More than just interest rate cuts? Former New York Fed expert: Powell may announce a $45 billion bond-buying program.

Original source: Wall Street News

With the Federal Reserve’s interest rate meeting approaching on December 10th next week, the market is not only focused on the already certain interest rate cut, but also on the possibility that the Fed may soon announce a major balance sheet expansion plan.

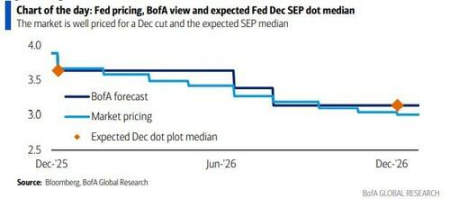

Recently, Mark Cabana, a former New York Fed repurchase expert and Bank of America interest rate strategist, predicted that in addition to the widely expected 25 basis point rate cut, Fed Chairman Powell will announce next Wednesday a plan to purchase $45 billion in Treasury bills (T-bills) per month. This bond-buying operation will be officially implemented in January 2026, aiming to prevent repurchase market interest rates from soaring further by injecting liquidity into the system.

In its report, Cabana warned that while the interest rate market reacted mildly to rate cuts, investors generally “underestimated” the extent of the Federal Reserve’s actions regarding its balance sheet. He pointed out that current money market interest rates indicate that bank reserves are no longer “ample,” and the Fed must fill the liquidity gap by restarting its auto bond purchase program. Meanwhile, UBS’s trading department also gave a similar forecast, believing that the Fed will begin purchasing approximately $40 billion in Treasury bills per month in early 2026 to maintain stability in the short-term interest rate market.

This potential policy shift comes at a crucial time as the Federal Reserve leadership is about to change. With Powell’s term nearing its end and market expectations rising that Kevin Hassett may succeed him as Fed chair, next week’s meeting will not only concern short-term liquidity but will also set the tone for the monetary policy path over the next year.

Former New York Fed expert predicts: $45 billion in bond purchases per month

While the market consensus is that the Federal Reserve will cut interest rates by 25 basis points next week, Mark Cabana believes the real variable lies in balance sheet policy. In his weekly report titled “Hasset-Backed Securities,” he points out that the Fed’s announced Reserve Measure-Based Monetary Policy (RMP) could reach as high as $45 billion per month, a prediction that significantly exceeds current market expectations.

Cabana broke down the composition of this figure in detail: the Federal Reserve needs to purchase at least $20 billion per month to address the natural growth of its liabilities, and an additional $25 billion to reverse the reserve losses caused by the previous “excessive balance sheet reduction.” He expects this level of bond purchases to continue for at least six months. This statement is expected to be included in the Fed’s implementation notes and will be published on the New York Fed’s website with detailed information on the scale and frequency of operations, focusing primarily on the Treasury bill market.

As previously reported by Wall Street Insights, since the Federal Reserve’s balance sheet peaked at nearly $9 trillion in 2022, its quantitative easing policy has reduced its size by approximately $2.4 trillion, effectively withdrawing liquidity from the financial system. However, even with QT discontinued, signs of tight liquidity remain evident.

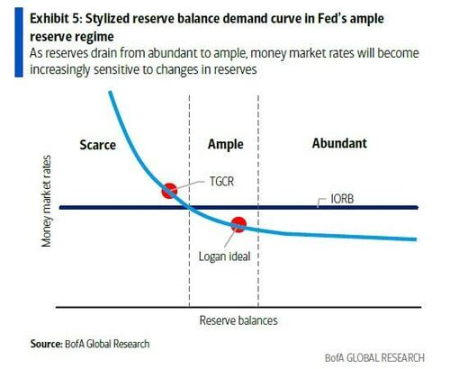

The clearest signal comes from the repo market. As the central hub of short-term funding in the financial system, overnight reference rates in the repo market, such as the Secured Overnight Financing Rate (SOFR) and the Tripartite General Collateralized Repo Rate (TGCR), have frequently and sharply breached the upper limit of the Federal Reserve’s policy rate corridor in recent months. This indicates that reserve levels within the banking system are sliding from “ample” to “sufficient,” and there is a risk of further decline towards “scarcity.” Given the systemic importance of the repo market, this situation is considered unacceptable to the Federal Reserve for long, as it could weaken the transmission efficiency of monetary policy.

Against this backdrop, recent statements from Federal Reserve officials have also hinted at the urgency of action. New York Fed President John Williams stated that “we expect to reach ample reserve levels soon,” while Dallas Fed President Lorie Logan noted that “it is appropriate to resume balance sheet growth soon.” Cabana interprets “soon” as referring to the December FOMC meeting.

Auxiliary tools designed to smooth out year-end fluctuations

In addition to its long-term bond-buying program, Bank of America expects the Federal Reserve to announce term repo operations lasting 1-2 weeks to address upcoming year-end liquidity volatility. Cabana believes these operations will likely be priced at or above the Standing Repo Facility (SRF) rate by 5 basis points, aiming to mitigate tail risk in the year-end funding markets.

Regarding managed interest rates, although some clients have inquired about a potential reduction in the Interest Rate on Reserves (IOR), Cabana believes that simply lowering the IOR “won’t solve anything,” as banks generally tend to hold higher cash buffers after the collapse of Silicon Valley Bank (SVB). He believes a more likely scenario is a simultaneous 5 basis point reduction in both the IOR and SRF rates, but this is not the benchmark case.

Another important backdrop to this meeting is the upcoming personnel change at the Federal Reserve. The market currently views Kevin Hassett as a strong contender for the next Fed Chair. Cabana points out that once the new chair is chosen, the market will price in the medium-term policy path more in line with the new candidate’s guidance.

UBS also agrees with the view that balance sheet expansion is returning to normal. UBS’s sales and trading department points out that the Federal Reserve can shorten asset duration by purchasing Treasury bills, thereby better matching the average duration of the Treasury market. Whether this operation is called RMP or quantitative easing (QE), its ultimate goal is clear: to ensure the smooth operation of financial markets during critical periods of political and economic transition through direct liquidity injections.

This article is sourced from the internet: More than just interest rate cuts? Former New York Fed expert: Powell may announce a $45 billion bond-buying program.

Related: After the tide recedes, let’s talk about the differences between Meme and Build

Perhaps it’s due to my lingering idealism that I personally tend to side with the latter in the Meme vs. Build factional debate. While I don’t oppose the concept of meme, and I do acknowledge its objective significance as a collective spiritual symbol in the post-internet era, and I believe that this collective sentiment naturally contributes to the cohesion of value, I don’t believe that the recent emergence of so-called “memes” with overtly flattering overtones and overt self-interest meet the core definition of a meme. Furthermore, I don’t believe these “memes” have sustainable value prospects—because the maintenance of such sentiment requires continuous positive feedback from flattering targets and position returns, rather than relying on the spontaneous emotional expression of the group like classic memes. This makes these “memes” inherently fragile…