Grayscale’s Latest Disclosure: Which Crypto Assets Are on the ‘Potential Investment Targets’ List?

Original Compilation: TechFlow

As a leading mật mã asset management firm, introducing a diverse range of investable digital assets to investors is a key part of our mission.

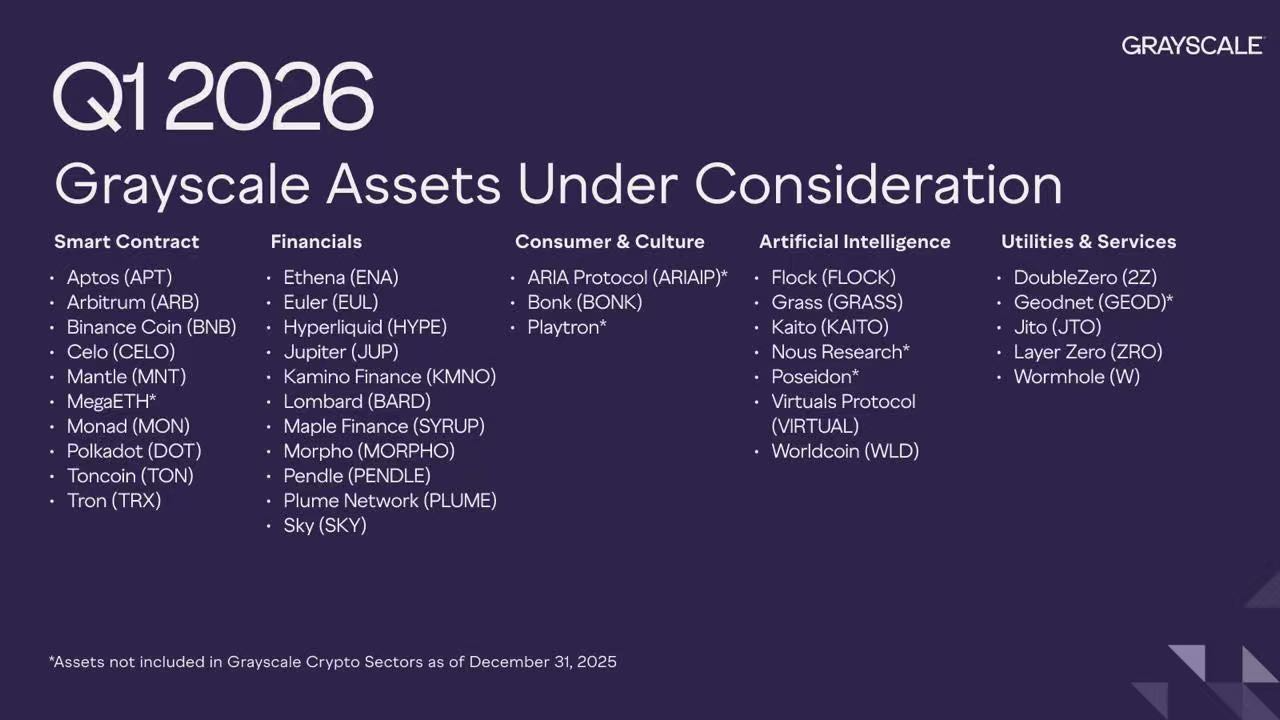

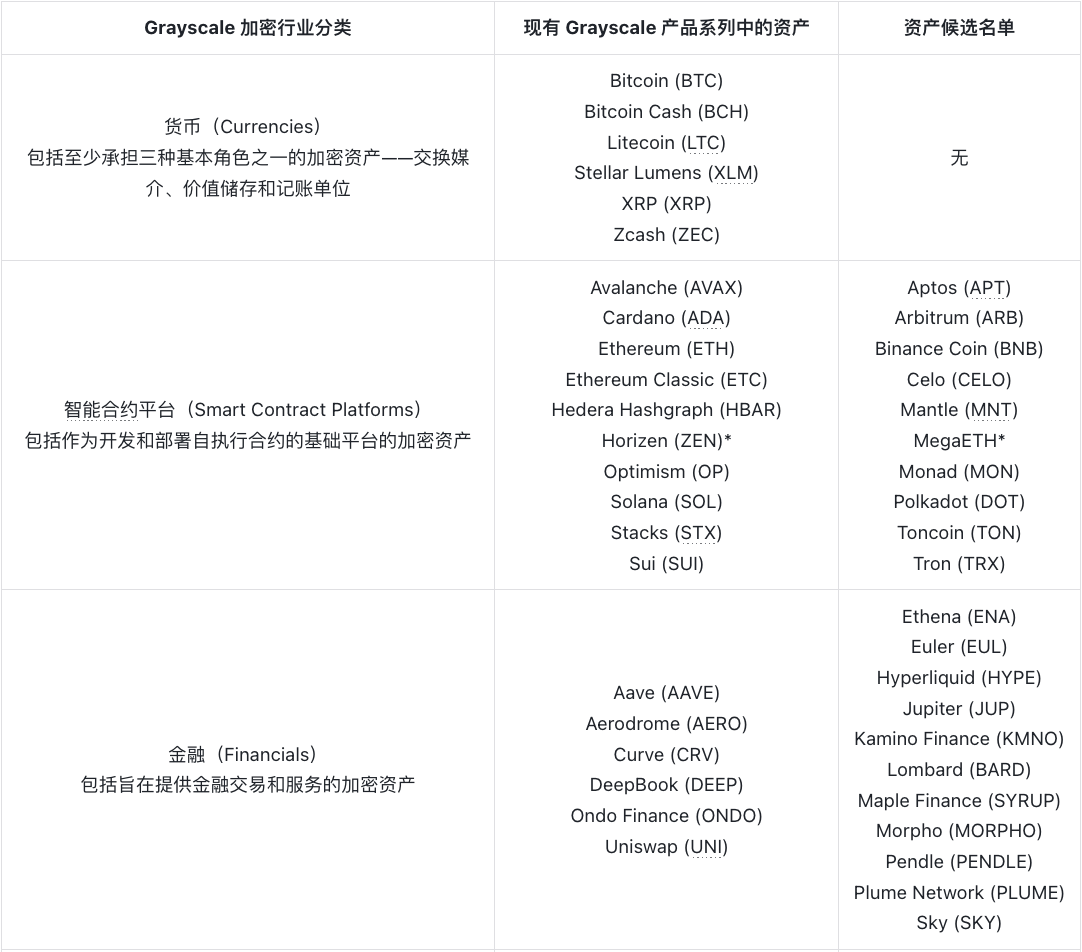

Therefore, we are pleased to share this list of assets under consideration for potential inclusion in future Grayscale investment products, along with an updated list of assets currently held within our existing product family. Both lists are grouped according to our designed Grayscale Crypto Sector Classification Framework, which aims to set a standard for organizing crypto asset categories.

The “Assets Under Consideration” list details digital assets not currently held in any Grayscale investment product but identified by our team as potential candidates for future products.

The “Assets in Existing Grayscale Product Family” list details digital assets held by Grayscale products as of January 12, 2026, which may be part of either single-asset or multi-asset products.

As the crypto ecosystem expands and the Grayscale team reviews or re-evaluates additional assets, we plan to update this list as frequently as possible, within 15 days following the end of each quarter. The lists below are as of January 12, 2026, and may change intra-quarter as some multi-asset funds rebalance their compositions and as we launch new single-asset products.

*As of December 31, 2025, assets not included in the Grayscale Crypto Sector Classification.

¹ Assets may be added to the Grayscale product family without first appearing on this list, for example, if a decision is made intra-quarter to include an asset in a Grayscale product.

The process of creating products similar to our existing investment offerings is complex and multifaceted. It involves extensive review and consideration and is subject to various factors including internal controls, custody arrangements, and regulatory requirements. It is important to note that this list is for informational purposes only, and not all assets under consideration will be converted into our investment products. Grayscale may also explore other assets not listed here for inclusion in its product family. Similarly, assets may be added to the Grayscale product family without first appearing on this list.

Grayscale may seek to have shares of new products quoted on a secondary market. While shares of certain Grayscale products are approved for trading on secondary markets (e.g., OTCQX), investors in new products should not assume that such shares will receive similar approval, as the SEC and/or FINRA may have concerns regarding the status of the product’s underlying digital asset under federal securities laws.

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction, nor shall it be deemed an offer, solicitation, or sale in any jurisdiction where such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. Grayscale, its affiliates, and clients may hold positions in the digital assets or securities discussed herein.

Bài viết này được lấy từ internet: Grayscale’s Latest Disclosure: Which Crypto Assets Are on the ‘Potential Investment Targets’ List?

Related: Former FTX employees have secured $35 million in funding to build a unique exchange.

On December 23, Architect Financial Technologies (hereinafter referred to as Architect), a fintech company founded by former FTX US president Brett Harrison, completed a $35 million Series A funding round, reaching a valuation of $187 million. This round was led by miax and Tioga Capital, with participation from ARK Invesst, Galaxy Ventures, VanEck, Coinbase Ventures, CMT Digital, and others. Back in February 2024, Architect completed a $12 million funding round, led by BlockTower and Tioga Capital. In the current bear market of the crypto market, attracting venture capital and securing tens of millions of dollars in funding is extremely rare across the industry. What makes Architect so exceptional? AX, a centralized exchange for traditional asset perpetual contracts Architect was founded in January 2023, just as the aftermath of the FTX…