Author|Golem (@web3_golem)

“Jesus will return to Earth before 2026.”

If you didn’t believe this in 2025, you once had the opportunity to profit from this “belief” and outperform U.S. Treasury bonds.

The contract “Will Jesus Christ return to Earth in 2025?” on the prediction market Polymarket attracted approximately $3.3 million in participation before its settlement on December 31, 2025, with the probability of Jesus’s return consistently staying above 3%. Since the event was ultimately resolved as “No,” participants who bet on “No” around the April high point achieved an annualized return of about 5.5%, even surpassing the U.S. Treasury yield (the 10-year yield was around 4.1% at the end of 2025).

If you’re slapping your thigh for missing this “risk-free” investment opportunity, then your thigh will love this article, because Odaily will now list 10 similar “risk-free” investment opportunities on prediction markets.

These opportunities can be easily identified as almost “risk-free” with just a bit of common sense. Of course, nothing is absolute; upsets are one thing, and how UMA resolves disputed outcomes is another. So, I have to put “risk-free” in quotes for now.

Today, there are over 20,000 unsettled event contracts on Polymarket. Finding these “risk-free” event contracts isn’t easy, but with the right screening criteria, the task can be accomplished. Odaily has established three criteria for this article:

- Contract order book depth exceeds $3,000, and sports competition contracts are excluded (upsets are common);

- The probability of “Yes” or “No” for the contract is between 90%-99% (theoretically, the more certain and risk-free an event is in a prediction market, the higher its probability should be);

- Low probability of a black swan event (common sense level).

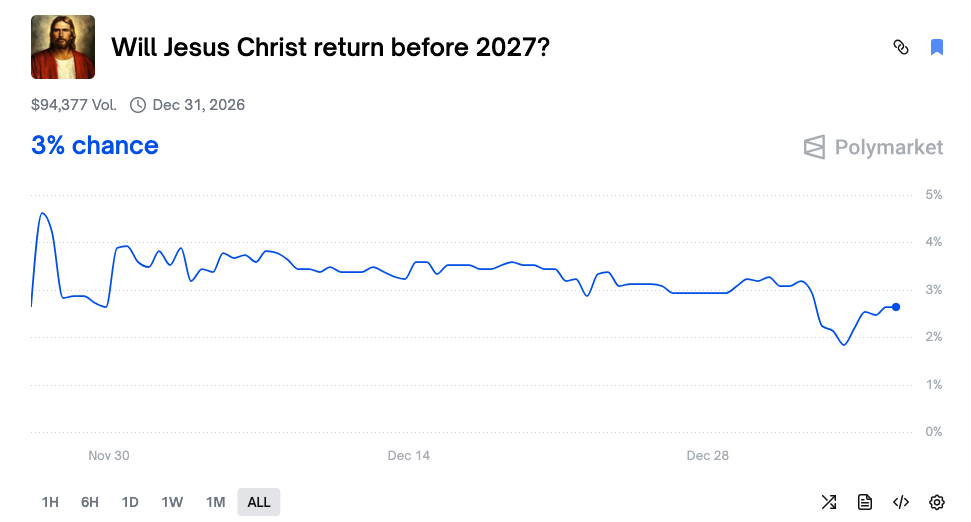

Will Jesus Return to Earth Before 2027?

- Event Contract Link: https://polymarket.com/event/will-jesus-christ-return-before-2027?tid=1767609729629

- Investment Return for Buying “No”: 2-3%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

As a non-believer, I truly think Jesus returning to Earth is just a biblical story. The settlement rule for this event is simply “the Second Coming of Jesus Christ occurs,” with no additional conditions. The return of Jesus is based on Messianic prophecies in the canonical Gospels: two thousand years ago, Jesus “first came” to Earth, completed the work of redemption, and ascended to heaven, and believers trust that he will return to Earth at some point in the future.

However, there is also a view that the return of Jesus refers to the spiritual reappearance of Jesus, where someone will reform Christianity and establish a new ideological system, at which point all religions will face a severe crisis. But the probability of such a great figure emerging this year is also very low, right?

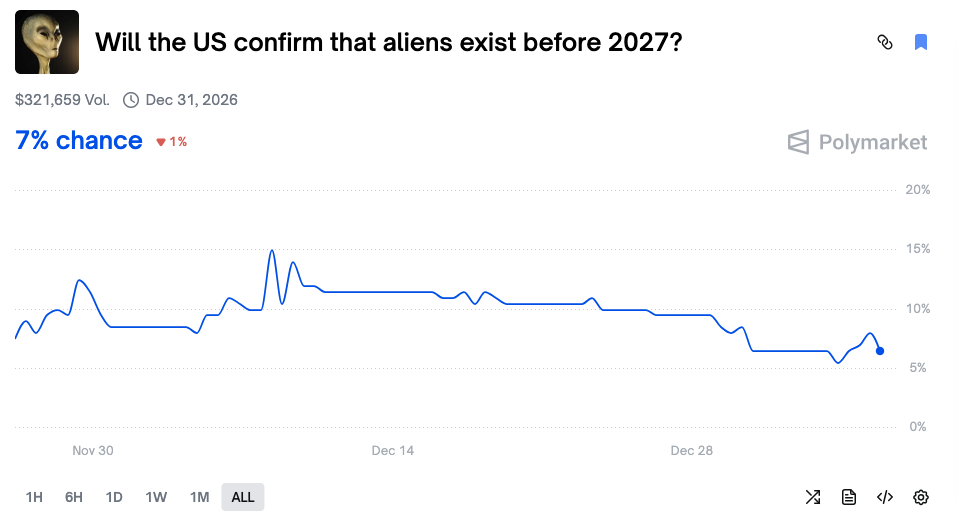

Will the US Confirm the Existence of Aliens Before 2027?

- Event Contract Link: https://polymarket.com/event/will-the-us-confirm-that-aliens-exist-before-2027?tid=1767610632144

- Investment Return for Buying “No”: 6-7%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

With the development of human technology and the exploration of the universe, we increasingly believe that intelligent life in the universe is not limited to humans, but there is still no clear evidence to prove it. The resolution rule for this event contract requires the U.S. President, any cabinet member, any member of the Joint Chiefs of Staff, or any U.S. federal agency to explicitly state the existence of alien life or technology, based on official statements. Therefore, although we may all believe in aliens, and it’s possible that U.S. authorities have already made contact with aliens, public disclosure is an entirely different matter. The combination of these various conditions makes the probability of this event occurring even smaller.

Will the US Have a Civil War Before 2027?

- Event Contract Link: https://polymarket.com/event/us-civil-war-before-2027?tid=1767611124616

- Investment Return for Buying “No”: 4-5%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

Historically, the U.S. has had only one true civil war, the American Civil War (also known as the War Between the States) from 1861 to 1865. This civil war was the largest and most decisive in U.S. history, fought between the Northern United States (the Union) and the Southern Confederate States of America.

Although the U.S. continues to have internal problems to this day, and conflicts between the two parties occur from time to time, none have escalated to the level of civil war, and there are currently no social, economic, or political signs indicating that the U.S. will have a civil war within a year.

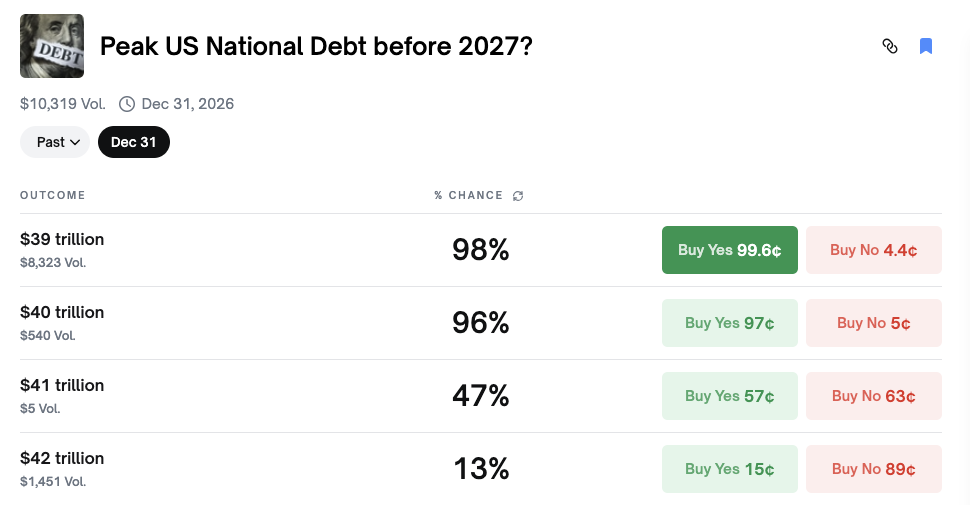

Will US National Debt Reach $39 Trillion Before 2027?

- Event Contract Link: https://polymarket.com/event/peak-us-national-debt-before-2027?tid=1767611508991

- Investment Return for Buying “Yes” on $39 Trillion: 1-2%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

U.S. national debt has increased every year since 1958, making it 68 consecutive years by 2025. As of December 31, 2025, the total U.S. federal debt was $38.51 trillion, currently only about $485.9 billion away from $39 trillion. In 2025, U.S. debt increased by a net $2.23 trillion. At this rate, it is highly likely that the total U.S. federal debt will rise to $40 trillion in 2026.

Although the rate may slow this year, reaching $39 trillion is almost a certainty, unless there is an exceptionally sustained fiscal surplus or a large one-time cash inflow, which is almost impossible in reality.

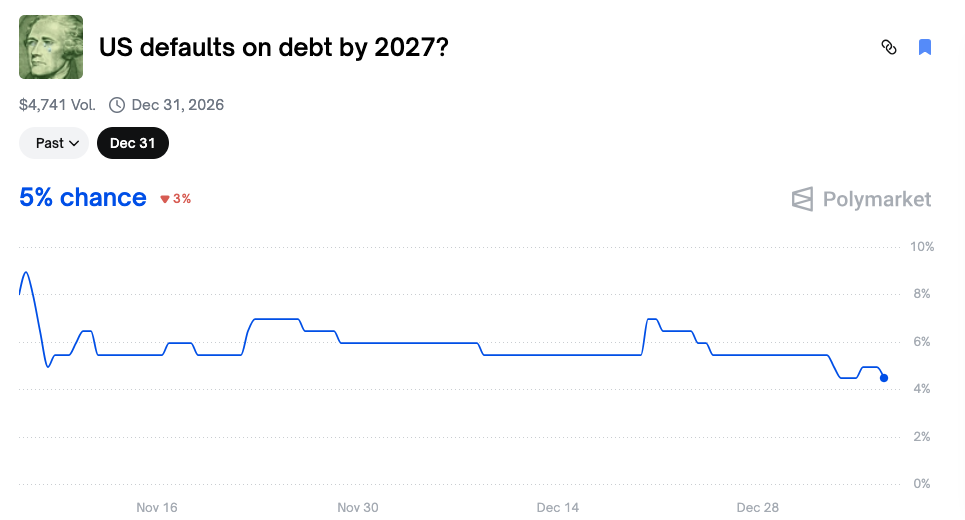

Will the US Default on Its Debt Before 2027?

- Event Contract Link: https://polymarket.com/event/us-defaults-on-debt-by-2027?tid=1767612065804

- Investment Return for Buying “No”: 4-5%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

Historically, U.S. Treasury bonds have “defaulted” twice. The first occurred in 1790, shortly after the nation’s founding, and the second was during the War of 1812 when British forces captured Washington and burned the U.S. Treasury, destroying bond records and preventing the federal government from repaying its debts on time.

In modern times, the U.S. has not defaulted on its debt a single time. Although U.S. debt increases year after year, the U.S. also raises its debt ceiling annually, allowing the government to continue borrowing to repay its debts. Furthermore, from another perspective, in the modern global economic system, if the U.S. were to actually default on its debt, it would mean the bankruptcy of U.S. national credit, a severe blow to the U.S. monetary system, and potentially the most severe financial crisis in history. If that really happens this year, the small amount we might lose on the prediction market would be nothing.

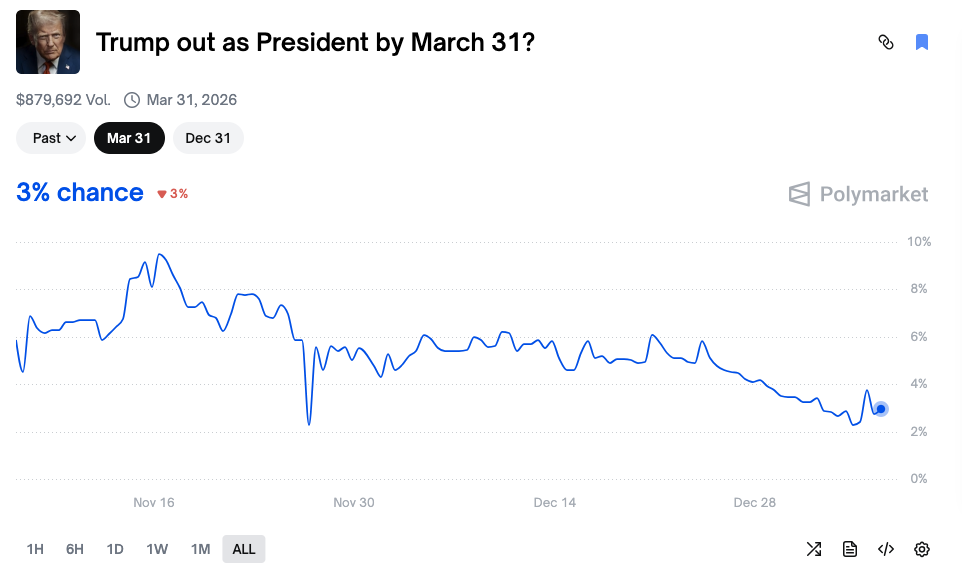

Will Trump Step Down as President by March 31?

- Event Contract Link: https://polymarket.com/event/trump-out-as-president-by-march-31?tid=1767612762887

- Investment Return for Buying “No”: 2-3%

- Settlement Time: March 31, 2026, 11:59 PM (Eastern Time)

Compared to other “risk-free” investment opportunities, the possibility of Trump stepping down as president before March 31 seems higher, mainly because his recent Maduro arrest operation has indeed caused domestic and international dissatisfaction. However, the resolution rule for this event contract is that Trump must resign, be permanently removed, or otherwise (e.g., death) cease to serve as U.S. President for it to be considered “Yes.” Temporary removal or impeachment without removal does not count.

This settlement condition makes the event even less likely to occur. First, Trump will not resign voluntarily. Although Trump does have health issues (he was reported to be taking medication), it’s unlikely he won’t make it past March 31.

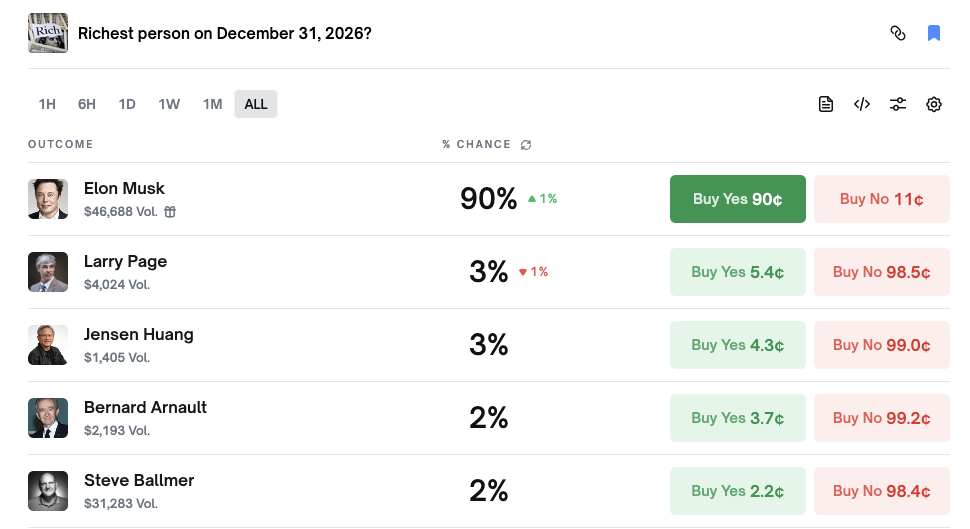

Who Will Be the World’s Richest Person on December 31, 2026?

- Event Contract Link: https://polymarket.com/event/richest-person-on-december-31-2026?tid=1767613303753

- Investment Return for Buying “Elon Musk”: 9-10%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

By 2026, Musk will have been the world’s richest person for 5 consecutive years (despite brief fluctuations). Musk first became the world’s richest person in 2021 when his wealth surpassed Jeff Bezos thanks to Tesla. Today, Musk’s net worth exceeds $610 billion, while the world’s second-richest person, Larry Page, has a net worth of $269 billion, more than double the gap.

Although it’s common for the ultra-wealthy to see their net worth fluctuate by billions, making up a gap of hundreds of billions is quite difficult.

Will the Bitcoin Network Replace the SHA-256 Algorithm Before 2027?

- Event Contract Link: https://polymarket.com/event/will-bitcoin-replace-sha-256-before-2027?tid=1767613902697

- Investment Return for Buying “No”: 4-5%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

The SHA-256 algorithm is one of the core algorithms of the Bitcoin network and the foundation of the Proof-of-Work (PoW) mechanism. Under this algorithm, miners continuously adjust the nonce in the block header and calculate the double SHA256 hash value until they find a hash value that meets the difficulty target. The first miner to do so receives a certain Bitcoin reward, while the algorithm maintains the block time at around 10 minutes through dynamic difficulty adjustment. Because of this algorithm, the Bitcoin network has a consensus mechanism for verifying transactions and preventing double-spending.

The SHA-256 algorithm is to the Bitcoin network what the constitution is to a country. It defines who has the right to record transactions (through computational power competition), how to verify transactions (integrity of the hash chain), and how to reach consensus (the longest chain principle), among other things.

On December 9, 2025, Google released the groundbreaking, cutting-edge quantum chip Willow, sparking anxiety in the crypto industry about whether Bitcoin’s encryption technology would be vulnerable to quantum computer attacks in the near future.

Therefore, some have proposed replacing Bitcoin’s SHA-256 algorithm, but the likelihood is very small. First, the threat of quantum computers to the Bitcoin network is still in the alarmist stage. Second, Bitcoin network upgrades are extremely slow and rigorous, especially for a core algorithm like SHA-256, which cannot be replaced on a whim in a short period.

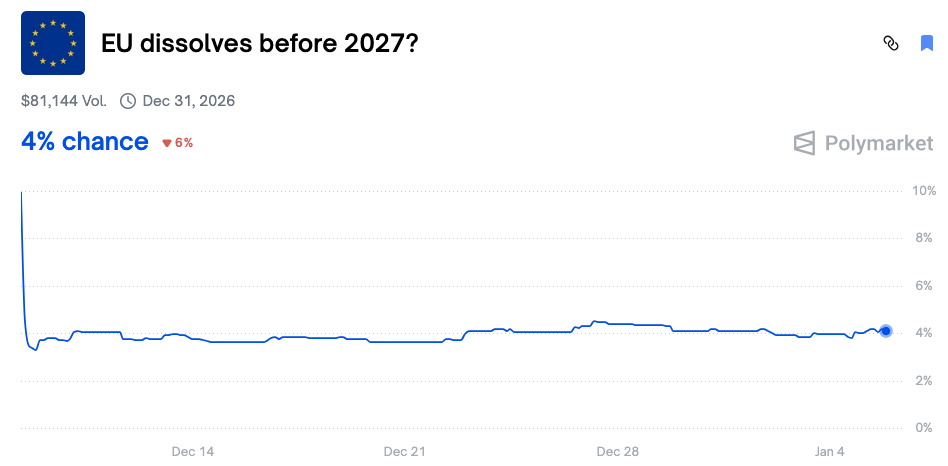

Will the European Union Dissolve Before 2027?

- Event Contract Link: https://polymarket.com/event/eu-dissolves-before-2027?tid=1767614994620

- Investment Return for Buying “No”: 4-5%

- Settlement Time: December 31, 2026, 11:59 PM (Eastern Time)

This contract settles if one of the following conditions is met:

- More than half of the EU member states (as of the market creation date) formally withdraw from the EU;

- All EU member states abolish or annul the Treaty on European Union or the Treaty on the Functioning of the European Union through a formal treaty or agreement;

- The EU ceases to exist as a legal entity.

In 2020, the United Kingdom announced its formal withdrawal from the EU, making it the only sovereign state to have formally left the EU so far, and this has been the biggest event for the EU in recent years. The EU is of great significance to Europe. Historically, Europe has experienced frequent wars (both World War I and World War II began in Europe), and the fragmented situation weakened the region’s political power internationally, which is why European countries decided to form the EU. In modern times, although the EU has internal conflicts, the benefits still outweigh the drawbacks, so the likelihood of dissolution within a year is very low.

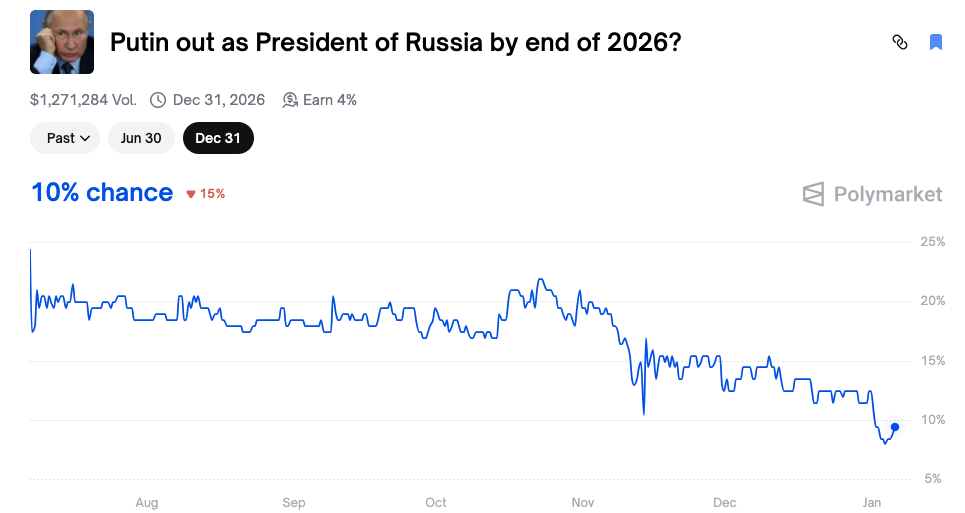

Will Putin Step Down as Russian President Before the End of 2026?

This article is sourced from the internet: Ten Almost Risk-Free Absurd Bets on Polymarket

Related: Hyperliquid at a crossroads: Follow Robinhood or continue the Nasdaq economic paradigm?

Original translation by: Saoirse, Foresight News Hyperliquid’s perpetual contract liquidation volume has reached Nasdaq levels, but its economic benefits have not matched this. In the past 30 days, the platform liquidated perpetual contracts with a notional value of $205.6 billion (an annualized value of $617 billion on a quarterly basis), but its fee revenue was only $80.3 million, with a fee rate of approximately 3.9 basis points. Its profit model is similar to that of a “wholesale trading venue”. In comparison, Coinbase reported a trading volume of $295 billion and trading revenue of $1.046 billion in Q3 2025, with an implied fee rate of 35.5 basis points. Robinhood exhibits a similar “retail-style profit model” in its cryptocurrency business: $80 billion in nominal cryptocurrency trading volume generated $268 million in cryptocurrency…