超流動性

專案推特: https://x.com/HyperliquidX

專案網站: https://hyperfoundation.org/

Number of tokens unlocked this time: 9.92 million

The amount unlocked this time: approximately US$257 million

Hyperliquid is a high-performance blockchain whose vision is to create a fully on-chain, open financial system. Liquidity, user applications, and trading activity work together on a unified platform, designed to accommodate all financial transactions.

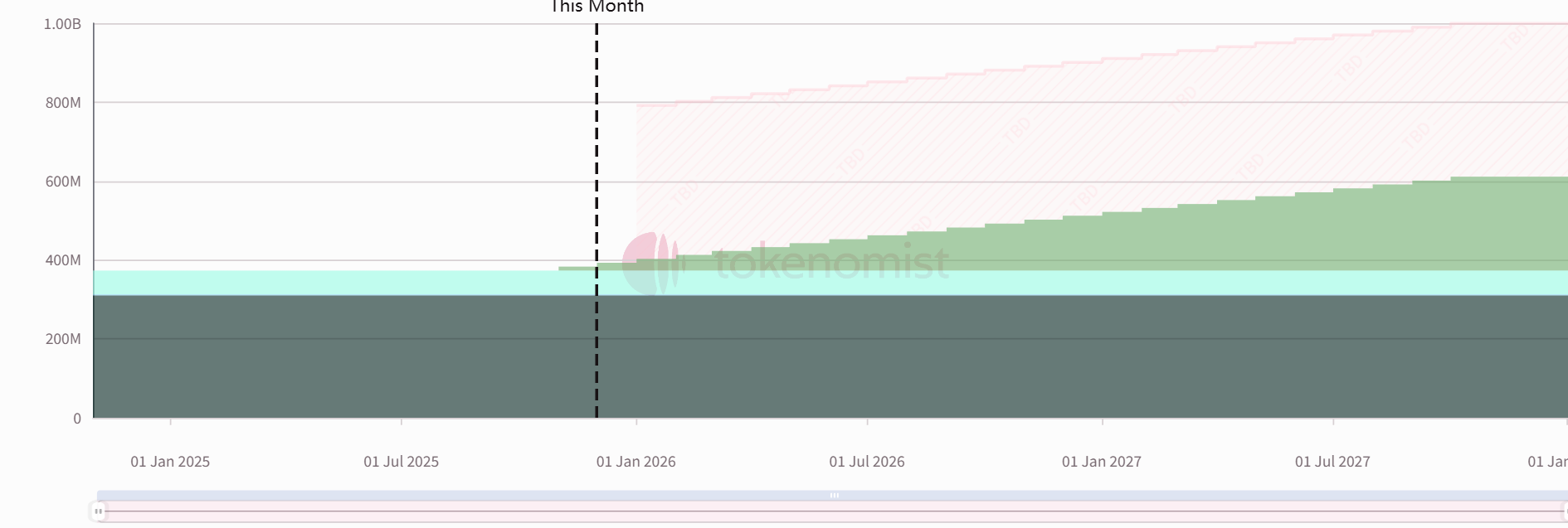

具體釋放曲線如下:

特徵層

專案推特: https://x.com/eigenlayer

專案網站: https://www.eigenlayer.xyz/

Number of tokens unlocked this time: 36.85 million

Unlocked amount: Approximately US$14.41 million

EigenLayer is a protocol built on top of Ethereum that introduces the concept of restaking, a new primitive in 加密貨幣economic security. This primitive allows ETH to be restaken at the consensus layer. Users who have staked ETH can choose to join the EigenLayer smart contract to restake their ETH and extend cryptoeconomic security to other applications on the network.

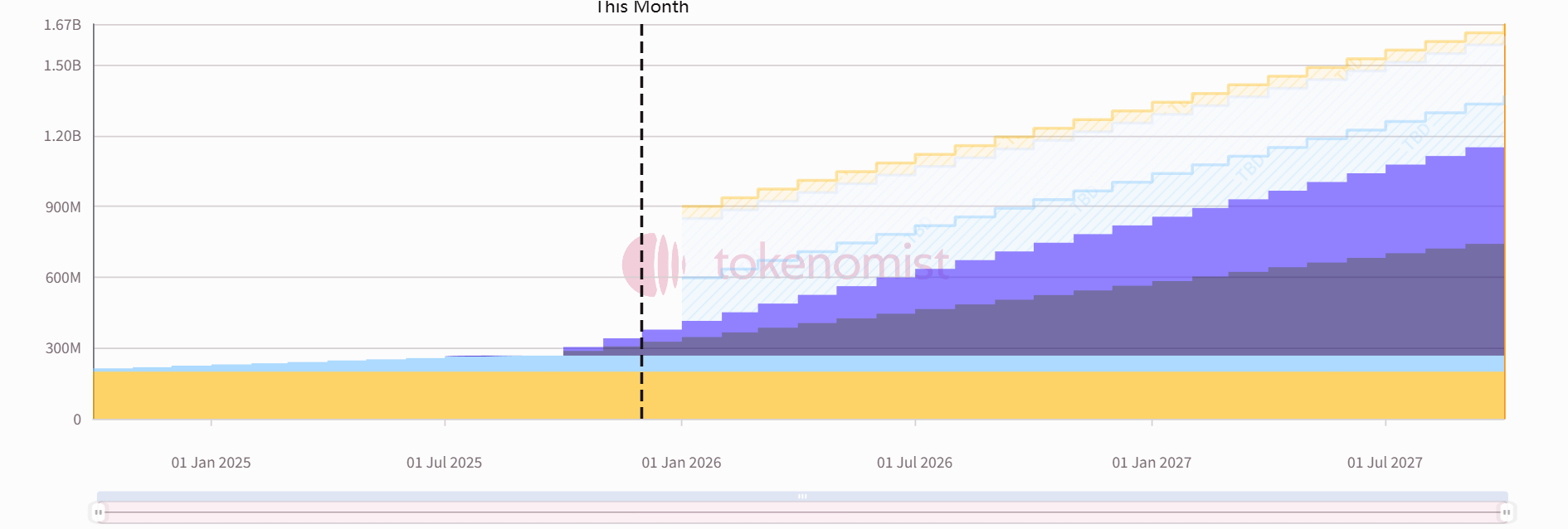

具體釋放曲線如下:

卡米諾

專案推特: https://x.com/kamino

專案網站: https://kamino.finance/

Number of tokens unlocked this time: 229 million

Unlocked amount: Approximately US$11.45 million

Kamino is an automated liquidity solution based on the Centralized Liquidity 市場 Maker (CLMM) mechanism. Liquidity providers (LPs) seeking to improve capital efficiency can leverage Kamino’s automated market-making library to enhance expected returns on fees and rewards. Kamino was incubated by Hubble Protocol.

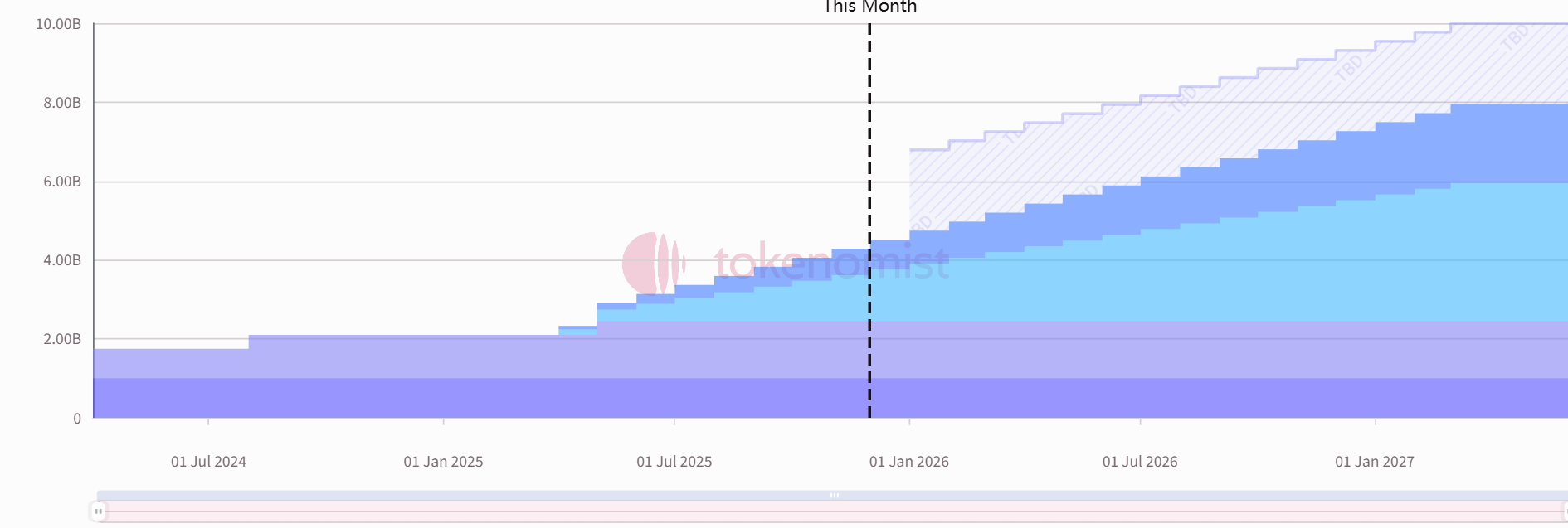

具體釋放曲線如下:

佐拉

專案推特: https://x.com/zora

專案網站: https://zora.co/

Number of tokens unlocked this time: 166 million

Unlocked amount: Approximately US$6.65 million

Zora was founded in 2020, initially operating similarly to Opensea as an NFT minting and trading platform. However, with the decline of the NFT sector and several years of development, Zora has launched its own L2 network based on the OP Stack, positioning itself as an on-chain social network with post tokenization capabilities.

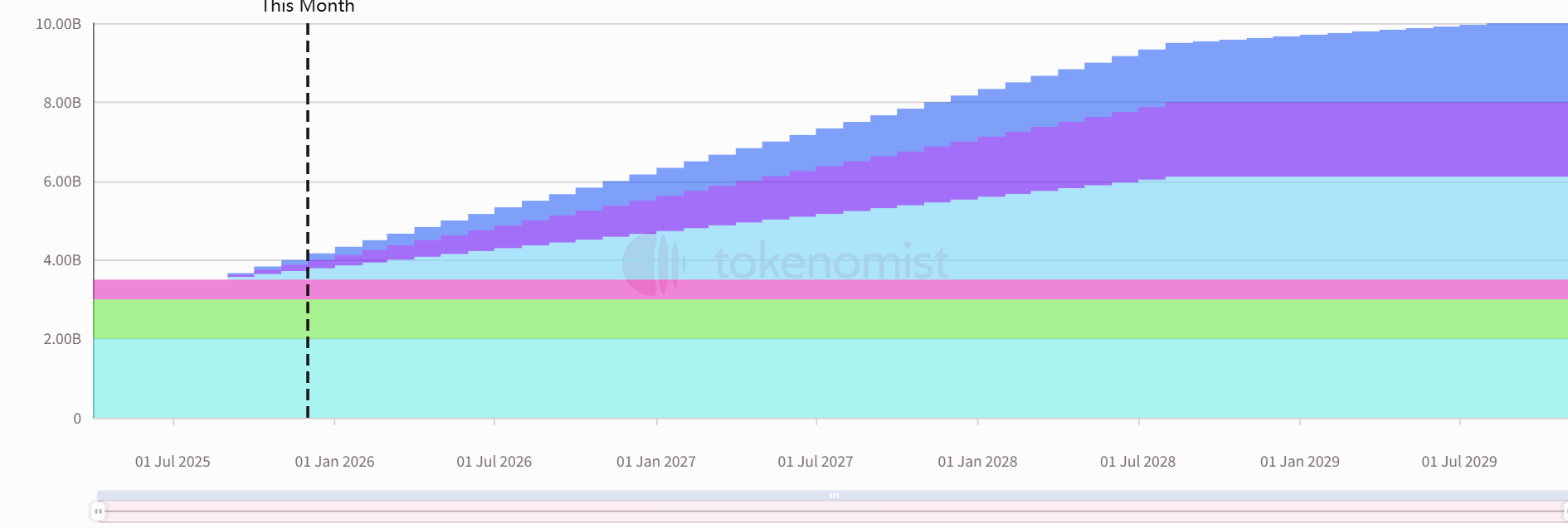

具體釋放曲線如下:

本文源自網路: One-week token unlock: HYPE unlocks nearly $260 million worth of tokens.

Original article translated by: Deep Tide TechFlow Ansem declared the market had peaked, and CT called this cycle “crime.” High FDV (Fully Diluted Valuation) projects with no real-world applications have squeezed every last penny out of the crypto space. The bundled sale of Memecoin has tarnished the crypto industry’s reputation in the public eye. Worse still, almost no funds are being reinvested in the ecosystem. On the other hand, almost all airdrops have turned into scams designed to pump and dump. The sole purpose of Token Generation Events (TGEs) appears to be to provide exit liquidity for early participants and teams. Firm holders and long-term investors are suffering heavy losses, and most altcoins have never recovered. The bubble is bursting, token prices are plummeting, and people are furious. Does this…