Toàn văn bài phát biểu của Arthur Hayes Token2049: Thị trường có thể sụp đổ sau khi cắt giảm lãi suất, nhưng Ethereum có thể hoạt động tốt

Compiled by: Weilin, PANews

Its fucking fed day, at Mã thông báo 2049 held in Singapore on September 18, Arthur Hayes, CIO of Maelstrom Fund, delivered a keynote speech on the macroeconomic environment, and his first sentence caused screams from the audience. In the early morning of September 19, Beijing time, the Federal Reserve is about to hold an interest rate meeting, which is also the most important decision this year. The Federal Reserves decision on interest rate cuts is directly related to the future market trend.

Hayes said there is about a 60% to 70% chance that the Fed will choose a 75 or 50 basis point rate cut. Hayes made an interesting prediction about the prospects of ETH, arguing that falling U.S. Treasury rates may indeed make high-yield tokens more attractive. He compared Ethereum to Internet bonds and further analyzed its potential. He emphasized the Japanese yen many times and reminded everyone to pay attention to the exchange rate between the US dollar and the Japanese yen, which is the only thing that matters.

The following is the speech content compiled by PANews on the spot (refer to AI translation):

I think there is about a 60% to 70% chance that the Fed will choose a 75 or 50 basis point rate cut. Before I talk about cryptocurrencies, I want to express my opinion that I think it is a huge mistake for the Fed to choose to cut interest rates in the current situation of increased intervention by the US government. I think the market will collapse in the days after the Fed cuts interest rates because it will narrow the interest rate differential between the US dollar and the Japanese yen. We saw a few weeks ago that the yen fell from 162 to 142 in about 14 days of trading, almost triggering a small financial collapse. Now, the Fed and the market expect them to continue to cut interest rates very quickly, and we will see similar financial stress again.

Back to crypto. This is one of my favorite trades in my non-crypto portfolio. I hold my short-term T-bills and collect interest. This is the yield on the 1-month T-bill, and it has been hovering around 5.5% for the past year or so after the Fed stopped raising rates.

When you have enough capital and earn a 5.5% return, you dont need to do much. Why take risks? Why try to increase value at the risk of capital preservation? When people have a lot of assets, they are reluctant to take certain actions because they can easily make money by holding short-term Treasury bills. This situation has a ripple effect in financial markets, including the cryptocurrency market. I want to ask you, who is the loser in the case of a changed interest rate environment? When short-term Treasury bill rates fall, the interest income that can be generated by holding the safest risk-free asset is a question worth pondering.

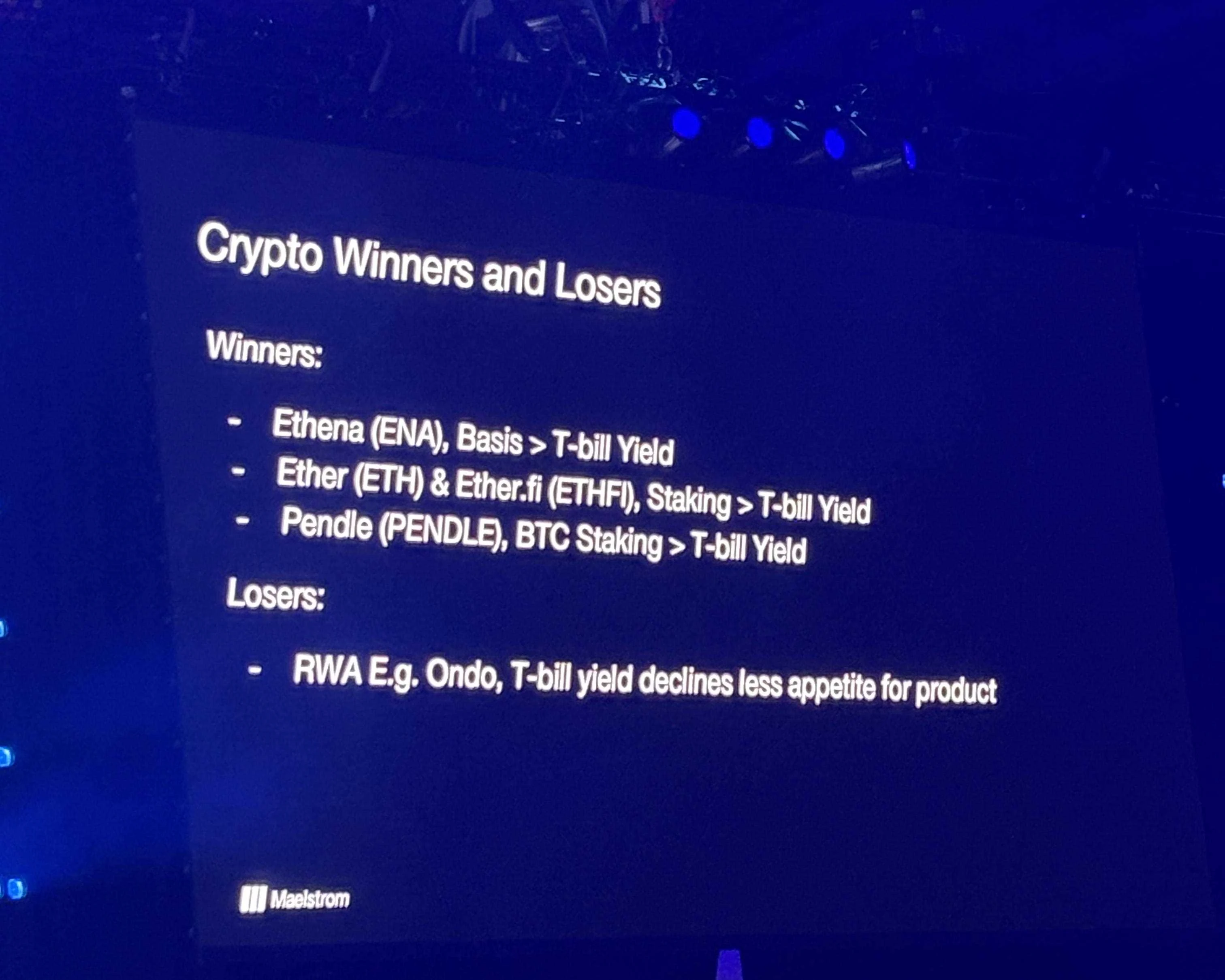

The first reaction was a comparison between the five Ethereum assets – I disclose that I hold a large number of these assets. Fortunately, I am not invested in any apartments, but the bottom line is that this portfolio is very adaptable to a falling interest rate environment. Basically, it means that I have invested in a lot of projects that provide users with interest income in different forms.

Currently, these yields are either slightly above or slightly below the interest rates on short-term Treasury bills, which puts pressure on price performance. After all, why invest in riskier DeFi applications when you can just call your broker and put your money in Treasury bills to earn 5.5%?

Now, there are some programs that do very well in a high interest rate environment. Im just using Ondo as an example, but there are many other types of real world asset (RWA) programs. Basically, these programs are like, You need to buy Treasury bills, well buy them, put them in some legal structure, and then give you a certificate that pays interest. These programs are a one-way bet that interest rates will go up and stay high. But when interest rates go down, there is no need for these products.

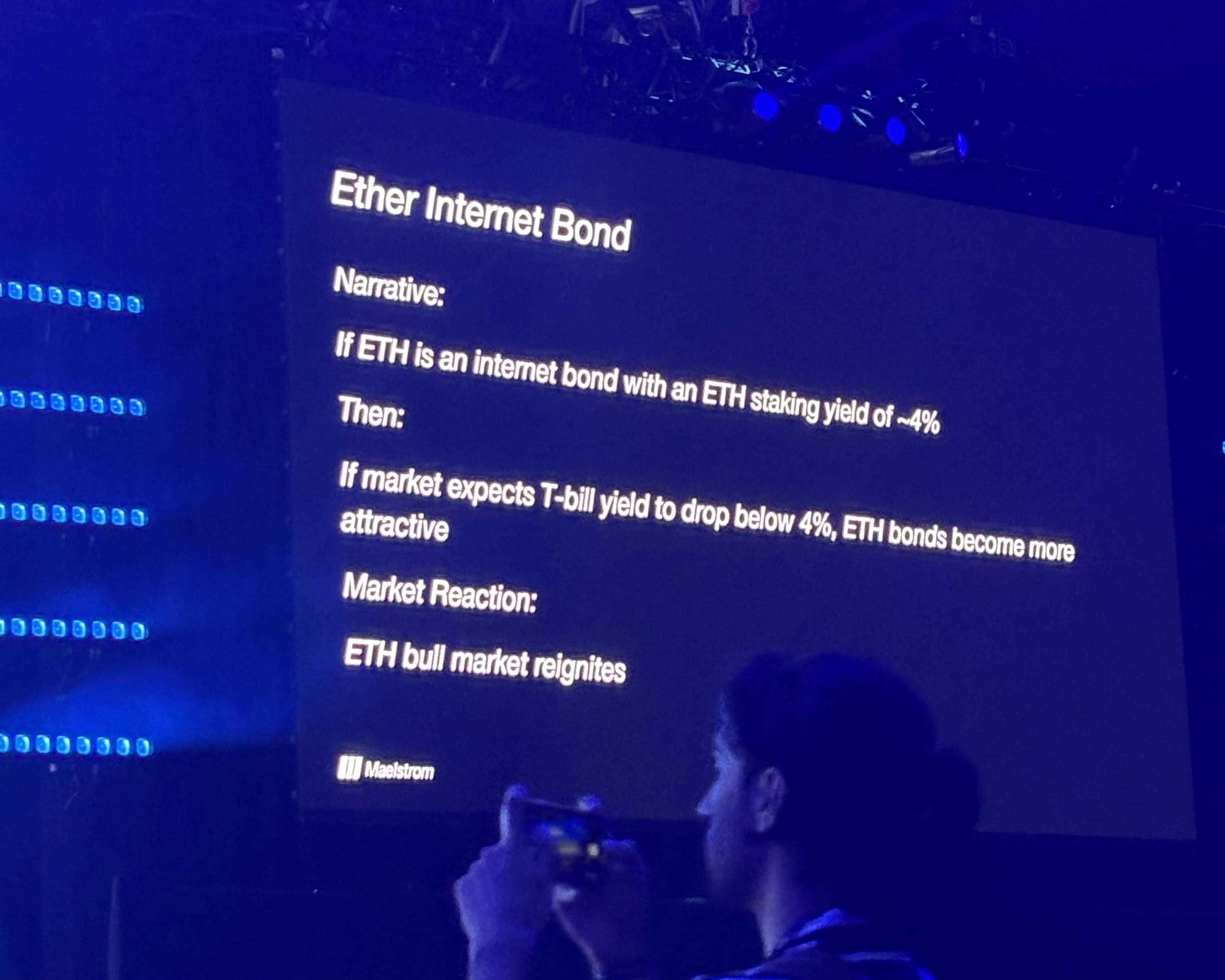

First, Ethereum. A lot of people hear Ethereum and think it hasnt made a big change. The main discussion point about ETH is that it is seen as an internet bond. If it is an internet bond with an annual yield of 4%, and short-term Treasury bills have a yield higher than that, then investors will naturally prefer Treasury bills. But if Treasury yields fall rapidly (which I think they will), then Ethereum becomes more attractive, and the return I get by holding Ethereum may exceed the return I can get by holding US dollars.

As you can see, interest rates are falling rapidly because the Fed is going to cut rates and the market is going to fall. Then they will say, Lets keep doing this because this is the way to solve the problem. Currently, what we can see is that the yields are basically staying in a line, and Ethereums yield is between 3% and 4%, which is not enough for holders, which is why I dont hold it.

As you can see, Ethereum has far underperformed Bitcoin in the current bull run. With ETH staking (ETHfi), you can stake your Ethereum, but apparently this strategy has also suffered. The yield after staking is only about 3%, which is not a good return after deducting fees. We need Treasury yields to fall faster so that the yield on Ethereum becomes more attractive.

Why is this a minor issue? Because traders use leverage, and they pay fees for that leverage. This has been going on for years. This is how I got started in crypto: I created a base trade, applied these strategies. It was a relatively simple approach, you just put money in and you earn. Again, this is a risky loan, not comparable to the security of a U.S. Treasury. If you are an investor looking for yield, and Ethereum doesn鈥檛 offer an attractive yield relative to Treasuries, you probably won鈥檛 put your assets into this protocol.

Heres a chart showing Ethenas yield versus Treasuries from earlier this year. This is very fascinating. Were seeing 30%, 40%, 50%, 60%, etc. yields relative to 5.5%. Id put my money into this product. But right now, its actually yielding around 4.5%. So the price is depressed because people are asking, why would I put my money into a protocol that doesnt yield as much as a Treasuries?

Another thing were going to talk about is interest rate derivatives agreements that allow you to trade fixed and floating rates. Theres a new product that just launched that allows you to stake your crypto and earn a fixed yield through a loan buy-side agreement. While this yield is attractive, it comes with some risk. I dont think the yield is high enough to attract a large number of people to switch from a 5.5% Treasury yield to this product. Similarly, if the yield drops, more people may not want to take this interest rate risk.

Again, you can earn up to 9% right now with this strategy. This was just launched a few weeks ago. Thats a high yield, very attractive compared to 4.5%. For some people, although there are risks and smart contract risks, a lot of rate-sensitive investors may not think that the yield is high enough, but if I can earn 5.5% interest rate, you can try Pendle. Obviously, it has given back 50% to 60% of its gains, but if the yield is significantly higher than the Treasury yield, it will be very attractive.

Ive talked about how a lot of crypto projects are terrible. The main reason is because of interest rates, and I can do these things in a much cleaner and cheaper way instead of paying a high price to buy some low liquidity token. But at the end of the day, these protocols provide a valuable service to people who dont have a US brokerage account or cant access traditional investments. There are a lot of very wealthy people in this room, and if you go to your personal banker, theyll probably recommend something that has nothing to do with US Treasuries because they dont make a lot of money from them. Treasuries are very cheap to hold.

These protocols are very attractive to certain types of investors, especially those who want an easy 5.5% yield. But if we expect central banks to aggressively cut rates in a deteriorating economic environment or financial crisis, then the reason to put money into these RWA (real world asset) protocols is gone. Why should I take smart contract risk to earn 1% or 2% yield? Therefore, I believe that a lot of TVL (total value locked) projects that rely on high-yield treasuries will suffer when interest rates fall. I use Ondo as an example. I just pulled its information off the website last night. It has a market cap of $6 million, a very low FDV (fully diluted market value), and you can earn 5.35% in their stablecoin. We expect yields to fall by 25 to 50 basis points now, and there will be more changes in the future.

On a relative basis, if you look at the other charts that theyve put out, theyre trading below where they were when they went public earlier this year, and I think thats because were in a high interest rate environment. Their product is reasonable, but as I mentioned quickly, we have about five minutes now. I want to get into the details now about why I think the more the Fed cuts rates, the more unhappy the market will be about whats going to happen next. I really want you to remember, if you only remember one thing tonight, its this: when youre drunk at a party somewhere, open your phone and check the dollar against the yen. Thats the only thing that matters. Because if the Fed suddenly cuts rates by 50 or 75 basis points, youre going to see a very negative reaction in the dollar.

Again, since the Bank of Japan is raising rates and the US central bank is cutting rates, in theory the exchange rate should reflect the interest rate differential. Therefore, the USD/JPY exchange rate should rise, which means the nominal price you see on your screen should fall. If I expect the central bank to unexpectedly cut rates by a large margin, or if they show very aggressive rate cut expectations in the dot plot (the dot plot is a tool that the central bank uses to ask each official what they expect interest rates to be over a period of time in the future), we will see a big appreciation of the yen.

What does this mean? The yen carry trade is probably one of the most commonly used trading strategies of the past thirty years. As an individual investor, a company, or a central bank, I borrow yen at little to no interest cost, sometimes even at no cost. I then invest these borrowed funds in assets with higher returns.

These assets may include US stocks, the Nasdaq, the SP 500, or even real estate and US Treasuries. This type of trading is estimated to involve up to $20 trillion in exposure worldwide, all by people who invest by borrowing yen.

If this rate appreciates quickly, your profits will be wiped out very quickly. Therefore, your risk manager will remind you to cover risk. This means you will sell assets, sell stocks (very liquid), sell Treasuries (very liquid). Japan is the worlds largest creditor, so US Treasury Secretary Powell and Yellen need to keep an eye on this. I think the US election is about 40 to 50 days away. The last thing they want to happen is Trumps approval rating is high and the SP is down 20%. This is why I believe they will aggressively cut rates. They will see the yen appreciate and provide more money supply, which should drive all the trades I talked about in my speech today. So even though I talked a lot about cryptocurrencies, the key point I want you to remember is: watch the exchange rate between the US dollar and the yen. That is the only thing that matters.

This article is sourced from the internet: Arthur Hayes Token2049 speech full text: The market may collapse after the interest rate cut, but Ethereum may perform well

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, Binance Labs announced the first batch of projects selected for the seventh season of incubation , including Astherus, CYCLE NETWORK, DILL and EigenExplorer. Their concepts and businesses are relatively cutting-edge, and the former two have launched early interactive activities, which are linked to future airdrops. Odaily will analyze the business, characteristics and interactive activities of each protocol in this article. Astherus: Liquidity Center for LRT Assets Agreement business The re-staking market space for BTC and ETH is as high as $20 billion and is still growing rapidly. Re-staking allows blockchain validators to deposit ETH or Liquid Staking Tokens (LST) into the platform, receive APR rewards and protect the network. But Astherus believes that most re-staking protocols…

哈哈

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”