anthropic looks more promising:

Annualized revenue is about $9 billion, projected to reach $20-26 billion in 2026, potentially touching $70 billion by 2028. Claude’s subscription revenue growth is 7x that of ChatGPT, albeit from a smaller base.

It’s hard to say who will win the competition between the two.

OpenAI dominates the consumer side, with ChatGPT having 800 million weekly active users; but Anthropic is growing faster in the enterprise market.

Who will IPO first? Currently, Anthropic seems more prepared. But OpenAI’s scale is larger, and once it decides to act, market attention will be on a different level.

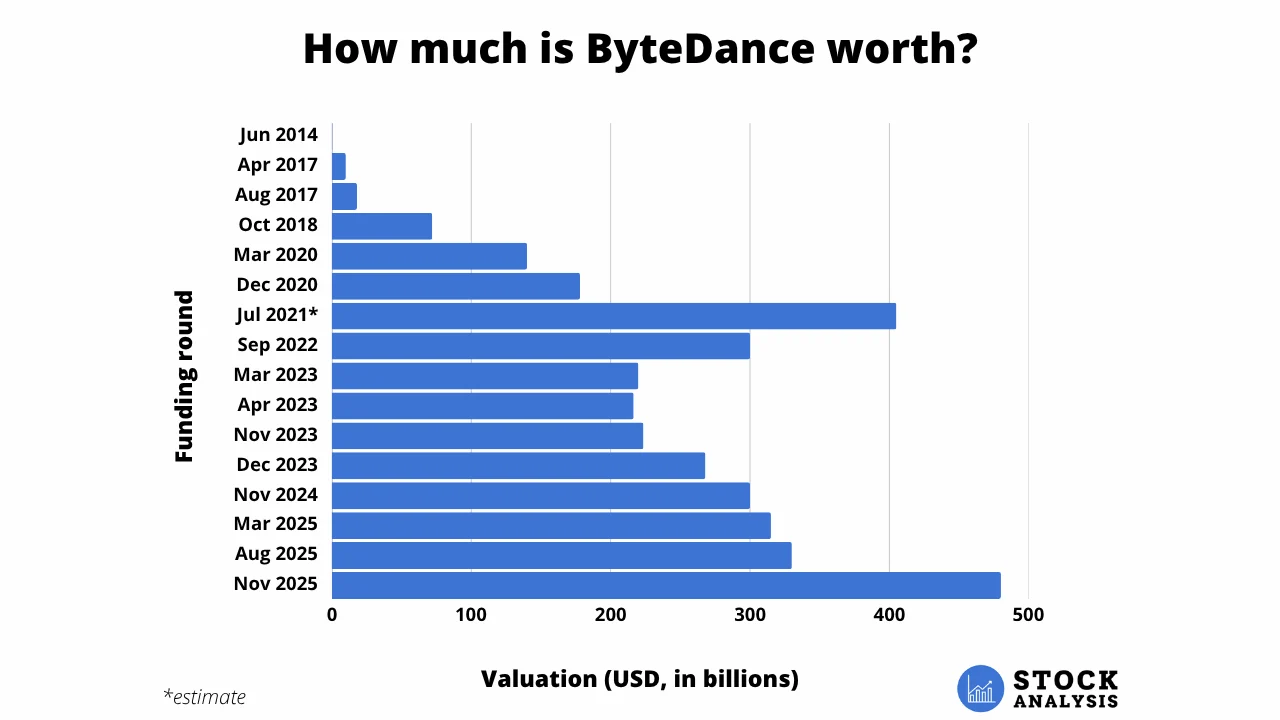

3. ByteDance Won’t Go Public, But Can TikTok?

Estimated Market Cap: $480 billion – $500 billion

Estimated Timing: Under consideration, uncertain

ByteDance is the world’s second-highest valued private company, after OpenAI.

In a secondary share transaction in November 2025, Capital Today acquired shares for nearly $300 million, implying a valuation of $480 billion.

The company’s global revenue in 2024 was $110 billion, up 30% year-over-year. Douyin’s dominance in the Chinese market goes without saying, and its Doubao chatbot’s monthly active users surpassed DeepSeek to become number one in China.

Planned capital expenditure for 2026 is 160 billion RMB, with 85 billion RMB earmarked for AI chip procurement.

But ByteDance has previously stated clearly: there are no IPO plans.

However, the variable might be TikTok. If the US divestment ultimately materializes, market rumors suggest TikTok US’s standalone valuation could rise from the current $400 billion to $500 billion.

A divested TikTok US could instead become one of the largest tech IPOs of 2026.

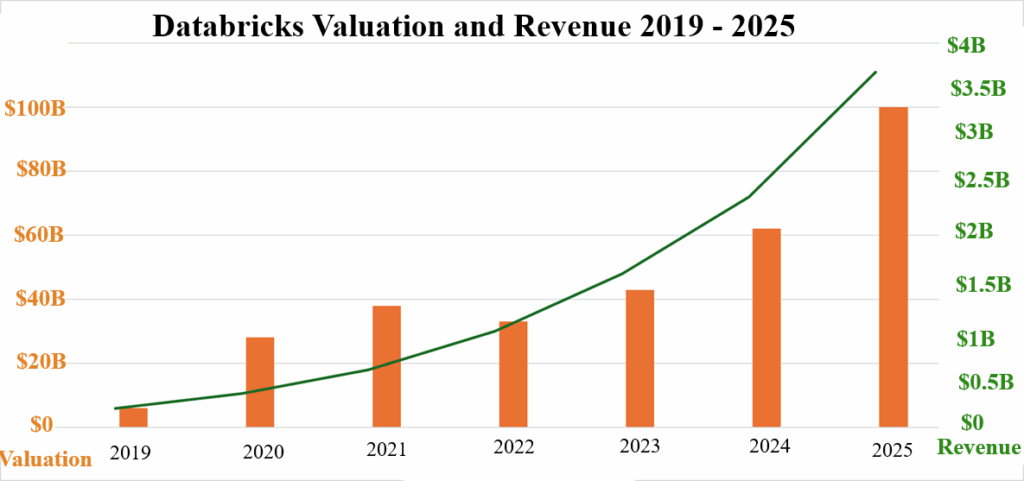

4. Databricks, You Haven’t Heard of It, But Everyone Uses It

Estimated Market Cap: $134 billion – $160 billion

Estimated Timing: Q1-Q2 2026

Databricks is a company most ordinary people haven’t heard of, but that almost every large corporation uses.

It provides a unified platform for data lake + data warehouse, allowing enterprises to store, process, analyze massive data, and train AI models on top of it.

In December 2025, Databricks completed a $4 billion Series L funding round, valuing it at $134 billion.

For comparison, its valuation was $100 billion three months prior and $62 billion a year ago. This growth rate is extremely rare in the private market.

Financially, the company’s annualized revenue exceeds $4.8 billion, up 55% year-over-year;

AI product revenue exceeds $1 billion. Over 20,000 customers include OpenAI, Block, Siemens, Toyota, Shell. Most crucially, the company is already cash flow positive.

Analysts widely expect Databricks to IPO in early 2026.

If it does IPO, it will directly compete with Snowflake. Snowflake’s IPO in 2020 valued it at $70 billion, with its stock price doubling on the first day.

Databricks is larger and growing faster, so market expectations will only be higher.

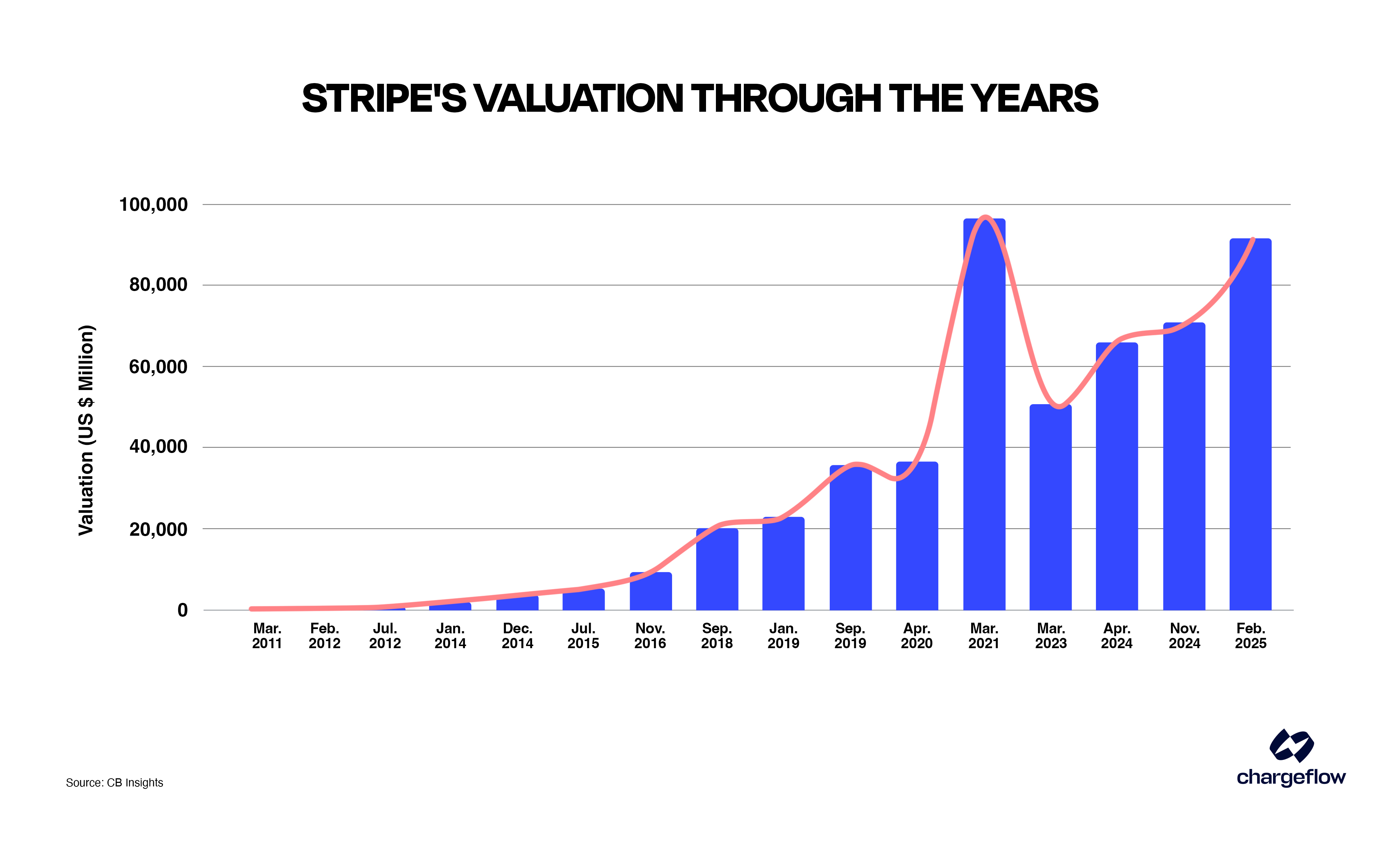

5. Stripe, The Least Hurried One

Estimated Market Cap: $91.5 billion – $120 billion

Estimated Timing: Signals in H1 2026, but could drag

Stripe might be the most unique among this batch: the most qualified to go public, but the least willing.

Valued at $91.5 billion, revenue over $18 billion, already profitable. It processes $1.4 trillion in global payments, with clients like OpenAI, Anthropic, Shopify, Amazon. Financially, it’s the cleanest in this group.

But founders, the Collison brothers, have consistently avoided the IPO question. In February 2025, they explained on the All In podcast:

Stripe is profitable and doesn’t need to raise funds through an IPO; many financial services companies like Fidelity haven’t gone public for decades; shareholders can get liquidity through regular employee stock buybacks, not necessarily needing public markets.

How long can this logic hold?

Sequoia has already started finding ways to allocate Stripe shares to its LPs, which is often a signal from VCs pushing a company to go public. Employees’ 10-year options are also expiring, increasing pressure to cash out.

If the IPO market remains hot in 2026, the probability of Stripe going public is not small. But if the market cools, the Collison brothers have the capital to wait. Their difference from the others is that the choice is in their hands.

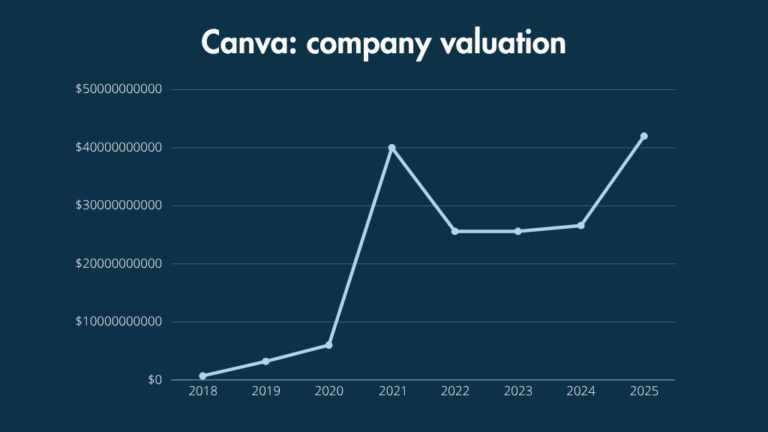

6. Canva, Probably the Least Risky of the Batch

Estimated Market Cap: $50 billion – $56 billion

Estimated Timing: Second Half 2026

Source: https://www.stylefactoryproductions.com/blog/canva-statistics

Compared to the trillion-dollar behemoths above, Canva seems much quieter. An Australian design tool company, valued at $4.2 billion, revenue over $3 billion, profitable.

No geopolitical risk, no pressure from the AI arms race’s cash burn, and a simple business model: sell subscriptions, make design tools.

Blackbird Ventures told investors in November that Canva would be ready in the second half of 2026. CEO Melanie Perkins has previously resisted going public, but employee liquidity needs might push her to change her mind.

If you’re looking for a “stable” option among these IPOs, Canva might be the closest. Not as sexy as SpaceX, but with far fewer variables.

In summary, this batch of companies preparing to go public in 2026 is no coincidence.

For example, the AI arms race needs ammunition. OpenAI plans to invest $1.4 trillion over the next 5 years, Anthropic committed $50 billion to build data centers, ByteDance spends heavily on chips annually. The private market can’t fill this funding gap.

However, for ordinary investors, the significance of these IPOs might be different from before.

These companies have already grown large and mature enough in the private market; by the time they are available to buy, they are no longer “early-stage.” The juiciest part of the growth has been eaten by the private market.

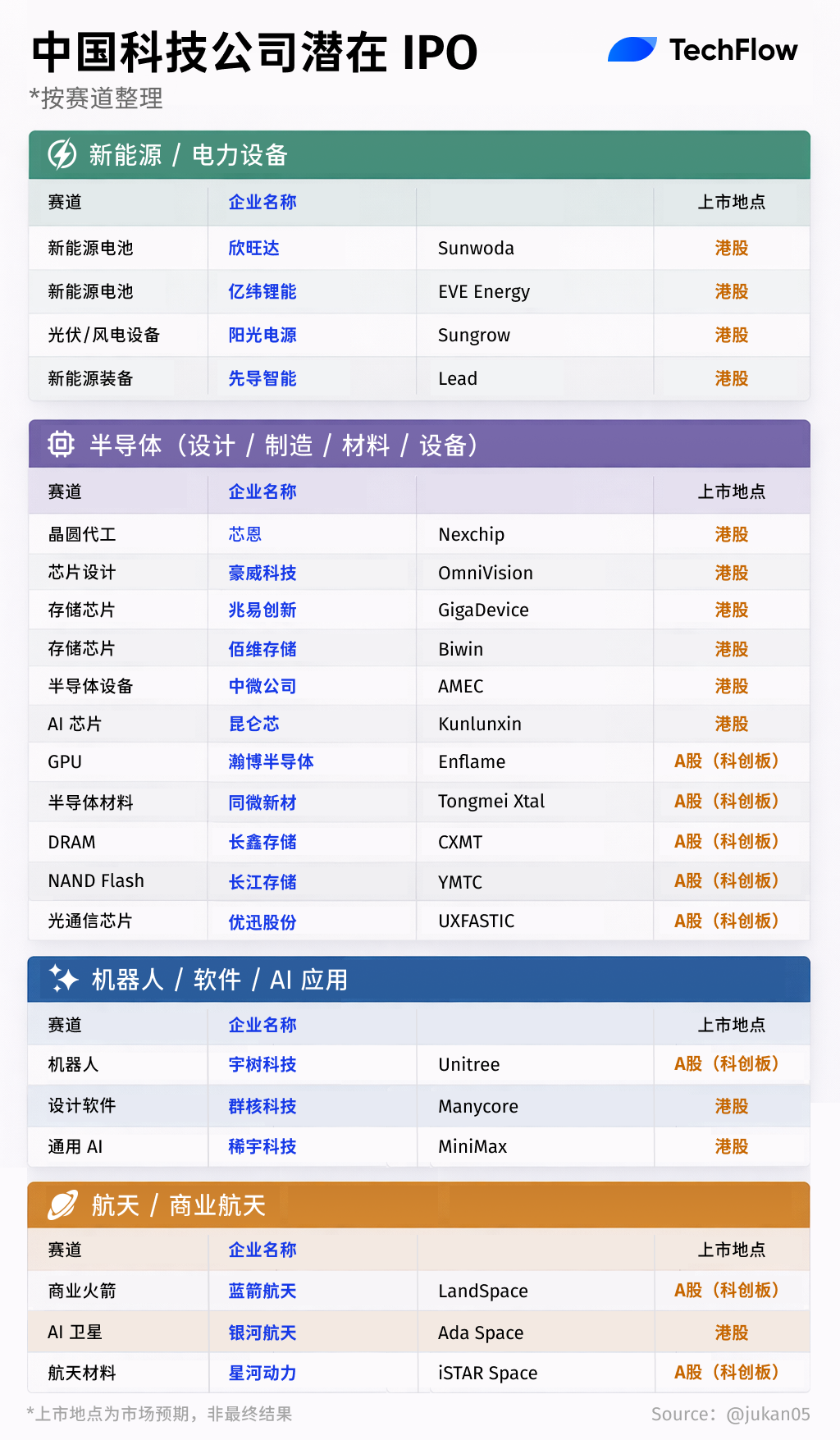

Chinese Tech IPOs, Two Tracks: Hong Kong and A-Shares

Zhipu and MiniMax rushed to list in Hong Kong in January, but the big show for Chinese tech IPOs is just beginning.

In 2026, commercial aerospace and robotics are the two hottest themes, targeting the STAR Market and Hong Kong respectively.

Source: X user @jukan05

تم تجميعها بواسطة: TechFlow

هذا المقال مصدره من الانترنت: SpaceX Leads the Way as the 2026 IPO Boom Begins

On January 11, Federal Reserve Chairman Jerome Powell released a rare video statement publicly accusing the U.S. Department of Justice (DOJ) of threatening criminal charges in an attempt to force the Fed to comply with former President Trump’s interest rate policy demands. This incident quickly became a focal point in global financial markets, sparking widespread concerns about the Fed’s independence. In his statement, Powell emphasized that this threat was a “consequence” of the Fed setting interest rates based on public interest rather than presidential preference, calling it a blatant attack on central bank autonomy. This event is not isolated but the latest manifestation of the intertwining of politics and economics during Trump’s second term. Following the incident, U.S. stock index futures fell rapidly, with S&P 500 futures dropping over 0.5%…