Weekly Token Unlocks: STRK Unlock Accounts for Approximately 4.6% of Circulating Supply

स्टार्कनेट

प्रोजेक्ट ट्विटर: https://twitter.com/Starknet

Project Website: https://starknet.io/

Unlock Amount This Time: 127 million tokens

Unlock Value This Time: Approximately $6.34 million

Starknet is an Ethereum Layer 2 that utilizes zk-STARKs technology to make Ethereum transactions faster and cheaper. Its parent company, StarkWare, was founded in 2018 and is headquartered in Israel. Its main developed products include Starknet and StarkEx. By using STARKs, Starknet validates transactions and computations without requiring all network nodes to verify every operation. This significantly reduces the computational burden and increases the throughput of the blockchain network.

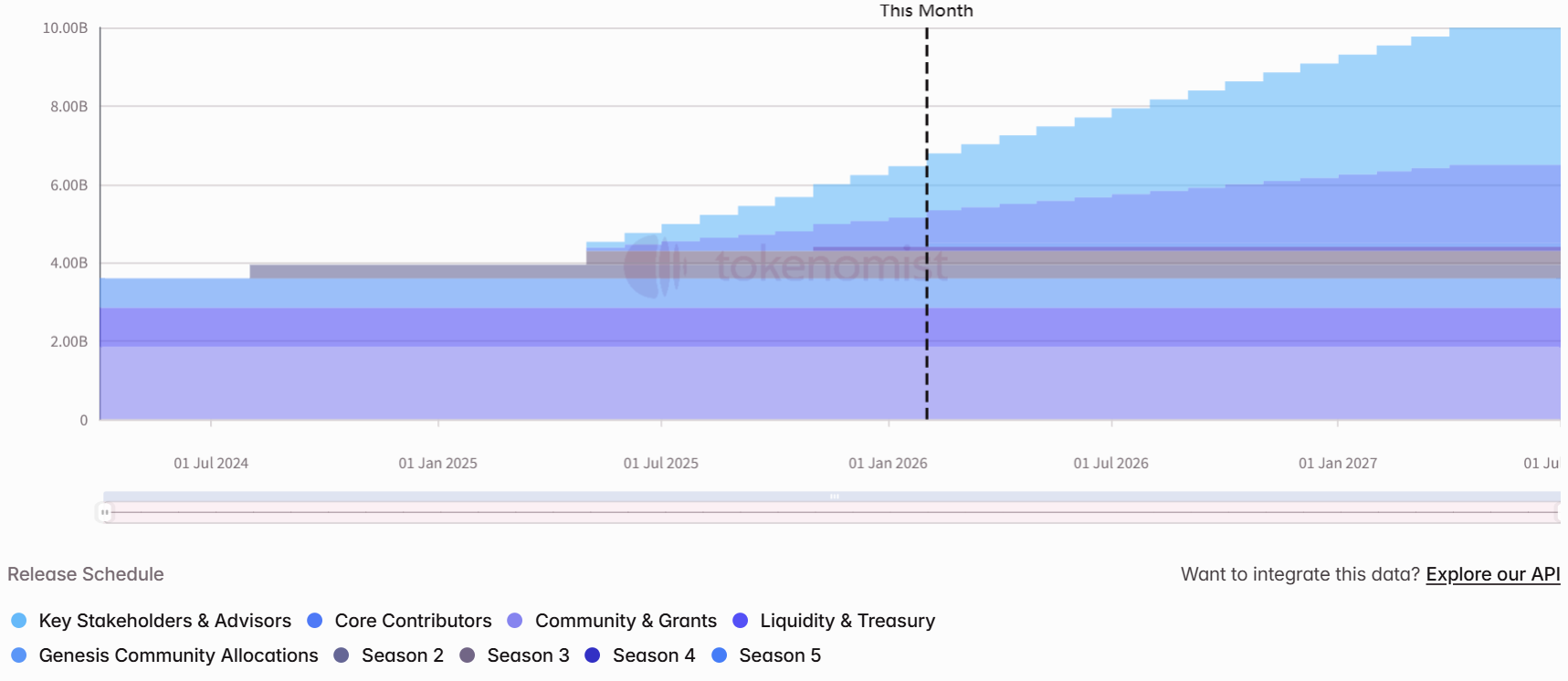

The specific release schedule is as follows:

कामिनो

प्रोजेक्ट ट्विटर: https://x.com/kamino

Project Website: https://kamino.finance/

Unlock Amount This Time: 12.5 million tokens

Unlock Value This Time: Approximately $13.63 million

Kamino is an automated liquidity solution based on the Concentrated Liquidity बाज़ार Maker (CLMM) mechanism. Liquidity Providers (LPs) seeking to improve capital efficiency can utilize Kamino’s automated market-making vaults to enhance the expected yield from fees and returns. Kamino was incubated by Hubble Protocol.

The specific release schedule is as follows:

यह लेख इंटरनेट से लिया गया है: Weekly Token Unlocks: STRK Unlock Accounts for Approximately 4.6% of Circulating Supply

Editor’s Note: After a period of continuous decline and volatility, crypto-related stocks experienced a broad-based rally last week. Companies with BTC treasuries, represented by Strategy, saw their stock prices recover. Although still significantly below their previous highs, this shows initial signs of a rebound. Meanwhile, the main market drivers are increasingly focused on events such as the nomination of the new Federal Reserve Chair, expectations for Fed rate cuts, and the progress of the U.S. CLARITY crypto bill. Considering the overall market conditions, crypto-related stocks are likely to remain under pressure. It is advisable to maintain the previous strategy of “trading short-term rebounds” and avoid going all-in. The following is a summary of last week’s crypto-stock market information compiled by Odaily. All U.S. stock data is sourced frommsx.com. Overview of…