Privacy Coin Sector Research Report: Can the Privacy Coin Sector Usher in a Long-Term Bull Market with Structural Growth?

1. Why was the privacy track launched in 2025?

1.1 The tension between regulation and on-chain structure is becoming apparent.

As the regulatory framework deepens, the industry is gradually entering a phase of “over-compliance.” Key technologies such as ZK, privacy, account abstraction, and social recovery are required to proactively adapt to the regulatory framework, leading to increasingly apparent friction between the native community and compliance logic. In 2025, several core community members, including Vitalik Buterin, repeatedly emphasized the importance of privacy. Their core argument can be summarized as follows: mật mãcurrencies lacking privacy protection will degenerate into mere financial instruments and cease to be part of the Cypherpunk movement.

This tension at the value level has made “privacy” a highly sensitive issue in the crypto ecosystem once again.

1.2 A marginal shift in regulatory attitude: from “comprehensive crackdown” to “selective neglect”

Compared to 2020–2023, global regulatory attitudes toward privacy tools showed a mild structural shift in 2024–2025:

- United States: Privacy discussions return to the technical realm

With the change of US government, the market’s regulatory narrative surrounding Tornado Cash-like protocols has cooled significantly, and privacy issues have gradually shifted from “political risks” back to “technical discussions.” Although there has been no substantial relaxation of regulation, the decrease in the frequency and intensity of enforcement has created more room for discussion on the privacy narrative.

- EU: Policies are becoming more moderate, with a focus shifting to VASP compliance.

In the new discussions of MiCA 2.0, technical requirements such as privacy addresses have been reduced, and greater emphasis has been placed on the sharing of KYC/AML responsibilities for VASPs, rather than directly negating the assets themselves. The focus of the policy framework has shifted from “prohibition” to “management,” leaving an operational compliance buffer for privacy assets.

- Asia: Regulatory focus returns to CEX and AML processes

Discussions about on-chain privacy have decreased significantly in the Asian market, with more focus on CEX AML processes and fund vetting logic. The risk label associated with on-chain privacy technology itself is being downplayed.

1.3 The narrative space of the privacy track is reopened

Under the aforementioned marginal changes in regulation, the privacy sector has gradually shifted from a “policy-sensitive area under high pressure” to an “area where technical discussions can be restarted.” This shift from comprehensive suppression to selective neglect has opened up crucial narrative space for privacy assets:

- It is no longer a key target of regulatory crackdown.

- It also retains anti-censorship value, which gives it a natural base of support within its original community.

- The softening of the regulatory framework provides a minimum level of policy tolerance for narrative restoration.

Historically, every surge in the privacy sector has stemmed from a combination of technological breakthroughs, marginal improvements in regulation, and changes in market structure. The context of 2025 once again perfectly aligns with this combination.

2. Liquidity Structure and Funding Behavior: The Privacy Sector Emerges as a New “Narrative Carrier”

2.1 Concentrated Liquidity: Traditional Rotation Paths Are Difficult to Continue

A key characteristic of the current market is:

Mainstream liquidity is highly concentrated, significantly compressing the room for rotation of on-chain native funds.

Including the following aspects:

- Large-scale interest rate cuts and easing at the macro level have not yet occurred , and the amount of new funds entering the crypto market is limited.

- ETFs and staking have locked up a large amount of BTC/ETH liquidity , reducing the tradable supply of mainstream assets.

- High-frequency speculative sectors such as Meme, AI-meme, BRC, and ICO have absorbed a large amount of on-chain gaming capital , squeezing out other sectors.

This structure leads to two results:

- The mainstream rotation pattern is difficult to replicate the previous cycle.

The traditional path of L1 → L2 → DeFi → GameFi → Public Chain is unlikely to be replicated in this round, as excessive concentration of funds in the pool limits the on-chain diffusion.

- The native crypto community lacks a new “narrative platform”.

- BTC is fully institutionalized

- Stablecoins are subject to strict regulatory frameworks

- L2 is highly competitive and unlikely to see 100x returns.

This necessitates a new direction for the market to accommodate the liquidity and emotional needs of native communities.

2.2 The privacy sector possesses four key advantages in this context.

Against the backdrop of highly concentrated liquidity and limited narrative space, the privacy sector precisely meets the real needs of native funding. It possesses four core conditions that allow it to “naturally become a gap in the market”:

(1) Low market capitalization and high price elasticity

The prolonged slump in mainstream privacy-related projects has resulted in a low valuation base, making them more susceptible to structural drivers and trend-driven market movements.

(2) Solid underlying technology and extensible narrative.

ZK technology, privacy payments, unified addresses, and composable privacy are all mature concepts with an engineering and narrative foundation for repeated expansion.

(3) Bearing the spirit of Cypherpunk

Privacy is an important component of the inherent value of encryption, easily gaining community recognition and having a long-term narrative foundation.

(4) Matching the “marginally mild” regulatory trend

The shift in regulation from “highly regulated targets” to “not priority enforcement targets” has reduced the market’s risk discount for this sector.

Therefore, the privacy sector has the structural conditions to become a focus of investment in 2025, not a catch-up rally, but rather the filling of a structural gap .

2.3 The rise in privacy-related stocks in Q3–Q4 of 2025 exhibited a “proactive, structure-driven” characteristic.

Observing recent market behavior, the current surge in privacy assets is not a natural contagion, but shows clear signs of being actively driven:

- Some OG funds and Asian trading teams have made early arrangements , increasing the concentration of their positions.

- Increased social interactions between funders, contract traders, and the ZEC/ZK development team have broadened market attention.

- Large ETH holders have repeatedly accumulated ZEC/DASH at low prices , demonstrating a strategic position-building approach.

The above signs indicate that:

This round of privacy-related market activity is more like the result of “structural factors + careful ignition” than a natural market sentiment driver.

Narrative resurrection and financial behavior are consistent in time and structure.

3. The large-scale integration of AI, payments, and crypto provides more room for growth.

As AI, on-chain payments, and data sovereignty become mainstream applications by 2025, privacy-related demands are showing a structural upward trend. Privacy coins are not the only solution in this system, but they are the most directly tradable and easily priced by the market . Therefore, these emerging narratives provide external incremental value for traditional privacy assets, enabling them to gain significant “narrative linkage rights” in this cycle.

By 2025, the deep integration of AI and encryption is forming several key trends:

- On-chain banks

It emphasizes the controllability of the account system, transaction path, and user privacy.

- Data sovereignty

Users are required to manage the visibility, transferability, and provability of their own data independently.

- PayFi and the Restructuring of the Crypto Payment System

In the process of cross-border payments, on-chain settlements and the promotion of stablecoins, the dual demand for “auditability + privacy” has increased.

- AI Agents and Automated Transaction Execution

When AI agents initiate on-chain actions on behalf of users, the risk of privacy breaches becomes a core concern.

- Increased demand for user-level privacy computing

It is necessary to ensure that user transactions, identities, and asset distributions on the blockchain cannot be easily linked.

These trends all point to a core fact:

As AI, payments, and on-chain identity enter the stage of large-scale implementation, privacy protection will no longer be an option, but a fundamental necessity.

Therefore, in this round of privacy-related market trends, the market is more inclined to trade mainstream privacy assets that are “practical, combinable, and have clear engineering progress,” rather than pricing future technologies in advance.

4. Engineering Progress of Mainstream Privacy Coins: The Real Driver of This Chợ Tập hợp

The core of this round of privacy-related market trends is not technological directions such as FHE, which are still in the conceptual stage, but rather the market’s repricing of the long-term breakthroughs and accumulations of mainstream privacy coins in engineering capabilities, wallet experience, protocol structure, and ecosystem governance .

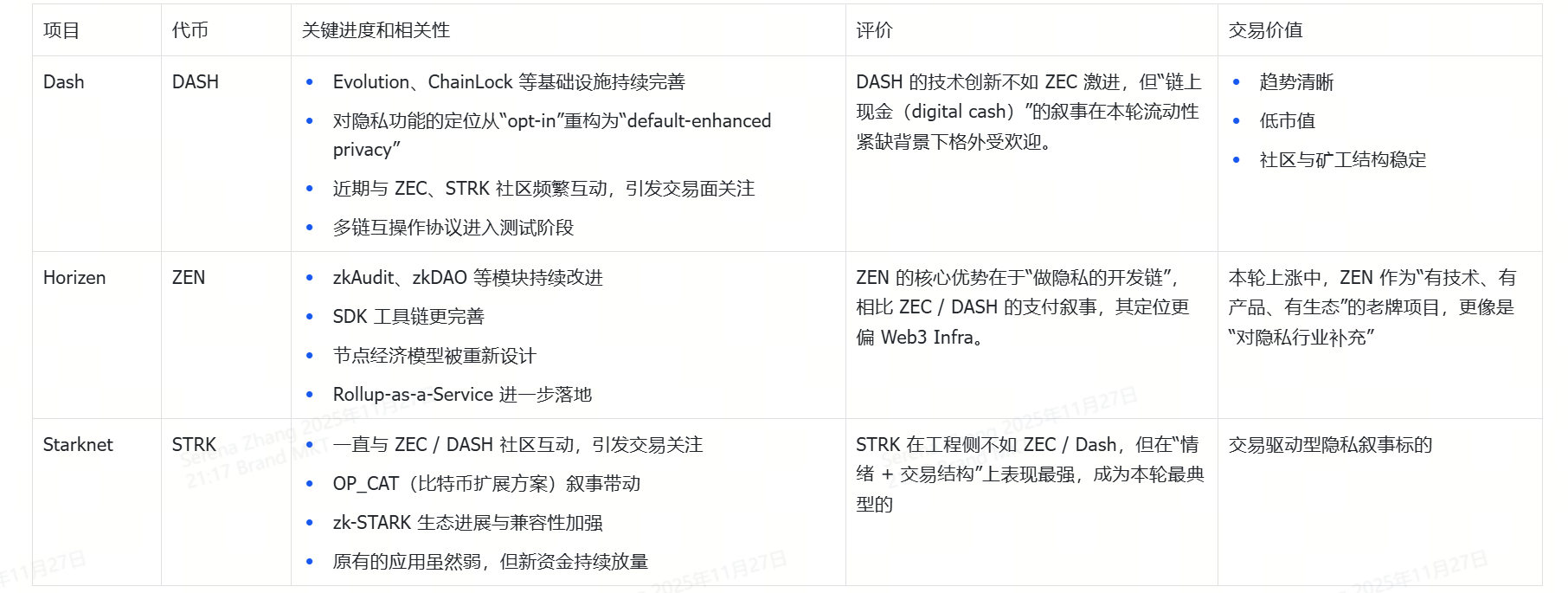

Projects such as ZEC, DASH, ZEN, and STRK constitute some of the most representative asset classes in the privacy sector. Their technological evolution, ecosystem positioning, and trading structure together form the underlying driving force of this round of market activity.

4.1 The Twin Wheels of ZEC (Zcash) Technology Foundation and Eco-Economy

- NU5 Upgrade: A Key Breakthrough from “Academic Privacy” to “Engineering Privacy”

Core upgrades such as Halo 2, Orchard, and UDT continue to advance, with NU5 (Orchard + Halo2 + Unified Addresses) propelling Zcash from an “academic-grade privacy technology” to a more “usable and composable” engineering phase. The Halo 2 proof system removes trusted settings, Orchard enhances the shielded transaction experience, and Unified Addresses simplify the wallet receiving process. Together, these three significantly lower the barrier to entry, while creating clearer possibilities for future compliant integration and L2/Rollup connectivity.

- Orchard does not rely on trusted settings. Driven by the Electric Coin Company engineering team (including Sean Bowe), it has become one of the most advanced, secure, and verifiable zero-knowledge payment systems available today.

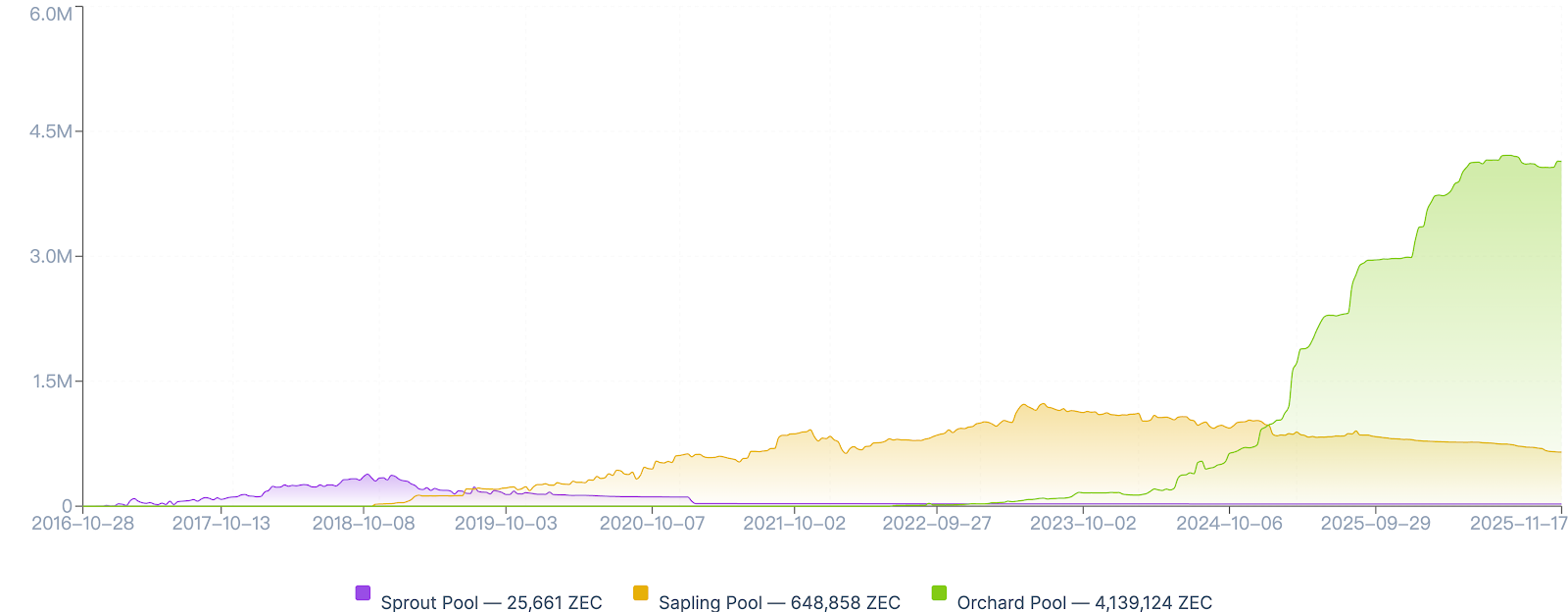

- Unified Address, by consolidating Orchard, Sapling, and Transparent addresses into a single payment format, is expected to significantly increase the proportion of funds entering the shielded pool. Currently, external observers cannot distinguish whether funds are entering the transparent pool or the shielded pool.

- The Orchard pool, as a significant enhancement to the existing shielded pool, together with the Sapling and Sprout pools, forms an independent anonymity environment.

- Transactions in Orchard reduce metadata exposure and enhance anonymity through Orchard’s “action” mechanism, a feature not found in the traditional UTXO model.

- NU6 Upgrade: From Technology-Driven to Ecological Governance and Sustainable Economic Models

One of the key initiatives of NU6 is the introduction of a brand-new Zcash Development Fund model. The new “indirect funding model” replaces the old model (which allocated 20% of the block subsidy to the Zcash community, the Electric Coin Company, and the Zcash Foundation).

The new Lockbox mechanism, proposed in ZIP 1015 based on community feedback, will accumulate 12% of the block subsidies into the Lockbox account. The funds will be used for ecosystem building after the community reaches a consensus on the allocation mechanism, ensuring that key development projects have stable support in the long term.

Meanwhile, Zcash Community Funding will continue to receive 8% of its annual funding for project grants.

- Long-term narrative direction: Expanding application scenarios and scaling capabilities become the next stage challenges.

The convergence of ZK-Rollup and L2 is considered a key potential direction for Zcash. However, it faces the dual challenges of engineering complexity and economic model structure. If realized, it could potentially make Zcash’s shielded pools a scalable, DeFi-compatible privacy execution layer. The community has already made initial explorations and proposals, but implementation will still take time.

Of particular note is the “Ztarknet” proposal put forward by ecosystem developer Dimahledba, which attempts to combine Starknet and Zcash to build a private yet scalable two-layer network, allowing network fees to be paid via ZEC. This proposal has already received early support from several community members, including founder Zooko Wilcox.

Overall, the NU6 series covers ecosystem governance, funding models, development fund management, and long-term sustainability mechanisms (including the coinholder-controlled fund and grant model proposed in NU6.1), while also including performance optimization and technical debt cleanup. NU5 laid the technological foundation, while NU6 supplements and strengthens it at the levels of ecosystem governance and economic structure.

After solidifying the technological foundation (NU5), the future ecosystem and funding model (NU6) will determine how development resources are allocated, how governance balances the community and institutions, and whether the development pace can remain stable, thus directly affecting ZEC’s long-term market confidence. ZEC and the Zcash network have shifted their positioning from “the hype narrative of BTC privacy forks” to “privacy infrastructure with continuous R&D and governance capabilities.”

4.2 Relevance of Other Mainstream Privacy Coins to the Industry

- The reason why related concepts such as ZK/FHE failed to catch up:

Privacy-related ZK and FHE concept projects did not collaborate in this round, mainly for the following reasons:

- The business scenario has not yet been validated, and a sustainable demand loop is lacking.

- There is insufficient engineering implementation; it remains in the early stages of research and development.

- Lacking long-term narrative accumulation and failing to gain recognition from mainstream funding.

Therefore, the nature of this round of market activity remains:

The valuation repricing of traditional privacy coins, rather than the hype and speculation surrounding ZK or FHE in advance.

5. Is this round of privacy-related trends sustainable?

The resurgence of the privacy sector in 2025 was not accidental, but rather a result of four factors: a marginal weakening of regulatory attitudes, a contraction in liquidity of mainstream altcoins, an accumulation of demand for native narratives, and long-awaited progress on the engineering side, creating a “crossroads” and “structural funding needs.” However, the core uncertainty regarding its sustainability lies in whether privacy assets can truly assume a foundational functional role in areas such as PayFi, AI Agents, and On-chain Banks.

If these roles can be fulfilled, the privacy sector has the potential to grow into a “value anchoring sector” for the new cycle; if not, this round of market activity may enter a differentiation phase after 1-2 quarters.

The rise of the privacy sector in 2025 is not a catch-up rally, nor is it solely driven by sentiment; rather, it is a structural outcome of the crypto industry entering the institutional era. BTC has been rebất chấpned as “digital gold,” ETH has become the L2 capital market, and privacy has once again become the core value outlet of Web3.

The essence of this round of market rally is a repricing of privacy value; a phased return to the Cypherpunk spirit; a reflection of the imbalance in mainstream capital structure; and a delayed realization of engineering breakthroughs. The real question worth pursuing is not “why is privacy rising,” but rather: in an era where AI and institutionalization are developing in parallel, will privacy once again become the main value driver of crypto assets? Is there an opportunity for a structural long-term trend in the privacy sector? All of this remains to be seen and will require further market validation.

Bài viết này được lấy từ internet: Privacy Coin Sector Research Report: Can the Privacy Coin Sector Usher in a Long-Term Bull Market with Structural Growth?Recommended Articles

Related: What signals did the Federal Reserve’s latest Fintech meeting send?

Original Editor: Jack On October 21, Washington, D.C., a conference room at Federal Reserve headquarters was filled with people who, just a few years ago, would have been considered troublemakers in the financial system. The founder of Chainlink, the president of Circle, the CFO of Coinbase, and the COO of BlackRock sat face to face with Federal Reserve Governor Christopher Waller to discuss stablecoins, tokenization, and AI payments. This was the Federal Reserve’s first Payments Innovation Conference. While not open to the public, the event was livestreamed. The agenda featured four topics: the convergence of traditional finance and digital assets, stablecoin business models, the application of AI in payments, and tokenized products. Each of these topics represents a multi-trillion dollar market. Waller opened his remarks by declaring, “This is a…

The privacy coins should be merged or acquired to strengthen the market.