Is Crypto Over? Don’t Give Up, Liquidity Relief is on the Way

Compiled by:CryptoLeo (@LeoAndCrypto)

This morning, Raoul Pal, CEO of Real Vision and GMI (Raoul Pal’s investment bible), published an article titled “False Narratives….and Other Thoughts“. Through data comparison and macro analysis, he explained the recent downturn and crisis facing the kripto industry, stating that the industry winter will pass soon, and everyone needs to be patient and not lose faith in the industry. Odaily has translated it as follows:

These are insights I derived while writing for GMI over the weekend, hoping to bring you some confidence. I would usually keep this content for discussions within GMI and Pro Macro, but I know you all need this to ease your tense nerves.

Mainstream Narrative: Is Crypto Over?

The mainstream view is that Bitcoin and cryptocurrencies have crashed, this cycle is over, everything is finished, and it can’t be like before. Cryptocurrencies have decoupled from other assets; this is CZ’s fault, it’s BlackRock’s fault, etc. This is undoubtedly an attractive narrative trap, especially when mainstream coin prices are plummeting daily.

But yesterday, a GMI hedge fund client sent me a brief message asking if they should buy the dip in SaaS stocks, or if, as everyone is saying now, Claude Code has already killed the SaaS industry.

So I started researching SaaS, and in the process, I found that the conclusions I reached overturned both the mainstream narrative about Bitcoin and the narrative about the SaaS industry. Do SaaS and BTC have exactly the same chart patterns?

UBS SaaS Index vs. Bitcoin Price Movement

This indicates there is another factor affecting this trend that everyone is overlooking.

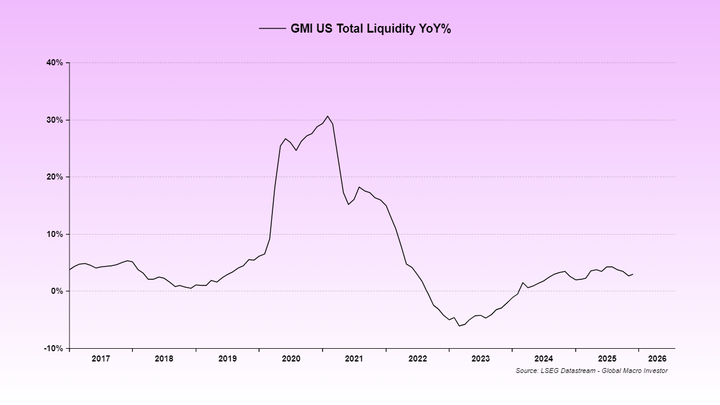

This factor is: US liquidity has been suppressed due to two shutdowns and issues with the underlying US financial system (the liquidity from the reverse repo mechanism was only fully replenished in 2024). Therefore, the TGA (Treasury General Account) rebuild in July and August lacked corresponding monetary offset measures, leading to a reduction in liquidity.

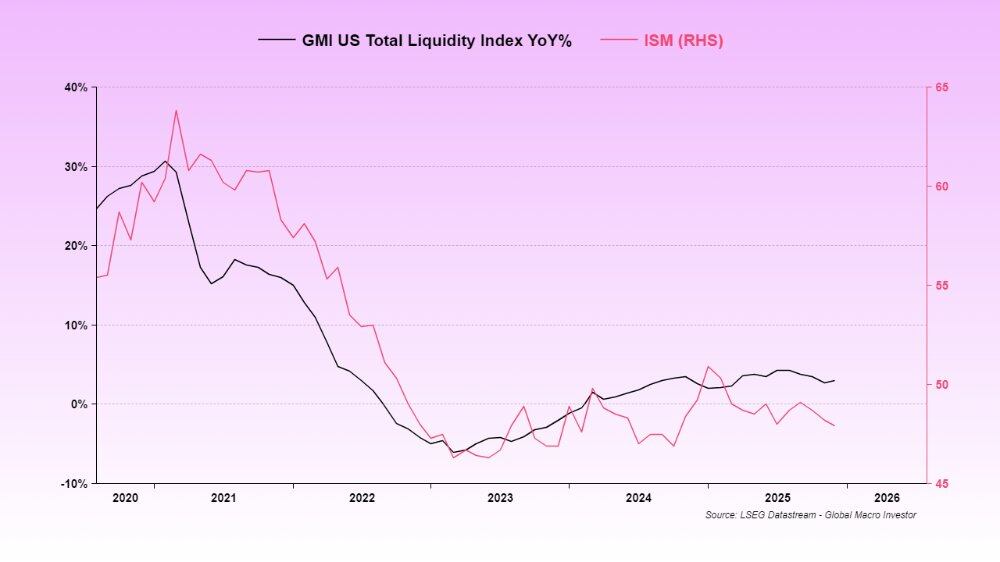

So far, the low liquidity is the reason the ISM Manufacturing Index has remained low.

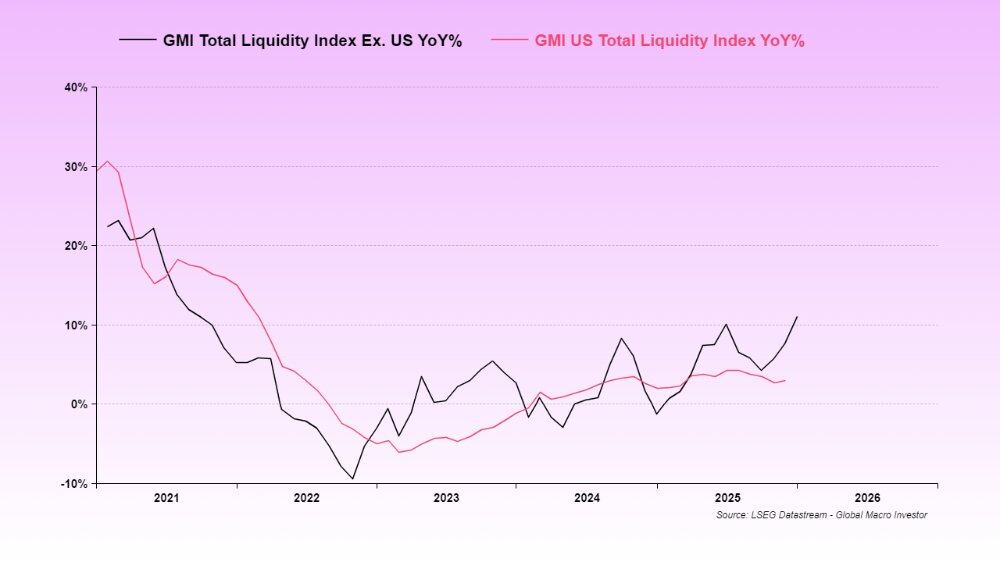

We typically use the Global Aggregate Liquidity indicator because it has the highest long-term correlation with BTC and the Nasdaq, but at this stage, US Aggregate Liquidity seems more important because the US is the primary provider of global liquidity.

In this cycle, the GMI Global Aggregate Liquidity Index is leading the US Aggregate Liquidity Index and is about to rebound (thus also driving the ISM index).

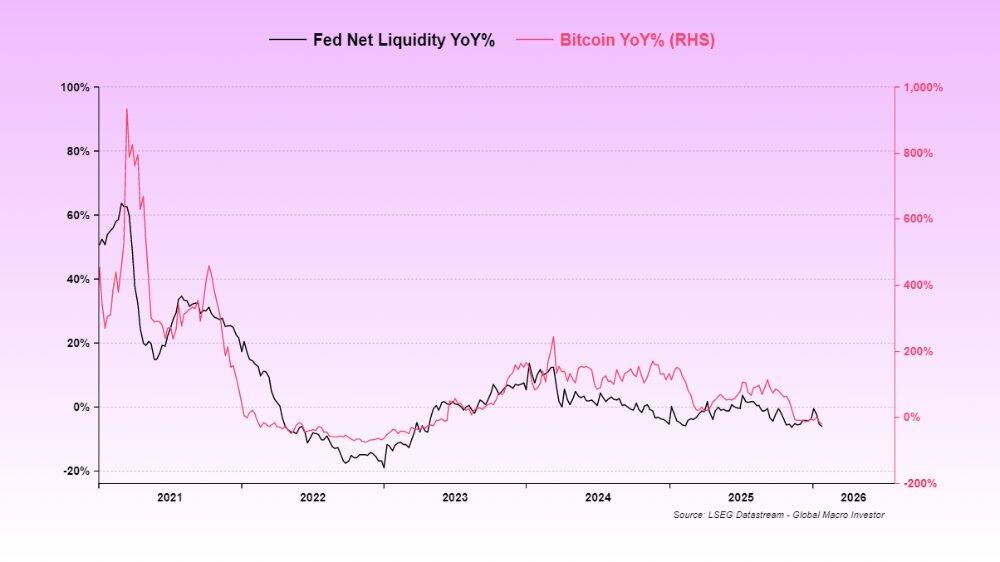

This is precisely what is affecting SaaS and BTC. Both assets are among the longest-duration assets in existence and have fallen due to the temporary withdrawal of liquidity.

The rise in gold has essentially sucked out the marginal liquidity from the system that might have flowed into Bitcoin and the SaaS market. There isn’t enough liquidity to support these assets, so high-risk assets are being hit and falling. There’s really no way around it.

Now, with the US government shutdown again, the Treasury has taken preventive measures: after the last government shutdown, they did not use any TGA funds; instead, they increased the asset size (i.e., further loss of liquidity). This is the crisis we are currently facing, causing violent price swings, and the cryptocurrencies we love still lack liquidity.

However, signs indicate that this government shutdown will be resolved this week, clearing the last liquidity obstacle.

Odaily Note: US House Speaker Johnson stated in an interview on NBC News’ “Meet the Press” on Sunday that he believes he has secured Republican support votes to ensure the shutdown of some government agencies ends by Tuesday.

I have mentioned the risk of this government shutdown many times before, but it will pass soon, and then we can continue to deal with the upcoming liquidity injections, which include measures from eSLR, partial TGA runoff, fiscal stimulus, and rate cuts, all related to the mid-term elections.

Odaily Note: US regulators’ bill to relax leverage ratio requirements to alleviate capital pressure on major banks like Bank of America (BAC.US).

In a complete trading cycle, time is often more important than price. Prices may be hit hard, but as time passes and the cycle evolves, everything gets resolved and eventually settles.

This is why I have always emphasized “patience”. Events need to unfold. Obsessing over profit/loss ratios only affects your mental health, not your portfolio.

The Fed’s False Narrative

Regarding the rate cut issue, another false narrative is that Kevin Warsh is a hawk. This is complete nonsense; these statements are mainly from over 18 years ago.

Warsh’s job and mission were to execute the strategy of the Greenspan era. Both Trump and Besant have said (not detailed here, but the main direction is rate cuts) to keep the economy hot, assuming that productivity gains from AI will suppress core CPI increases (like the 1995-2000 era).

Odaily Note: Greenspan is one of the longest-serving chairs in Fed history. His advocated monetary policy (controlling inflation + promoting maximum employment) was highly flexible but practically prioritized fighting inflation while actively injecting liquidity during crises.

He doesn’t like the balance sheet, but the system is reserve-constrained, so he is unlikely to change its current practice, otherwise, it would destroy the credit market.

Warsh will cut rates and do nothing else. He will not interfere with Trump and Besant’s actions to manage liquidity through banks. Fed Governor Milan will likely forcefully push for a comprehensive eSLR reduction to accelerate this process.

Don’t believe me? Then believe Druck ↓

The above chart shows “investment guru” Stanley Druckenmiller’s content on Warsh’s monetary policy philosophy and his agreement with Besant upon becoming Fed Chair.

I know how difficult it is to hear an optimistic narrative when the crypto market looks so dark. My SUI holdings are terrible, and we don’t know what or who to believe anymore. First, we’ve been through this many times before. When BTC drops 30%, altcoins can drop even 70%. But if they are high-quality alts, their rebound is also faster.

Mea Culpa (My Fault)

GMI’s mistake was not considering US liquidity as the current driving factor; usually, Global Aggregate Liquidity dominates the entire cycle. But now the situation is clear, anything is possible.

The two are not unrelated. We just couldn’t predict the combination of a series of events (Reverse Repo draining liquidity > TGA rebuild > Government shutdown > Gold surge > Shutdown again), or we failed to anticipate their impact.

It’s almost over, and soon we can get back to normal work.

We can’t guarantee every link is error-free (now with a deeper understanding), and we remain very bullish on the 2026 outlook because we understand the Trump/Besant/Warsh strategy. These three have repeatedly told us: we just need to listen and be patient. In full-cycle investing, time is more important than price.

If you are not a cycle investor and don’t have that strong risk tolerance, that’s completely fine. Everyone has their own style, but Julien (GMI Head of Macro Research) and I are not good at swing trading (we don’t care about intra-cycle ups and downs), but we are proven and have a track record in full-cycle investing, leading the industry for the past 21 years. (Warning: We also make mistakes, like in 2009). Now is not the time to give up. Good luck, and let’s achieve greater results in 2026.

Liquidity relief is on the way!

Artikel ini bersumber dari internet: Is Crypto Over? Don’t Give Up, Liquidity Relief is on the Way

Introduction: Three Forces Driving Global Trading Phenomena Bitget’s internal data shows a significant surge in tokenized US stock trading activity during the recent earnings season (mid-October to late November). Pasar participation was exceptionally high during this period, with demand surging by a record 450%. This growth momentum was evident in both the spot and futures markets, with trading volume increasing by 452% and 4,468% respectively compared to the previous period. This earnings season frenzy is not an isolated event, but rather driven by three powerful and interconnected forces that are defining a new era for global stock trading. These three forces are the characteristics of the trading instruments, the global accessibility offered by the 24-hour market, and the unique behavioral patterns exhibited by participants. This report will analyze these three…