BitMart Weekly Market Report (December 9 – December 15)

This Week’s Crypto Pasar Updates

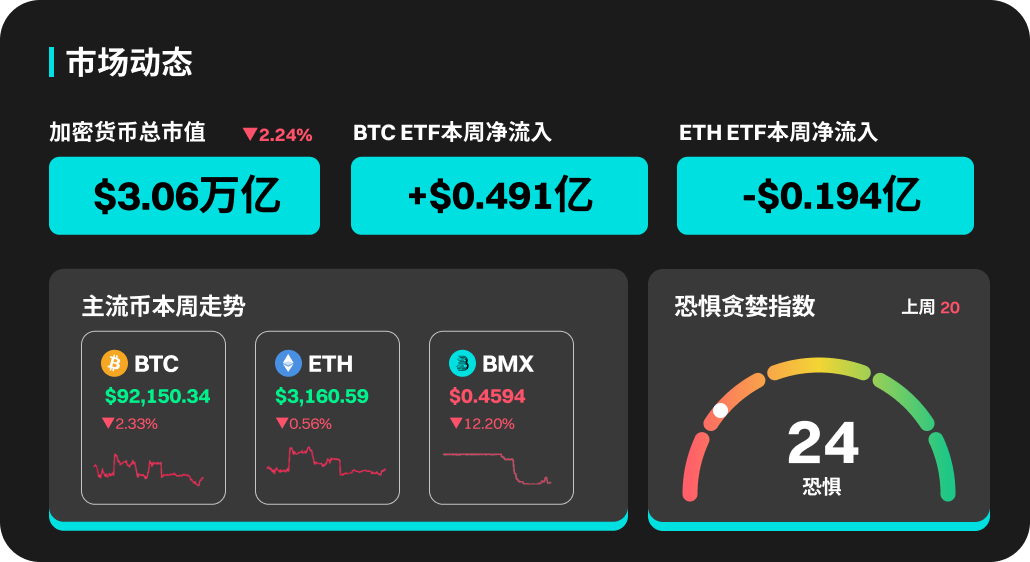

The kripto market remained volatile at high levels this week, with BTC fluctuating widely between $88,200 and $94,300, influenced by divergent macroeconomic signals. The Federal Reserve cut interest rates by 25 basis points as expected in December, but simultaneously released hawkish guidance, suggesting only one more rate cut in 2026; it also announced a $40 billion monthly purchase of short-term Treasury bonds starting in mid-December (interpreted by some as “QE-Lite”). With inflation still above target (around 3%) and the unemployment rate rising to 4.4%, stagflation concerns intensified, leading to cautious sentiment towards risk assets and continued safe-haven flows into gold and silver. Despite relatively flat price performance, positive developments emerged at the industry level. On the regulatory front, the Abu Dhabi Global Market (ADGM) issued key licenses to Binance and Circle, creating an institutional-level gateway for “compliant exchanges + compliant stablecoin issuers,” significantly enhancing the Middle East’s attractiveness to institutional funds. In terms of institutional activity, Citadel participated in Ripple’s $500 million funding round, boosting market confidence with its strict buyback and return guarantee terms; meanwhile, the XRP ETF has outperformed other mainstream crypto ETFs since its listing.

Overall, macroeconomic uncertainties continue to limit short-term upside potential, but clearer regulations and increased institutional participation are laying the foundation for medium- to long-term capital inflows.

Popular cryptocurrencies this week

Among popular cryptocurrencies, M, MERL, MYX, MNT, and XMR all performed well, ranking in the top five in terms of percentage increase. M’s price rose 35.48% this week. MERL’s price rose 30.04%. MYX’s price rose 25.59%. MNT and XMR rose 13.01% and 7.72% respectively this week.

US Market Overview and Hot News

The US market remained relatively stable this week, with risk sentiment leaning towards caution. US stocks closed slightly higher, with the S&P 500 and Nasdaq recording modest gains, but the technology sector faced significant pressure. Oracle plunged nearly 11% in a single day due to lower-than-expected revenue, dragging down major AI concept stocks such as Nvidia and Alphabet. In the foreign exchange market, the US dollar index weakened throughout the week after the Federal Reserve confirmed its December rate cut as expected. In commodities, crude oil declined due to expectations of slower demand in 2025, particularly with concerns about peaking demand in China exacerbating market anxieties; gold closed slightly higher, with precious metals generally supported by macroeconomic uncertainties. The bond market was relatively stable, with limited interest rate volatility amid policy divergence between the Fed’s rate cut and the Bank of Japan’s rate hike. Market volatility continued to decline, and the Fed’s decision, lacking surprises, stabilized sentiment in both stocks and bonds. Overall, risk assets remained cautiously watched, with a coexistence of mild stagflation and economic divergence at the macro level, and the market remaining highly sensitive to future policy paths.

On December 15, the U.S. Securities and Menukarkan Commission (SEC) Cryptocurrency Working Group will hold a public roundtable discussion on financial regulation and privacy.

On December 17, Coinbase Global Inc. announced plans to launch a prediction market and tokenized shares this week.

On December 17, HASHKEY announced plans to raise up to HK$1.67 billion and is expected to be listed for trading on December 17.

On December 18, the U.S. Bureau of Labor Statistics will release the November CPI report, while canceling the release of the October CPI.

The Bank of Japan will announce its interest rate decision on December 19.

Project unlock

Starknet (STRK) will unlock 127 million tokens at 8:00 AM Beijing time on December 15th, representing 5.07% of the circulating supply, worth approximately $13.2 million.

Sei Network (SEI) will unlock approximately 55.56 million tokens at 8 PM Beijing time on December 15th, representing 1.08% of the circulating supply, with a value of approximately $7.1 million.

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 PM Beijing time on December 16th, representing 1.90% of the circulating supply, with a value of approximately $19.7 million.

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7 PM Beijing time on December 20th, representing 6.79% of the circulating supply, with a value of approximately $38.6 million.

Lista DAO (LISTA) will unlock approximately 33.44 million tokens at 5 PM Beijing time on December 20th, representing 6.85% of the circulating supply, with a value of approximately $5.5 million.

Peringatan risiko:

Using BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve a significant risk of loss. Past, assumed, or simulated performance is not indicative of future results.

The value of cryptocurrencies may rise or fall, and buying, selling, holding, or trading cryptocurrencies may involve significant risks. You should carefully consider whether trading or holding cryptocurrencies is right for you, based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

Artikel ini bersumber dari internet: BitMart Weekly Market Report (December 9 – December 15)

For the past few years, the “initial public offering” (IPO) scenario in the cryptocurrency primary market has consistently operated in a regulatory gray area. Since 2018, US users have been almost completely excluded from token initial offerings. However, this situation is beginning to change. Less than a month after acquiring on-chain fundraising platform Echo for $375 million, cryptocurrency exchange Coinbase has taken another significant step. Overnight, its official token sale platform was officially announced, reopening the door for US retail investors to legally participate in token launches. Coinbase IPOs: A Structural Shift 1. From panic buying to algorithmic allocation: Improving fairness for retail investors In the past, most mainstream platforms (such as Binance Launchpad and OKX Jumpstart) adopted a “lottery” or “first-come, first-served” mechanism. Project teams tended to attract large…