Institutional selling? What is the real meaning behind BlackRock’s large transfer of cryptocurrency to Coinbase?

Author|Azuma ( @azuma_eth )

With the market sluggish, investors are on edge.

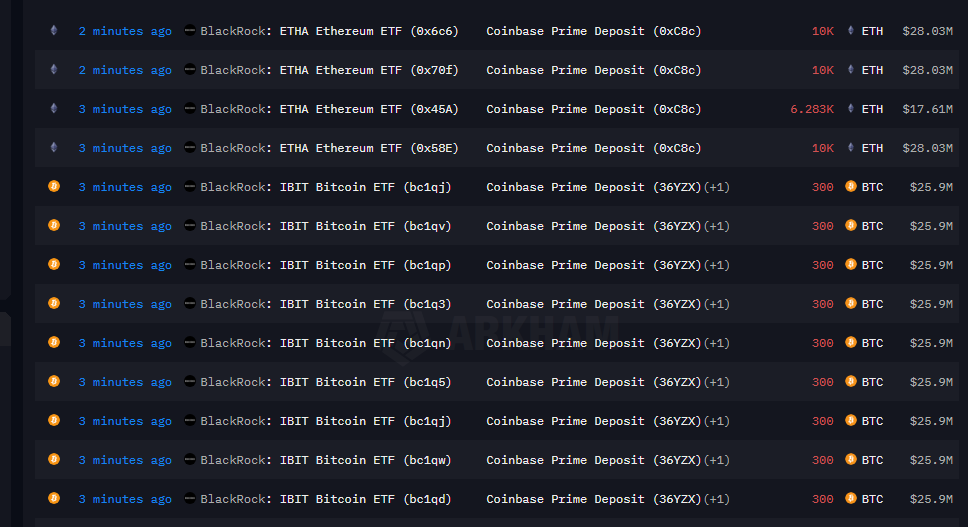

Over the past week, the frequent large-scale transfers of BTC and ETH from BlackRock to Coinbase have attracted the attention of many investors . Many people immediately interpret the transfer activity as a sell-off signal and try to interpret short-term market trends based on this signal. But is this methodology really sound?

- Odaily Note: BlackRock transferred a large amount of BTC and ETH to Coinbase again last night.

Early on November 25th, Evgeny Gaevoy, founder of market-making giant Wintermute, commented on the matter on X, saying: ” This (the large transfer from BlackRock) is actually a highly lagging indicator. The sell-off had already occurred in the ETF. The same often happens with on-chain transfers by market makers.”

How should we interpret Evgeny’s statement? If there is a lag in the transfer process, then when exactly does the actual sell-off occur?

First and foremost, it needs to be clarified that the so-called large BlackRock transfer refers to the transfer of mật mãcurrency from the reserve addresses of BlackRock’s Spot Bitcoin ETF (IBIT) and Spot Ethereum ETF (ETHA) to the Coinbase Prime custody address.

According to Evgeny’s subsequent explanation in response to netizens’ questions, this is actually a process where large market makers make markets and hedge around ETFs when there is a net outflow.

Cụ thể, market makers buy shares from ETF sellers and then submit a redemption request to BlackRock to exchange the ETF shares for BTC (usually with a 1-day delay) . There is no selling pressure in the subsequent stages because the market makers have already completed the hedging (selling) operation when they buy the ETF.

Nói cách khác, the real selling pressure won’t occur when retail investors see the on-chain transfers, but rather when market makers are simultaneously accepting sell orders for the ETF (which is buying for them) while also selling to hedge in the external market. Since there is usually a one-day delay in redemption and circulation, the actual selling pressure may occur a day earlier.

To add to that, the above describes the market-making process when an ETF experiences net outflows. Conversely, when an ETF experiences net inflows, market makers will simultaneously sell ETFs to buyers and purchase cryptocurrencies (such as SOL, which is currently experiencing net inflows) and send them to the ETF issuer. Since there are no redemption time limits here, the lag time will be shortened, but there will still be some lag.

In conclusion, the so-called “large BlackRock transfer” is actually just a settlement step in the standard ETF operating procedure. The selling pressure it represents generally occurs before the transfer, not after. Relevant data will be presented more clearly and comprehensively in the daily ETF inflow and outflow monitoring, and there is no need to interpret it as an additional bearish signal, thus causing unnecessary panic.

Bài viết này được lấy từ internet: Institutional selling? What is the real meaning behind BlackRock’s large transfer of cryptocurrency to Coinbase?Recommended Articles

Liên quan: Airdrop Weekly Report | Polymarket Confirms Token Launch and Airdrop; Aster Uses 70-80% of S3 Fees for ASTER Buybacks (October 13-27)

By Golem ( @web3_golem ) Odaily Planet Daily has reviewed the airdrop projects that can be claimed from October 13, 2025 to October 27, 2025, and also sorted out important airdrop information during this period. For detailed information, please see the main text. Monad Project and airdrop qualification introduction Monad, a high-performance L1 blockchain, announced its airdrop on October 14th. The airdrop will distribute tokens to 5,500 members of the Monad community and nearly 225,000 members of the broader crypto community. The airdrop targets five key user groups: Monad community members (the largest group), active on-chain users (including DEX traders, DeFi protocol participants, and NFT holders), members of the broader crypto community, crypto contributors (security researchers and educators), and Monad ecosystem builders. Active on-chain users primarily fall into the following…