On-the-spot report | Web3 lawyers interpret the latest changes in US stock tokenization

However, Nasdaq’s application is not simply to extend trading hours, but to change trading hours into two formal trading sessions:

Trading is conducted during the daytime session (4:00 AM – 8:00 PM Eastern Time) and the nighttime session (9:00 PM – 4:00 AM the following day Eastern Time). Trading is suspended from 8:00 PM to 9:00 PM, during which all unfilled orders are cancelled.

Many readers were excited upon seeing the news, wondering if the US was preparing for 24/7 tokenized trading of US stocks. However, after carefully studying the documents, CryptoShalu wants to tell everyone not to rush to conclusions, because Nasdaq stated in the documents that many traditional securities trading rules and complex orders are not applicable to nighttime trading hours, and some functions will also be limited.

We have been paying close attention to the tokenization of US stocks, believing it to be one of the most important targets for the tokenization of real-world assets, especially given the recent flurry of official actions by the US SEC (Securities and Trao đổi Commission).

This application has reignited expectations for the tokenization of US stocks because the US wants to take a significant step closer to making securities trading hours 24/7 like those in the digital asset market. However, upon closer inspection:

The Nasdaq document didn’t mention anything about tokenization; it only addressed institutional reforms for traditional securities.

If you’d like a deeper understanding of Nasdaq’s actions, CryptoSalt can write a separate article for detailed analysis. But today, we want to talk about some concrete news related to tokenization in the US stock market—

The SEC has officially “permitted” the major U.S. securities custody hub to attempt to provide tokenized services.

On December 11, 2025, U.S. time, an official from the SEC’s Division of Trading and Chợs issued a No-Action Letter (NAL) to the DTCC, which was subsequently published on the SEC’s website. The letter explicitly stated that, subject to certain conditions, the SEC would not take enforcement action against the DTCC for providing tokenization services related to its custodial securities.

At first glance, many readers think the SEC has officially announced an “exemption” from the use of tokenization technology in US stocks. However, upon closer inspection, the actual situation is quite different.

So, what exactly did this letter say? What is the latest development in the tokenization of US stocks? Let’s start with the main subject of the letter:

I. Who are DTCC and DTC?

DTCC, short for Depository Trust & Clearing Corporation, is an American conglomerate that includes various entities responsible for custody, stock clearing, and bond clearing.

DTC, short for Depository Trust Company, is a subsidiary of DTCC and the largest securities custodian in the United States. It is responsible for the unified custody of securities such as stocks and bonds, as well as settlement and transfer. Currently, the scale of securities assets under custody and accounting exceeds 100 trillion US dollars. DTC can be understood as the ledger administrator of the entire US stock market.

II. What is the relationship between DTC and tokenization of US stocks?

In early September 2025, news broke that Nasdaq had applied to the SEC to issue shares in tokenized form. DTC was already mentioned in that application.

Nasdaq stated that the only difference between tokenized shares and traditional shares lies in the clearing and settlement of orders on the DTC platform.

(The image above is a screenshot from the Nasdaq application proposal)

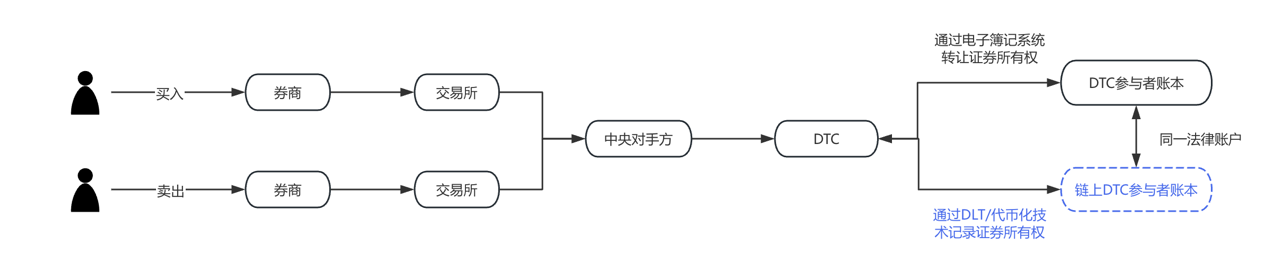

To make this easier to understand, we’ve created a flowchart. The blue section represents the changes Nasdaq proposed in its September filing. It’s clear that DTC is a key implementing and operational body for tokenization in the US stock market.

III. What does the newly released “Letter of No Action” say?

Many people equate this document directly with the SEC’s approval of the DTC’s use of blockchain for US stock market accounting, which is inaccurate. To understand this correctly, it’s essential to understand a clause in the US Securities Exchange Act:

Section 19(b) of the Securities Exchange Act of 1934 requires any self-regulatory organization (including clearing houses) to submit a request for rule change to the SEC and obtain its approval when making changes to rules or significant business arrangements.

Both of Nasdaq’s proposals were submitted based on this rule.

However, the rule filing process is typically lengthy, potentially taking months, up to 240 days. If every change requires application and approval, the time cost would be prohibitively high. Therefore, to ensure the smooth operation of its securities tokenization pilot program, the DTC applied for an exemption from the obligation to fully comply with the 19b filing process during the pilot period, which the SEC granted.

Nói cách khác, the SEC has only temporarily exempted the DTC from some procedural reporting obligations, and has not substantially permitted the application of tokenization technology in the securities market.

So, how will the tokenization of US stocks develop next? We need to clarify the following two questions:

(1) What pilot activities can the DTC conduct without reporting?

Currently, the custodial accounting system for US stocks operates as follows: assuming a brokerage firm has an account with DTC, DTC uses a centralized system to record every stock purchase and sale, and the corresponding share amount. DTC has now proposed offering brokerage firms the option to record these stock holdings again using blockchain tokens.

In practice, participants first need to register a qualified, DTC-approved registered wallet. Once a participant sends a tokenization instruction to DTC, DTC will do three things:

a) Move these shares from the original account to a general ledger pool;

b) Minting tokens on the blockchain;

c) Depositing tokens into the participant’s wallet represents the participant’s interest in these securities.

After this, these tokens can be transferred directly between these brokerages without each transfer needing to go through DTC’s centralized ledger. However, all token transfers will be monitored and recorded in real time by DTC through an off-chain system called LedgerScan, and LedgerScan’s records will constitute DTC’s official ledger. If a participant wishes to exit the tokenized state, they can issue a “de-tokenize” instruction to DTC at any time. DTC will then destroy the tokens and revert the securities rights back to their traditional accounts.

NAL also details the technical and risk control restrictions, including: tokens can only be transferred between wallets approved by DTC, so DTC even has the authority to forcibly transfer or destroy tokens in wallets under certain circumstances; the token system and DTC’s core clearing system are strictly isolated, etc.

(2) What is the significance of this letter?

From a legal perspective, it is important to emphasize that the NAL is not equivalent to legal authorization or rule modification. It does not have universally applicable legal effect, but only represents the enforcement attitude of SEC staff under given facts and assumptions.

The U.S. securities law system does not contain a separate provision “prohibiting the use of blockchain for ledgers.” Regulators are more concerned with whether existing market structures, custodial responsibilities, risk control, and reporting obligations are still met after the adoption of new technologies.

Furthermore, in the U.S. securities regulatory system, letters like the NAL have long been regarded as an important indicator of regulatory stance, especially when the recipient is a systemically important financial institution like the DTC, where their symbolic significance is actually greater than the specific business itself.

Based on the disclosed information, the premise of the SEC’s exemption is very clear: DTC does not issue or trade securities directly on the blockchain, but rather tokenizes existing securities interests in its custody system.

These tokens are essentially a “stake mapping” or “ledger representation” used to improve back-end processing efficiency, rather than altering the legal attributes or ownership structure of securities. The related services operate in a controlled environment on a permissioned blockchain, with strict limitations on participants, usage scope, and technical architecture.

Crypto Law believes this regulatory stance is very reasonable. On-chain assets are most prone to financial crimes such as money laundering and illegal fundraising. Mã thông báoization technology is a new technology, but it should not become an accomplice to crime. Regulators need to acknowledge the potential of blockchain applications in securities infrastructure while adhering to the boundaries of existing securities laws and custody systems.

IV. Latest Developments in US Stock Market Tokenization

The discussion surrounding tokenization in the US stock market has begun to shift from “whether it’s compliant” to “how to implement it.” If we break down current market practices, we can see at least two parallel but logically different paths emerging:

- DTCC and DTC represent tokenization paths led by official hướng dẫnlines, with the core objective of improving settlement, reconciliation, and asset transfer efficiency. Their primary target audience is institutional and wholesale market participants. In this model, tokenization is almost “invisible”; for end-investors, stocks remain stocks, only the back-end system has undergone a technological upgrade.

- Ngược lại, brokerages and trading platforms may play a leading role. Take Robinhood and MSX MetQ as examples; in recent years, they have continuously explored products related to mật mã assets, fragmented stock trading, and extended trading hours. If the tokenization of US stocks gradually matures in terms of compliance, these platforms naturally possess the advantage of becoming user entry points. For them, tokenization does not necessarily mean reshaping their business model, but rather a technological extension of the existing investment experience, such as closer real-time settlement, more flexible asset splitting, and the integration of cross-market product forms. Of course, all of this is predicated on the gradual clarification of the regulatory framework. Such explorations typically operate near regulatory boundaries, with risks and innovation coexisting. Their value lies not in short-term scale, but in validating the next generation of securities market forms. From a practical perspective, they are more like providing samples for institutional evolution than directly replacing the existing US stock market.

To make it more intuitive for everyone to understand, please see the following comparison chart:

V. Viewpoints on Encrypted Salads

From a broader perspective, the real problem that US stock tokenization attempts to solve is not simply turning stocks into “cryptocurrencies,” but rather how to improve asset circulation efficiency, reduce operating costs, and reserve interfaces for future cross-market collaboration while maintaining legal certainty and system security. In this process, compliance, technology, and market structure will engage in a long-term, parallel interplay, and the evolutionary path will inevitably be gradual rather than radical.

It is foreseeable that the tokenization of US stocks will not fundamentally change the way Wall Street operates in the short term, but it is already an important project on the US financial infrastructure agenda. This interaction between the SEC and DTCC is more like a “trial run” at the institutional level, setting initial boundaries for broader exploration later. For market participants, this may not be the end, but rather a starting point truly worth continued observation.

Special Note: This article is an original work by the CryptoShaLaw team and represents only the author’s personal views. It does not constitute legal advice or counsel on any specific matter. For reprint authorization, please contact shajunlvshi via private message.

Bài viết này được lấy từ internet: On-the-spot report | Web3 lawyers interpret the latest changes in US stock tokenization

Related: Tiger Research: We maintain our $200,000 price target amid heightened market volatility.

Amid heightened market volatility, we maintain our $200,000 price target. This report assesses the nature of the current pullback and the sustainability of the long-term fundamentals. Key points summary The US government shutdown has lasted 35 days, causing short-term pressure —the US Treasury’s TGA liquidity is frozen, and Polymarket predicts there is a 73% chance the shutdown will continue beyond mid-November. Record-breaking forced liquidations dampened market sentiment – the forced liquidations on October 10th amounted to $20 billion, affecting 1.6 million traders, clearing out excessive leverage and triggering a temporary pullback in the market. The fundamentals remain solid, and the long-term upward trend remains unchanged – global liquidity is expanding, with M2 broad money supply exceeding $96 trillion, institutional investors are maintaining strategic buying, and the target price for Bitcoin…