Meme Cultivation Manual: Reborn as a Diamond Hand (Part 4) | Produced by Nan Zhi

作者|南栀(@Assassin_Malvo)

Last week, after introducing the Deep Evaluation System, the stability of Copy Trading Accounts No. 1 and No. 2 improved significantly. They began providing continuous funding support for other test accounts, and Copy Trading Account No. 6 achieved a gain of nearly 5x in one week.

In this article, the author will update the progress of each wallet, display the copy trading address tracking charts, and update the upgrade status and future plans of the Deep Evaluation System.

Risk Warning: This system was launched on October 8th and has only been running for 28 days. While it has achieved certain results, objectively speaking, the data volume and control experiments are insufficient, and the rigor is limited. It is for readers’ reference only.

Funding Progress and Strategy Showcase

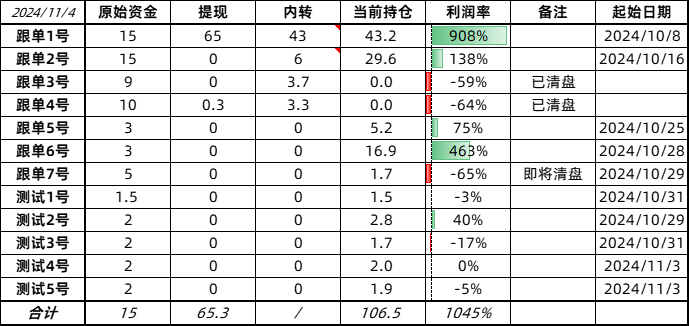

The funding status of each address as of November 4th, 17:30 (UTC+8) is shown below. The profitability and growth curves of each account vary greatly depending on the style and strategy of the copy trading target. Notably, Copy Trading Account No. 6 achieved a gain of nearly five times in one week under some special circumstances. Specific details are in the next subsection.

This section will further showcase specific copy trading plans and the author’s thought process during this period.

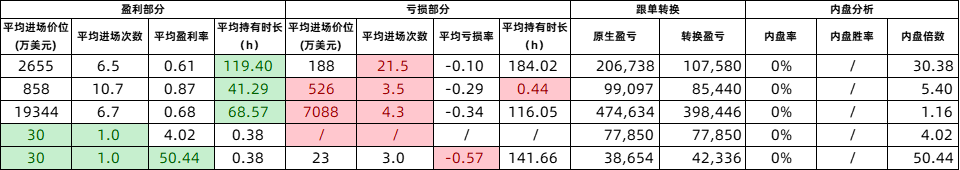

The details of copy trading target tracking are shown in the figure below, where:

- The left sidebar is the strategy bar, with different settings based on the wallet’s profitability, purchase frequency, and on-chain profitability.

- The middle section shows the practical results feedback and preliminary evaluation system labels.

- The right sidebar shows labels based on Deep Evaluation System One, with label categories as shown in the legend in the top right corner.

(Note: The rationale for the left sidebar settings can be found in “Diamond Hands, High Risk-Reward Ratio? What Are the Winning Factors in Solana Meme Trading?” and “Meme Cultivation Manual: Reborn as a Diamond Hand (Part 2)“. The right sidebar details are in “Meme Cultivation Manual: Reborn as a Diamond Hand (Part 3)“.)

Copy Trading Strategy Overview

- Copy Trading Accounts No. 1 and No. 2 are early-selected low-frequency, high risk-reward ratio, diamond hand addresses. Following the 指导lines from Part Three, addresses with high drawdowns were removed. The results so far are acceptable: Account No. 1’s profit rate increased from 725% to 908% in 6 days, and Account No. 2’s increased from 84% to 138%.

- Copy Trading Account No. 5 is an extremely low-frequency (only 11 purchase operations to date), high risk-reward ratio, extreme diamond hand address. Because these addresses have historically successfully added positions at higher prices multiple times, they are the only addresses where multiple purchases are allowed, and the single purchase amount has been reduced. However, due to the limited total number of transactions, there is no conclusion yet regarding their impact on the system’s profitability.

- Before the split of Copy Trading Accounts No. 6 and No. 7, Wallet B (i.e., Account No. 7) purchased a certain token. Wallet B performed a large number of profit-taking operations on this token, but after the split, we stopped copying Wallet B’s operations, resulting in unexpected gains and profits (approximately 50% of Account No. 6’s total profit). Therefore, although Account No. 6 achieved a 5x gain in a week, it is more accurate to compare the combined results of Accounts No. 6 & 7 with Account No. 2. The combined weekly increase was 10.6 SOL (a 132.5% increase), which still shows a certain advantage over Account No. 2’s increase of 8.1 SOL.

- Test Accounts No. 1-6 are used to test addresses with outstanding highlights but insufficient stability. They track these addresses with very small amounts to test their long-term purchasing ability. If an account gets liquidated, it is cleared and marked as unsuitable for copy trading.

Version Iteration

Deep Evaluation System (One)

在 Part Three, the author mentioned the launch of Deep Evaluation System (One) to further analyze an address’s ability to “buy at the bottom,” risk of losing money from “FOMO at highs,” ability to win big with small bets, stop-loss style, and degree of “diamond hands.”

Last week, the system was further enhanced with two new sub-modules: “Copy Trading Effect Test” and “On-chain Performance Evaluation.” The complete evaluation results of the system are shown in the figure below.

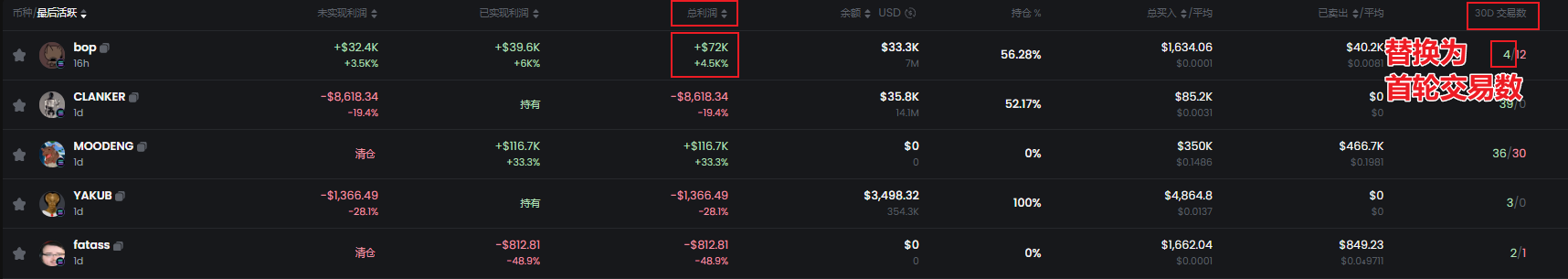

The “Copy Trading Effect Test” is currently still relatively basic. Its calculation method is: Total Profit provided by GMGN ÷ Number of First-Round Transactions. The converted profit for each token is then summed to obtain the “Converted Profit” for each address.

(Number of First-Round Transactions = The number of transactions between the first purchase and the first sale, taken from GMGN – Address Data – 代币 交易详情。 Transferring tokens is also considered a sale.)

The reason for adopting this calculation method is that the copy trading system mostly only copies a single buy. Therefore, we need to assess the profit change under this style. A situation where the converted profit declines little or even increases is ideal. The reason for this ideal situation is that the copy trading target’s high-profit tokens result from “one well-timed buy,” while high-loss tokens come from “multiple position additions.”

The calculation method for the “On-chain Performance Evaluation” is also currently quite straightforward. First, it checks whether the token was purchased on Pump.fun. Then, based on the token’s total profit and total cost, it calculates the win rate and multiple. The purpose of this data is to evaluate whether to copy on-chain trades. Once a situation arises where “On-chain Participation Rate” is too high + “On-chain Win Rate” is high + “On-chain Multiple” is too low, it indicates the address poses a risk of exploiting copy traders. Conversely, if the win rate is low and the risk-reward ratio is not high, it suggests its on-chain trading skill is poor, and on-chain trades should not be copied.

未来展望

The copy trading system still has many areas for improvement. Current plans include:

本文来源于互联网: Meme Cultivation Manual: Reborn as a Diamond Hand (Part 4) | Produced by Nan Zhi

Author | Asher ( @Asher_0210 ) On December 1st, Zama, a fully homomorphic crypto network that has raised a total of $130 million, announced on the X platform that it will sell 10% of its total ZAMA token supply through a sealed-bid Dutch auction. The auction will use fully homomorphic encryption (FHE) to maintain the confidentiality of the bidding. Furthermore, the Zama mainnet is expected to launch before the end of the year. Zama is arguably the most discussed project in the community during the recent TGE. Below, Odaily Planet Daily will analyze the Zama project, the sealed-bid Dutch auction, and the last interactive opportunity before the token issuance. Project Overview Zama is a company specializing in fully homomorphic encryption (FHE), one of the most hardcore innovations in privacy computing.…