Huiwang Payment’s Closure Crisis: Compliance Crisis in the Crypto Payment Industry and Global Regulatory Warnings

On December 1, 2025, Huiwang Payment, a subsidiary of Huiwang Group, suddenly announced the suspension of operations and the postponement of payments . Huiwang Payment’s headquarters issued a statement saying that “due to the external market environment, operational difficulties and tight cash flow, the company is unable to make payments on time” and outlined its deferred payment plan.

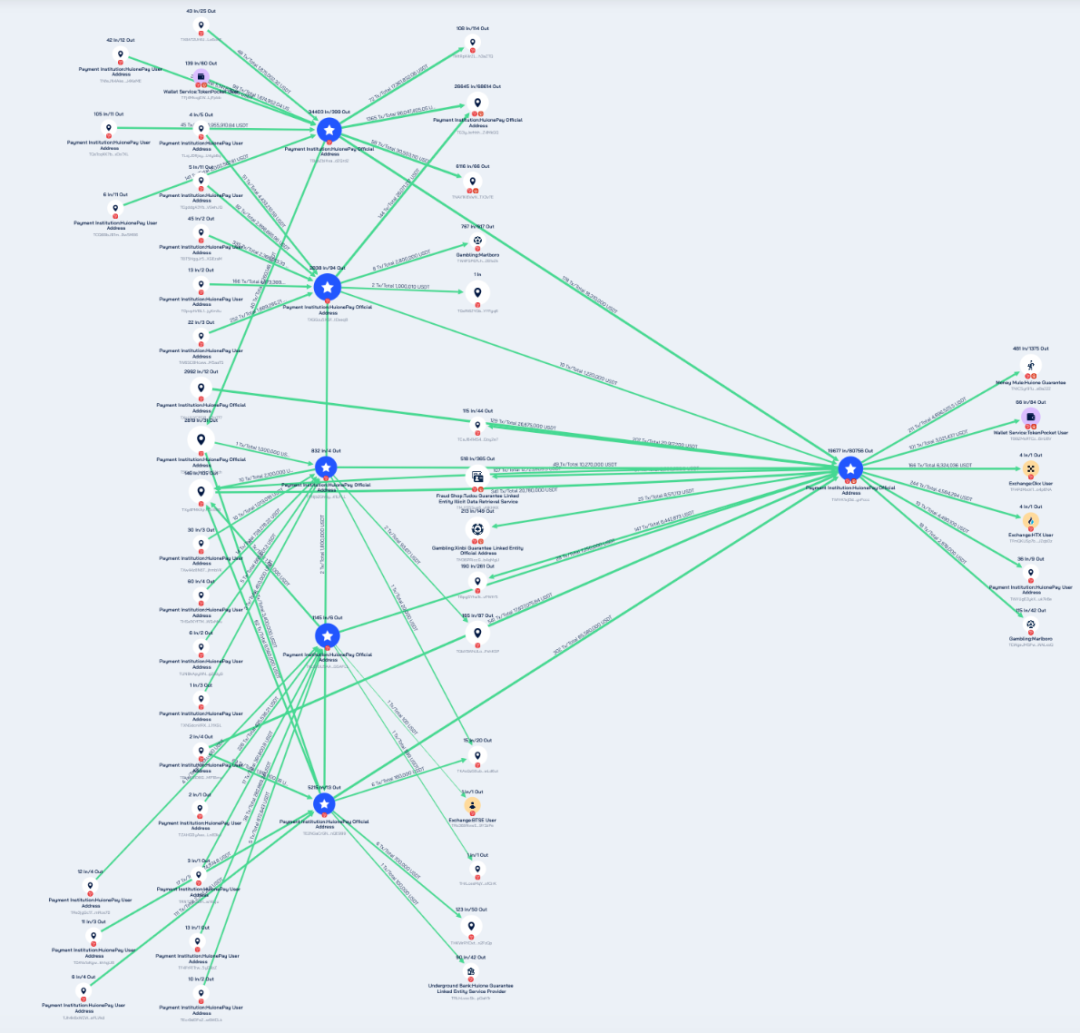

In response to the news that Huiwang Payment has suspended operations and withdrawals, the Beosin team conducted statistical analysis on the transaction data of its relevant business addresses using the blockchain tracking and analysis tool Beosin Trace and the anti-money laundering analysis platform Beosin KYT, and shared the results as follows :

Huiwang Payment: Becomes a tool for تشفيرcurrency money laundering by black and gray industries

Huione Group owns several business platforms, including Huione Pay/H-Pay, the virtual asset exchange Huione Crypto, and the guarantee platform Huione Guarantee. Huione Pay has its own dedicated payment app, offering services such as daily consumer spending/money transfers (Cambodia), cross-border payments, and cryptocurrency payments .

Through its multiple business platforms, Huiwang Group has built an efficient and automated underground fund transfer system, with Huiwang Payment serving as a crucial component. Huiwang Payment aggregates various fiat currencies, cryptocurrencies, and lifestyle services for the payment, receipt, transfer, and laundering of illicit funds.

According to the U.S. Department of Justice, Huiwang laundered at least $4 billion in illicit proceeds between August 2021 and January 2025. FinCEN found that of these $4 billion, at least $37 million in virtual assets stolen from North Korean hackers, at least $36 million in virtual assets obtained through investment fraud, and $300 million in virtual assets obtained through other online scams were laundered.

US sanctions may trigger panic and a run on banks.

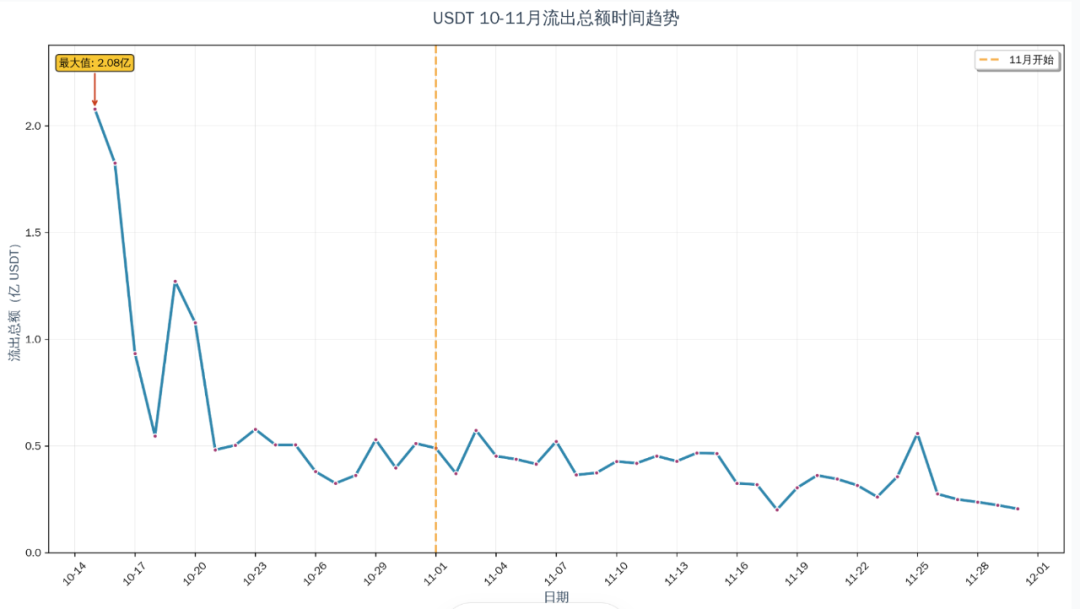

On May 1st of this year, the U.S. Financial Crimes Enforcement Network (FinCEN) issued a notice of proposed rulemaking under Section 311 of the USA PATRIOT Act, designating Cambodia-based HSBC Group as a primary target for money laundering . While the rule was not yet finalized at the time, the U.S. financial system typically reacts immediately to Section 311 proposals, often severing ties immediately after the announcement to avoid regulatory risks— however, on-chain transaction data from Beosin KYT regarding its related business addresses shows that its operational scale actually increased in May .

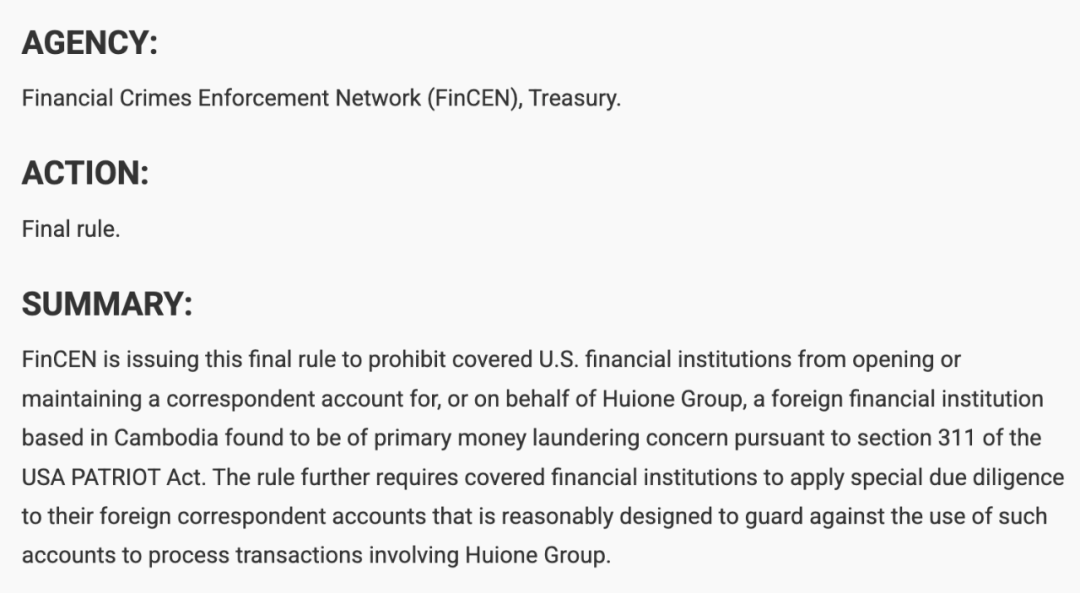

On October 14, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) and Financial Crimes Enforcement Network (FinCEN), together with the UK Foreign, Commonwealth and Development Office (FCDO), launched the largest-ever sanctions action against Southeast Asian cyber fraud groups. As part of this action, FinCEN finalized the regulations it issued in May, formally severing the HSBC Group’s ties with the U.S. financial system .

https://www.federalregister.gov/documents/2025/10/16/2025-19571/imposition-of-special-measure-regarding-huione-group-as-a-foreign-financial-institution-of-primary #footnote -20-p48297

With the rule finally taking effect, regulated financial institutions are prohibited from opening or maintaining agency accounts for HSBC Group and are required to take reasonable measures to avoid processing agency account transactions in the United States involving foreign banking institutions of HSBC Group, thereby preventing HSBC Group from indirectly accessing the U.S. financial system.

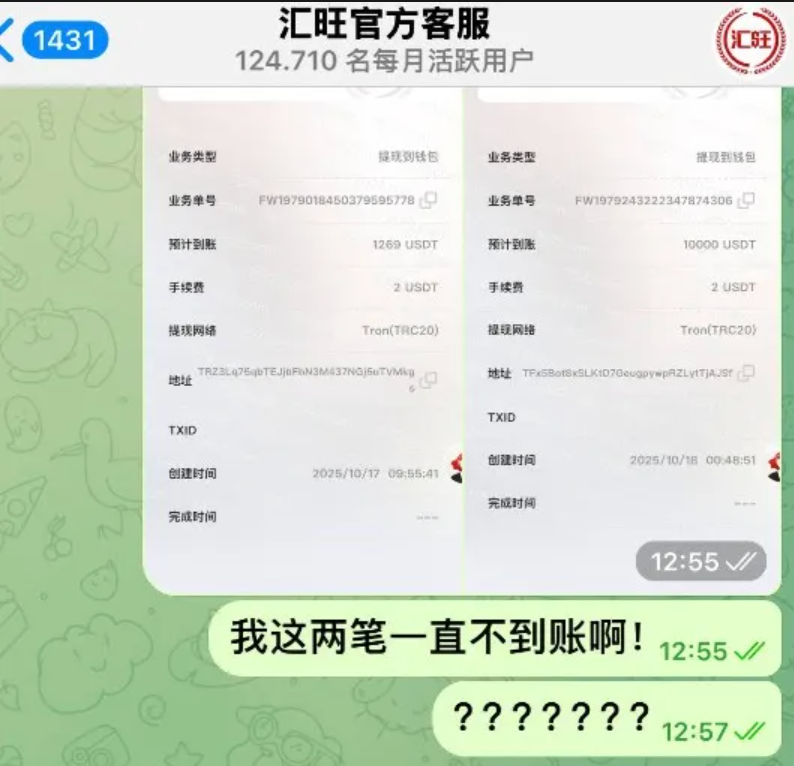

Following the announcement of the sanctions, HSBC’s clients, concerned about the safety of their funds, began withdrawing cash . According to Cambodian media reports, starting October 17th, large queues formed at multiple HSBC physical stores in Phnom Penh and Sihanoukville, Cambodia, for cash withdrawals . Beosin’s analysis of its on-chain transaction addresses also confirmed this .

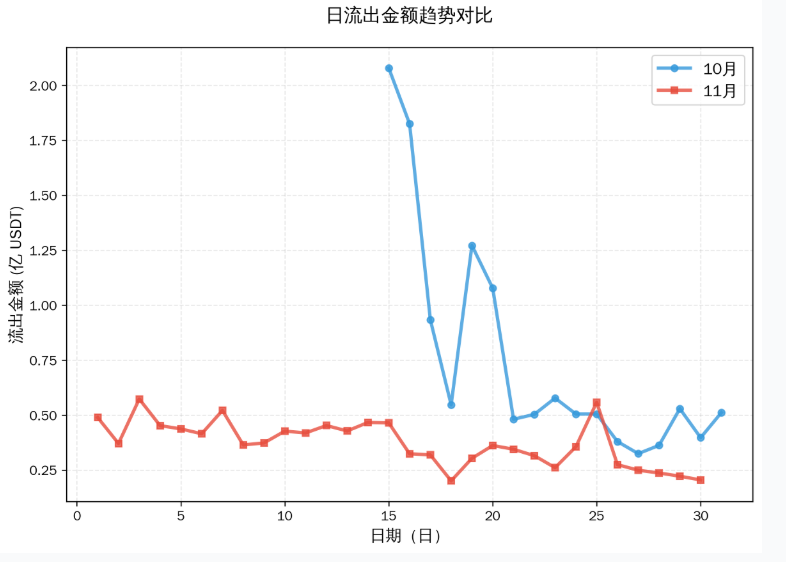

From October 15th to 17th, in response to a surge in user withdrawal requests, Huiwang Payment experienced a net outflow of over 483 million USDT from its business addresses . From October 19th to 20th, approximately 235 million USDT flowed out , with multiple instances of online withdrawal delays occurring during this period.

On November 27th, Huiwang Payment began limiting withdrawal limits, and finally announced the suspension of operations and withdrawals on December 1st. The daily outflow trend of its USDT is shown in the following figure :

After Huiwang Payment issued its delayed payment announcement, we tracked and analyzed its platform addresses using Beosin Trace and found that the USDT balance in Huiwang Payment’s related hot wallet addresses exceeded 8.17 million .

Following the announcement, Huiwang Payment quickly activated a batch of new wallet addresses, and funds are still flowing through these addresses on the blockchain .

How can encrypted payment service providers and users ensure the security of their funds?

Huiwang Payment was sanctioned by the United States for becoming a channel for money laundering and illegal transactions . The run on its platform, which ultimately led to the suspension of operations and withdrawals, served as a warning to the cryptocurrency payment industry.

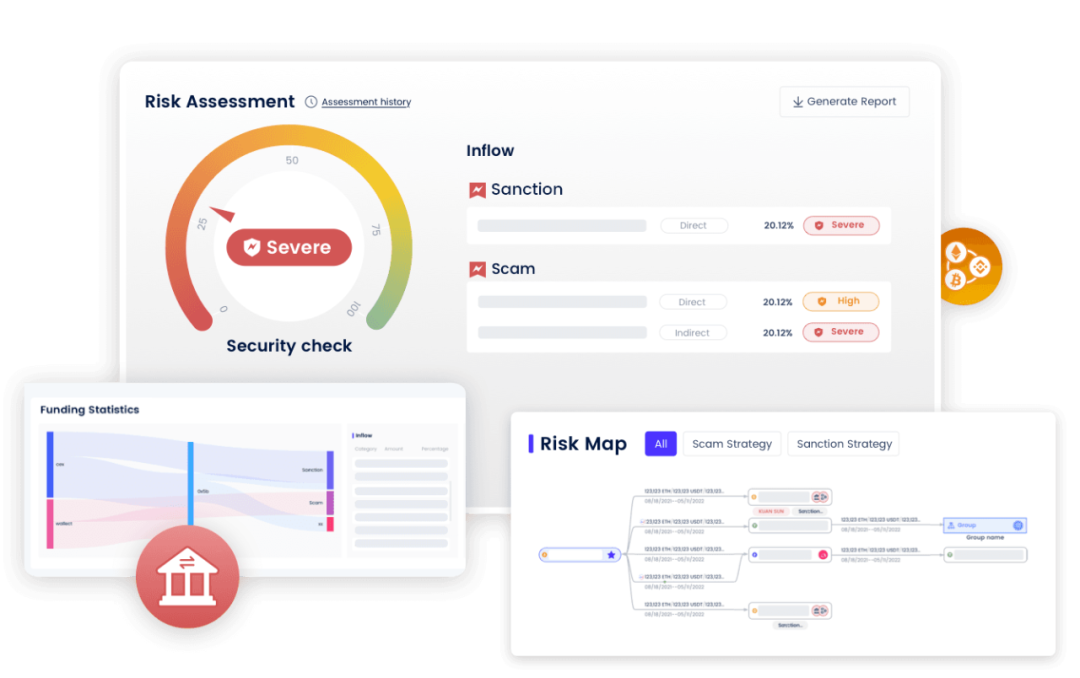

For payment companies , compliance and security are the core foundations of payment services. In the increasingly stringent global environment of crypto-based anti-money laundering and compliance, crypto payment service providers need to accelerate the construction of crypto asset anti-money laundering systems , conduct anti-money laundering compliance screenings for businesses involving crypto assets, and identify addresses involving high-risk funds .

For users , the ability to trace the complete flow of funds between trading counterparties, avoid high-risk transactions, and alert platforms to suspicious activities is a key capability to ensure the safety of their assets .

Beosin KYT: https://beosin.com/solutions/kyt

Beosin KYA Lite: https://kya.beosin.com/

News Link:

https://cc-times.com/posts/30428

https://tw.theblockbeats.news/flash/316781

https://jinbiannews.com/archives/5246

هذا المقال مصدره من الانترنت: Huiwang Payment’s Closure Crisis: Compliance Crisis in the Crypto Payment Industry and Global Regulatory Warnings

Related: Dialogue with Coinbase CBO: Why did we acquire Cobie’s Echo platform?

Guest: Shan Aggarwal, CBO of Coinbase Host: Yano Podcast source: Empire Inside Coinbase’s $375m Acquisition of Echo | Shan Aggarwal Air Date: October 21, 2025 Summary of key points Coinbase Chief Business Officer Shan Aggarwal explains the Echo acquisition. This podcast features Coinbase’s Chief Business Officer, Shan Aggarwal, as they discuss the acquisition. This episode delves into Coinbase’s strategy for bringing capital markets on-chain, Echo’s role in compliant on-chain financing, the integration of the acquisition team, tokenized stocks, prediction markets, and Coinbase’s ambition to become a comprehensive financial platform. Summary of highlights Coinbase’s ultimate goal is to completely migrate the capital market to the chain. When seeking collaboration, Coinbase will proactively express its interest directly. Overall, I would say about 75% of the contacts are proactive and 25% are passive.…