Why are Bitcoin miners collectively shifting their focus to AI? The reasons are astonishing.

Key points summary

- Unstable revenue and rising Bitcoin mining costs have made the core business of 加密 mining companies unstable.

- Therefore, crypto mining companies are transforming by leasing data center space in their existing mining farms to large technology companies.

- This move reduces intense competition and makes the industry more stable.

1. Business Risks Faced by Crypto Mining Companies

We previously analyzed the financial risks that the decline in Bitcoin prices poses to Digital Asset Treasury (DAT) reserve companies. However, DAT companies are not the only ones facing pressure. Bitcoin mining companies that directly operate mining businesses also face significant risks.

Mining companies are vulnerable due to their simple business model. Revenue depends almost entirely on the price of Bitcoin, which is inherently unpredictable. In contrast, costs tend to increase over time.

- Unpredictable revenue : The company’s revenue depends entirely on the market price of Bitcoin.

- Rising structural costs : Mining difficulty continues to increase, electricity prices are rising, and hardware needs to be replaced regularly.

This structure becomes particularly problematic during periods of declining Bitcoin prices. Revenue drops immediately, while costs continue to rise. Mining companies are caught in a double bind.

Regulatory risks have added another layer of uncertainty. New York State has proposed raising the sales tax on mining companies. Currently, most large cryptocurrency mining companies are located in relatively less regulated areas like Texas, so the impact will be limited in the short term. Nevertheless, the risks posed by broader regulatory pressure should not be ignored.

Against this backdrop, mining companies face a fundamental question: can this business model remain viable in the long term?

2. Structural Vulnerability of Crypto Mining Companies

Source: 老虎研究

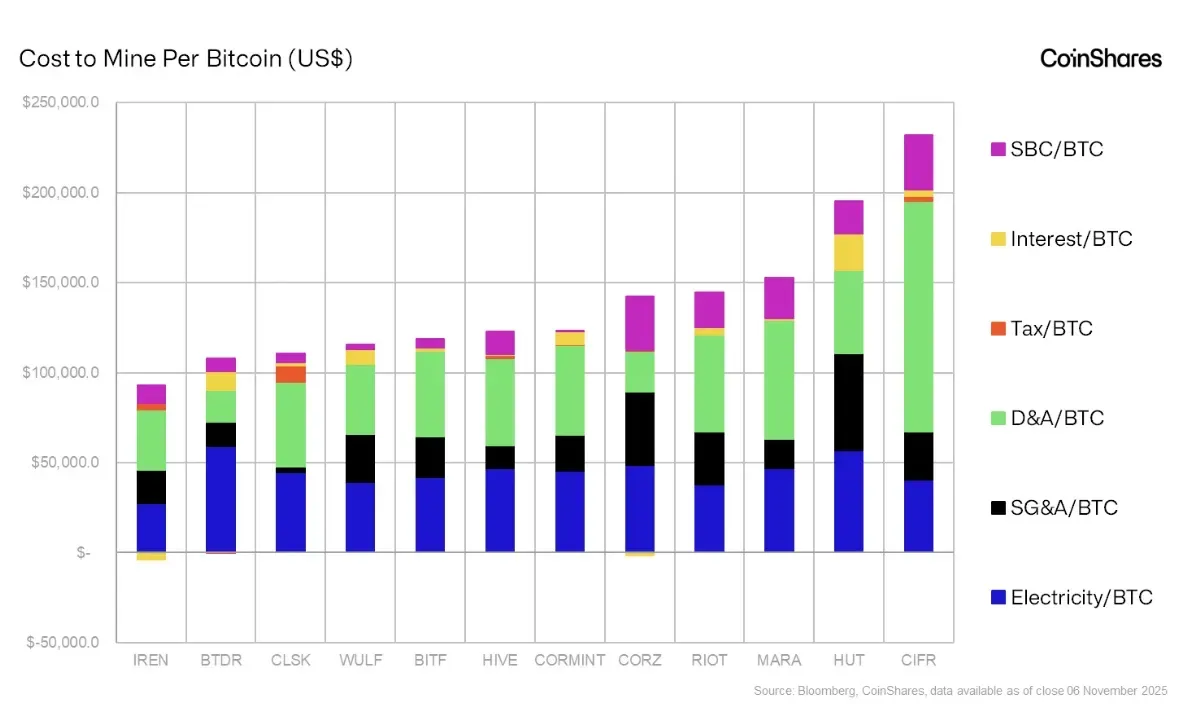

As of today, the average cost of mining one Bitcoin is approximately $74,600, nearly 30% higher than a year ago. If factors such as depreciation and stock-based compensation are taken into account, the total production cost of each Bitcoin would rise to approximately $130,000.

With Bitcoin currently trading at around $90,000, this means mining companies incur a paper loss of approximately $46,000 for every Bitcoin they mine. This gap highlights the widening disconnect between operating costs and market prices.

The situation becomes more fragile over time. Mining difficulty in 2025 will increase significantly compared to 2022, while energy regulations in several regions are tightening. These factors reduce cost predictability and decrease the structural stability of mining operations.

3. Shifting towards AI data center leasing

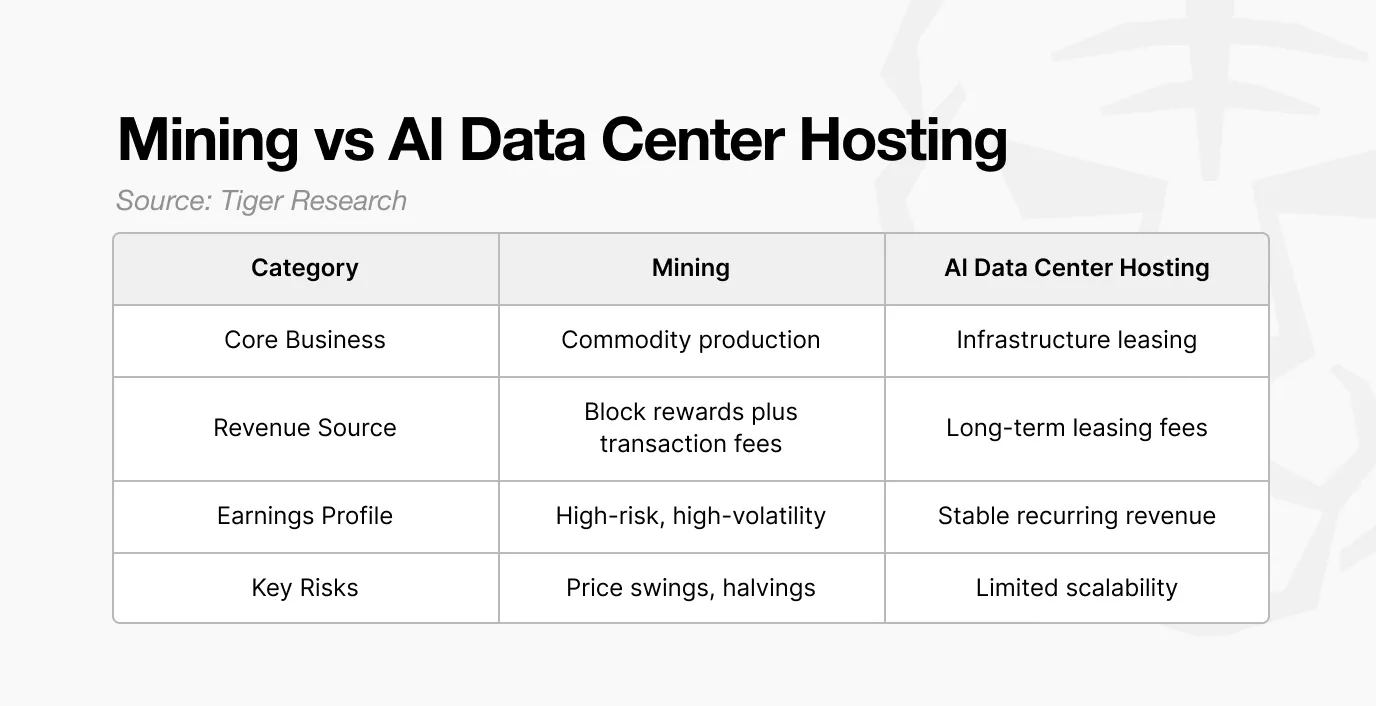

Source: 老虎研究

As competition intensifies in the field of artificial intelligence, the demand for data centers from large technology companies is rising sharply. However, building new data centers takes years. In the AI race, which is measured in months or quarters, waiting is unacceptable.

Mining companies have recognized the opportunity presented by this market gap. Their current facilities are equipped with high-performance computing hardware, massive power supplies, and advanced cooling systems. While these facilities cannot be completely transformed overnight, their specifications are highly compatible with the needs of large technology companies. This allows them to be converted into artificial intelligence data centers relatively quickly.

- High-performance GPUs : Crypto mining companies operate massive GPU clusters that can be repurposed for artificial intelligence computing. NVIDIA GPUs are a common example. By adapting their facilities, these assets can support new revenue streams beyond mining.

- Power infrastructure : Mining companies have secured grid access on a scale of hundreds of megawatts. In a highly regulated electricity market, such access is scarce and difficult to replicate, even with sufficient capital.

- Cooling systems : Experience gained from operating ASIC miners can be well applied to managing high-heat AI servers such as the H100 and H200. In fact, many mining farms can be converted into AI data centers within six to twelve months.

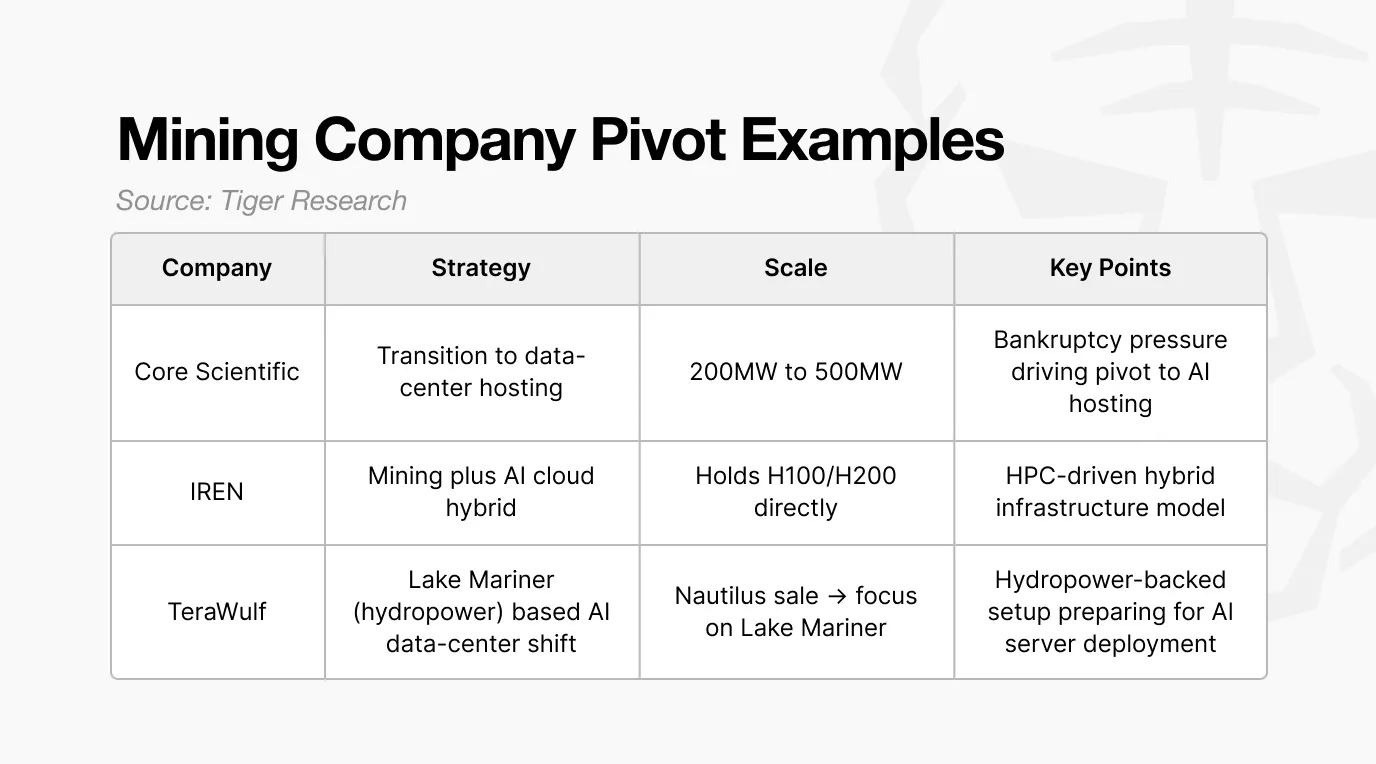

Source: 老虎研究

Core Scientific is a prime example. Facing bankruptcy in 2022, the company successfully transformed itself by entering the field of artificial intelligence data center operations. Currently, it operates approximately 200 megawatts of data center capacity and plans to gradually expand to 500 megawatts. This transformation from a struggling mining company to a data center leasing enterprise clearly demonstrates how utilizing alternative infrastructure can help businesses achieve stable growth.

Other mining companies are following a similar model. IREN and TeraWulf are also expanding beyond their core mining operations. While they haven’t fully transformed into data center leasing companies, they are developing complementary business models beyond Bitcoin mining.

These moves reflect a broader trend: as mining profitability declines, crypto mining companies are seeking business models more suited to the age of artificial intelligence. This shift is less driven by growth ambitions and more by necessity.

4. Diversification Strategies of Crypto Mining Companies

The shift of cryptocurrency mining companies from unprofitable mining operations to AI data center businesses is not a temporary trend, but rather reflects a rational survival strategy aimed at reallocating capital to more efficient uses.

This shift should not be seen as a negative development. On the contrary, it helps mining companies build a more stable cash flow. With more stable revenue, companies can continue to hold Bitcoin without being forced to sell it at a low price.

The alternative is far from that. Companies with consistently negative cash flow face bankruptcy risks and are often forced to sell Bitcoin at unfavorable prices. In contrast, data center revenue allows mining companies the flexibility to hold or sell Bitcoin, enabling strategic trades. This is far more beneficial for both the company and the market as a whole.

Not all companies are focused on pure data center leasing. Some, such as Bitmine and Cathedra Bitcoin, are expanding their businesses beyond mining into DAT-style business models.

In summary, these changes indicate that the cryptocurrency mining industry is maturing. Less competitive players are exiting the market or transforming their businesses, thus reducing mining pressure. At the same time, leading companies are evolving from simple mining operations into diversified DAT (Digital Amount and Data) businesses.

In fact, weaker links are being eliminated, and the overall market structure is becoming more resilient.

本文来源于互联网: Why are Bitcoin miners collectively shifting their focus to AI? The reasons are astonishing.

Related: On-the-spot report | Web3 lawyers interpret the latest changes in US stock tokenization

However, Nasdaq’s application is not simply to extend trading hours, but to change trading hours into two formal trading sessions: Trading is conducted during the daytime session (4:00 AM – 8:00 PM Eastern Time) and the nighttime session (9:00 PM – 4:00 AM the following day Eastern Time). Trading is suspended from 8:00 PM to 9:00 PM, during which all unfilled orders are cancelled. Many readers were excited upon seeing the news, wondering if the US was preparing for 24/7 tokenized trading of US stocks. However, after carefully studying the documents, CryptoShalu wants to tell everyone not to rush to conclusions, because Nasdaq stated in the documents that many traditional securities trading rules and complex orders are not applicable to nighttime trading hours, and some functions will also be limited.…