A Polymarket Top 0.7% Winner’s Account: How to Lose $19,000 in One Minute

Biên soạn bởi Odaily Planet Daily Golem ( @web3_con quỷ )

Despite being in the top 0.7% of traders on Polymarket, I still lost $19,000 on November 9th. So, about three hours after the loss, I wrote this article hoping it will be helpful to other Polymarket traders.

I started trading on Polymarket about a month ago, with two goals at the time:

- Make trades with positive expected returns (EV).

Positive EV refers to a trade or bet that, from a mathematical perspective, may not be profitable in the short term but is likely to be profitable in the long term. Each bet has an expected value based on its probability of winning and the amount of payout. The formula is: EV = (P(win) × Payout) − (P(loss) × Loss)

If the expected value (EV) is positive, then after repeated operations, a profit will eventually be obtained on average.

For example, if the probability of something happening is 60%, but the market price prediction shows 50%, then this is a positive EV opportunity because the actual probability is higher than the probability implied by the price.

- Accumulated trading volume prepares for the upcoming POLY token airdrop.

Polymarket’s Chief Chợing Officer, Matthew Modabber, confirmed last month that Polymarket will be having an airdrop. Polymarket’s airdrop is expected to be one of the largest in the mật mã space next year, so participating early and accumulating trading volume is the right choice.

Earn $3,500 through end-of-day trading strategy

When I first started betting, things didn’t go well. I lost $600 in the Women’s Golden Globe, and objectively speaking, the result of that match was rigged, but that’s another story. Anyway, over time, I started to find some personal advantage on Polymarket.

I look for mispriced markets and expired orders, sometimes even betting on events that have already been decided. For example, betting on the “winning team” after the game has ended can yield a 1% return; I once bet $6,500 on a finished game.

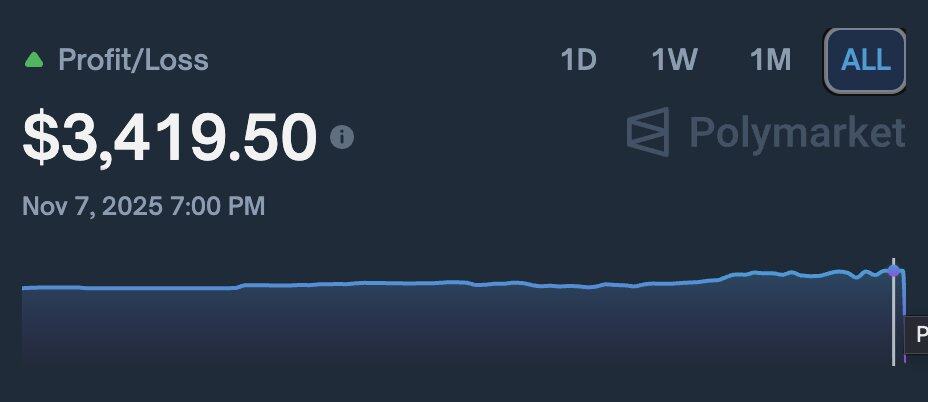

A 1% daily return can accumulate to a 365% annual compound interest rate. Before this $19,000 loss, I had already earned $3,500, with a total trading volume of $200,000, placing me in the top 0.7% of all Polymarket traders.

Lost $19,000 in one minute

Last night, I decided to pull off something big.

I deposited $35,000 into my account so I can scale my capital faster, whether through profits or airdrop interactions. I want my time on Polymarket to be worthwhile; rather than investing only $20,000, I’d rather earn a 1% return on $55,000, thus maximizing my time investment.

Then, the Manchester United vs. Tottenham match started. I turned on the TV because I’m a die-hard Manchester United fan.

With about five minutes remaining in the game, the situation suddenly reversed, with Manchester United taking a 1-0 lead and Tottenham taking a 2-1 lead.

At this point, I checked Polymarket and found a 5-cent spread on the “Tottenham win” line, which looked like a free positive EV opportunity. So I placed a $9,000 order at 91 cents, but it didn’t fill. I then placed another $9,000 order at 93 cents.

In the end, only 10% of my order was filled. I thought everything was fine, and I kept watching the game, but I made a fatal mistake: I forgot to cancel my previous bid.

A minute later, I glanced back at Polymarket, intending to close those bids, but just as I hovered my mouse over the close button, my previous order was filled.

A few seconds later, Manchester United’s odds soared, and 15 seconds later, I saw on TV (with a slight delay) that Manchester United had scored.

I immediately understood what had happened; I had handed over $18,500 to those traders and bots who saw the goal before me.

The feeling was awful; anger, regret, and disbelief were all mixed together. I didn’t want to go out, but I had plans to go running with my brother and girlfriend, so I forced myself to go. This gave me time to reflect.

The advantage doesn’t lie with me, it lies with them.

People often post “free money” bets with odds as high as 99% and pretend they’ve found positive EV, but in most cases, it’s just good luck.

Just as my bet today appears to have positive EV, it is actually 1000% negative EV. I’m simply paying for someone who’s faster than me.

The advantage doesn’t lie with us, it lies with them.

Another huge mistake I made was leaving my orders hanging. In a fast-paced market, orders that are being filled are a trap. People watching faster live streams or running bots can react in milliseconds, and by the time an average person refreshes their screen, they’ve already taken your money.

Risk tolerance and betting size are crucial.

In betting, there is a concept called the quarter Kelly (QK) rule, which is a method of adjusting the betting size based on expected value and variance.

I hadn’t paid attention to this concept before. Instead of balancing risk and reward, I put $18,500 into a low-return bet. When variance came into play, I lost everything.

Even if your bet is positive EV, you can’t always win.

The expected value can only be realized after multiple attempts. This is mathematics, not luck, and mathematics requires a large number of samples to eliminate fluctuations.

Even if you toss a coin with a 55% chance of winning, you might still lose 10 times in a row. This doesn’t mean you’re wrong, but rather that you haven’t tossed the coin enough times.

The same applies to trading or betting. We need to make thousands or thousands of bets to truly see if we have a real advantage.

This is why risk management and controlling betting size are so important.

Even if your expected return (EV) is positive, you will never gain an advantage if you overleverage or let volatility devour your funds before the mathematical calculations are complete.

Long-term winners are not always the smartest; they are simply those who can persist long enough to allow their advantages to accumulate.

Expected earnings (EV) and a differentiated advantage (Edge) are the only ways to make a profit.

In Polymarket (or any prediction market), real profits come from differentiated advantage, not belief.

Currently, Polymarket’s market efficiency remains relatively low, which presents an opportunity. However, as trading volume and liquidity increase, these differentiating advantages will disappear.

You must strive to generate excess returns (Alpha).

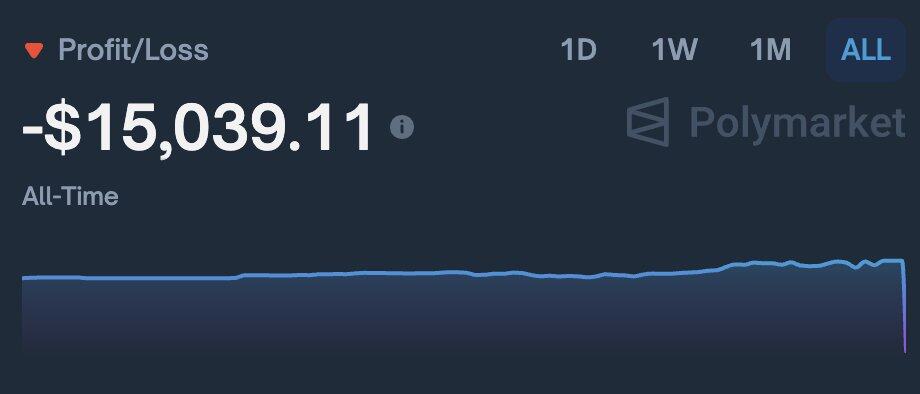

I’m still down $15,000, but I won’t give up. I still believe in the process, in EV (Effective Value), in self-discipline, and in learning faster than others.

One of the best things about Polymarket is that it’s publicly available on the blockchain. You can’t fake results or hide losses. My portfolio is also visible to everyone.

My current goal is to achieve a total trading volume of over $1 million before the POLY token airdrop and turn a profit.

Bài viết này được lấy từ internet: A Polymarket Top 0.7% Winner’s Account: How to Lose $19,000 in One MinuteRecommended Articles

By integrating Chainlink’s industry-leading oracle network, X Layer developers now have direct access to high-quality, tamper-proof market data. This data infrastructure is trusted by approximately 70% of Web3 projects to support secure DeFi, trading, and automation. Significance for X Layer By joining the Chainlink SCALE program, X Layer will cover the costs associated with oracles and cross-chain services, enabling developers to access Chainlink’s advanced data sources and cross-chain tools at minimal or even zero cost. This significantly reduces operational expenses, improves development efficiency, and allows teams to focus on building high-impact applications without being distracted by infrastructure management. Chainlink CCIP functionality on the X Layer includes: Deep security protection : Utilizing the same infrastructure to safeguard over $100 billion in DeFi TVL. Tamper-proof data access : Ensures accurate pricing, manageable…