Yen Depreciation Triggers Inflation Alarm: Bank of Japan May Be Forced to Front-Load Rate Hikes

Original Author: Ye Huiwen, Wall Street CN

Bank of Japan (BOJ) officials are increasingly focusing on the potential impact of the yen’s weakness on inflation, a trend that could materially disrupt the future path of interest rate hikes. According to sources familiar with the matter who spoke to Bloomberg, although the BOJ is likely to keep interest rates unchanged at its upcoming policy meeting, exchange rate factors may prompt it to reassess the timing of rate hikes, potentially forcing it to act earlier than planned.

As reported by Bloomberg, BOJ officials believe the influence of a weak yen on prices is strengthening, particularly as companies are increasingly inclined to pass on rising input costs to consumers, which could further intensify inflationary pressures. Although the BOJ just raised its benchmark interest rate last month and has not set a predetermined path for borrowing costs, if the yen continues to weaken, policymakers may consider moving forward rate hikes that were originally expected to occur later.

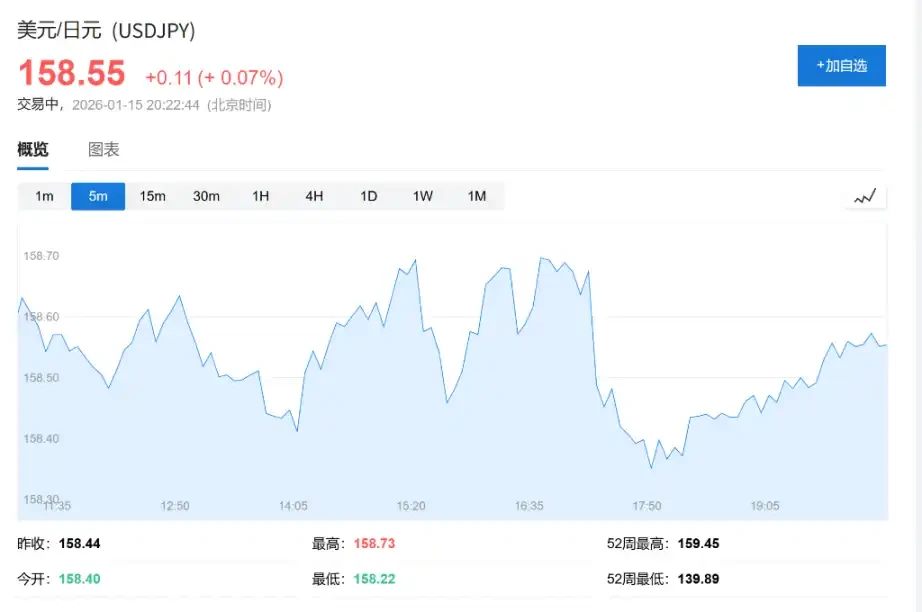

Currently, the consensus among private economists is that the BOJ will hike rates at a pace of about once every six months, suggesting the next move could come this summer. However, sources told Bloomberg that officials tend to execute policy adjustments in a timely manner rather than being overly cautious, indicating that the previously market-expected pace of hikes faces uncertainty. Affected by this news, the USD/JPY exchange rate briefly fell to around 158.68 before recovering to 158.33. As of the time of writing, USD/JPY has fallen to 158.55.

January Meeting Expectations: Rates to Remain Unchanged

The Bank of Japan will announce its latest policy decision on January 23rd. Sources told media that officials currently view maintaining the interest rate at 0.75% as appropriate, a level that has reached a three-decade high. Although the overall inclination is to hold steady, the committee will continue to monitor economic data and financial market developments until the last moment before making a final decision.

The focus of this meeting will be on how the central bank assesses the yen’s impact on potential inflation. Sources told Bloomberg that, given inflation trends are already close to the BOJ’s 2% target, officials will closely watch how exchange rate fluctuations alter price expectations among households and businesses.

交換 Rate Transmission Mechanism Under Scrutiny

A weaker yen typically increases inflationary pressure by raising import costs, while also boosting exporters’ profits. However, some officials point out that as the yen remains persistently weak, its negative impact on the economy may be increasing. Officials believe the BOJ still has room to continue raising interest rates, with the key being to time the policy adjustments correctly.

Voices from the Japanese business community on the exchange rate issue are also becoming more frequent. Yoshinobu Tsutsui, chairman of Keidanren (Japan Business Federation), the country’s largest business lobby, made rare comments this week calling for government currency intervention to stop the yen’s excessive depreciation, describing recent yen movements as “a bit too much.”

市場 Background and Political Factors

Despite the BOJ raising its benchmark interest rate on December 19th, the yen has remained weak against the US dollar. Influenced by news that Prime Minister Sanae Takaichi will hold a snap election next month, the yen slid further this week to a new 18-month low.

Data compiled by Bloomberg shows the 10-year average USD/JPY exchange rate is 123.20, while over the past two-plus years, the yen has generally fluctuated between 140 and 161.95. Although the yen rebounded slightly earlier this week after touching an 18-month low, as monetary authorities stepped up warnings, the overall depreciation trend continues to exert persistent pressure on the central bank’s decision-making.

本文源自網路: Yen Depreciation Triggers Inflation Alarm: Bank of Japan May Be Forced to Front-Load Rate Hikes

Related: Odaily Editorial Team Tea Party (December 17)

This column’s content is based on the real investment and observation experiences of Odaily’s editorial team members. We do not accept any form of commercial advertising, nor do we constitute investment advice (after all, we are equally experienced in losing money). Its purpose is merely to broaden perspectives and supplement information sources, not to create consensus. Welcome to join the Odaily community ( Telegram group , X official account ) to exchange ideas, ask questions, and joke around. Asher (X: @Asher_0210) Profile: Primarily plays interactive games and financial management, occasionally buys memes (but doesn’t like to sell them), not good at contract trading but enjoys participating. Content: Yesterday, the crypto fear index dropped to 11, but I still believe there will be a rebound. I’ve started buying the dip in…